-

Ethereum has dropped below the $3,000 price range.

ETH supply in profit dropped by around five million.

As a seasoned crypto investor, I’ve seen my fair share of market fluctuations, and the Ethereum [ETH] decline below $3,000 is a reminder that this asset class is inherently volatile. The sudden drop in price on the 30th of April was accompanied by a notable decrease in ETH supply in profit and an increase in long position liquidation.

On the last day of April, there was a significant drop in Ethereum (ETH) prices that left a marked impact on various important indicators related to the cryptocurrency.

Ethereum falls 6%

According to AMBCrypto’s assessment of Ethereum, the month of April brought about a unfavorable outcome, signified by a substantial decrease in its value.

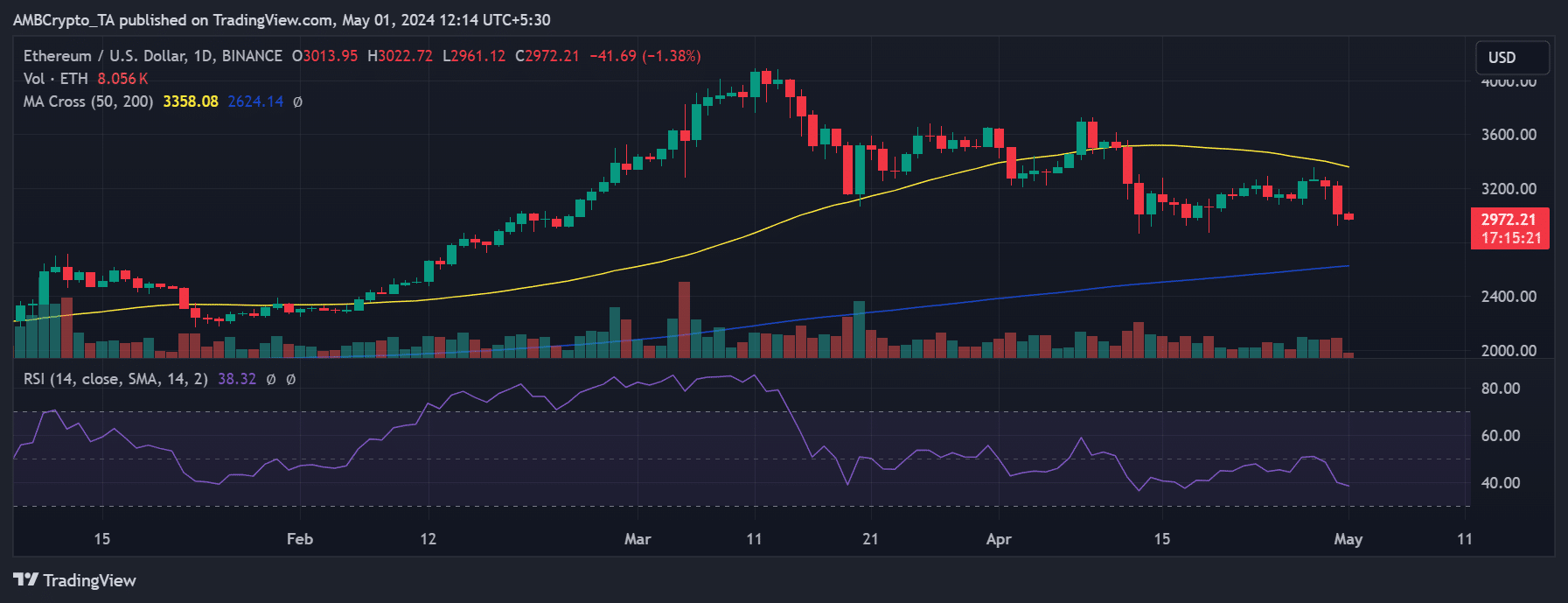

On April 30th, ETH went through a decrease of nearly 6.3%, reaching roughly $3,013 in value, barely maintaining its position above the $3,000 mark.

Despite the recent update, Ethereum’s downward trend continued, causing its value to drop beneath the $3,000 mark and hover around $2,972 as of now.

At first, Ethereum appeared ready to surpass its short-term moving average (signified by the yellow line), serving as a barrier between $3,300 and $3,500.

The latest economic slump has caused Ethereum to move farther from its desired goal, resulting in a notable jump on its Relative Strength Index (RSI) chart.

At press time, ETH dipped below 40 on the RSI, signaling a strong bearish trend.

