-

Market sentiment around BNB turned bearish in the last few days.

Most metrics also looked bearish on the coin.

As a seasoned researcher with years of experience in the cryptosphere, I have learned to read between the lines and decipher the market trends. After thoroughly analyzing BNB‘s current state, it appears that the coin might be heading for a correction this week. The sell signal flashed on its chart, coupled with the declining weighted sentiment and social volume, suggests that investors are losing confidence in BNB.

Last week saw a strong presence of bullish trends in the crypto market, leading several digital currencies to record increases in their prices.

Nevertheless, it appears that conditions for BNB may be shifting, as a sell indicator has emerged on its graph. Let’s examine the current situation of the coin more closely to gain insight into its potential behavior this coming week.

BNB’s price to plummet?

According to CoinMarketCap’s findings, the coin’s price increased by over 6% during the past week. However, the previous 24 hours showed a downward trend, causing the coin’s graph to switch from green to red.

Currently, as I type this, Binance Coin (BNB) is being traded at approximately $577.01. Its market cap exceeds a staggering $84.2 billion, positioning it as the fourth largest cryptocurrency in existence. The recent drop in price was not entirely unexpected.

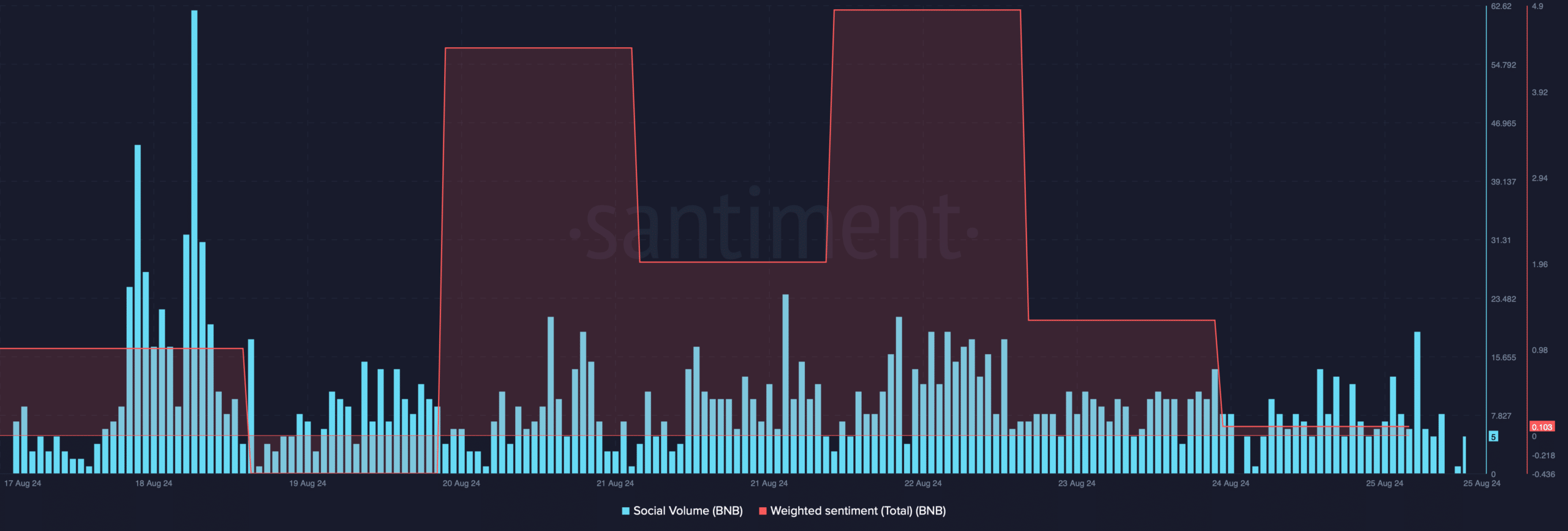

According to an analysis by AMBCrypto using Santiment’s data, it appears that investor trust in BNB has been decreasing over the last few days. This decrease can be seen through the decline in its weighted sentiment, indicating a loss of confidence. Furthermore, the social volume associated with BNB has also dropped, suggesting a decrease in its appeal or popularity among investors.

While delving into my ongoing analysis of cryptocurrencies, I recently noticed a tweet from well-known crypto analyst, Ali, suggesting a potential further drop in prices. The tweet mentioned that BNB‘s TD sequential had indicated a sell signal, which aligns with my current findings and adds weight to the bearish outlook.

Therefore, AMBCrypto dug deeper to find out where the coin’s price might drop in this fresh week.

A closer look at BNB’s state

At the current moment, as reported by AMBCrypto, the Fear & Greed Index stands at 61%, indicating that the market is experiencing a “greed” period.

Whenever the metric hits this level, it suggests that the chances of a price correction are high.

