- Bitcoin has a bearish trajectory in the short-term.

- Liquidity pools could pull the price to $63k in the coming days.

As a seasoned researcher with years of experience navigating the volatile cryptocurrency markets, I find myself cautiously optimistic about Bitcoin’s short-term trajectory. The recent miner capitulation and increased outflows from miners have created a challenging landscape, but the potential for liquidity pools to pull the price to $63k in the coming days is intriguing.

Two weeks back, I observed a significant decline in my profitability as a Bitcoin miner when the value dropped to approximately $49,000. Consequently, this drop led to a wave of miner capitulation and an increase in outflows from mining operations.

The spike in hash rate and mining difficulty put the smaller miners in a tough spot.

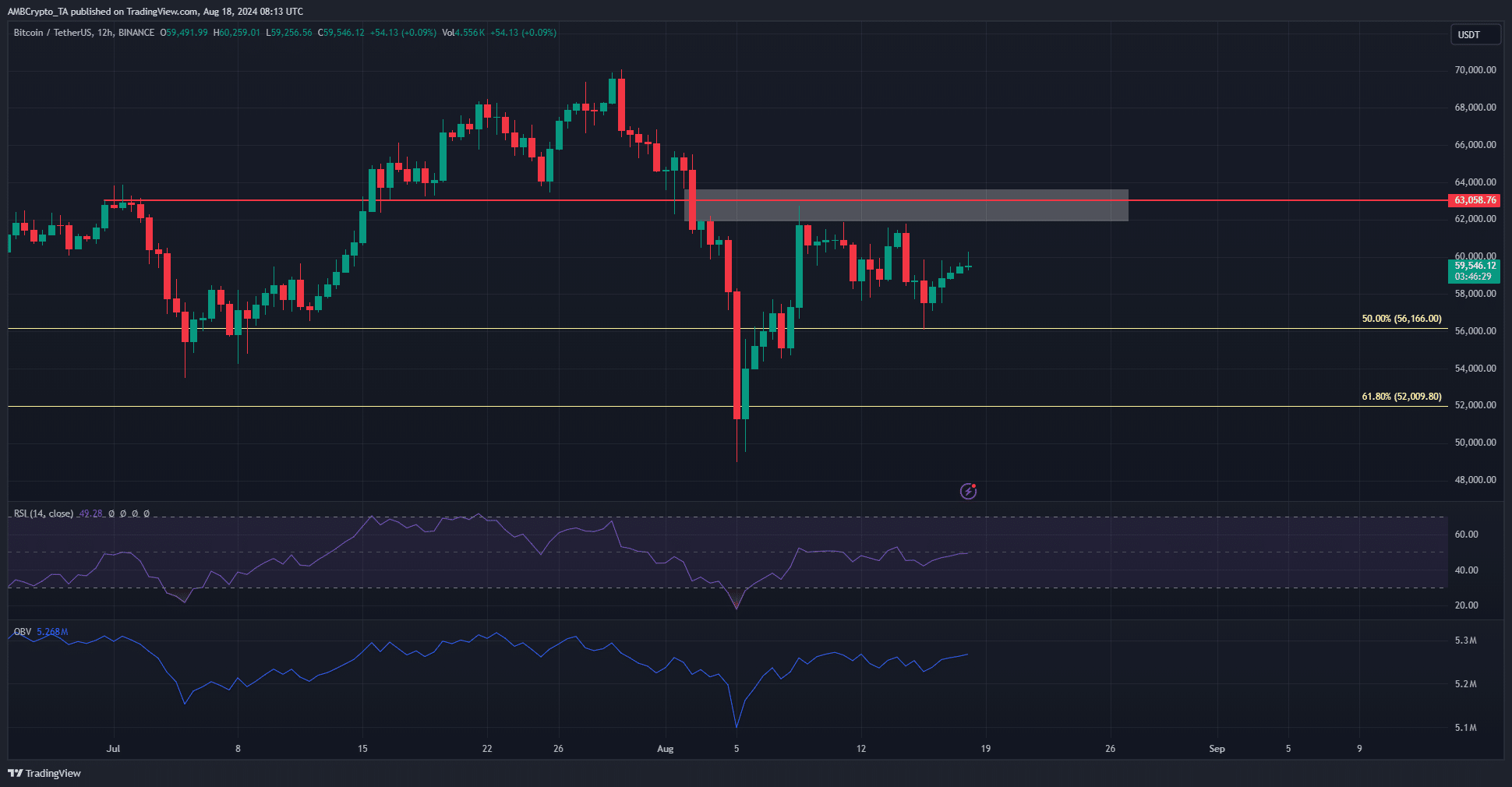

As a crypto investor, I’ve been closely monitoring the market trends, and my technical analysis and liquidation heatmap indicators suggest that breaking the $60k psychological resistance for Bitcoin could prove to be quite challenging. The question now is, do the bulls have sufficient firepower to blast through this barrier?

