- Bitcoin could decline into the new year based on historical patterns.

- BTC has declined by 6.01% since the Christmas uptick.

As a seasoned analyst with over a decade of observing and analyzing cryptocurrency markets, I have seen my fair share of ups and downs, bull runs, and bear markets. Based on the historical patterns presented by Alphractal, it appears that Bitcoin could decline into the new year, much like it has done in previous years with similar market conditions.

However, while history can provide us with valuable insights, it is essential to remember that the cryptocurrency market is notoriously unpredictable and volatile. I have learned throughout my career that past performance does not guarantee future results, but it can certainly help inform our expectations.

The current drop of 6% since Christmas, coupled with the bearish sentiment among long-term holders and a decline in the number of active addresses, suggests that we may be in for a rocky ride as we head into the new year. That being said, if history is any guide, there may also be opportunities for investors who are willing to take calculated risks.

In the world of cryptocurrencies, one must always expect the unexpected. As the saying goes, “the only constant in crypto is change.” So, while I cannot predict with certainty what will happen to Bitcoin’s price going into 2025, I do know that it will be an exciting ride!

And on a lighter note, if you think about it, isn’t it funny how the market can make even the most seasoned analysts feel like they’re riding on a rollercoaster? It’s enough to make you want to grab onto your seat and scream with excitement (or terror)! So buckle up, folks, and let’s see where this wild ride takes us.

For the last seven days, Bitcoin [BTC] has bucked common predictions. On Christmas Day, the cryptocurrency experienced a significant boost, climbing from $92k to $99k.

Initially, the fluctuation in prices instilled hope within the market, leading investors to anticipate a robust advancement towards the upcoming year. Yet, Bitcoin has subsequently shown significant price swings, plummeting to a low of approximately $91,315.

Under current market trends, experts are debating the price trajectory of Bitcoin up until 2025. Following historical patterns, as we move towards the end of this year, Alphractal predicts that Bitcoin may experience a significant drop.

