- Dogecoin has a bullish market structure, once again.

- The lack of trading volume might dent the bullish sentiment.

As a researcher with experience in analyzing cryptocurrency markets, I believe that Dogecoin’s bullish market structure is a promising sign for the meme token. However, the lack of trading volume is a concern that could potentially dent the bullish sentiment.

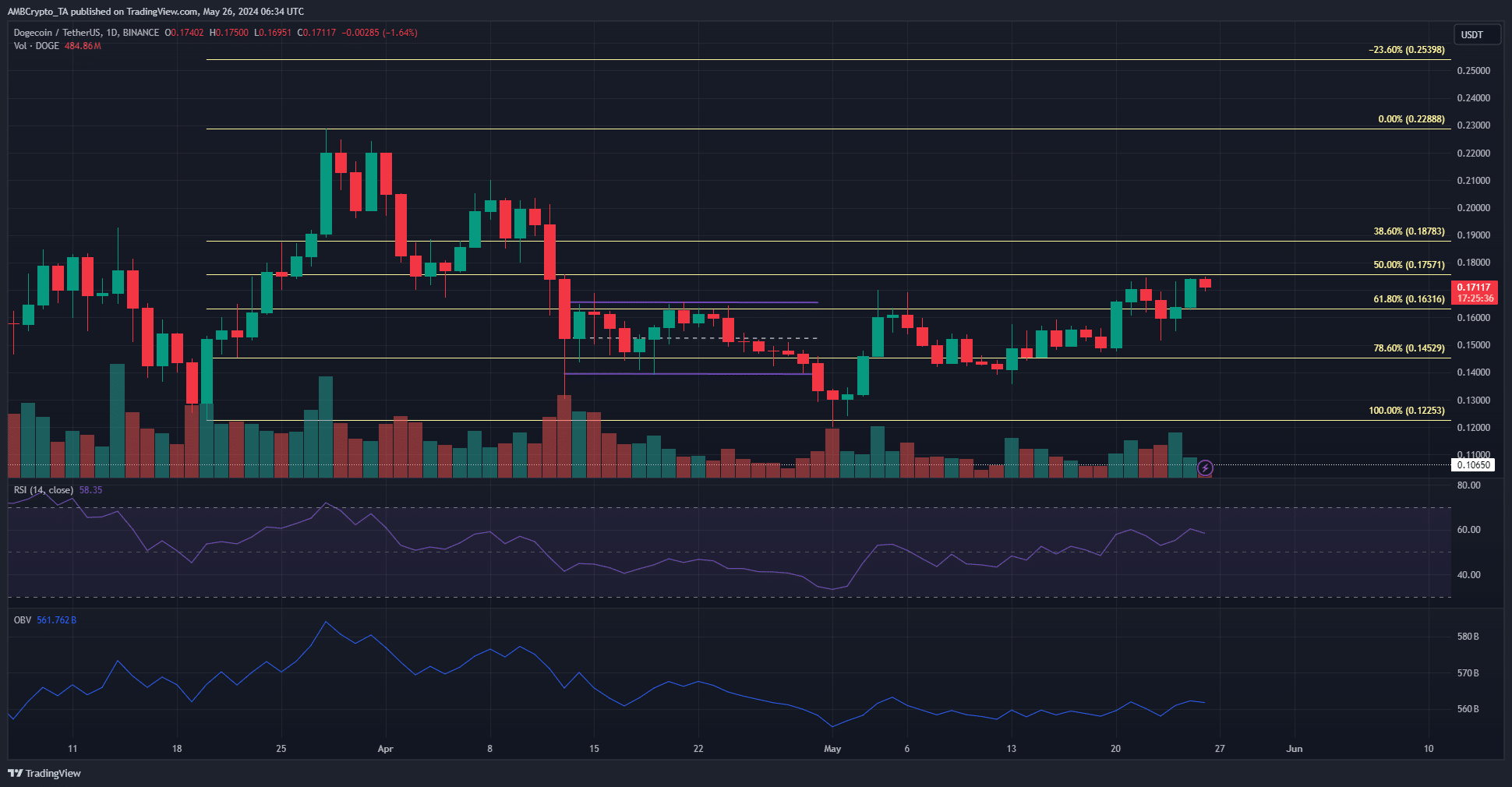

Over the past month, Dogecoin’s [DOGE] price had been on the rise, surpassing the $0.165 barrier and creating a string of successive lower highs.

A recent analysis by AMBCrypto revealed that the sentiment associated with the meme token, based on weighted data, was negative.

As a crypto investor, I’ve noticed that despite DOGE‘s impressive gains over the last three weeks, there seems to be a lack of enthusiasm from the broader public regarding its bullish prospects.

The technical analysis revealed that the weak social sentiment toward this token manifested in various ways within the market.

The lack of hype was visible on the volume indicators

The past week has seen a modest increase in volume following the robust price action on May 20th.

Despite the volume increase, it was relatively small in comparison to the significant rallies observed in late February and even late March.

The OBV, alongside the price, formed a series of higher lows in May.

