As a seasoned crypto investor with years of experience navigating the tumultuous waters of the digital asset market, I’ve learned to take every metric and indicator with a grain of salt. However, the current state of Bitcoin seems to be following a familiar pattern. The selling pressure from short-term holders is evident, but history has shown us that such patterns can also signal bottoms before rallies.

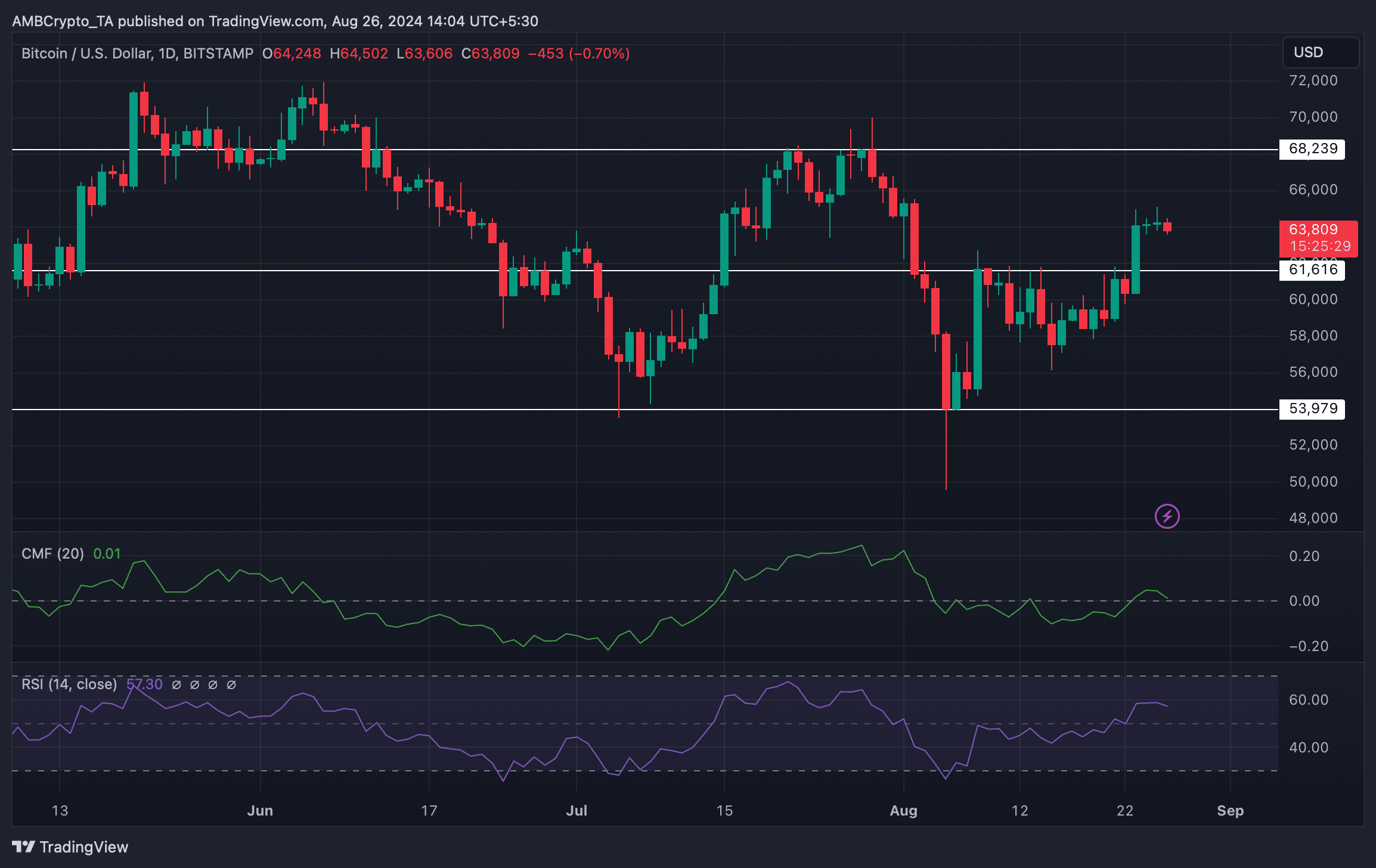

After approaching approximately $65,000, Bitcoin [BTC] has once again shown signs of bearishness, as its daily chart has switched to red. At the same time, short-term holders have been offloading their investments. Is this a sign of a trend reversal or further price decline? Let’s explore the possibilities.

Is selling pressure rising on Bitcoin?

Last week, the value of the cryptocurrency known as “King Coin” surged over 8%. This upward trend gave bullish investors an opportunity to drive the price up to approximately $65,000 on August 24th.

