-

CME Group added XRP to its crypto benchmarks

According to Ripple’s CEO, Spot XRP ETFs are one step closer now

As a researcher with a background in finance and experience following the crypto market closely, I believe that CME Group’s addition of XRP to its crypto benchmarks is a significant step towards institutional recognition for Ripple’s digital asset. The launch of XRP reference rates and real-time indices signals growing demand for reliable price feeds among investors, particularly institutions, which can foster trust and confidence in the cryptocurrency market.

As a researcher following the developments at Ripple closely, I’m excited to report that the company has recently achieved several notable milestones amidst its ongoing tussle with the SEC. One such advancement came today with the announcement from CME Group and CF Benchmarks about the launch of XRP reference rates and real-time indices.

The CME Group unveiled the initiation of XRP reference rates and real-time indices on their dedicated X page. This announcement was made by the company itself.

Beginning July 29, enjoy clear-cut pricing for two fresh cryptocurrencies – the CME CF Internet Computer-Dollar and XRP-Dollar Reference Rates and Real-Time Indices – as they get incorporated into our growing collection of benchmarks.

As an analyst, I’m thrilled and hopeful about the recent move by Ripple’s CEO, Brad Garlinghouse. Like numerous other industry observers, I see this development as a potential milestone on the path towards institutional acceptance, perhaps even paving the way for XRP exchange-traded funds (ETFs) in the future. According to Garlinghouse himself, this is his perspective as well.

As an analyst, I’m pleased to observe the partnership between CME Group and CF Benchmarks in creating an XRP index. This collaboration reflects the market’s demand for more diverse and innovative financial instruments.

Significantly, this action underscores the increasing need amongst investors, particularly institutions, for accurate pricing information in the cryptocurrency market. By supplying dependable and transparent pricing data, we can identify emerging market tendencies regarding institutional interest in cryptocurrencies. This initiative is instrumental in building trust and confidence, thereby promoting wider usage and acceptance of cryptocurrencies.

Following the July 29th debut, the live market data for XRP will be refreshed on prominent cryptocurrency exchanges including Kraken, Coinbase, and Bitstamp.

SEC’s XRP is a Security controversy

The Securities and Exchange Commission (SEC) in the United States has been engaged in a protracted legal dispute with Ripple over allegations that the company unlawfully sold XRP tokens in unregistered securities offerings. Despite this, the SEC has historically considered XRP to be a security. However, Judge Torres recently made a ruling that XRP, on its own merit, does not qualify as a security.

Despite going against the recent federal ruling, a California judge’s decision from last month casts uncertainty over the standing and future of the altcoin.

Ripple’s leaders and legal consultants have consistently held a contrasting viewpoint. In their perspective, XRP does not qualify as a security based on current legal definitions.

XRP ETFS Possible Soon With SEC’s previous stand?

The debate over XRP‘s legal classification as a security has fueled uncertainty about the prospect of spot exchange-traded funds (ETFs). Yet, Ripple’s CEO is optimistic about XRP’s trajectory for institutional investment. In response to CME Group’s introduction of reference rates, he expressed this belief.

To initiate the creation of cryptocurrency offerings from institutions, it’s essential to establish a reliable benchmark rate as a point of reference.

For the past three months, there has been ongoing debate about the potential approval of XRP-backed spot ETFs. Despite this uncertainty, Garlinghouse and others continue to express optimism regarding the possibility. In a recent interview, he went so far as to assert that an XRP ETF is not only feasible but also logical.

Impact on XRP’s price charts

As a crypto investor, I’m observing that XRP is currently priced at $0.517, marking an impressive 18% increase in value over the past week. This positive trend was also reflected in the last 24 hours with a significant surge in trading volume exceeding 52%.

According to AMBCrypto’s assessment, XRP is currently experiencing a robust upward trend. If this trend continues, it could lead to a brief price surge in the near term.

