-

Interest in Bitcoin ETFs had grown as ETF volumes reached new highs.

Whale interest also surged, however, BTC’s price remained stagnant.

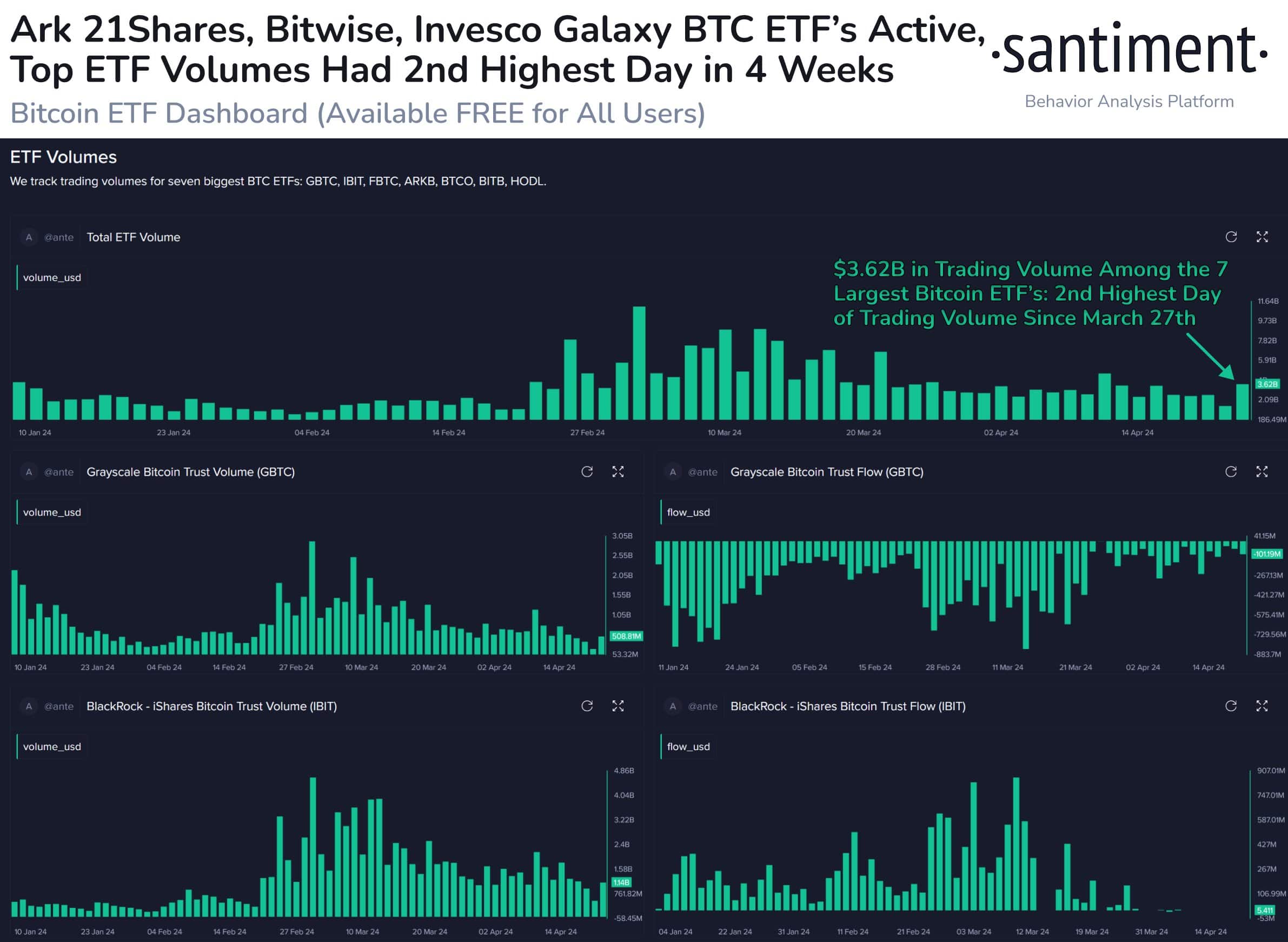

As a seasoned investor with a keen interest in the cryptocurrency market, I’ve noticed that institutional interest in Bitcoin ETFs has been on the rise lately, as evidenced by the record-breaking daily trading volume of over $3.6 billion. This surge in activity comes amidst a period of sideways price movement for Bitcoin and other cryptocurrencies.

