- Bitcoin miners are feeling the pinch as transaction fees plummet to historic lows. Who knew mining could be so… unprofitable?

- Network difficulty is rising faster than my blood pressure when I can’t find a parking spot. Smaller miners are sweating it out!

So, here we are in 2025, and Bitcoin [BTC] miners are in a bit of a pickle. Transaction fees? Lowest since 2012! It’s like a bad joke, right? And network difficulty? Climbing like my neighbor’s obnoxious Christmas lights.

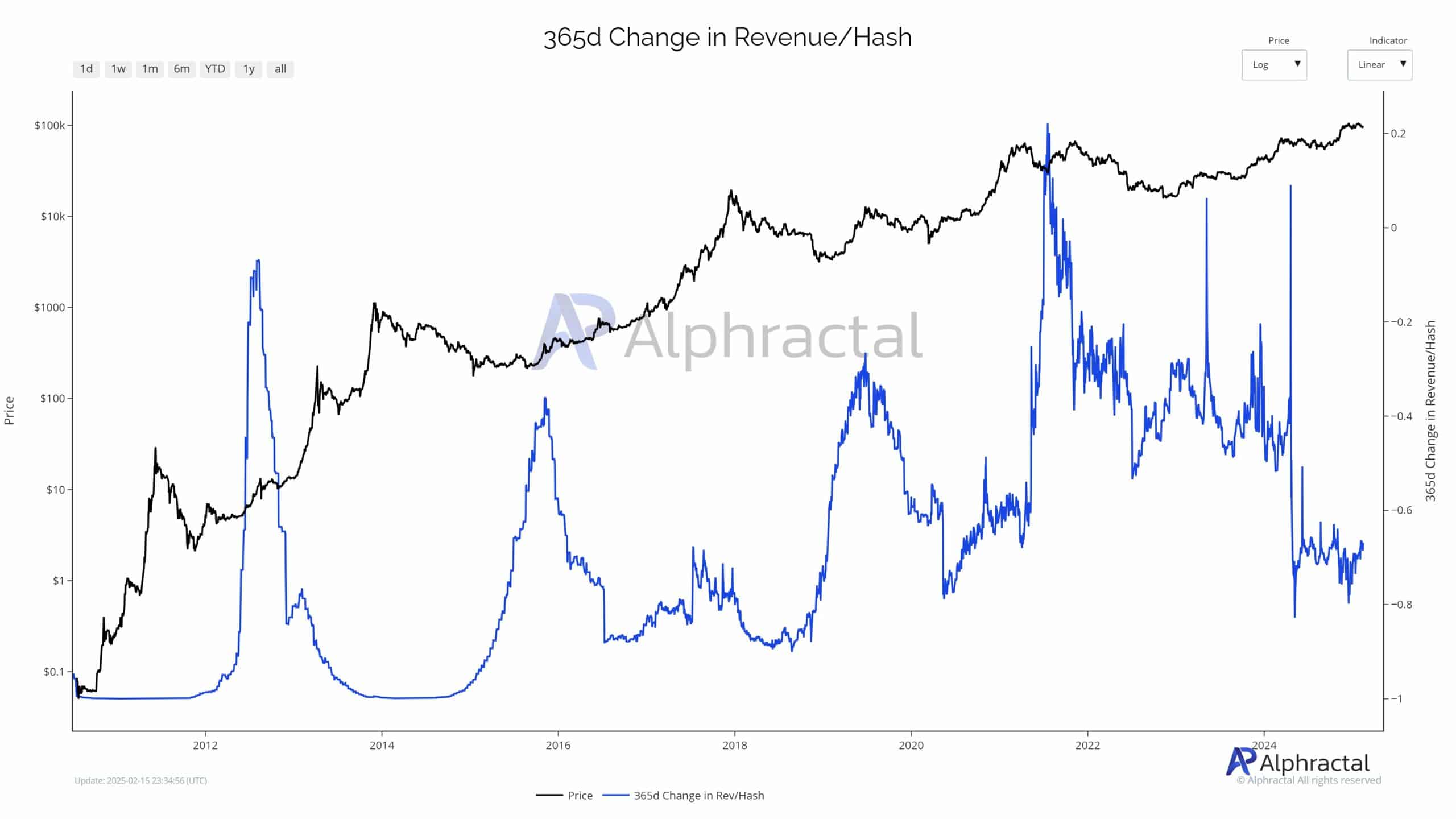

Thanks to the 2024 halving, competition is fiercer than ever. Revenue per unit of computational power is dropping faster than my enthusiasm for a long meeting. And let’s not even get started on the USD-denominated mining revenue—it’s as volatile as my mood on a Monday morning.

With profit margins tighter than my jeans after the holidays, miners are scrambling to optimize operations, shut down old equipment, or—wait for it—consider mergers. Mergers! Like that’s going to solve everything. What’s next, a reality show about it?

Smaller players are on the brink of exiting stage left, and it looks like only the big, well-capitalized operations will survive this circus. 🎪

Bitcoin mining faces profitability strain

The Bitcoin mining ecosystem is like a bad sitcom—full of challenges and declining profitability metrics. The Bitcoin mempool? At its lowest in years! It’s like nobody wants to play anymore.

This drop is hitting miners’ revenue from transaction fees hard, which are as vital as coffee on a Monday. Historically, when transaction activity drops, bear markets follow. So, despite Bitcoin’s high price, we might be looking at a structural shift. Great, just what we need!

