- Bitcoin’s price recovery is linked to reduced sell-side pressure from major stakeholders.

- Increased ETF inflows and institutional demand are supporting Bitcoin’s current price stability.

As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely monitored Bitcoin’s price movements and market dynamics over the past few months. Based on the recent developments, it appears that Bitcoin’s price recovery can be attributed to reduced sell-side pressure from major stakeholders and increased institutional demand.

💣 Urgent EUR/USD Warning: Trump’s New Tariffs Unleashed!

A massive forex shakeup could be moments away. Get the inside story!

View Urgent ForecastAfter experiencing a prolonged price decline, Bitcoin (BTC) has recently bounced back and surpassed the $65,000 threshold once again today, indicating a potential recovery.

At present, the price of Bitcoin stands at $65,448, representing a 4.4% increase over the previous 24-hour period. Notably, the value peaked at $66,059 earlier today.

Based on Glassnode’s analysis of blockchain data, this price increase could be due to a short-term reduction in sellers, indicating a brief respite from the intense selling pressure that has significantly impacted Bitcoin’s price trend over the past few weeks.

Significant sellers, such as the German government, have halted massive selling activities, leading to a substantial reduction in the pressure on Bitcoin’s market value from the sell-side.

Based on my extensive experience working in the financial markets, I firmly believe that this development represents a significant turning point. As someone who has witnessed numerous market shifts over the years, I can tell you that this change could potentially set the stage for more consistent or even rising prices down the line. This is an exciting prospect, as it may provide stability and opportunities for growth in what has historically been a volatile industry.

Bitcoin: Analysis of recent market movements

According to Glassnode’s analysis, the cause behind Bitcoin’s recent price drop to approximately $53,000 can be attributed to two primary factors: forthcoming restitution payments from the defunct Japanese crypto exchange Mt. Gox and significant Bitcoin sell-offs by the German government.

Based on my extensive experience in the cryptocurrency market, I believe that several factors have played a significant role in driving up the supply of Bitcoin and putting pressure on sellers. These factors include increased institutional investment, heightened regulatory scrutiny, and growing market speculation.

During this compact timespan from July 7th to 10th, approximately 39,800 Bitcoin were sold off by the German government in quick succession. This massive transfer brought about a noticeable decrease in Bitcoin holdings, which soon leveled out afterwards.

During this period of stability, Bitcoin’s price didn’t dip any farther, implying that the market had effectively dealt with the impact of these transactions.

The surge in Bitcoin spot ETF investments, amounting to a substantial inflow of funds, bolstered the price, signaling a renewed enthusiasm for the cryptocurrency market since late spring.

As a researcher studying the cryptocurrency market, I’ve observed an influx of over a billion dollars into these specific funds last week. This surge in investment coincides with Bitcoin’s price rebound, suggesting that the selling pressure may have been exhausted, potentially indicating a shift towards buying sentiment in the market.

Institutionally driven purchases have offset the initial round of selling activity, resulting in a noticeable improvement.

The significant reduction in Bitcoin exchange transactions signifies this Market trend, serving as vital markers of market fluidity and investor mood.

The daily exchange flow has noticeably dropped from its peak in March, settling around $1.5 billion as the new normal.

A decrease in Bitcoin’s exchange activity typically means fewer sellers are offloading their coins, leading to less pressure to lower prices. Simultaneously, growing institutional involvement implies a more optimistic market perspective.

Upward move to be extended?

It’s interesting to note that according to Glassnode, the recent surge in Bitcoin’s price may be a result of sellers running out of steam. However, to assess whether this price increase is likely to persist, it’s essential to examine Bitcoin’s underlying fundamentals.

