- In the dusty corners of the BNB Chain, liquidity has been growing like weeds in a forgotten garden, and a rally to $730 is not just a dream but a possibility lurking on the charts.

- Market sentiment is like a grumpy old man, bearish and skeptical, yet the buying volume could just be the cheerful neighbor who brings cookies to turn the tide.

For the first time in what feels like an eternity, BNB has decided to show some bullish gains, rising nearly 2% in just 24 hours. This comes after a previous downtrend that left investors feeling like they’d just lost a game of poker with a raccoon. 🦝

This rally could be the dawn of a new era, especially if BNB can leap over a critical resistance line and if the selling pressure in the derivatives market decides to take a vacation. So, let’s dive into the depths of BNB’s potential movements, shall we?

Liquidity inflows strengthen BNB’s price movement

According to the wise folks at AMBCrypto, there have been notable inflows into the BNB Chain, intensifying like a soap opera plot twist. These inflows have not only fueled the price rally but have also sparked an uptick in Total Value Locked (TVL), which is just a fancy way of saying folks are locking up their BNB like it’s a prized possession.

TVL measures the amount of BNB deposited and locked across various protocols on the BNB Chain. A hike in this number suggests that more investors are putting their faith in a potential price rally, or perhaps just trying to impress their friends.

Between March 12-15, BNB Chain’s TVL surged by a whopping $496 million, which is like finding a forgotten treasure in your attic. The scale of these liquidity inflows can also be linked to a rise in active addresses during this period.

As of now, active addresses are peaking at 1.1 million, after hitting a monthly low of 959,200 on March 8, with transaction counts soaring to 4.5 million. The growth in these metrics, along with the price and TVL, hints at the dominance of buyers across the market, like a pack of hungry wolves at a buffet.

BNB faces key resistance

This price surge has pushed BNB to a resistance line that has been forming since mid-February, like a stubborn fence that refuses to fall. On the last two occasions when the price touched this resistance, it led to a decline across the board, much like a bad sequel to a beloved movie.

If it manages to breach this level, there’s a high chance the asset will record gains of 23.48%, climbing to as high as $732. Fingers crossed! 🤞

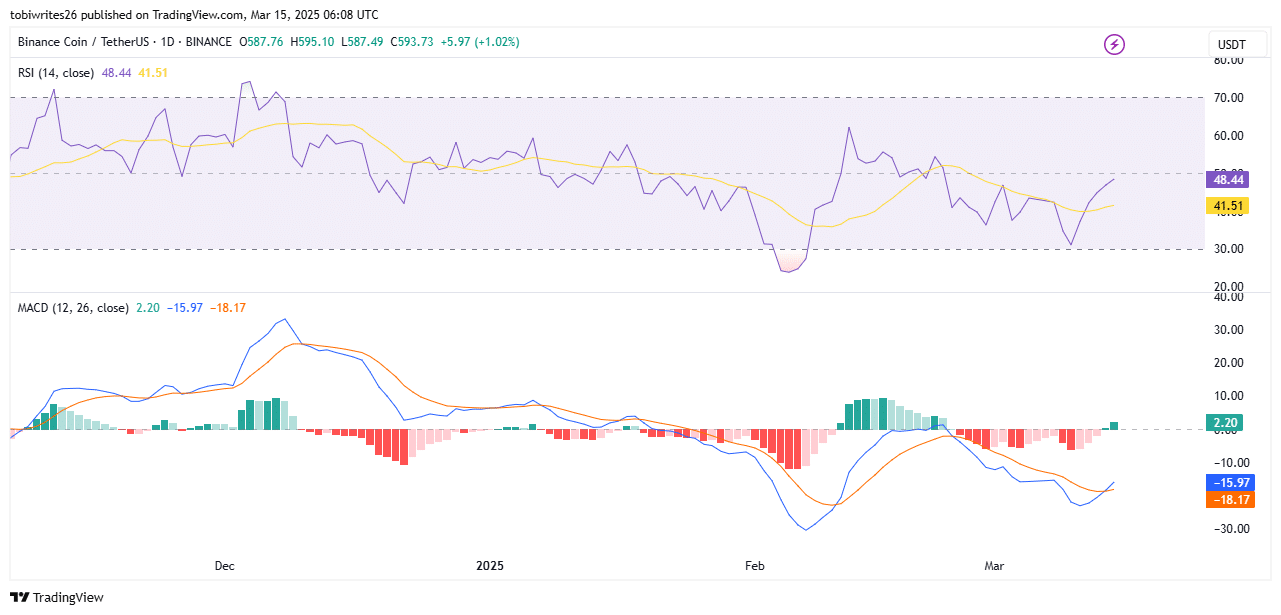

Technical indicators on the chart are hinting at a potential market rally. At press time, the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are whispering sweet nothings of a bullish scenario for the altcoin.

The daily RSI movement suggests that the asset might continue to trend higher, especially as it seems to be closing in on the buy zone – above 50, which is like the sweet spot for a good party.

The MACD has also formed a classic golden cross pattern, which is like the universe aligning for a bullish move. If this occurs, a BNB breakout could be just around the corner, ready to surprise us all.

Derivatives data shows mixed sentiment among traders

Despite the high bullish sentiment in the market, some traders have been selling like they’re trying to get rid of last year’s fruitcake. As of now, Open Interest in both the Futures and Options markets has fallen by 2.30% and 1

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2025-03-15 21:15