- The cryptocurrency market capitalization has ballooned to $2.7 trillion after a $500 billion hike in under one week.

- Retail FOMO, US politics, and short-sellers could be driving the rally.

As a seasoned analyst with over two decades of experience in financial markets under my belt, I must admit that the current cryptocurrency market bull run is nothing short of exhilarating. Having witnessed numerous market cycles, I can say with confidence that this one has all the ingredients for a historic ride.

This year, the cryptocurrency market is having one of its strongest months on record. Over the past week, Bitcoin [BTC] has consistently reached new peaks and just surpassed $81,000. For the first time in three months, Ethereum [ETH] has also exceeded $3,100.

As a market analyst, I’ve observed an impressive expansion in the cryptocurrency sector over the past week. The collective market value of all cryptocurrencies has surpassed $2.7 trillion, marking a substantial increase of over $500 billion.

A number of elements fueled this upward trend, and if the favorable attitude persists, it might result in further increases.

Fear of missing out (FOMO)

As a short-term crypto investor, I find myself more responsive to market fluctuations and hype compared to my long-term counterparts. While they tend to concentrate on the fundamentals, my decisions are largely influenced by price swings and the buzz in the market.

On November 10th, the Fear and Greed Index peaked at 78, marking its highest point in a year and suggesting that the market was experiencing “intense greed” at the time of reporting.

According to Google Trends, there’s been an increase in people searching for “Bitcoin.” The search score rose significantly from 18/100 just last month, reaching 50/100 now, suggesting growing interest.

When there’s a lot of interest in shopping, it encourages purchasing actions that can eventually result in price increases. But the fear of missing out (FOMO) tends to be temporary, and as buyers become fatigued, crypto prices might dip or stabilize.

Speculation of a pro-crypto Senate leader

Following the Republican Party’s victory in the November 5th US elections, attention is now shifting towards the Senate’s leadership role. It’s being widely discussed that Florida Senator, Rick Scott, could assume this position, given his recent endorsement by Tesla CEO, Elon Musk.

Senator Scott has been identified as a supporter of cryptocurrencies due to his role in approving Senate Resolution 121 earlier this year, which permits banks to securely hold digital assets.

In February 2024, Senator Scott endorsed the Anti-Surveillance State Act concerning Central Bank Digital Currencies (CBDCs), which was put forward by Senator Ted Cruz, a supporter of cryptocurrency. Scott expressed concerns about CBDCs, stating they facilitate government monitoring. If Scott manages to win the vote, it could potentially clear the path for pro-crypto legislation. This might lead to further market growth.

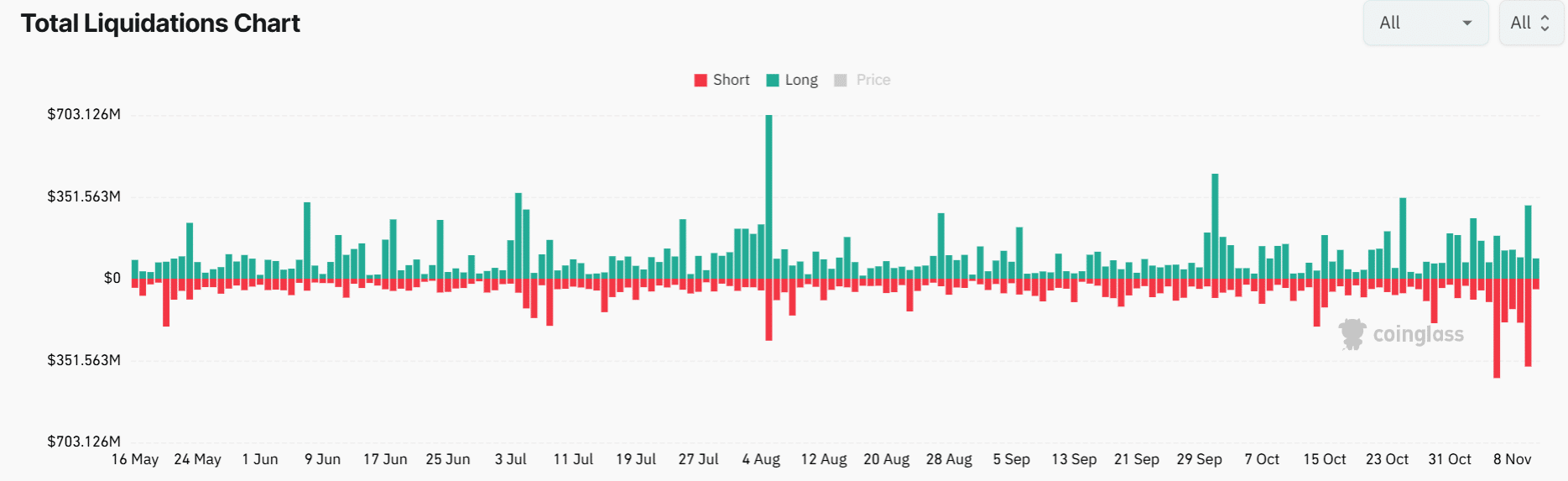

Short liquidations

Over the past week, the unpredictable fluctuations within the cryptocurrency market have resulted in a significant increase in forced settlements, also known as liquidations. According to Coinglass’ data, the number of short liquidations has skyrocketed and continues to climb, with approximately $283 million worth of shorts being liquidated in just the last 24 hours.

As a researcher examining market dynamics, I’ve observed that when short sellers are forced out of their positions (a process known as liquidation), they are compelled to buy to close their bets. This compulsory buying often amplifies the upward trend in the market. Recently, within the past 24 hours, over $650 million worth of both long and short positions were liquidated. Remarkably, open interest, a key indicator of overall sentiment, still increased, suggesting a predominantly bullish outlook among traders.

Indeed, as we speak, the open interest for Bitcoin has reached record levels, standing at approximately $49 billion. An increase in open interest suggests that investors are becoming more optimistic about the cryptocurrency’s price movement.

Read Bitcoin’s [BTC] Price Prediction 2024-25

According to CryptoQuant’s CEO, Ki Young Ju, the futures market indicates that Bitcoin might be experiencing excess heat, which could lead to a price correction and potential consolidation prior to any further bullish momentum.

If the existing bullish trend persists through the remainder of this year, there’s a possibility that it might result in a bear market by 2025.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-11 18:15