-

LINK’s price dropped by over 11% in the last seven days.

A successful breakout might allow LINK to touch $22.

As an experienced analyst, I have seen my fair share of cryptocurrency price movements and market trends. The recent decline in Chainlink’s [LINK] price has been concerning for investors, with the token shedding over 11% in value in just seven days. However, it’s important to note that markets can be unpredictable, and there are signs that a bullish breakout might be on the horizon.

Last week didn’t bring any profit gains for investors holding Chainlink (LINK). However, there’s a possibility that things could turn around in the new week. The token is close to breaking free from a bullish trend on its charts.

Chainlink’s possible breakout

According to CoinMarketCap’s latest findings, the value of LINK experienced a significant decrease of approximately 11% over the past week. Furthermore, within the previous 24-hour period, there was an additional decline of around 3% in the price of this token.

As a crypto investor, I’m observing that LINK is currently being traded at a price of $14.27. The total value of all existing LINK tokens in circulation amounts to over $8 billion.

According to IntoTheBlock’s findings, approximately 45% of LINK investors experienced a profit as of that point. This situation might be partially explained by the recent significant weekly price decrease exceeding ten percent.

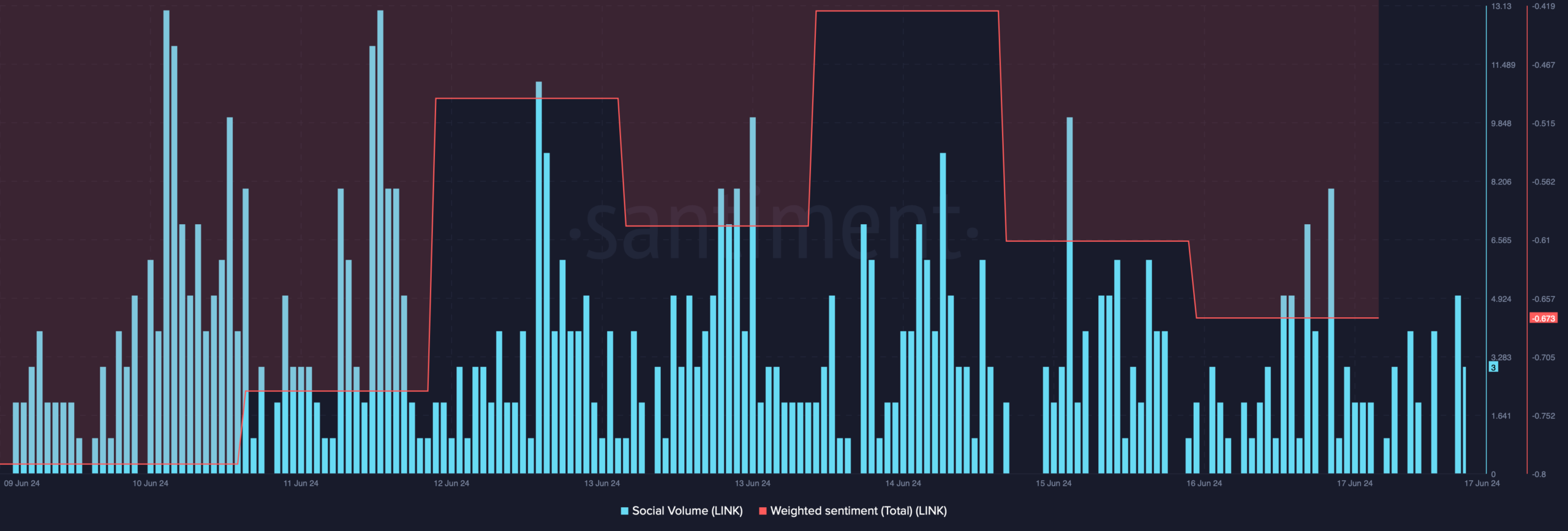

According to AMBCrypto’s interpretation of Santiment’s findings, the bearish market trend negatively influenced the social media activity surrounding the token. Specifically, Chainlink’s overall sentiment score stayed in the red range.

The prevailing attitude towards the token among traders was bearish, with pessimism outweighing optimism. Moreover, the social media buzz surrounding LINK experienced a noticeable decrease, indicating a drop in interest and hype around the cryptocurrency.

