-

LINK’s Long/Short ratio currently stands at 1.031, indicating a bullish market sentiment among traders.

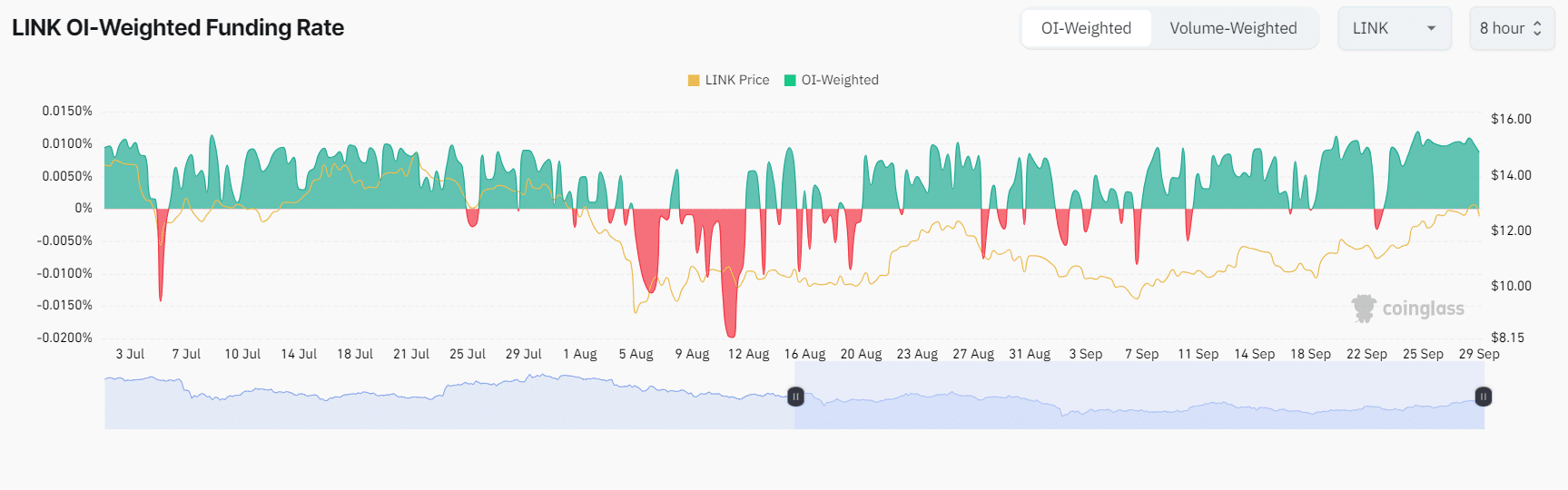

LINK’s OI-weighted funding rate is positive at 0.0087%, further signaling bullish sentiment.

As a seasoned crypto investor with a knack for recognizing promising opportunities, I find myself intrigued by Chainlink [LINK]’s current market dynamics. The bullish sentiment among traders, as indicated by the Long/Short ratio and positive OI-weighted funding rate, suggests that LINK could be on the verge of a significant upside rally.

