- Chainlink’s Open Interest rose to a three-month high of $206M

- A descending triangle pattern on the daily chart highlighted a prevailing bearish trend

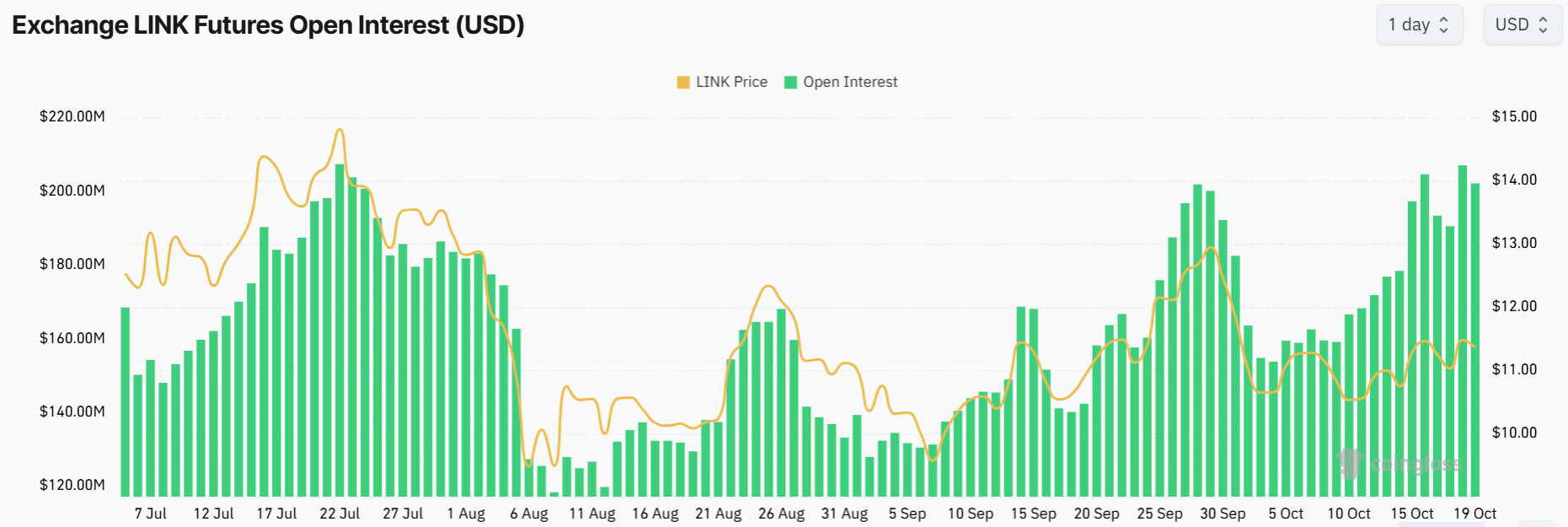

As a seasoned analyst with years of experience in the crypto market, I find myself constantly navigating between bullish and bearish sentiments. Today, my analysis leads me to lean towards the latter when it comes to Chainlink (LINK). The spike in Open Interest (OI) to a three-month high of $206M is a red flag for me, given its historical precedent of leading to a price drop.

At this moment, Chainlink (LINK) seems to be indicating a potential slowing down of its upward momentum. Currently priced at $11.38, it has experienced a minor decrease of 0.6%. Interestingly, despite a strong 4% surge over the past week, the trading volume has dropped by approximately 9%, suggesting a possible decline in investor enthusiasm for this altcoin.

On the contrary, a look at the Futures market revealed that more traders have opened positions on LINK lately. Open Interest (OI) jumped to a 13-week high of $206M – A sign of heightened activity among derivative traders as they speculate on future price movements.

Worth noting, however, that this spike in OI has often preceded a fall in LINK’s prices. For instance, the last time LINK’s OI was at this level on 22 July. The altcoin’s price dropped by 45% within just two weeks.

At the end of September, the Open Interest (OI) for LINK reached a two-month peak once more. However, shortly after, its price plummeted by almost 20%.

If Chainlink tends to follow its past patterns, it might lead to a shift towards bearish feelings in the near future.

