-

Data showed that ADA sellers were exhausted, and have offered buyers a chance to buy at lower prices.

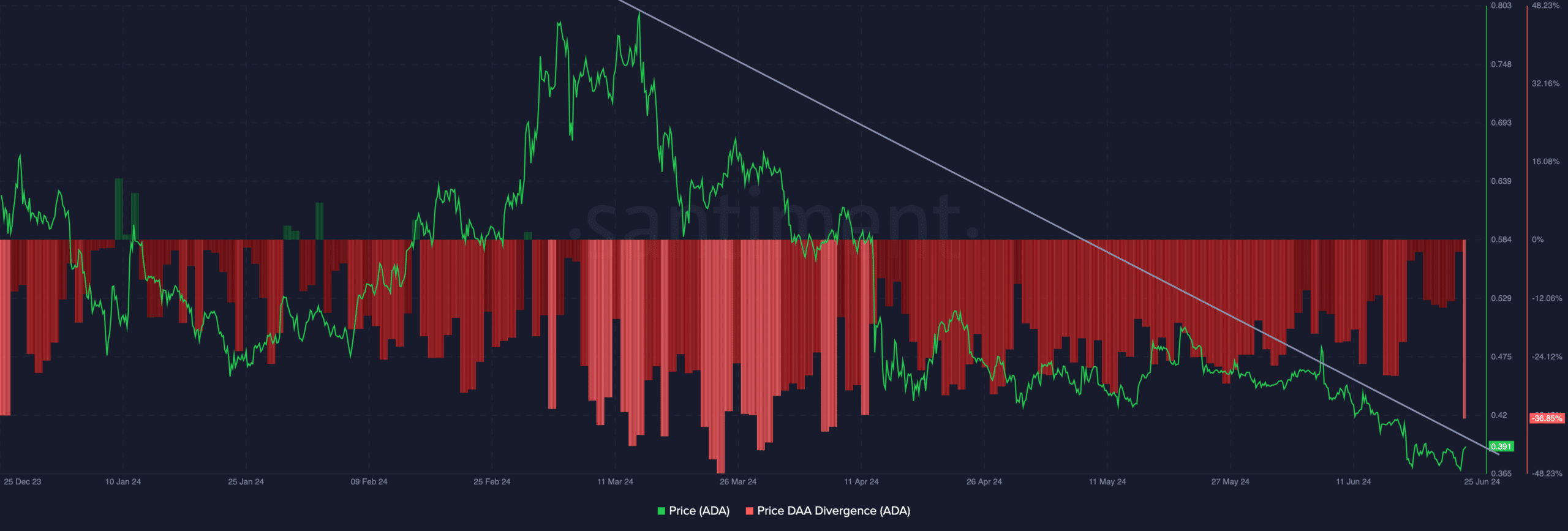

The price-DAA divergence reinforced the bias, suggesting an increase to $0.40.

As a seasoned analyst with extensive experience in the crypto market, I believe that Cardano (ADA) is on an uptrend and the recent price action supports this theory. The Tom DeMark Sequential indicator presented a buy signal on ADA’s chart, suggesting a potential increase to $0.40. However, it is crucial to consider the token’s network activity from an on-chain perspective to validate this prediction.

According to crypto analyst Ali Martinez at X (previously known as Twitter), although Cardano‘s [ADA] price has risen alongside the broader market recovery, there is still a possibility that the token could continue its upward trend.

Based on Martinez’s analysis, the TD Sequential indicator signaled a buying opportunity for Cardano according to its reading on the chart. This tool, developed by Tom DeMark, assesses market trends and pinpoints instances of potential exhaustion, indicating an impending price reversal in the cryptocurrency.

ADA on the right track

At the moment of publication, ADA was trading at a price of $0.38. But if verified, the altcoin’s worth might increase, potentially reaching $0.40. Nevertheless, it’s crucial to assess the token’s potential from an on-chain standpoint.

