- Bitcoin’s short-term holder supply is rising. Is this a sign of a market shift or just a cosmic joke?

- Key resistance near $87,000 could determine BTC’s next breakout as short-term holders adjust their positions. Or not. Who knows?

Ah, Bitcoin [BTC], the digital currency that has everyone scratching their heads and wondering if they should have paid more attention in math class. Recent data reveals that short-term holder (STH) supply has increased significantly over the past month, reflecting a renewed speculative interest as BTC attempts to reclaim key resistance levels. Or perhaps it’s just trying to find its way home.

Does this indicate a bullish continuation, or are short-term holders merely setting up a distribution phase? The universe may never know!

Short-term holders’ influence on Bitcoin’s price trend

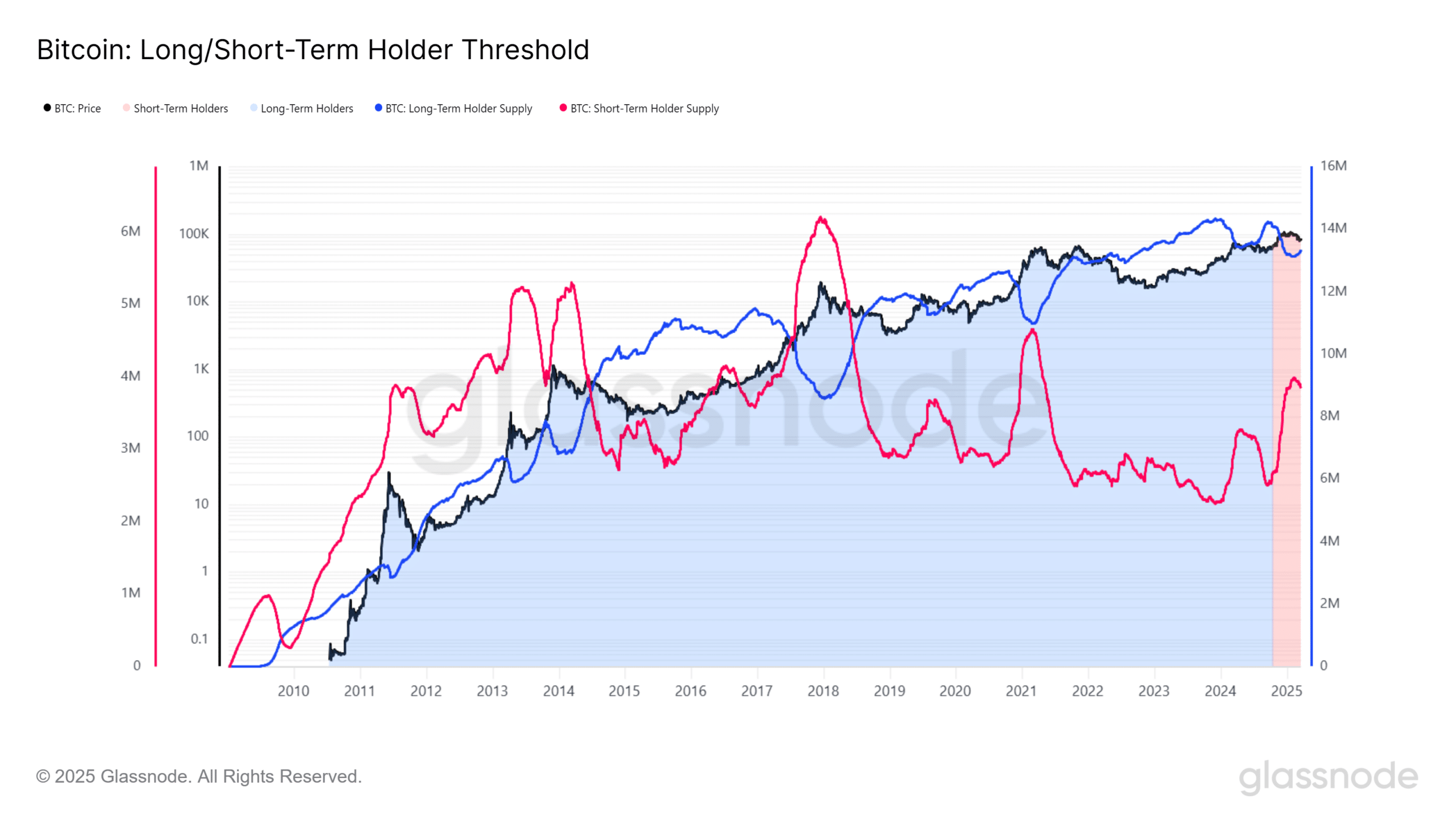

According to Glassnode’s Long/Short-Term Holder [LTH/STH] threshold data, STH supply has seen a sharp rise in correlation with Bitcoin’s recent price recovery to $85,856. It’s almost as if the universe is conspiring to keep us on our toes!

Historically, an increase in STH holdings during an uptrend often signals heightened trading activity, leading to either sustained bullish momentum or profit-taking that stalls price growth. It’s like a cosmic game of musical chairs, but with more zeros and less music.