In contrast to the previous trend, there’s been a shift in the past day as Bitcoin’s price slightly decreased. As per CoinMarketCap, currently, Bitcoin is being traded at approximately $63,816.53, and its market capitalization exceeds $1.28 trillion.

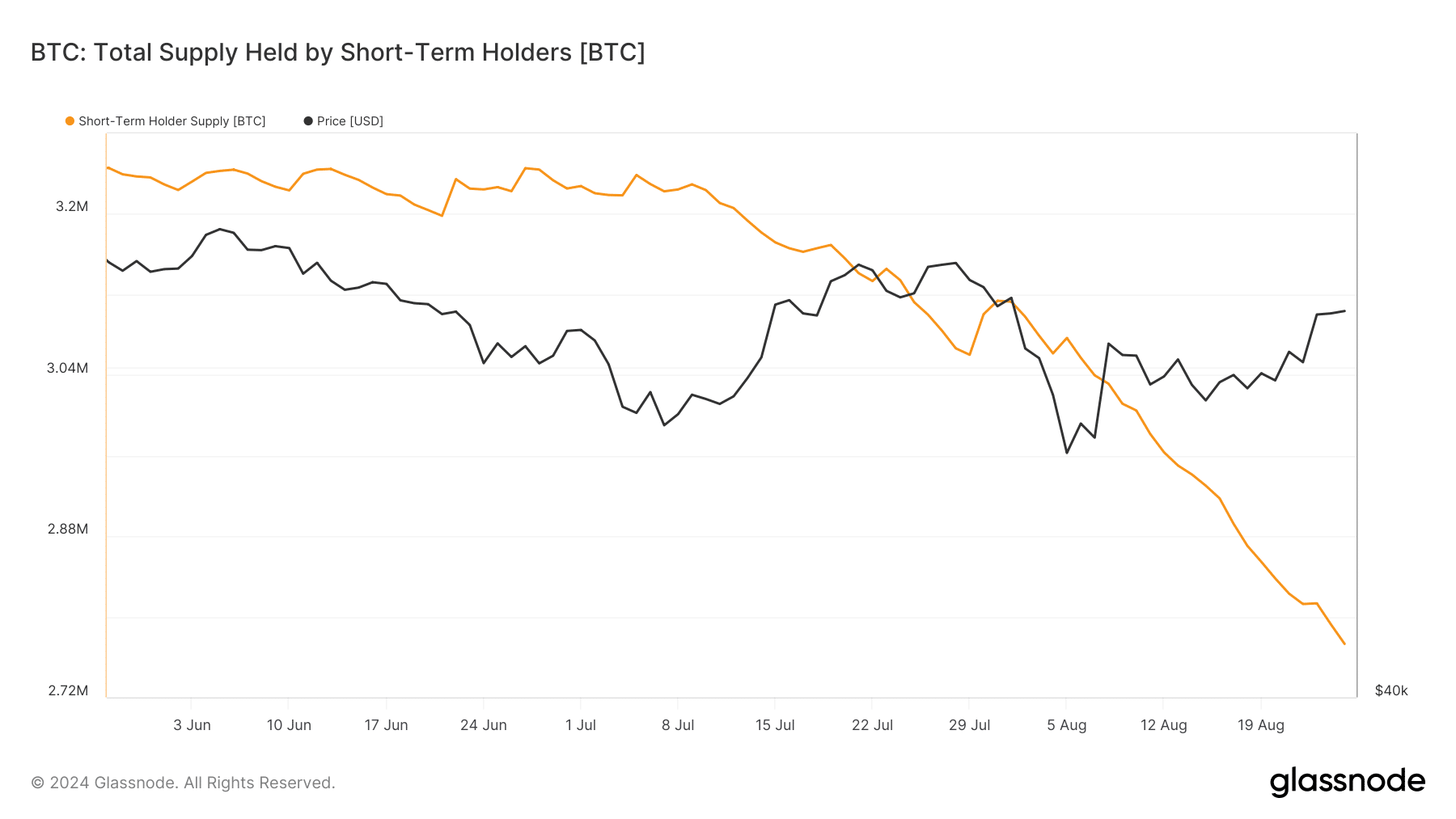

Meanwhile, intoTheBlock shared a tweet highlighting an intriguing trend. According to the post, it’s beneficial to monitor the balances of short-term traders to gain significant information.

Historically, spikes in this metric often occur around market peaks and troughs, making it a helpful indicator for predicting market trends.

After reviewing data provided by Glassnode, it appears that Short-Term Holders (STHs) have been actively selling their cryptocurrency. This trend is supported by a significant decrease in the overall amount of crypto held by STHs over the past three months.

