Here’s What You Need to Know (Because, Let’s Face It, You’re Curious):

- Leveraged bitcoin longs on Bitfinex are at their lowest since December, which might just be the prelude to a Bitcoin boom.

- Contrary indicators — because who doesn’t love confusing signals — often do the exact opposite of what they seem to say.

- Historically, a drop in Bitfinex long positions has been a sign of Bitcoin price increases. But don’t just take our word for it.

If you’ve been keeping an eye on financial markets, you’ve probably encountered those cheeky little things known as “contrary indicators.” They look all shiny and promising, like a unicorn in a field of rainbows, but often signal the exact opposite of what they appear to. So, the next time something looks “too good to be true” in the market, just remember: It probably isn’t.

One such bizarre market signal comes courtesy of Bitfinex’s leveraged bitcoin longs. In a world where up often means down, and down often means up, these metrics defy all logic. Over time, the number of leveraged longs on Bitfinex has typically dipped during Bitcoin bull runs and surged during market crashes. It’s the kind of market behavior that makes you wonder if anyone knows what’s going on.

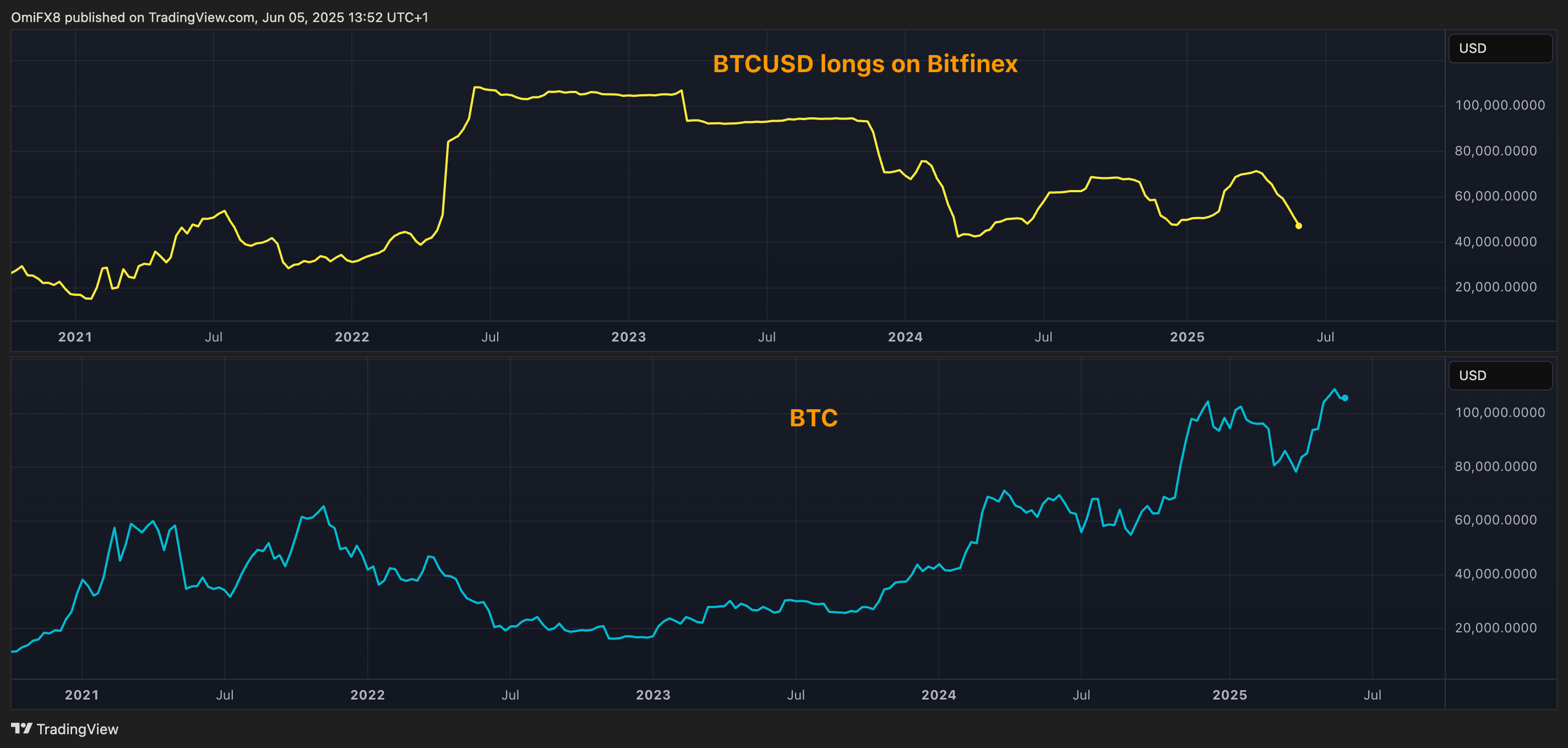

Right now, as we speak (or rather, as you read), the number of BTCUSD longs on Bitfinex has plummeted to a meager 47,691, the lowest it’s been since December. This, my friends, is potentially very good news for Bitcoin, if we believe the data from TradingView. Just look at the chart below, which shows a nice downward slide in BTC longs as Bitcoin prices went from a humble $75K to some jaw-dropping new heights of over $110K.

“When Bitfinex Long Positions rise, the price tends to fall. When Long Positions drop, the price usually goes up,” said crypto analytics firm Alphractal in their *totally calm* X post. If this sounds a little too good to be true, that’s because it probably is. Traders seem to have a knack for being spectacularly wrong about the market, and when they’re wrong, they panic and liquidate, which forces prices in the exact opposite direction. Brilliant, right?

Alphractal’s João Wedson, CEO and apparently the oracle of crypto, even predicts that as long as Bitfinex long positions keep dropping, Bitcoin will keep on rising. Ah, the sweet smell of market madness!

Above, you’ll find the chart illustrating just how wonderfully wrong everyone can be. It shows the bizarre inverse relationship between BTC/USD longs on Bitfinex and Bitcoin’s price movements.

If you’re still with us, here’s the kicker: Since 2021, every major BTC rally — including the festive crypto frenzy of November-December last year and the recent rebound from the early April lows — has coincided with a drop in BTCUSD longs on Bitfinex. Meanwhile, Bitcoin’s bearish moments (like that painful crash in 2022 or the recent dip from $100K to $75K) have been preceded by a surge in longs. In short, if you can’t stand the market’s logic, you’re not alone. 🙄

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2025-06-05 17:04