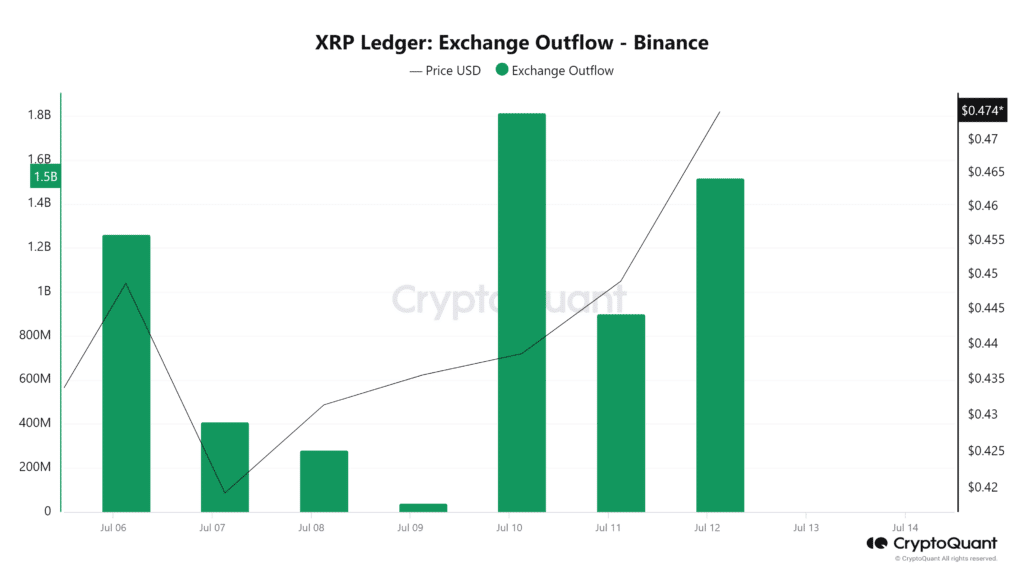

As an analyst, I’ve discovered through our examination of CryptoQuant that XRP experienced a significant increase in exchange outflows. These outflows rose from a minimal amount of $40.6 million to a substantial $1.5 billion. This trend signifies that investors are holding onto their XRP for the long term, thereby reducing selling pressure and fueling the price upward on the charts.

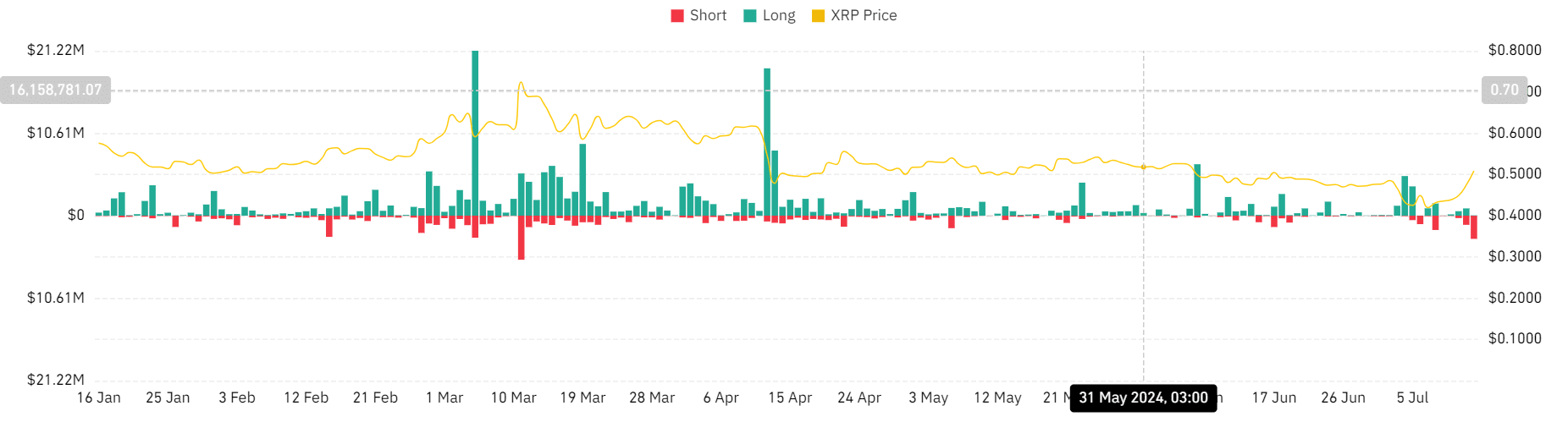

Last week, as reported by Coinglass, there was a significant drop in long positions for XRP. The peak stood at around $1.5 million, but this figure fell sharply to approximately $52,000.

During the same timeframe, the value of short position liquidations peaked at $2.98 million. This indicates that long-term investors are optimistic about the altcoin’s future prospects. Concurrently, those who had wagered against the market were compelled to abandon their positions, leading to increased demand for buying.

Read More

2024-07-13 23:04