BTC’s road ahead

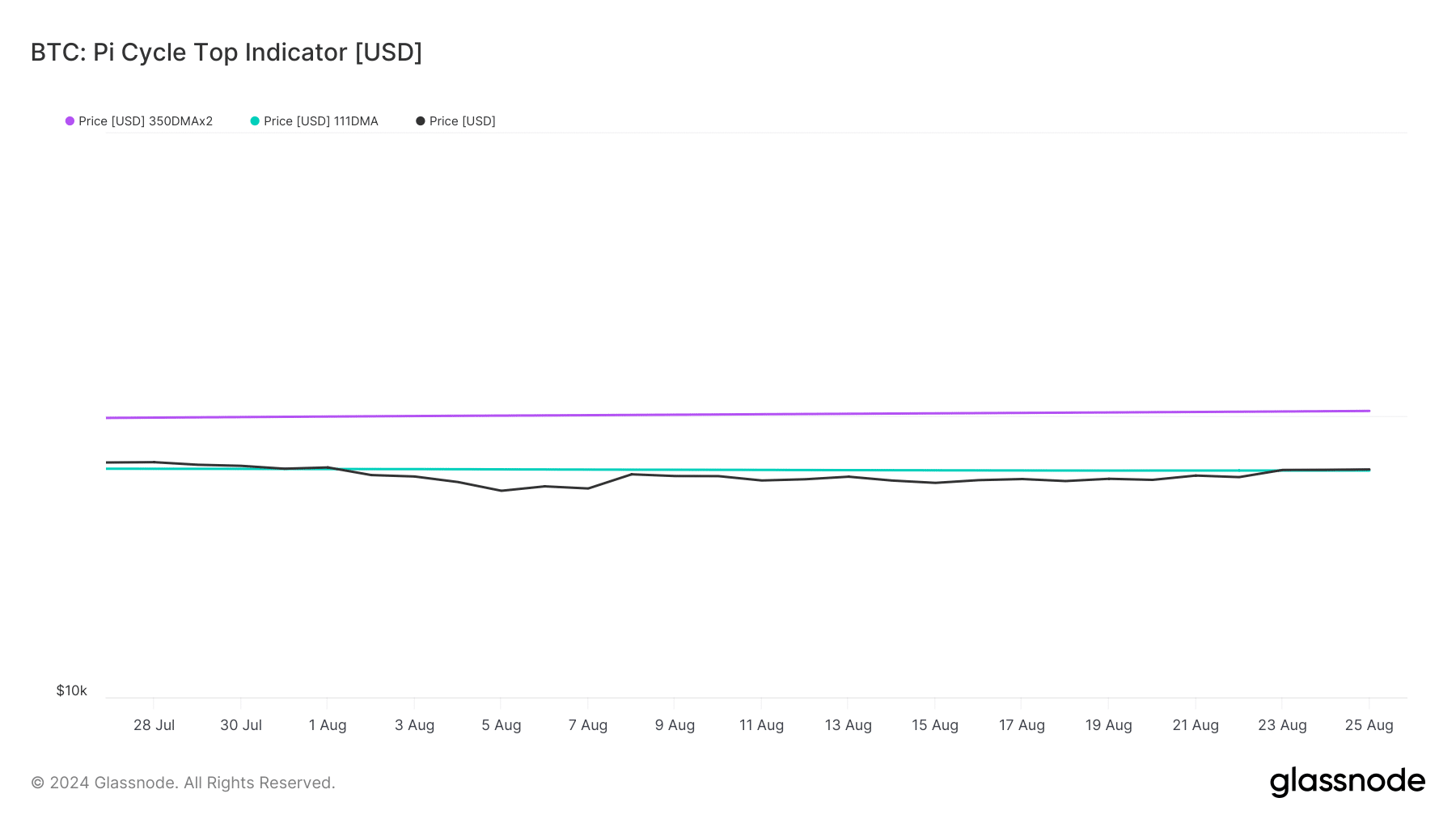

To determine if Bitcoin had reached its market minimum, AMBCrypto examined the Bitcoin Pi Cycle Top indicator. According to our assessment, Bitcoin was precisely at its market bottom priced at around $63,700.

According to the data, it seems like Bitcoin could potentially ignite a new bull run, possibly reaching a peak of around $102,000 within the next few weeks or months.

After examining various factors, we wanted to determine if Bitcoin might start another price surge. By looking at the information from CryptoQuant, our investigation showed that the Coinbase premium for Bitcoin had turned positive.

This meant that buying sentiment was strong among US investors.