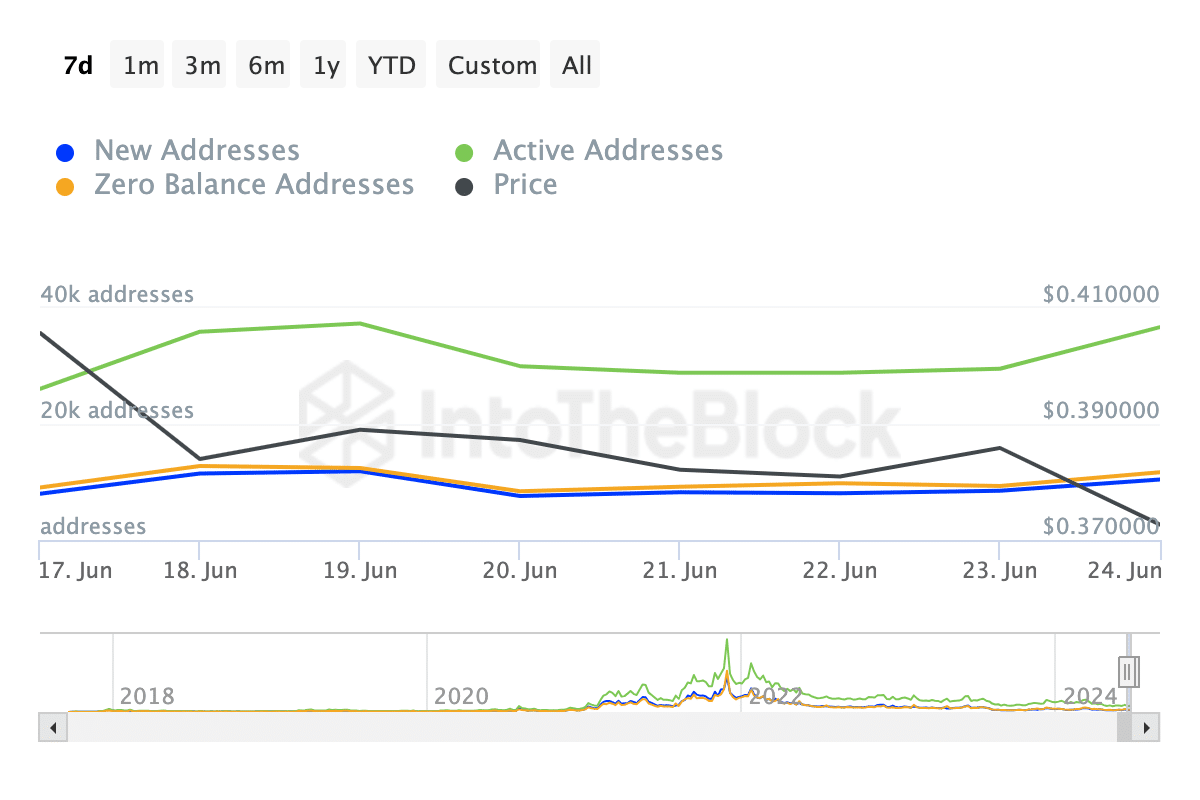

Technical indicators by themselves don’t dictate price movements. Instead, to gain a more comprehensive understanding, AMBCrypto examined Cardano’s network activity. We focused on three aspects: the number of active addresses, the emergence of new addresses, and the count of zero-balance addresses.

As a crypto investor, I closely monitor the health and growth of the Cardano (ADA) ecosystem. The combination of various key performance indicators, such as the number of active addresses, transaction volume, and network fees, offers valuable insights into the adoption of ADA and the traction on the Cardano network. Based on the latest data from IntoTheBlock, these metrics have shown a positive seven-day trend.

I analyzed the data and found that the number of new addresses grew by 30.70% during this timeframe. Simultaneously, there was a significant surge in active addresses, which expanded by 40.80%. Additionally, the count of zero-balance addresses went up by 29.24%.

As a crypto investor, I’ve noticed some significant growth indicators for ADA recently. These developments suggest a surging interest in the coin, potentially leading to a greater price hike than the 4.23% increase we witnessed within the past 24 hours.

Buy now, sell later

As a researcher, I investigated the disparity between ADA‘s price and its Daily Active Addresses (DAA) to determine if the discrepancy indicated a potential buying opportunity.

From my perspective as a crypto investor, the price-DAA (Daily Active Addresses) divergence serves as a crucial indicator signaling the disparity between price fluctuations and network activity. Based on the chart below, Cardano’s price-DAA divergence amounted to -36.85%. This substantial discrepancy suggests that price moves have not aligned with the underlying network activity, which could potentially lead to significant shifts in market trends.

Commonly, this indicator provides possible buying and selling opportunities. In the context of trading, an increase in participation greater than the price rise signifies a buy signal.

If the network activity outpaces ADA‘s price rise as depicted in the image, then selling may be a viable option. This discrepancy suggests that the price increase might not be sustainable.

Based on Martinez’s forecast, if the trend continues as expected, ADA may reach $0.40. In an extremely optimistic scenario, the price could even surge to $0.42.

Read Cardano’s [ADA] Price Prediction 2024-2025

As a market analyst, I would caution investors about the seemingly optimistic outlook for the token. The market’s volatility remains high and may pose risks even to those considering investment.

Should this scenario hold true, cryptocurrencies may exhibit significant price fluctuations. Currently, the bulls are in control, but it’s also plausible that bears will take charge temporarily.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-25 22:06