The momentum might be shifting towards the bulls

Over the past week, the Relative Strength Index (RSI) on the 12-hour chart has hovered close to the 50-neutral mark. During this time, the price has repeatedly been pushed back by the $61.5k zone.

At press time, the RSI appeared to be trying to move above 50 once more.

Over the last two days, I’ve observed the On-Balance Volume (OBV) trending upward. This suggests that the demand could potentially propel Bitcoin towards the $63k threshold. Nevertheless, it’s crucial to note that an equilibrium and a significant resistance level align at this price point.

Supporters of Bitcoin may find it challenging to counteract the sellers, however, they possess an element that might prove beneficial.

Magnetic zones favor the BTC bulls in the short-term

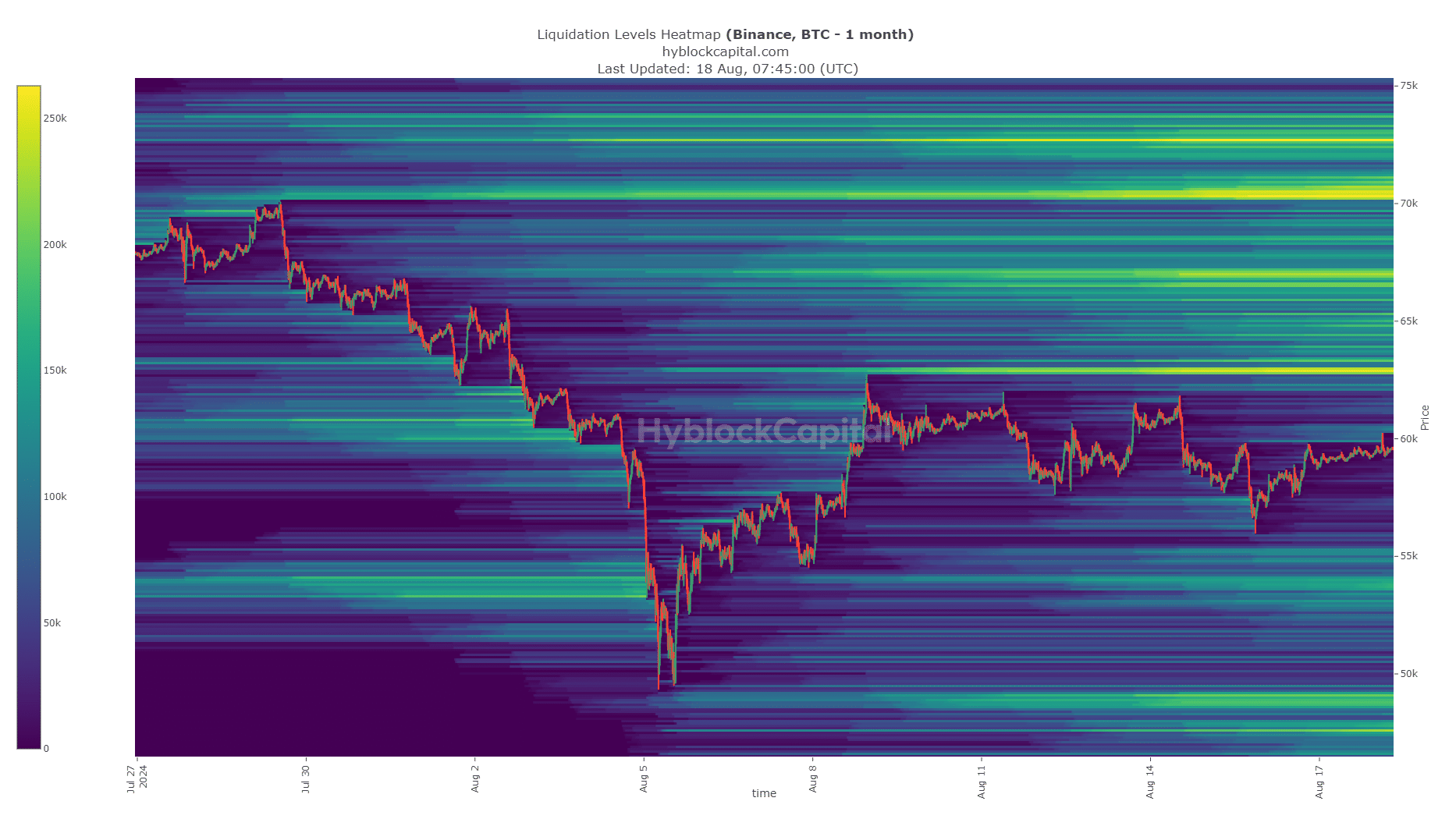

The liquidation heatmap showed a high concentration of liquidation levels at $63k and $67.1k.

At approximately $63,000, the concentration and crowd-like nature of the Bitcoin liquidity group might propel it further upwards, covering that zone before experiencing a potential decline.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The liquidity above $65k was also a magnetic zone, and a move to $67.1k can not be discounted.

Keep in mind, though, Bitcoin’s overall trend on the weekly chart is bearish. A price rise above $69,500 could potentially alter this bearish structure.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-18 16:07