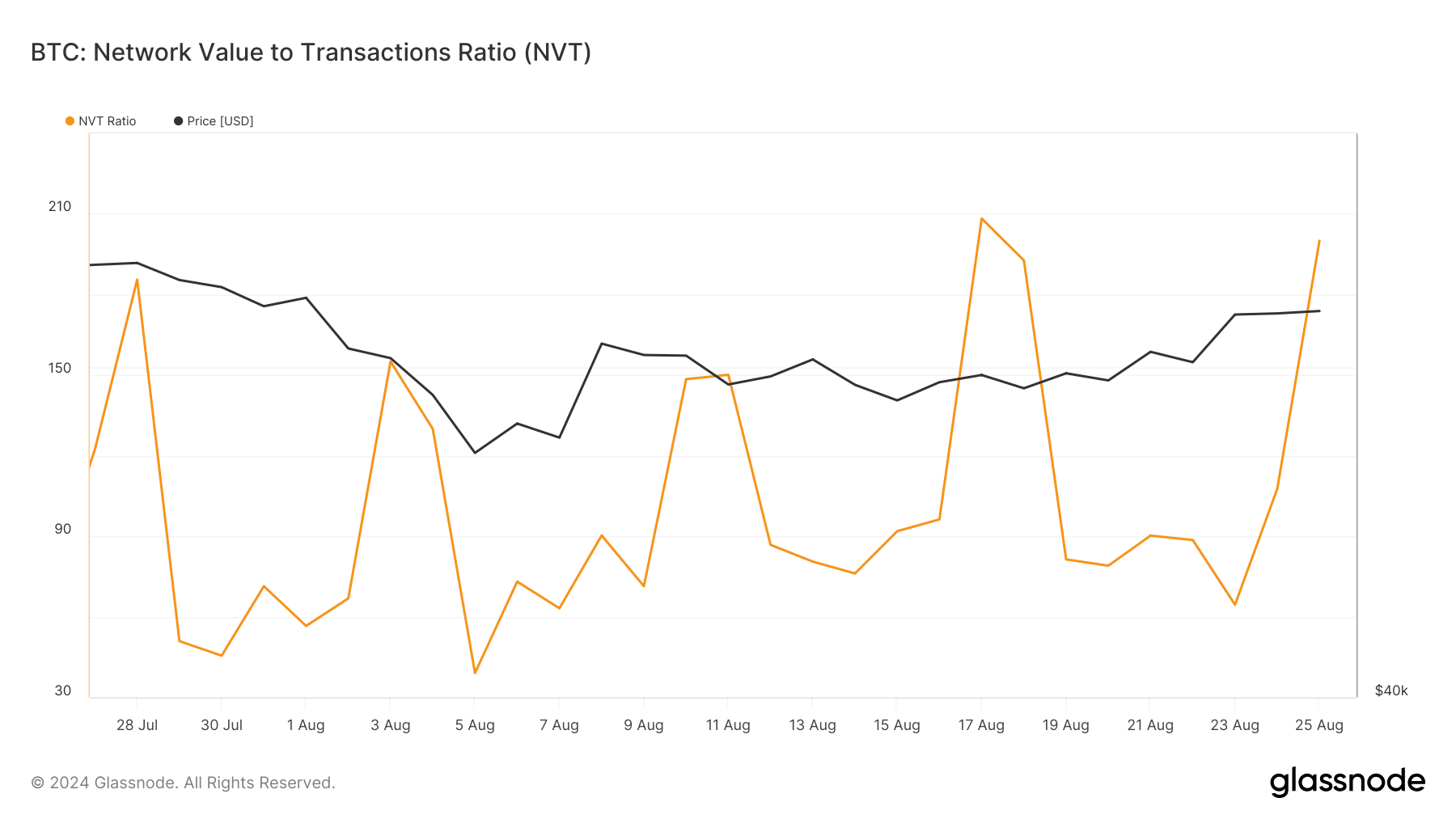

The amount of Bitcoin deposited onto exchanges recently has been relatively low when compared to the typical seven-day average, suggesting an increase in purchasing demand. Yet, the Bitcoin Network Value to Transactions (NVT) ratio showed a significant spike.

Generally, a rise in the metric means that an asset is overvalued, suggesting a price correction.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Just as previously mentioned statistics, market indicators for Bitcoin appeared to be quite negative. For instance, the Chaikin Money Flow (CMF) showed a decrease. Similarly, the Relative Strength Index (RSI) exhibited a declining trend.

This suggests that investors could see a temporary drop in Bitcoin’s price, followed by a resurgence of its upward trend in the near future.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-27 08:08