Additionally, data from Coinglass showed another potential bearish sign. From what we can see, the long/short ratio for BNB experienced a significant drop. This implies that there are currently more short trades in the market compared to long ones, suggesting an increase in bearish feelings toward the coin.

According to findings from Hyblock Capital, the difference between ‘whale’ (large investors) and ‘retail’ (individual investors) participation in BB’s market decreased significantly, falling from 61 to 19. This indicates that large investors are becoming less active or reducing their presence in the market.

To begin, let me clarify that this particular metric spans a range of -100 to 100. A score of zero signifies an equal distribution between whales (large institutional investors) and retail (individual or smaller-scale investors).

Realistic or not, here BNB’s market cap in BTC’s terms

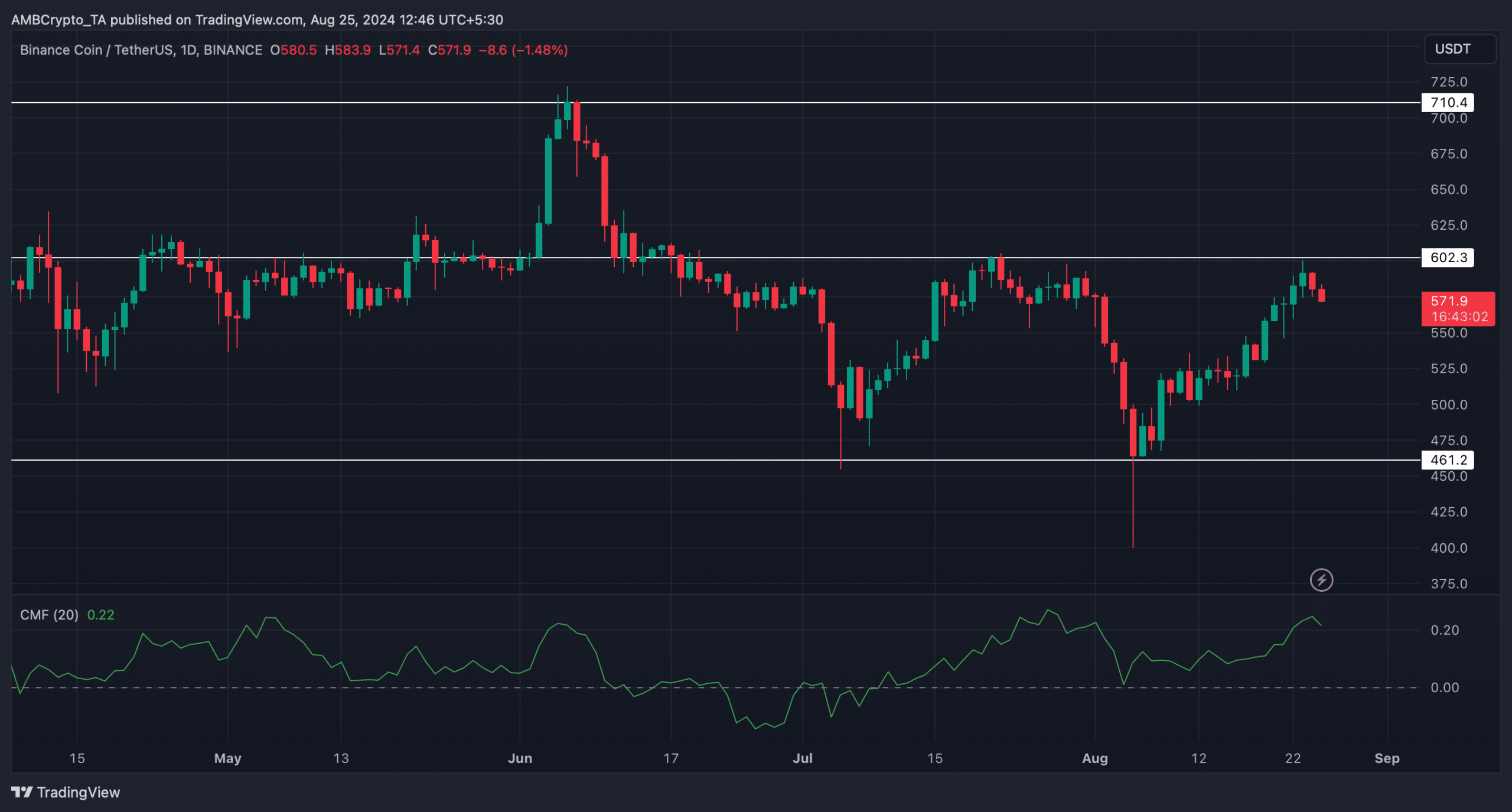

Analyzing the day-to-day trajectory of the coin, I noted that BNB encountered a rejection near the resistance level of approximately $602.3.

The Chaikin Money Flow (CMF) showed a decrease, suggesting that the price could continue falling in the near future. If this trend continues, it wouldn’t be unexpected to see the value of the coin dropping down to approximately $461.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2024-08-26 03:04