- Bitcoin’s ROI has diminished over cycles, but it still outperforms traditional investments in long-term growth

- Rising leverage and shifting whale sentiment signal increased volatility, making short-term risks more likely

As Bitcoin [BTC] matures, its once-explosive returns have settled into a more stable, yet still impressive, growth pattern. Think of it as a fine wine that has aged, but still occasionally gives you a headache. 🍷💥

With the latest cycle showing a 560% return on investment (ROI), Bitcoin continues to outpace traditional investments like stocks, making it the darling of long-term investors. Who knew digital coins could be so charming? 💰✨

However, with rising market leverage and a shift in whale sentiment towards short positions, the potential for increased volatility looms like a dark cloud over a picnic. ☁️🍔

Diminishing returns, growing maturity

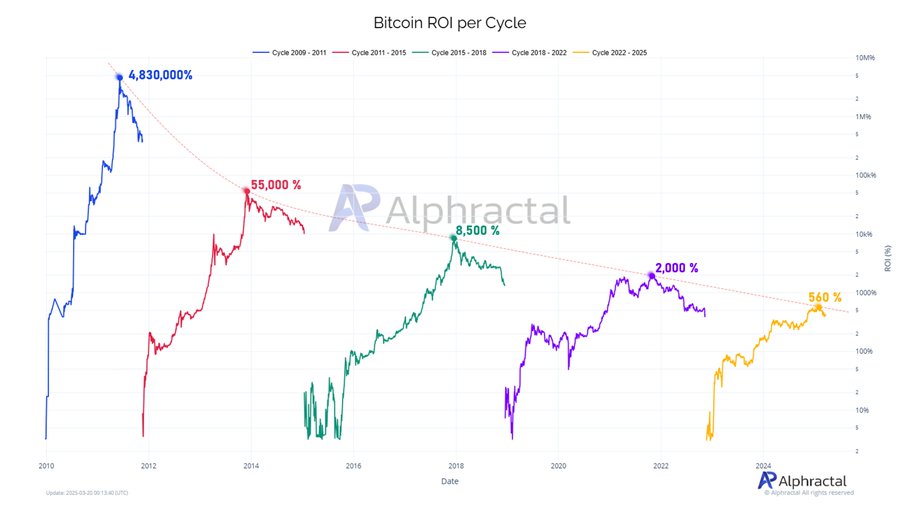

Bitcoin’s ROI has followed a clear downtrend with each halving cycle: from a staggering 4,830,000% gain in its earliest days (2009–2011) to a mere 55,000% in the 2011–2015 cycle, 8,500% in 2015–2018, and a paltry 2,000% during 2018–2022. It’s like watching a once-great rock band slowly turn into a cover band at a retirement home. 🎸🏡

The current cycle (2022–2025) so far shows a 560% ROI—still outperforming traditional markets but reinforcing a steady pattern of diminishing returns as Bitcoin scales and matures. It’s like watching your favorite TV show get renewed for another season, but the plot just keeps getting weirder. 📺🤷♂️

This declining ROI arc mirrors the asset’s increasing liquidity, institutional adoption, and reduced speculative blow-off tops. It’s all very grown-up and responsible, really.

Whale positioning flips bearish as short exposure grows

The latest sentiment data from large Bitcoin holders reveals a shift in positioning. The whale position sentiment index has turned lower after peaking, indicating a rising preference for short positions. It’s like watching a group of whales suddenly decide they prefer the taste of plankton over krill. 🐋🍽️

Historically, sharp downturns in this metric have preceded either short-term pullbacks or high-volatility price zones. So, hold onto your hats, folks!

The change comes at a time when BTC price action shows consolidation around $85k-$90k, suggesting whales may be hedging against downside risk. It’s like they’re putting on their life jackets just in case the boat starts to rock. 🚤💦

This flip in sentiment does not always signal a trend reversal, but it highlights a cooling of confidence among influential market participants. It’s like the cool kids at school suddenly deciding they don’t want to hang out with you anymore. 😢

In a maturing market, such behavior shows the growing influence of derivative markets on price psychology and near-term volatility. It’s all very complicated and slightly terrifying.

Open Interest surges relative to market cap

Bitcoin’s Aggregated Open Interest (OI) relative to Market Cap is rising sharply again, crossing the 3% threshold—a level that has historically preceded increased volatility or short-term corrections. It’s like a warning sign that says, “Caution: Wild Ride Ahead!” 🚧🎢

As the blue line trends upward, it signals a build-up in leverage across futures markets. The growing gap between price and OI/Market Cap ratio suggests speculative positioning is heating up faster than spot market demand.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2025-03-21 12:10