- Per analysts, Bitcoin needs a 3.5% rally to close above $60,600, which will help reclaim its crucial re-accumulation range.

- Historical patterns suggested that Bitcoin’s price could reach around $65,000, following established cyclical behaviors.

As an experienced analyst, I closely monitor Bitcoin’s price movements and trends to identify potential patterns and indicators for traders. Based on my analysis, I believe that Bitcoin needs a 3.5% rally to close above $60,600 to reclaim its crucial re-accumulation range. Historically, this level has been significant for Bitcoin as it often leads to price increases.

As a crypto investor, I’ve noticed Bitcoin’s price fluctuations lately. Currently, BTC is priced at $57,123.74 according to CoinGecko’s most recent update. Compared to the previous day, this represents a 1.79% decrease. However, considering the past week, Bitcoin has experienced a 5.31% price increase.

Renowned analyst Rekt Capital has pointed out that for Bitcoin to regain its lost ground and close above $60,600 in a weekly candlestick, it needs to gain an extra 3.5%.

Reaching this stage is essential for Bitcoin to resume its previous pattern of accumulating resources, a process that has typically been followed by price growth in the past.

At the current moment, the Bitcoin trading market saw a robust volume of approximately $28.6 billion.

Trading analysts found that Bitcoin’s price fluctuations and volume patterns held significant clues for predicting future market trends.

Historical and predicted trends

The examination conducted by Rekt Capital on Bitcoin’s price trend from the years 2020 to 2024 unveiled distinct patterns that emerged post-halving events.

On May 11, 2020, Bitcoin experienced a halving event, leading to a roughly 11-week period during which its price decreased by 19.56%.

Afterward, Bitcoin experienced a parabolic rise that lasted for 23 weeks and 161 days, peaking at a volume of 1.183 million.

In the projected chart for 2024, we anticipate seeing consistent patterns with a 11-week period of re-accumulation having a volume of approximately 142,103 thousand units. Following this, we expect a parabolic growth phase that lasts over 22 weeks and 154 days, resulting in a volume of around 150,299 thousand units.

Key support levels were identified by orange circles, showing points of price consolidation.

The estimated maximum price of approximately $65,000 emphasized the possibility of substantial growth, aligning with historical market trends.