The price of Bitcoin [BTC] has taken a dip lately, hovering near the $64,000 mark for an extended period.

Institutional interest

Based on Santiment’s analysis, Bitcoin (BTC) may experience a positive development in the near term. Notably, the collective daily trading volume of Bitcoin ETFs hit a four-week high, amounting to $3.62 billion.

This surge in activity includes leading Bitcoin ETFs like GBTC, IBIT, FBTC, ARKB, BTCO, and HODL.

I’ve noticed an unexpected five-week trend of lateral shifts in the wider cryptocurrency market.

Given the current lack of growth, the robust trading in Bitcoin ETFs might be interpreted as a positive indication.

Investors can maintain faith in Bitcoin’s long-term growth and utilize ETFs as a means to acquire exposure to this cryptocurrency.

The significant number of Bitcoin ETF trades indicates increasing interest from investors new to cryptocurrencies, who find these ETFs a more convenient way to enter the market.

The approval of Bitcoin ETFs might make it easier for investors to adopt Bitcoin, as they would no longer need to purchase and store the digital currency themselves.

Additionally, the optimistic outlook is supported by on-chain statistics showing a significant increase in large investors buying Bitcoin within the past two months.

I’ve noticed an intriguing trend emerging in this area. Not only are fresh investors jumping on board, but seasoned players are also ramping up their involvement. It seems they’re preparing for a possible price surge in the future.

How are investors holding up?