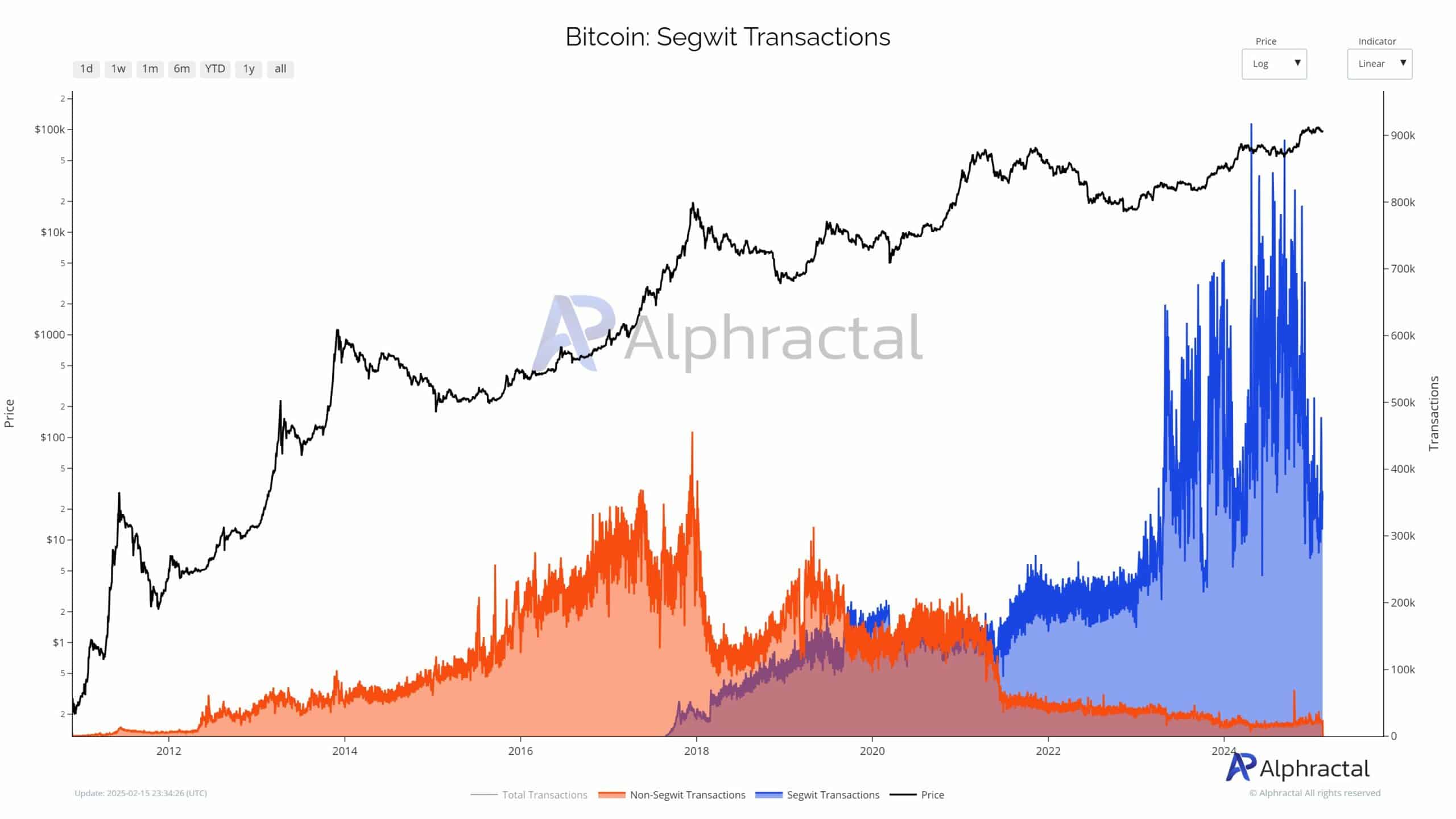

And SegWit transactions? Once the belle of the ball, now they’re in decline. It’s like watching your favorite show get canceled. This is reducing overall network efficiency and putting even more pressure on miners’ earnings. Can it get any worse?

The Revenue/Hash ratio is at historic lows. It’s like a bad breakup—no matter how high Bitcoin’s price goes, the diminishing returns are eroding profitability. With the halving coming up, smaller operations might just throw in the towel.

This could lead to a centralization nightmare, where only the big, tech-savvy miners thrive. It’s like a bad sequel nobody asked for.

Increasing difficulty and rising costs

Bitcoin miners are feeling the squeeze as network difficulty hits record highs. It’s like trying to squeeze into a pair of jeans after Thanksgiving dinner—good luck!

With declining revenue per hash, smaller operators with outdated equipment are struggling to keep up. Energy and hardware costs are rising faster than my stress levels during tax season.

To survive, many miners are moving to regions with cheaper energy sources. Hydro or geothermal power? Sounds fancy! Some are diversifying into computing services, while others are looking for mergers. Because that always works out, right?

This could lead to further centralization, leaving only the most capitalized and efficient mining firms standing. It’s like a game of musical chairs, and I’m not sure who’s going to be left without a seat.

And what about Bitcoin’s decentralization? It’s like a bad magic trick—now you see it, now you don’t!

Market rebalancing

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2025-02-17 07:08