It was once the great oracle of the masses—that merciless gauge of human folly—Google’s echo chamber of “Bitcoin” searches, rising and falling in divine synchronicity with the mad dance of prices. The crowd’s fevered curiosity was a tempest, and the price a wild stallion rearing upon the storm.

But now, dear reader, we find ourselves in a peculiar epoch—a stillness, a whisper where once there was uproar. Hunter Horsley, the shepherd of Bitwise, casts his long shadow upon this strange phenomenon: though the Bitcoin price serenely lingers near the lofty heights of $90,000, the pulse of Google searches has withered to a feeble murmur, as if the masses have turned away in ennui or perhaps dread.

The Curious Case of the Vanishing Public Interest

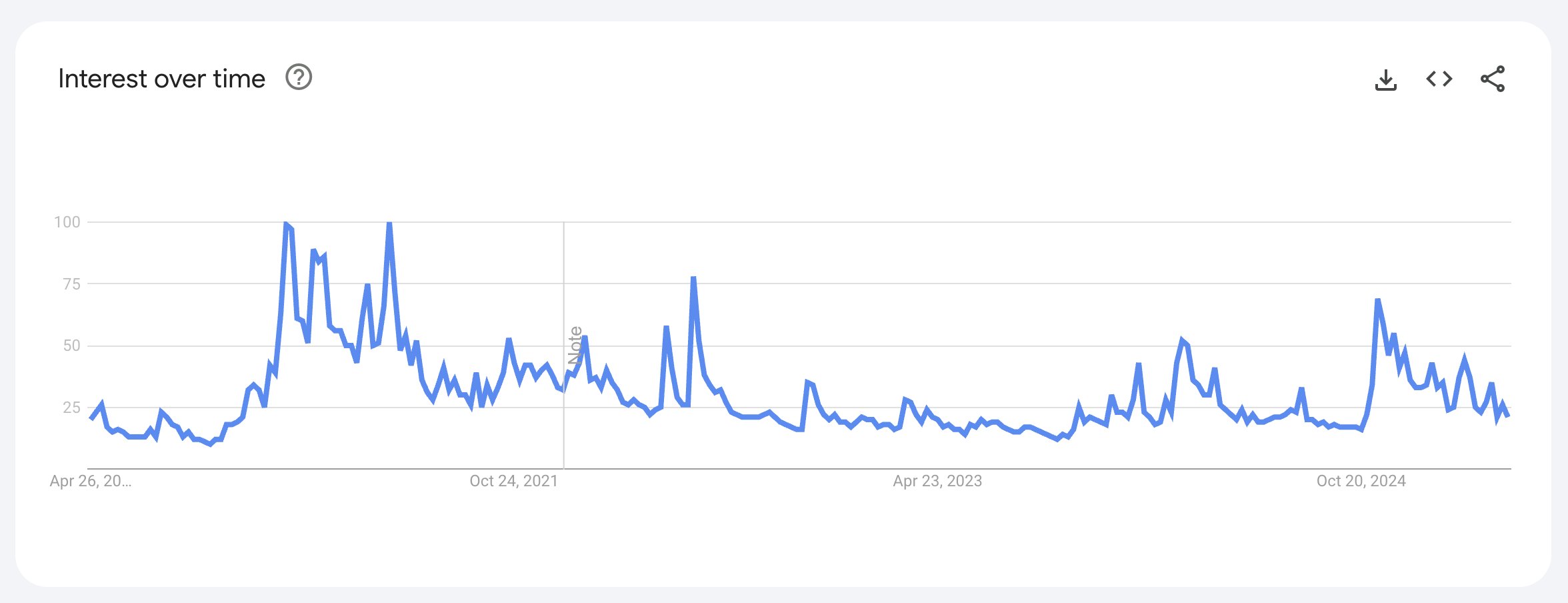

Observe the solemn charts of Google Trends—a dwindling flame of public zeal flickers from seventy-five points in days of yore to a mere twenty-five today. How cruel and ironic, that the feverish spikes of 2017 and 2021, those grand civic orgies of Bitcoin mania, have passed into the shadow of fading memory. And yet the price—ah, the price!—unfazed, climbs higher still, as if mocking the very ignorance it inspires. It has multiplied, swelled by 380% since 2017, and boasts a robust 38% climb past 2021’s summit.

Horsley, with the weary wisdom of a man who has seen the soldiery come and go, proclaims that this ascent is no child’s play of retail fear or fervor. No! The titans of industry—institutions, advisors, and even whole nations—wield their grim authority, steering the cryptic vessel through silent corridors, undetected by the common eye.

“Bitcoin at $94,000, yet — Google searches for ‘Bitcoin’ near long-term lows. This hasn’t been retail driven. Institutions, advisors, corporates, and nations have come into the space,” intoned Horsley, as if narrating a fable of high finance and deep shadows.

Once, the market was a raucous carnival, where retail investors jostled and gambled in the bright sunlight. Now, these street merchants have donned the cloaks of sanctioned investment products, courting the grand institutional houses: BlackRock, Fidelity, ARK Invest—the new czars of cryptocurrency’s empire. Through their lightning-fast conduits, retail funds flow covertly, concealed beneath layers of ETFs and corporate camouflage.

“Retail is in. Big time in. But not on the spot market. When you hear it’s institutions buying, remember—the money is retail’s, only laundered through the hallowed halls of finance,” whispers one sage investor on the mystical platform named X. 🤑

Fidelity, an oracle itself, declares the public companies’ hoarding of 350,000 Bitcoin since the fateful US election, devouring over 30,000 monthly—a true gluttonous appetite. Meanwhile, ARK Invest gazes into the abyss and predicts an eye-watering $2.4 million Bitcoin by 2030, a prophecy fueled by institutional fervor.

Why the Silence? The Market’s Quiet Metamorphosis

But what of this near silence in the clamor? Several reasons murmur beneath this quietude. Bitcoin, that once-novel beast, has been known all too well for over a decade. The fresh eyes are tired eyes now; the masses have drunk deeply from the well of knowledge and thus seek no longer the Google oracle’s counsel.

Furthermore, the avenues to wisdom have transformed. The seekers now frequent the dark cafés of AI and social media—X, a coliseum of digital gladiators—rather than the old temples of Google search pages. The game is changed, the rules rewritten, and the crowd has shifted its gaze.

So here we are, watching the silent colossus stride, its price soaring beyond mortal reckoning, while the whispers of common man grow faint. A market no longer of the people, but of the shadowy leviathans behind the curtain. And what shall the dawn bring? Only time, that eternal interrogator, will decide. 🤷♂️

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2025-04-28 12:19