- BTC has recorded an ATH with its latest price trend.

- Another ATH could be on the horizon with the ongoing rise in the coin’s realized cap.

As a seasoned crypto investor with battle-tested nerves and a knack for reading market trends, I can’t help but feel the excitement brewing in the Bitcoin[BTC] market. The recent ATH it has reached is just the tip of the iceberg, with another potential one on the horizon.

In simpler terms, the Bitcoin market often experiences fluctuations in its prices, and investors are always keeping an eye out for indicators suggesting changes might be coming. The data from its realized capitalization seems to support a positive outlook.

Lately, there’s been a substantial increase in the realized capitalization rate of Bitcoin, a change that might be important for predicting its future price trend.

What does the rise in realized cap imply for BTC’s price trend?

Bitcoin sees record realized market capitalization

The realized cap is an alternative to the market cap that accounts for each Bitcoin’s acquisition cost rather than its current market value. It reflects the sentiment of holders who acquired BTC at different price points.

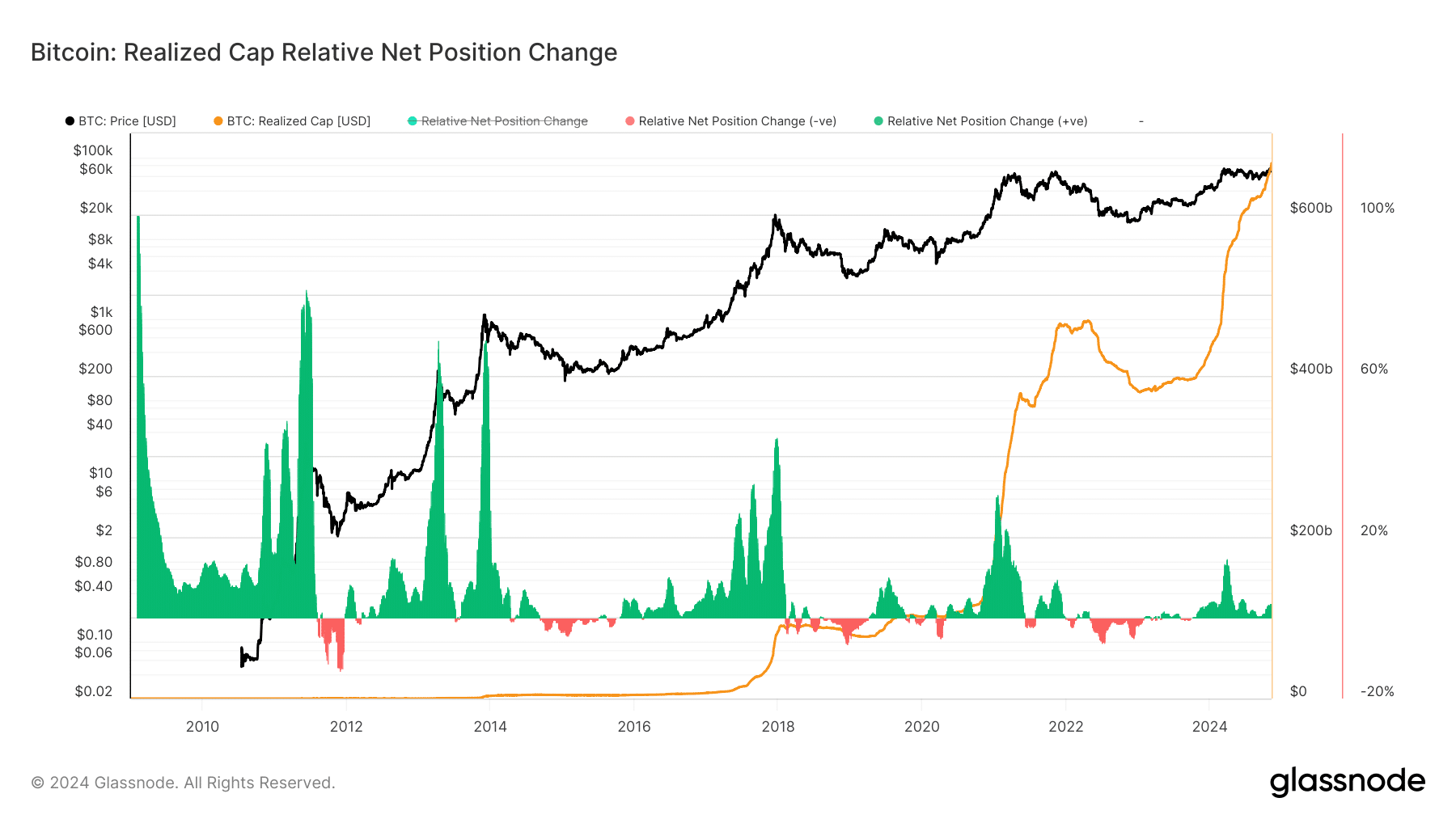

Based on data from Glassnode, we observed a record high of approximately $663 billion for this particular metric, marking an all-time high.

An increasing realized cap implies that the value of cryptocurrencies owned by long-term investors is on the rise. This trend signifies market stability and high investor confidence. The latest surge in Bitcoin’s realized cap indicates a growing influx of capital into BTC, despite its price volatility.

As a seasoned crypto investor, I’ve noticed an interesting pattern with Bitcoin: A surge in the realized capitalization tends to signal reduced selling pressure from holders. Interestingly, when this metric reaches an unprecedented peak, it usually precedes a price drop, followed by another record-breaking high for the coin.

As Bitcoin’s Realized Cap hits record levels, it indicates increased investor faith in its potential price increase in the future. This could lead to a decrease in the amount of BTC circulating in the market for trading purposes.

The impact on BTC’s price trend

An increase in the realized capitalization could potentially influence Bitcoin’s market value. With a growing realized cap, it implies that more investors are choosing to keep their holdings instead of offloading them.

Making this shift might stabilize Bitcoin’s existing price range, paving the way for potential future price growth.