Chainlink flashes bullish signals

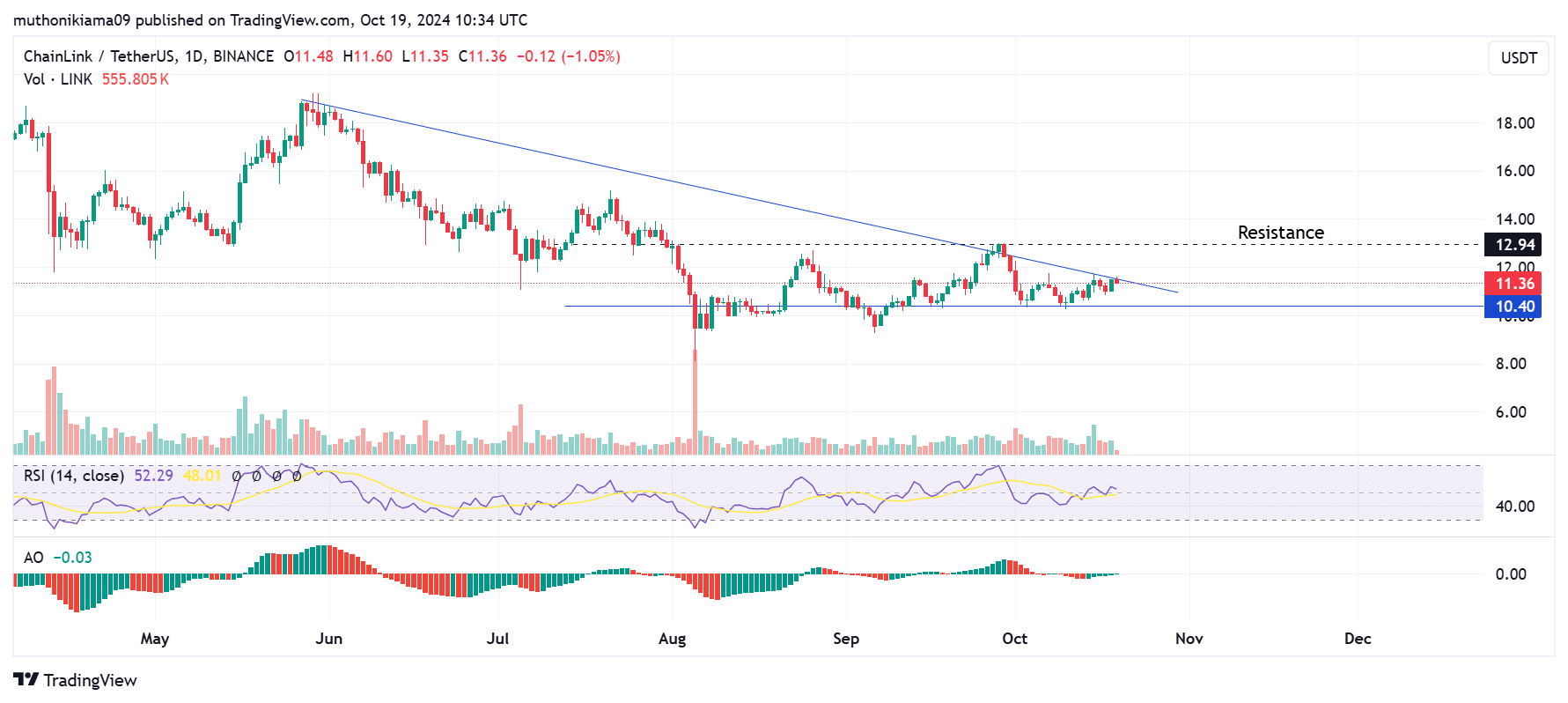

On a day-to-day scale, LINK’s Relative Strength Index was at 52 – a level indicating a slight edge for buyers over sellers, leaning towards neutrality. The RSI line hovered above the Signal line, implying that positive buying pressure or bullish momentum could potentially be present.

At the moment of publication, there appeared to be a downward trend in this line, suggesting that sellers might be joining the market.

As a crypto investor, I noticed that the recent bullish sentiments weren’t as strong as they seemed, according to the Awesome Oscillator (AO). Despite the green bars, they were still showing negative values, which suggests there aren’t enough enthusiastic buyers at this time to sustain an uptrend.

Additionally, the cryptocurrency formed a downward triangle shape, often suggesting a potential downtrend ahead. Currently, it’s found at the top limit of this pattern, indicating that buyers are trying to seize the initiative.

On the contrary, a breakout situation typically involves significant purchasing activity. Interestingly, the volume histogram indicates that there have been fewer buyers than sellers during periods of increased trading.

If buyers re-enter the market and LINK invalidates this bearish thesis, the next resistance would lie at $12.94. Conversely, if the bearish trend persists, LINK will likely drop to test support at $10.40.

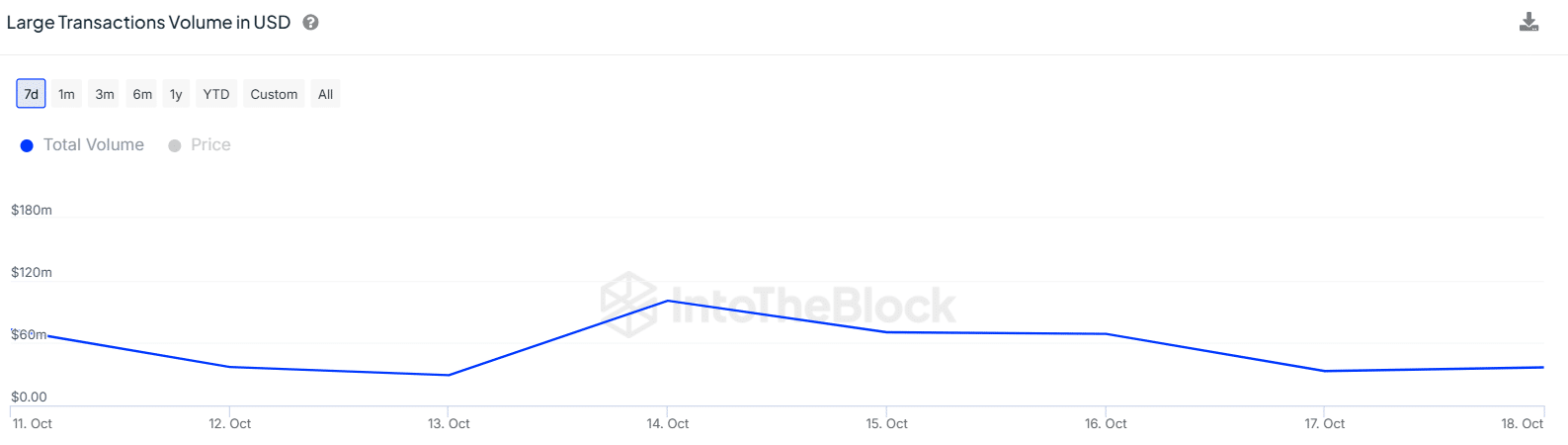

One factor fueling LINK’s upward movement is the activity of large investors, or “whales.” Large transaction amounts peaked at $100 million earlier this week. However, at the current moment, these transactions have dwindled to $36 million, indicating that whales are no longer active. This decrease in activity may lead to a temporary slowdown in LINK’s price growth as reflected on the charts.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-20 01:11