Analysis of Bitcoin’s price variation

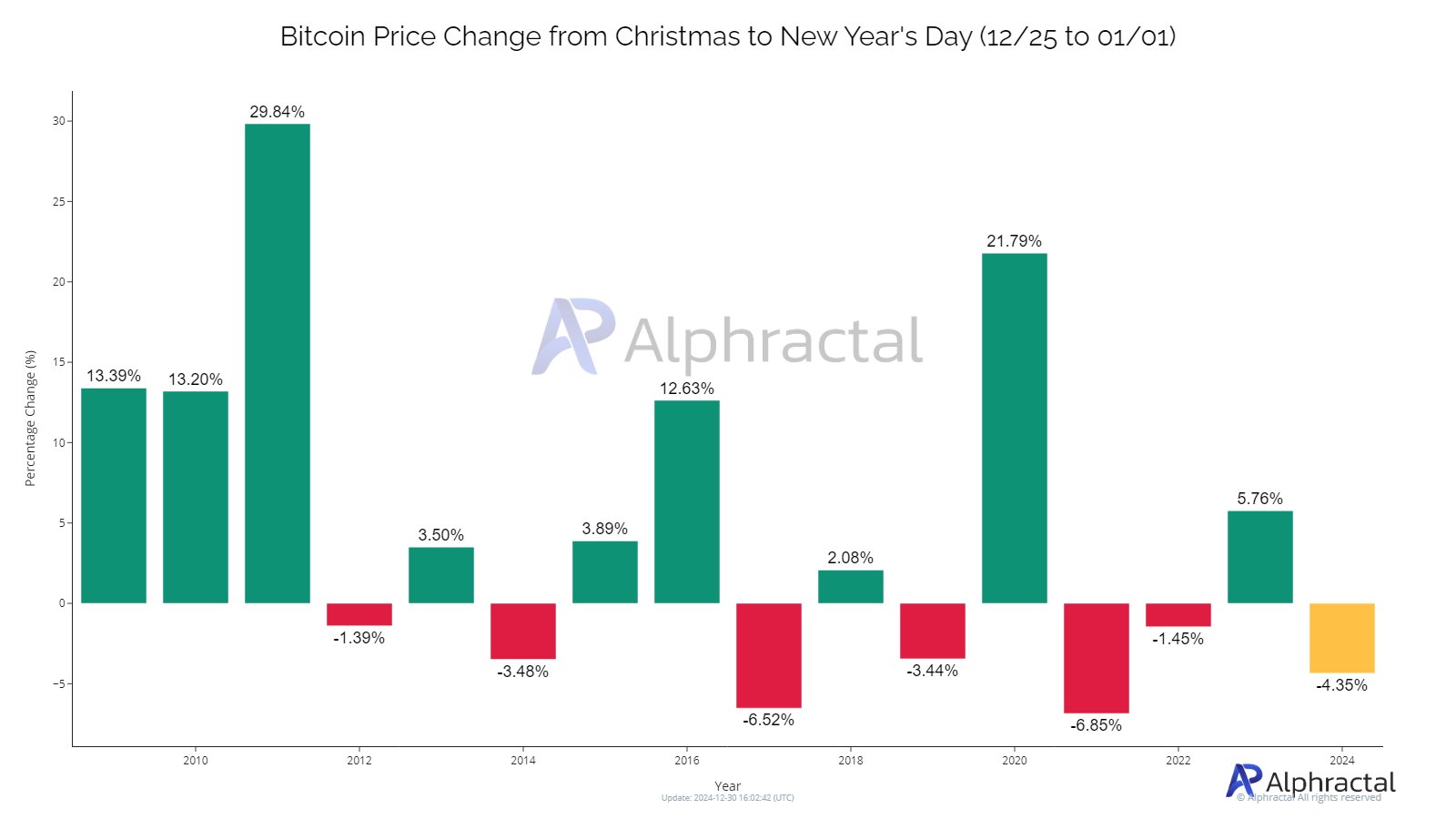

Over the years, Bitcoin’s behavior around Christmas and New Year’s Eve has shown a mix of trends, as analyzed using Alphractal methods.

Bitcoin’s value has fluctuated significantly, with periods of increase followed by drops. As of now, due to recent market movements, its price has decreased by approximately 6.01% since December 25th, going from $99,881 down to $93,879.

Based on past trends, as suggested by Alphractal, this decrease could potentially signal a downward trend approaching the new year.

Previously, it was noticed that there were declines in Bitcoin price during certain years such as 2012 to 2013, 2014 to 2015, 2017 to 2018, 2019 to 2020, and 2021 to 2022. During these timeframes, the Bitcoin market exhibited characteristic year-end volatility and unpredictability.

In certain years, the value of Bitcoin displayed either growth or minimal changes. For instance, between 2013 and 2014, as well as from 2015 to 2016, there was a modest increase in its worth.

Given historical trends, there might be a continuation of a downward spiral starting from the New Year in 2025, if the 6% decline observed since Christmas continues till then. This suggests that the beginning of 2025 could see a negative trajectory persisting from the end of that year.

What lies ahead for BTC

Although past trends don’t usually repeat themselves, it is crucial to examine other market signals and understand what they might suggest about Bitcoin as we approach the new year.

Based on AMBCrypto’s assessment, Bitcoin appears to be going through a period of consolidation right now. This has led some investors to become more pessimistic because they are concerned about the cryptocurrency’s uncertain future trajectory.