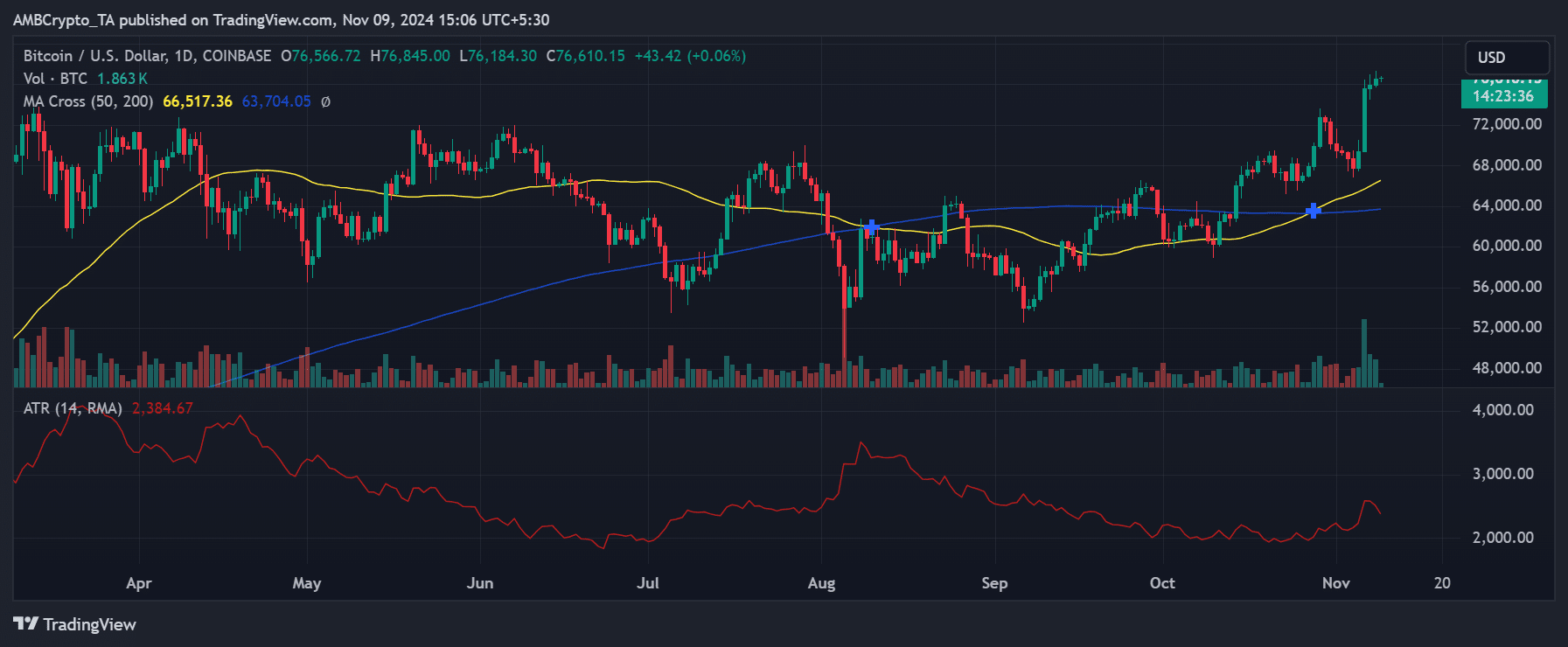

In simpler terms, technical indicators like the moving averages on Bitcoin’s price graph support a positive outlook. Right now, at the current moment, Bitcoin is moving higher than its 50-day and 200-day Moving Averages, indicating a strong upward trend.

Should the expanding actual capitalization persist, it could attract additional investors to purchase and maintain their holdings. This influx might provide lasting price reinforcement at elevated thresholds.