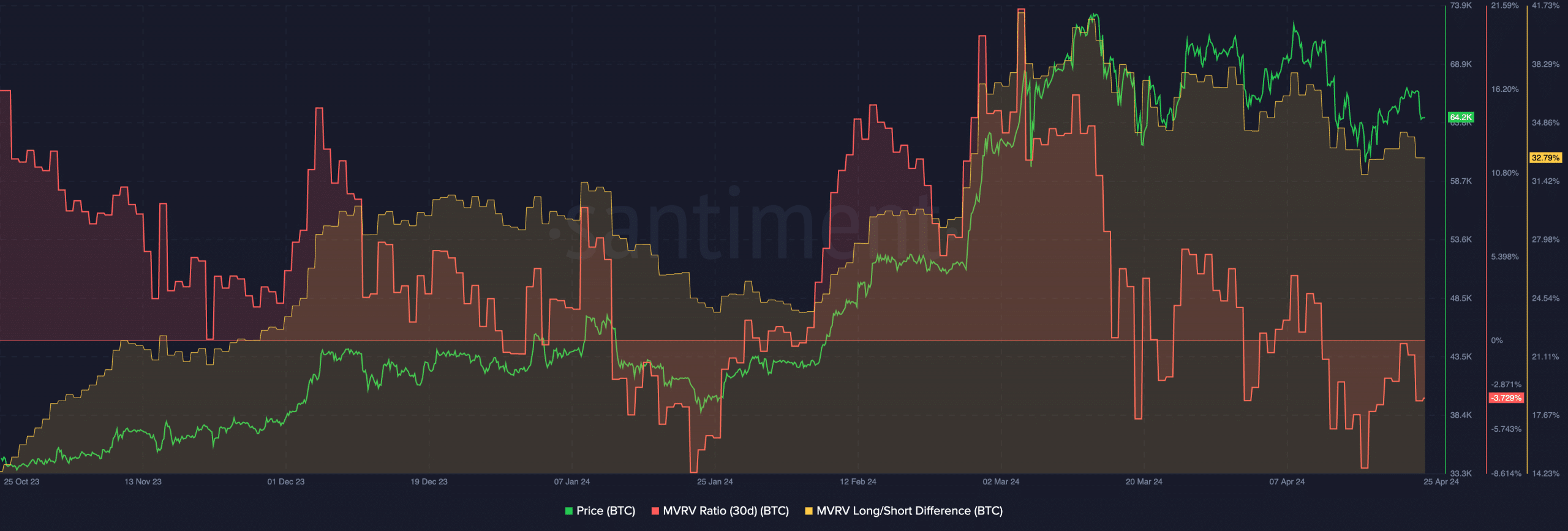

Currently, Bitcoin was priced at $64,334.93 in the media’s latest update. Over the past day, its value dropped by a significant 3.44%. Additionally, the MVRV ratio took a downturn, suggesting that many investors had not yet turned a profit.

Additionally, the Long/Short difference had grown despite the declining prices.

In the recent past, a decline in the Long/Short ratio signified that more investors held long-term positions than short-term ones.

The holders are less inclined to dispose of their Bitcoin, thereby supporting its existing price points.

Read Bitcoin’s [BTC] Price Prediction 2024-25

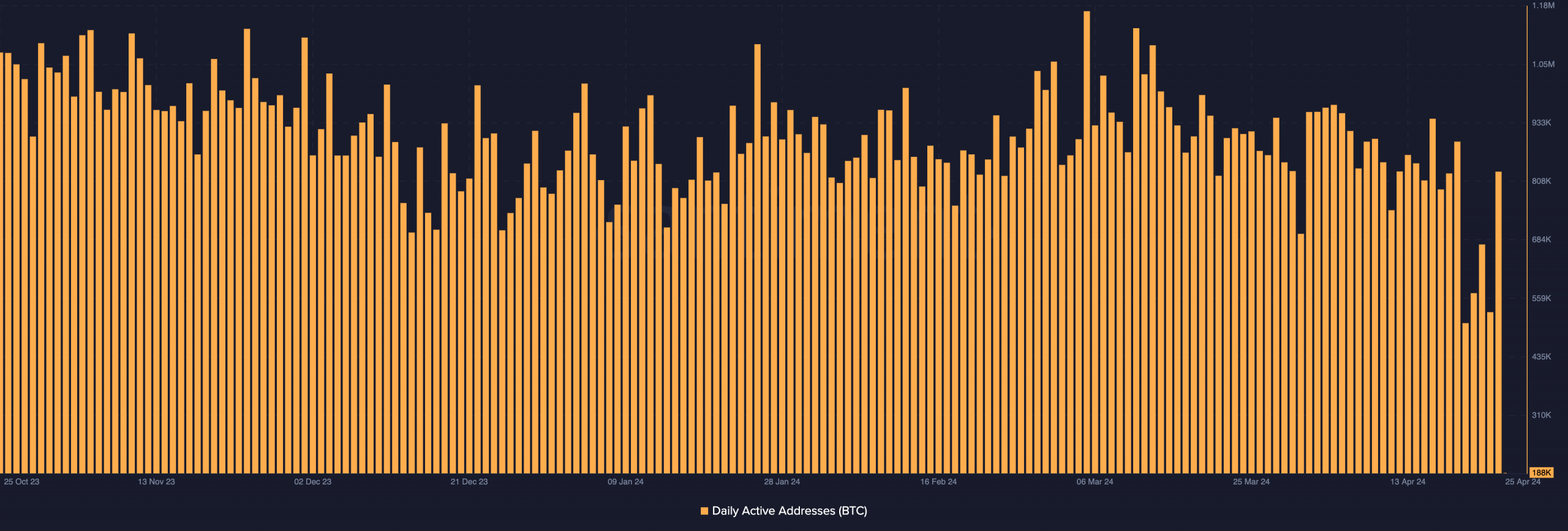

The overall interest in Bitcoin’s ecosystem would also play a great role in the king coin’s growth.

In recent times, there has been a noticeable drop in the count of daily active addresses on the network over the past few days.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-04-25 17:11