However, investors must not get disheartened, as there are chances for the trend to change.

A well-known cryptocurrency analyst, World of Charts, has brought attention to a bullish trend in LINK‘s price chart through a recent tweet. This trend is represented by the formation of a falling wedge pattern.

Based on the tweet I’ve read, it seems that LINK is poised to break free from its current pricing pattern, potentially leading to a substantial increase of around 32%. Should this event transpire, the price of LINK could reach as high as $22 for investors.

Is a bull rally possible?

As an analyst, I delved into the on-chain data of AMBCrypto’s specified token to assess if there were any indicators pointing towards a potential bullish breakthrough.

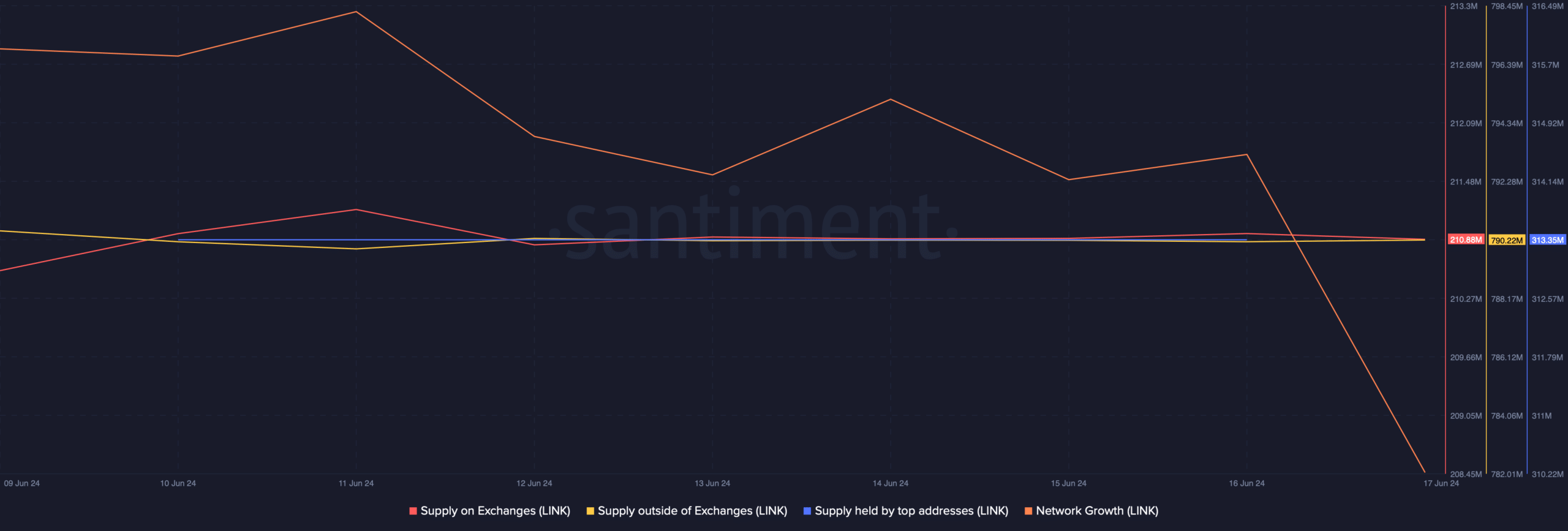

The graphs showing the supply of LINK tokens on exchanges and off exchanges didn’t show much difference. This indicates that there was minimal buying or selling activity among investors, suggesting a low level of market liquidity for LINK.

As a researcher studying whale behavior in the cryptocurrency market, I observed that their activity levels did not significantly change despite the stable supply held by the leading wallets, as indicated by the consistent pattern on the graph depicting their balances.

Additionally, the expansion of Chainlink’s network slowed down recently, resulting in a decrease in the number of new addresses used for token transfers during the past week.