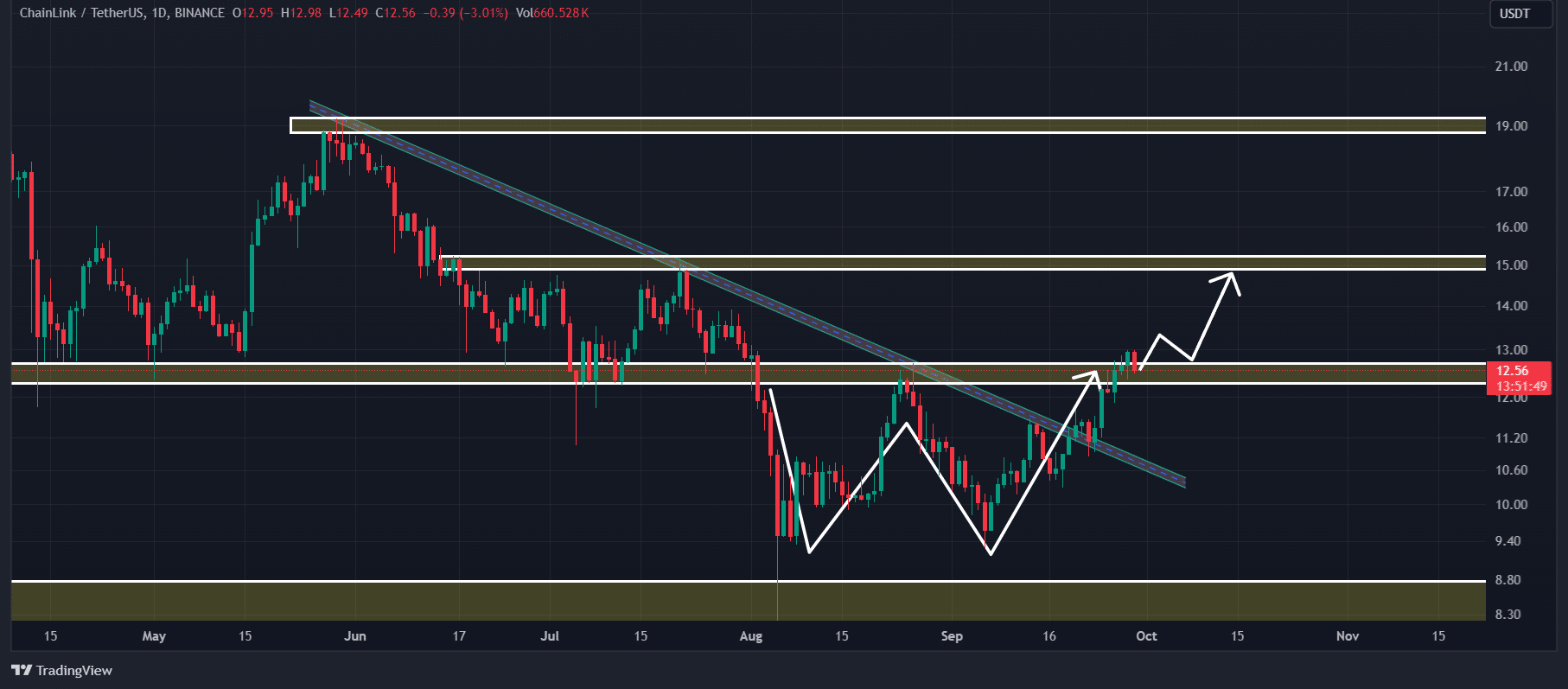

Chainlink (LINK) appears ready for a significant surge following its breakout from a favorable price pattern, which suggests potential upward momentum.

Currently, the general feeling towards the crypto market is steady, as there haven’t been any significant surges observed in prominent cryptocurrencies like Bitcoin, Ethereum, or Solana.

Chainlink technical analysis and key levels

Based on the technical analysis provided by AMBCrypto, Chainlink (LINK) displayed a bullish trend after it successfully broke through the anticipated double-bottom pattern that was formed in the daily chart. This pattern had been eagerly awaited by traders.

Many investors and traders frequently interpret this pattern as a positive sign, particularly when they decide to invest for potential growth (going long).

Given the latest trends in LINK‘s price movement, if it ends today’s trading session above the $13.10 mark, it’s quite likely that we might see a 20% increase, potentially pushing the price up to around $15 in the near future.

Although the overall sentiment is positive, the Relative Strength Index (RSI) indicates that LINK‘s value trend is decreasing.

One significant technical indicator in trading and investment is the Relative Strength Index (RSI), which aids users in identifying whether a particular asset is experiencing an upward or downward trend.

Mixed sentiment from on-chain metrics

Beyond the technical assessment, the sentiments surrounding LINK, as indicated by its on-chain data, seem somewhat divided. As per the on-chain analytics provider Coinglass, the Long/Short ratio for LINK is presently 1.031, which suggests that traders are generally optimistic towards the market.

Moreover, the OI-weighted funding rate stands at a favorable 0.0087%, indicating a bullish trend in market sentiments.

As a crypto investor, I’ve noticed that over the last 24 hours, LINK‘s future open interest has remained steady. This suggests that neither my nor other traders’ positions have been liquidated, nor are there any new positions being built. This could be due to some apprehension about a possible price correction, as we keep an eye on market movements.

Read Chainlink’s [LINK] Price Prediction 2024–2025

Based on information from Coinglass, the key points for potential market reversals are currently set at around $12.12 (on the downside) and $13.16 (on the upside). This is because traders have taken on a high level of leverage at these price points.

Currently, LINK is close to being priced at around $12.65. In the last day, it has seen a significant increase of approximately 1.2%. However, there’s been a noticeable drop in trading activity, with a decrease of about 25% in the number of trades made within the past 24 hours, suggesting reduced interest from traders and investors.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-29 23:03