Key levels indicate BTC’s next move

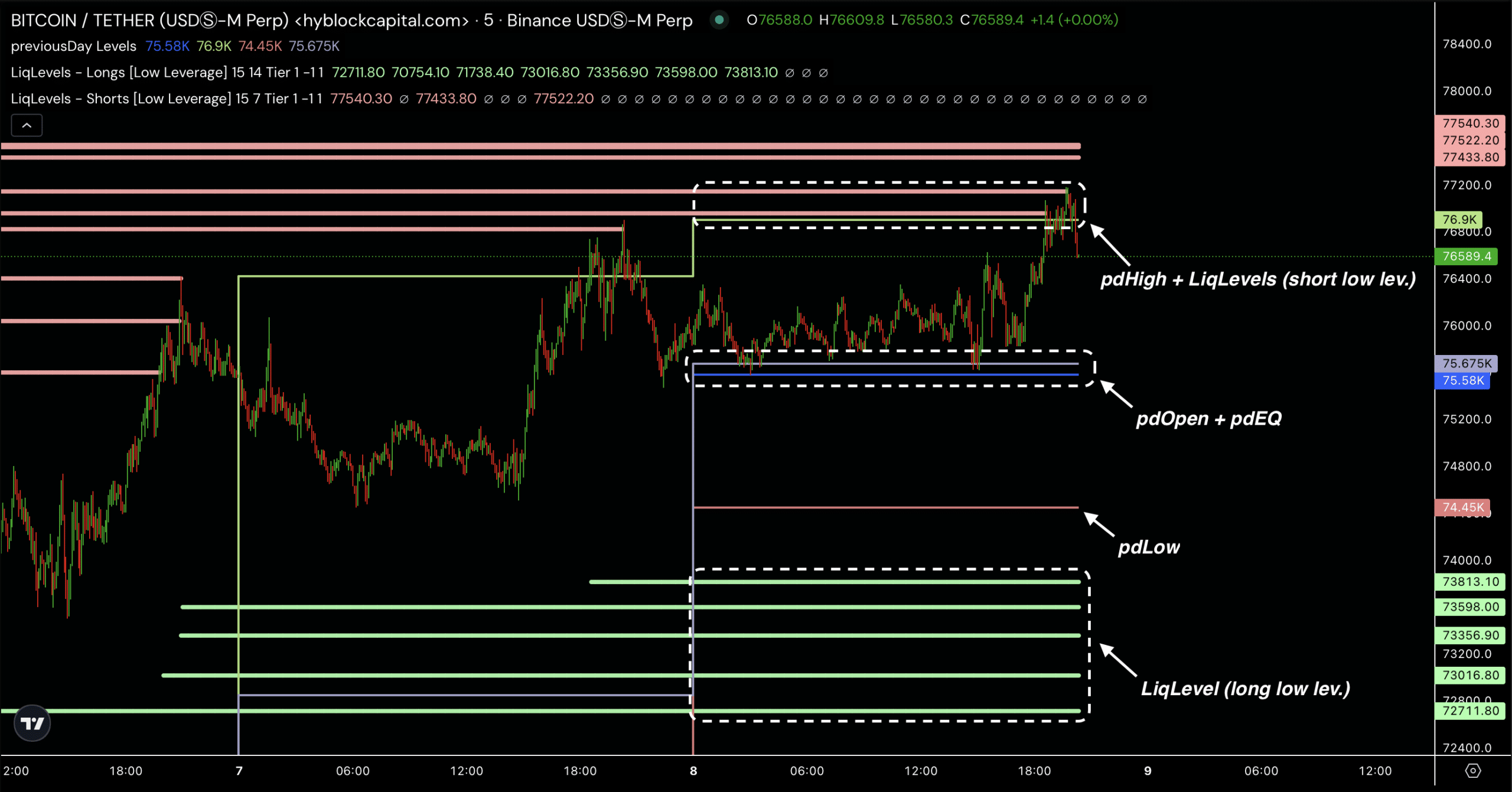

An examination of data from Hyblock revealed that the value of Bitcoin was moving in a narrow band, encompassing both its previous day’s high (pdHigh) and the average of its opening price and equilibrium point (pdOpen + pdEQ). The market conditions indicated potential strong resistance and support points at these levels.

Based on recent figures, Bitcoin encountered resistance near its highest point (pdHigh), as a concentration of short liquidation points suggests significant selling activity.

If Bitcoin breaches this level, it could trigger short liquidations, fueling upward momentum.

From a supportive standpoint, Bitcoin showed resilience near the area of pdOpen plus pdEQ, potentially serving as an opportunity for optimistic investors to enter. The significant long liquidation levels beneath pdLow suggest extra defensive barriers that might hinder a sudden drop, particularly if demand for buying escalates.

This merger indicates a market adopting a cautious approach, mirroring wider patterns of increasing value in the realized capitalization of Bitcoin. This underscores a robust belief among long-term holders regarding its future potential.

What to expect in the coming months?

Historically, significant price increases tend to occur when the realized capitalization of Bitcoin rises during an upward trend. This is due to the fact that investor confidence stays high, and large-scale selling is usually minimal.

If this current trend persists, Bitcoin might experience a new surge and possibly attain or surpass its previous peak levels. Moreover, the Average True Range (ATR) suggests a controlled level of volatility, fostering an ideal setting for Bitcoin’s ongoing expansion.

– Read Bitcoin (BTC) Price Prediction 2024-25

A growing total value held by investors (realized capital) indicates a solid basis for Bitcoin’s pricing, since long-term owners seem unwilling to part with their assets easily.

As an analyst, I’m observing that if past trends persist, this trajectory might serve as a springboard propelling Bitcoin towards reaching fresh price peaks.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-10 08:08