Bitcoin, on-chain

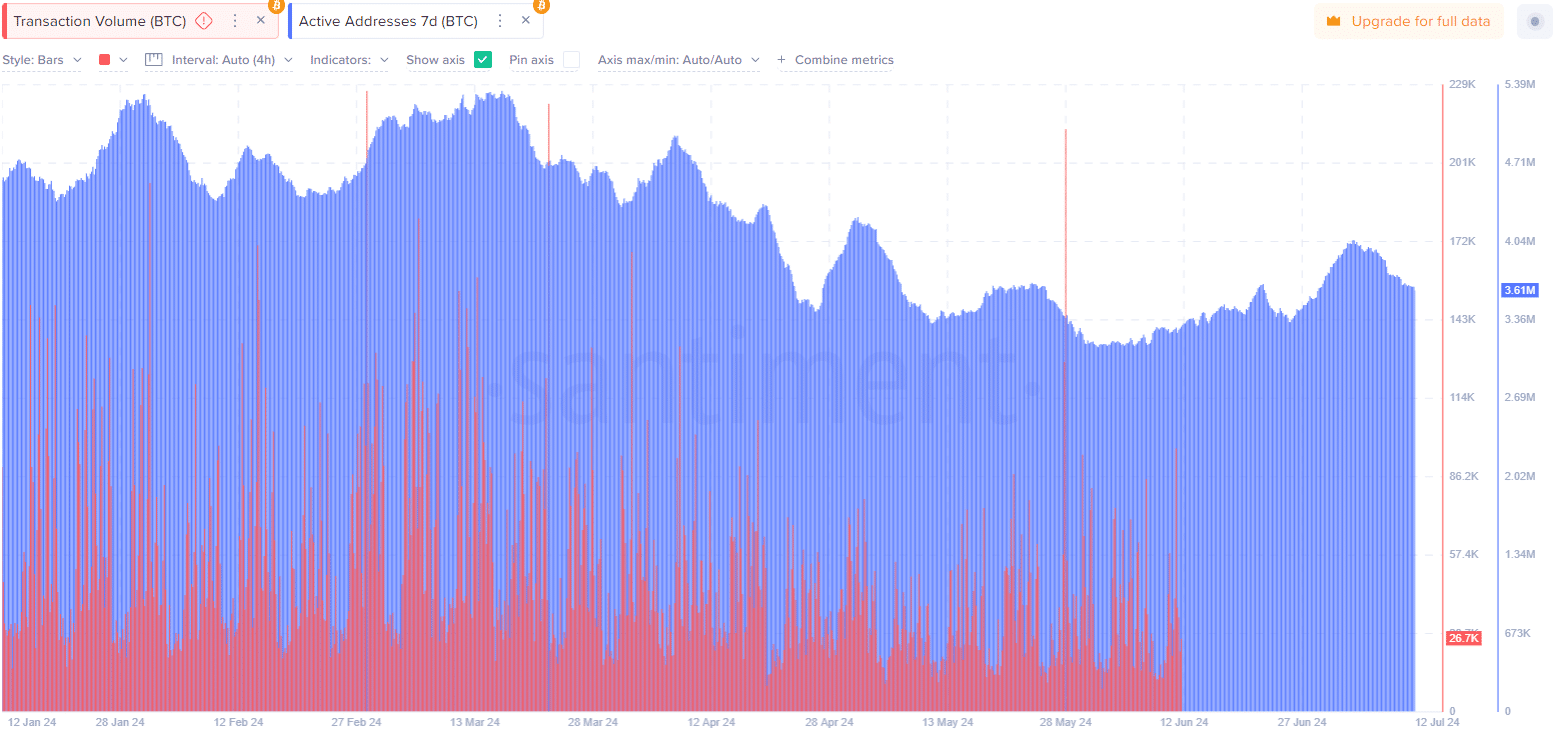

According to AMBCrypto’s analysis of Coinglass’ data, there were significant increases in Bitcoin liquidations towards the end of February, around the beginning of April, and at the end of June.

During these instances, the Bitcoin price experienced significant swings, correlating with the observed spikes and suggesting heightened volatility and robust trading action within the market.

An uptrend in the number of active addresses has been observed, reaching its peak around late March, followed by a subsequent decrease.

The transaction volume showed notable increases, particularly in the early April and mid-June timeframes, indicating episodes of intense trading and network engagement.

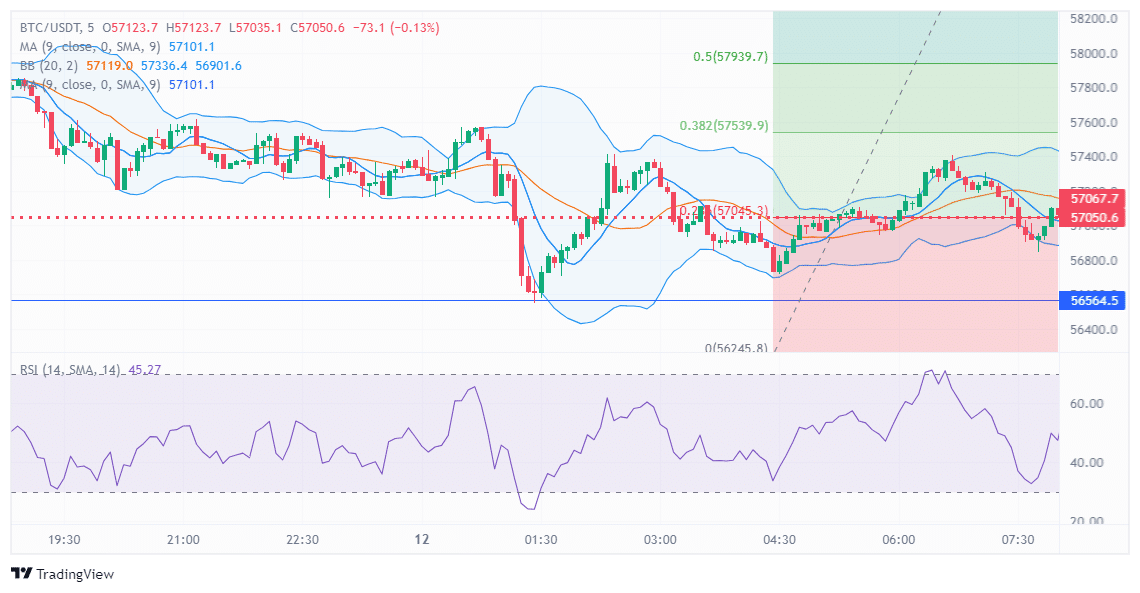

During this timeframe, the 9-day Simple Moving Average (SMA) of 57025.1 functioned as a flexible pivot point for price movement, causing the market to oscillate nearby, emphasizing its significance in making brief-term trading judgments.

Using a 20-period lookback, Bollinger Bands with two standard deviations display the price range, indicating periods where volatility is comparatively low or high.

When the price plummeted to 56245.8, the price ranges expanded, signaling heightened market instability. Subsequently, these ranges have narrowed slightly as the price hovers around 57008.4, hinting at possible breakout or consolidation periods.

Based on my analysis up to this point, the Relative Strength Index (RSI) had a reading of 46.84 using a 14-day window. This figure suggests that the momentum was relatively neutral and hovered near the 50 mark, which is generally considered neutral territory in stock market analysis.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

The price decrease caused a substantial drop, showing bearish trends, but its recent uptick indicates possible price stabilization.

The Fibonacci retracement levels, calculated from the recent high of 57939.7 to the low of 56245.8, served as significant points of resistance during the price bounce back. These levels were marked at 57045.3 (representing 23.6%), 57539.9 (38.2%), and 57939.7 (50%).

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Solo Leveling Arise Amamiya Mirei Guide

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Avowed Update 1.3 Brings Huge Changes and Community Features!

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

2024-07-13 02:16