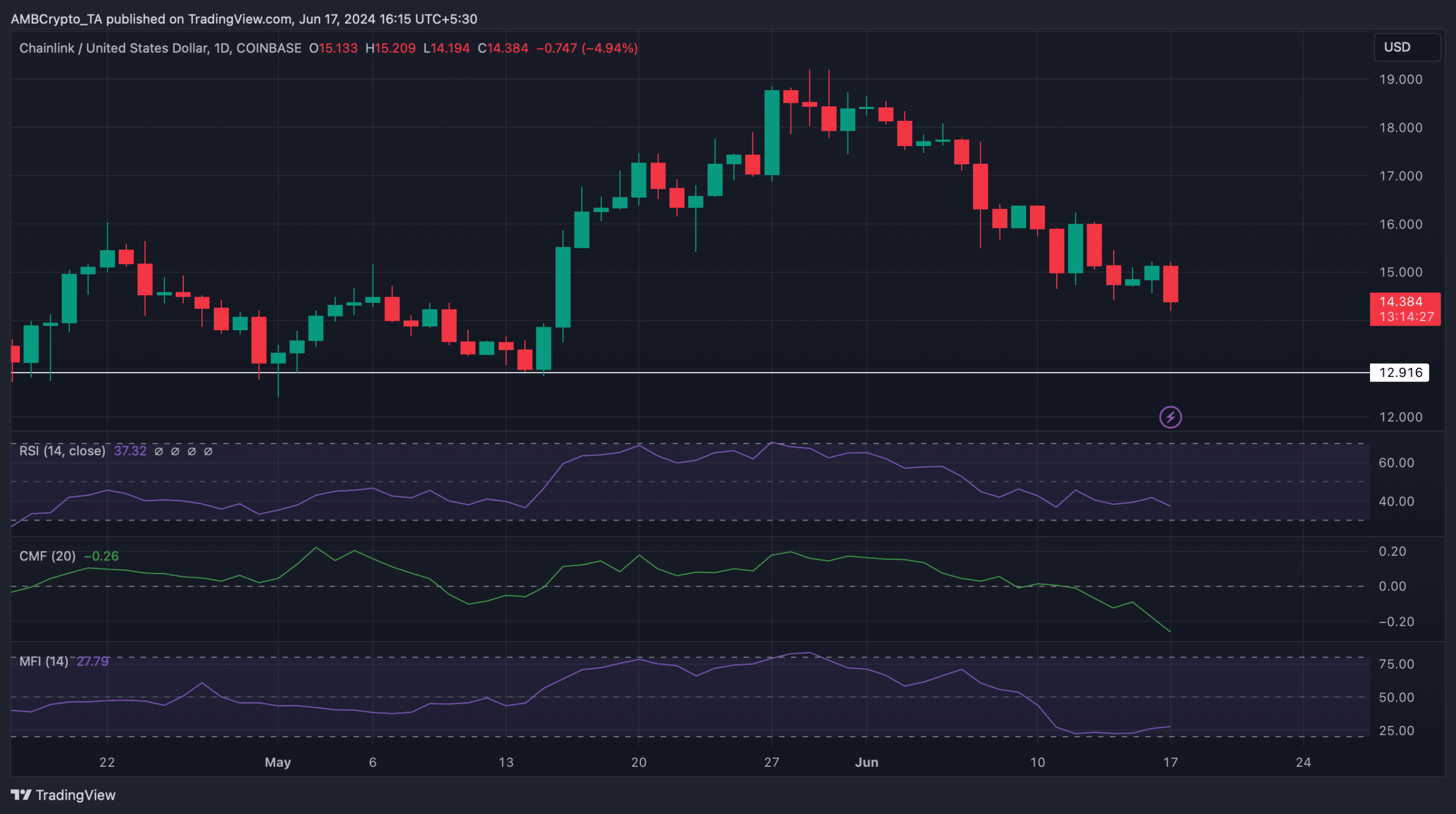

We then took a look at LINK’s daily chart to better understand whether a bull rally was possible.

Based on our examination of LINK‘s technical indicators, I noticed that its Relative Strength Index (RSI) took a dip. Furthermore, the Chaikin Money Flow (CMF) mirrored this downward trend, implying a possible continuation of the price decline in the near term from my perspective as a crypto investor.

Realistic or not, here’s LINK market cap in BTC’s terms

If this bearish price trend continues, then LINK might soon plummet to its support level of $12.9.

Nonetheless, the Money Flow Index (MFI) was slightly bullish as it made a northward movement.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-06-18 06:15