Despite the low trading volume in this month contrasting with past months, it failed to surpass the noteworthy support levels established in April.

In simpler terms, the RSI indicator on the daily chart registered a value of 58, indicating robust momentum. Meanwhile, the price was poised to surpass the $0.175 mark, which represents the 50% Fibonacci retracement level, imminently.

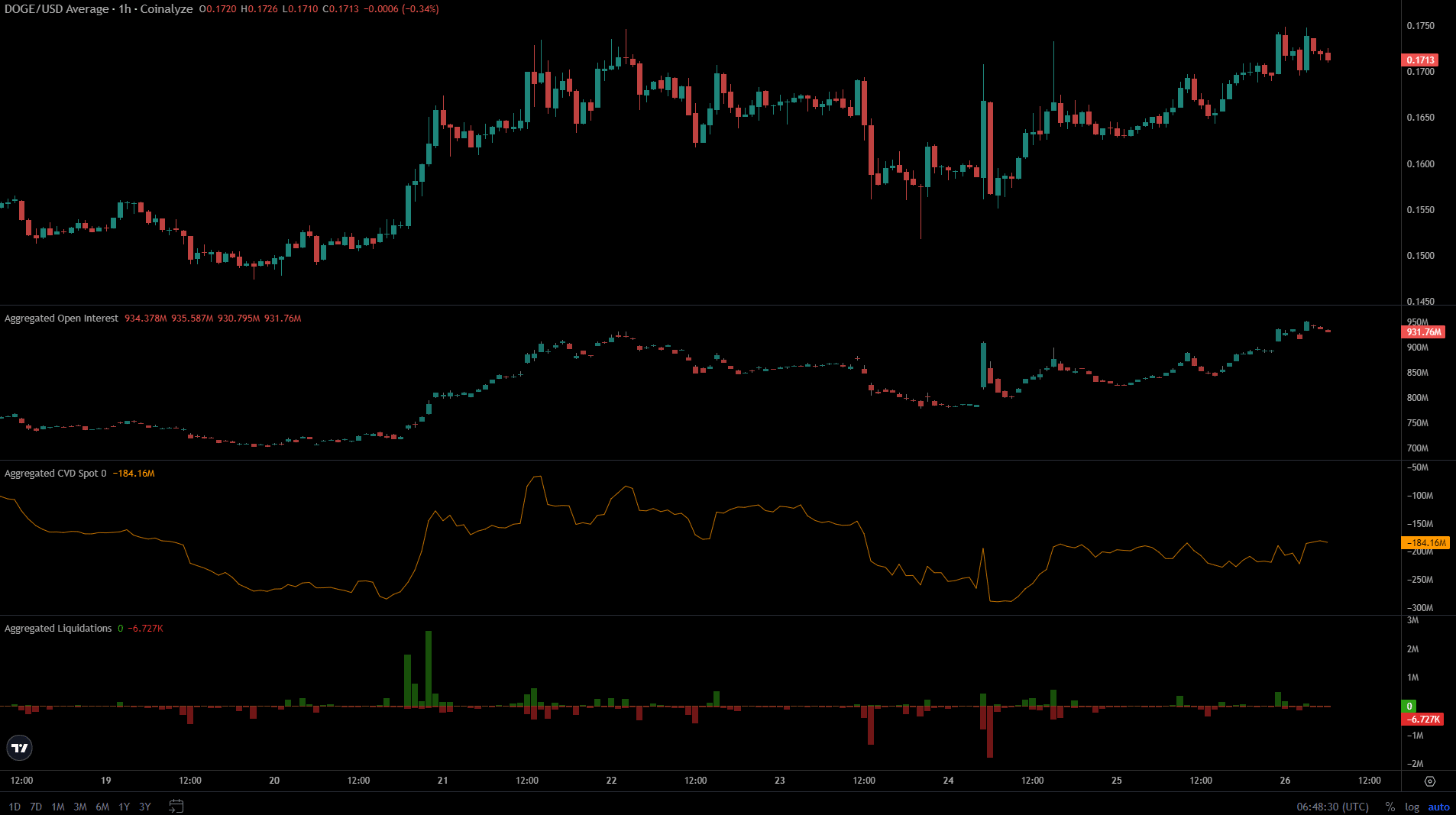

The liquidations were few

In just one day, Open Interest surged from $800 million to an impressive $931 million, with DOGE experiencing a nearly 8.5% price increase.

Speculators’ buying behavior strongly indicated their bullish outlook, implying they anticipated further price increases.

As an analyst, I’d rephrase that statement as follows: In the last 24 hours, the number of liquidations was relatively low. However, on the 24th, there was significant market volatility that led to a large number of long positions being closed out.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

As a crypto investor observing the market, I noticed that there were fewer short liquidations taking place as prices continued to rise. This suggested to me that traders were less eager to maintain their short positions.

Over the last two days, the price of Dogecoin at that particular point in relation to cardiovascular diseases (CVD) has gradually risen higher. Should the current pattern persist, it’s plausible that Dogecoin will regain the $0.175 mark as a new support level.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-26 16:07