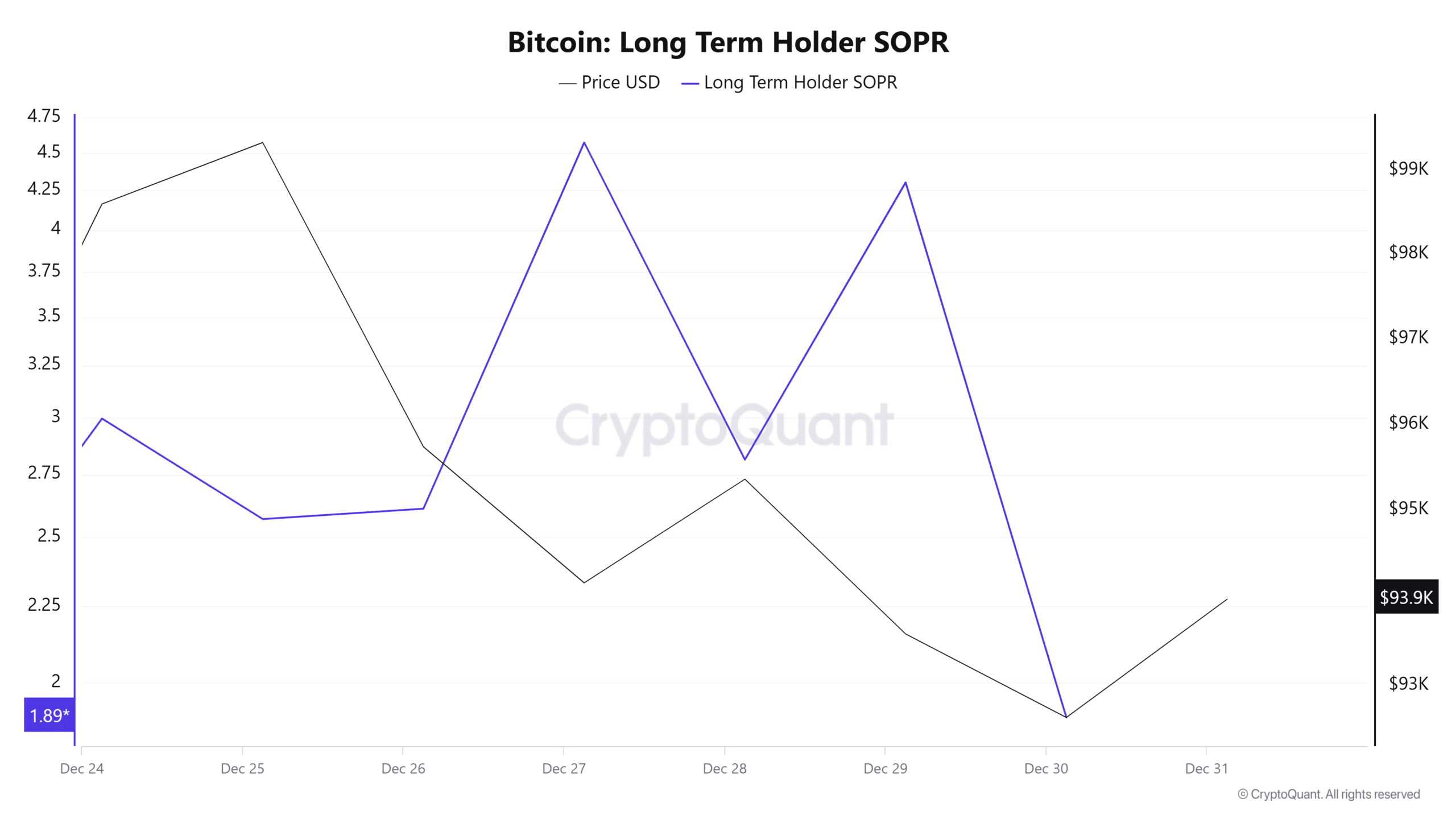

In simpler terms, the long-term Bitcoin holders’ Strength of Purchase Ratio (SOPR) has dropped from 4.5 to 1.8, indicating that these holders are becoming less optimistic about the market and more inclined to sell at a loss. This selling pressure could potentially lower prices even more, prolonging the current bearish trend.

Read Bitcoin [BTC] Price Prediction 2025-2026

As a crypto investor, I’ve noticed that Bitcoin’s Price Daily Active Addresses (DAA) has shown a negative divergence over the past week. This means fewer active addresses and participants are engaging with Bitcoin. Consequently, considering this trend, the current price might be elevated and could potentially retrace to align more closely with actual demand.

Based on my years of observation and analysis of the cryptocurrency market, I believe there is a possibility that Bitcoin could see a decline as we approach the new year. This is not an unfamiliar pattern for me, having witnessed similar drops in previous years. If history repeats itself, Bitcoin might dip to around $91,500. However, if optimistic buyers enter the market in anticipation of a post-new year rally, as I have seen happen before when participants return from holiday breaks, it’s possible that Bitcoin could recover and reach $95,400 again. Keep in mind that this is just one potential scenario, and the market can always surprise us with unexpected events.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-01-01 10:16