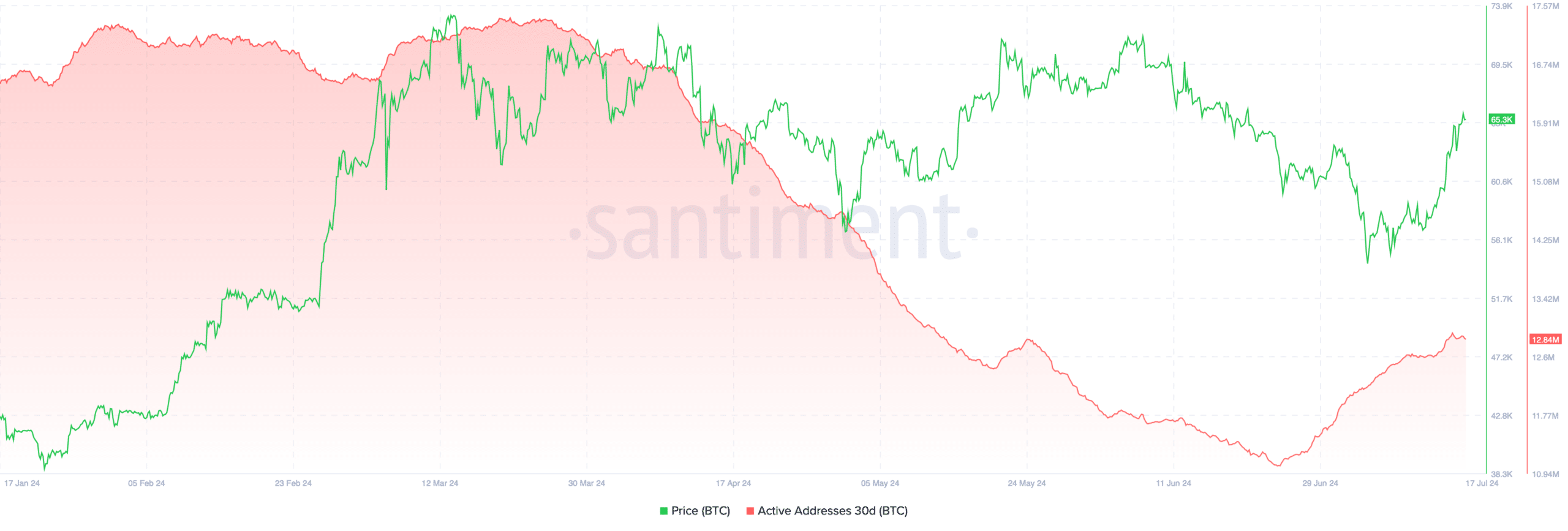

As an analyst examining Santiment data, I’ve noticed that the number of active Bitcoin addresses has been on the mend. This metric dipped to a low of 11 million in late June from a high of 17.35 million back in March. However, recent developments have seen this figure rebound and now stands at 12.84 million.

The bounce back in Bitcoin’s price indicates increasing retail demand, possibly contributing to its further upward trend.

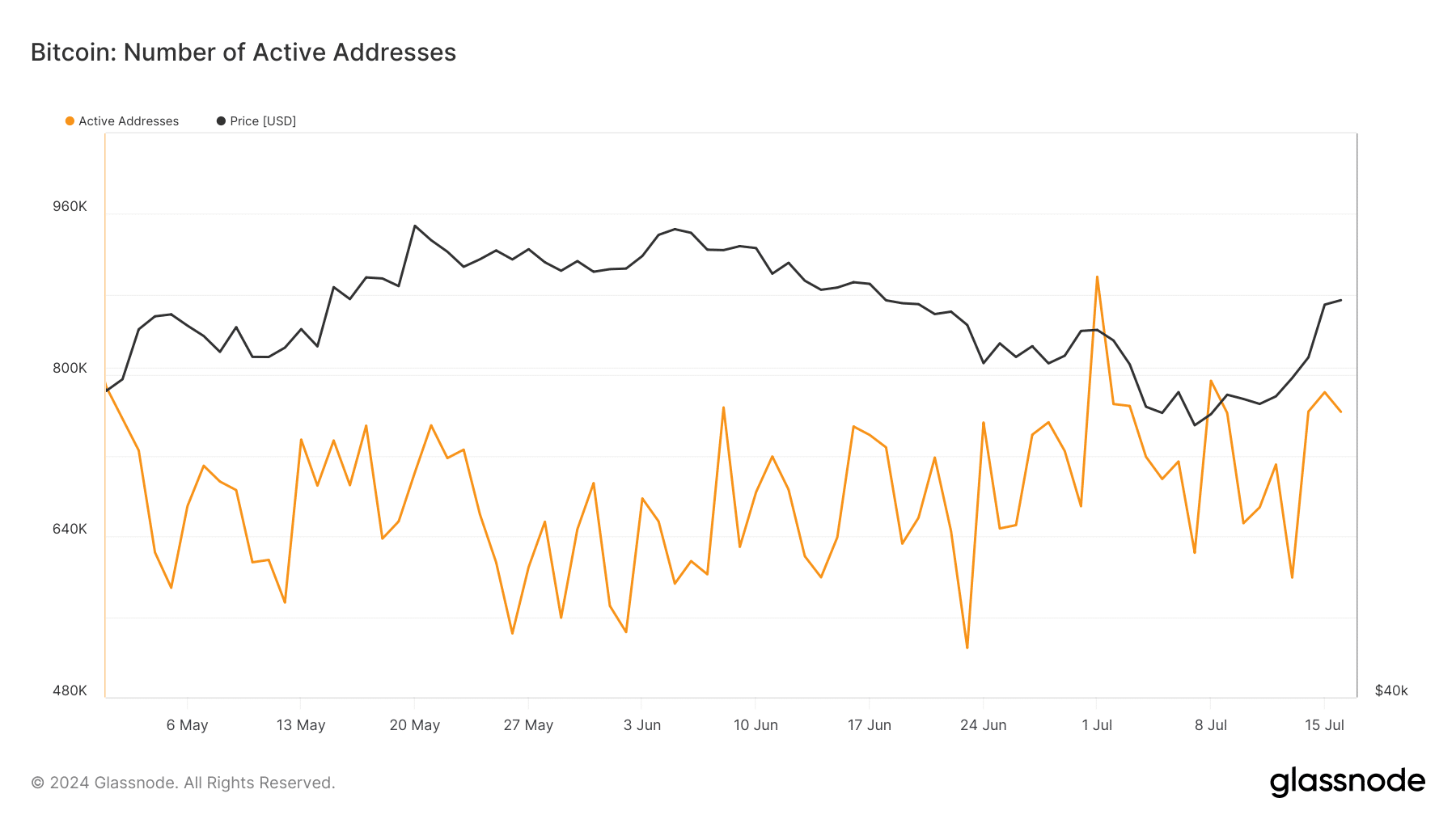

As a researcher studying Bitcoin’s dynamics, I’ve observed an intriguing trend in its new address creation based on data from Glassnode. After experiencing a dip below 600,000 new addresses in late June, there was a noticeable surge, reaching a high of 897,000 on the first of July. However, this number has since stabilized at approximately 763,000 new addresses as of now. This uptick in new address creation underscores the growing interest and activity within the Bitcoin network.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In spite of this temporary setback, the continuous growth in the number of active and new addresses could be a sign of a more robust market presence. This could potentially lead to additional price stability or increases.

In line with this perspective, AMBCrypto noted that Bitcoin’s tendency to transform resistance levels into support might indicate an approaching period of stability or even a price increase if it continues to surpass crucial benchmarks.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-07-18 07:04