The latest chart shows that while long-term holders [LTH] maintain a dominant position, the recent uptick in STH supply suggests a shift in market sentiment. Or maybe they just found a really good sale on Bitcoin.

STH supply tends to rise when new market participants enter during a rally, but if profit-taking accelerates, it could add selling pressure that limits BTC’s upside potential. It’s like trying to hold onto a slippery fish while riding a rollercoaster.

Key BTC price levels and market implications

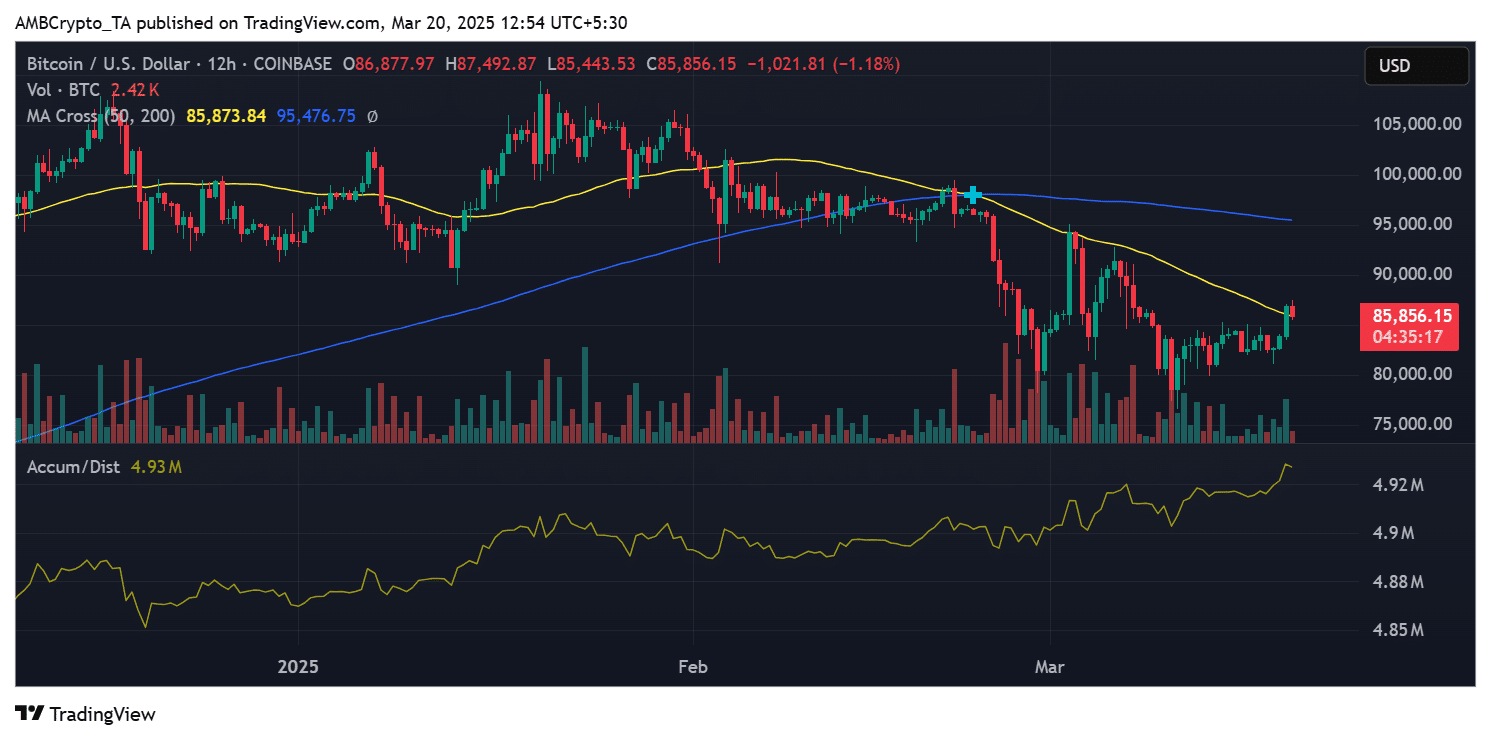

Bitcoin’s price was $85,856 at press time, testing resistance near its 50-day moving average at $85,873. If short-term holders continue accumulating and holding onto their positions, BTC could attempt a breakout toward the 200-day moving average at $95,476. Or it could just decide to take a nap instead.

However, if STHs begin offloading their holdings at resistance levels, BTC could face a correction toward the $82,500-$83,000 support range. It’s like watching a soap opera, full of drama and unexpected twists!

Another critical factor is accumulation trends. As of this writing, the accumulation/distribution indicator showed a rising trend at 4.93 million BTC, indicating ongoing demand. If this continues, it could provide a foundation for BTC to stabilize and push higher. Or it could just as easily collapse like a house of cards in a windstorm.

Further upside or volatility for BTC?

The recent increase in STH supply highlights growing trader activity, which could either support further upside or lead to near-term volatility. It’s like trying to predict the weather in a galaxy far, far away.

The market’s reaction to key resistance levels will determine BTC’s next major move. If demand remains strong, Bitcoin could regain its bullish momentum, but if selling pressure increases, a deeper pullback may be on the horizon. Buckle up, folks!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-03-21 04:13