Longs feel the heat of the dip

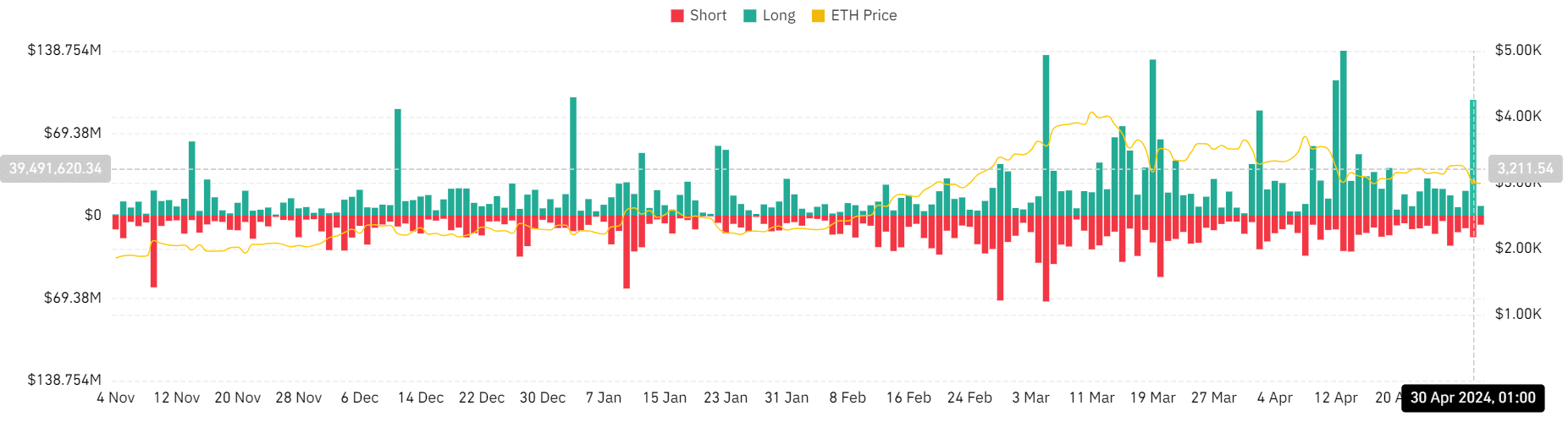

As an analyst, I’ve examined the liquidation data provided by AMBCrypto on Coinglass, and I came across an intriguing spike in liquidation volumes on the 30th of April.

As an analyst, I observed a significant surge in liquidation volume for the leading altcoin during the recent trading session, with a grand total exceeding $115 million by the day’s end.

As I delved deeper into the analysis of the chart, it became clear that long positions sustained significant losses, amounting to around $97.4 million. Conversely, short positions were responsible for a much smaller portion of the total liquidation, at approximately $18.11 million.

A notable surge in large-scale Ethereum liquidations occurred recently, representing the highest trading volume in weeks. This event indicates that traders holding long positions or expecting a price rise for Ethereum were compelled to close their positions against their will.

Possible reasons for the Ethereum decline

Some people have been talking about the Hong Kong ETFs that were introduced on April 30th, and they’ve expressed frustration over their lackluster results, attributing it to low trading activity.

Approximately $12.7 million was represented by the figures, with Bitcoin accounting for approximately $9.7 million and Ethereum contributing around $3 million.

While some hold differing opinions, they argue that the volume was respectable and not a flop, contrary to what others may have claimed. The slow initiation, though, played a role in Ethereum’s price decline.

An extra factor that might have contributed to the downturn is anxiety over the Federal Reserve possibly keeping a aggressive monetary policy during their Federal Open Market Committee meeting on May 1st.

Without the assumption of a rate reduction in the face of ongoing inflation within the American economic landscape, the history of cryptocurrency markets shows a tendency for price decreases preceding Federal Open Market Committee (FOMC) gatherings. Cautious investors typically adopt this approach as they prepare for potential policy changes.

Ethereum supply in profit declines

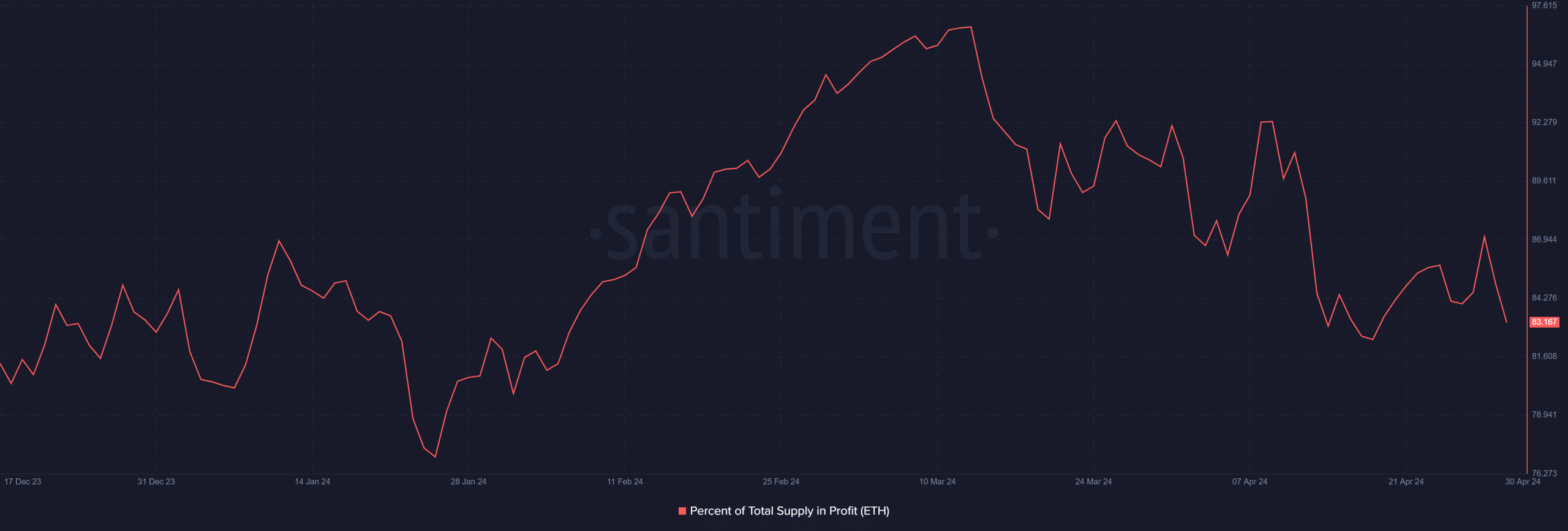

Theanalysis by AMBCrypto, as reported by Santiment, uncovered a significant drop in Ethereum’s profitable supply. Specifically, between the 28th and 30th of April, this figure fell from around 87% to roughly 83%.

The decrease in volume from approximately 119 million to around 114 million Ethereum suggests that an increasing number of holders are choosing to keep their Ethereum assets, despite incurring a loss, as the price has been falling.

Read More

2024-05-01 17:12