- Doge has declined by 17% on weekly charts.

- Despite the dogecoin’s decline, analysts remain bullish based on historical cycles.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed countless bull and bear cycles, from the dot-com bubble to the cryptocurrency boom. The recent decline of Dogecoin [DOGE] by 17% on weekly charts has raised concerns among some investors, but as a firm believer in historical patterns, I remain optimistic about its future performance.

Over the past month, the cryptocurrency market has seen significant ups and downs. During this timeframe, Bitcoin reached a high of around $69,000 but then dropped below $60,000.

As a seasoned cryptocurrency analyst with years of experience in this dynamic and volatile market, I have witnessed the ebb and flow of various digital assets, including altcoins and meme coins. Over the past few days, it has become increasingly apparent that the recent turbulence in the crypto market has hit these assets particularly hard. The struggles of meme coins in particular are a cause for concern, as they have historically shown resilience and the ability to bounce back quickly from adversity.

“I’m scared about the #Altcoin markets.”

Doge’s historical cycles

As a researcher delving into the world of digital currencies, I’ve come across some contrasting views regarding meme-coins, particularly Dogecoin [DOGE]. While some voices express concern, others present a more optimistic outlook.

Experts are suggesting that Dogecoin (DOGE) may follow its past trends and recover based on the observation that these trends form a consistent pattern. For example, analyst Vision Pulse has provided an analysis of Dogecoin’s historical trend, emphasizing that this repetitive pattern could indicate a potential rebound for DOGE.

As someone who has been closely following the crypto market for quite some time now, I can’t help but draw parallels between Dogecoin’s current performance and its behavior during the last cycle. Back in 2020, Dogecoin saw an incredible surge of nearly 400%, reaching a peak at the .236 retracement level. However, just as quickly as it rose, it plummeted by around 50% as Bitcoin Dominance (BTC.D) increased.

Based on expert analysis, it’s expected that Dogecoin (DOGE) could experience a significant increase of around 400%, replicating its 2020 pattern. Looking back at its past behavior, this digital coin seems unlikely to stay in a downtrend for an extended period.

Analyst Javon Marks has also suggested a comparable analysis, highlighting the potential for Dogecoin’s patterns to recur, emphasizing that these cycles might be set to repeat.

“Throughout its history, Dogecoin’s (DOGE) price increases have frequently followed Log Breakouts. Currently, we’re experiencing another such breakout, and if past trends continue, this could lead to DOGE prices exceeding $10 in a bull run of over 7,200%. Each previous run has seen increasing gains, so if this pattern holds true again, we might be in for a significant surge.”

What DOGE price charts suggest

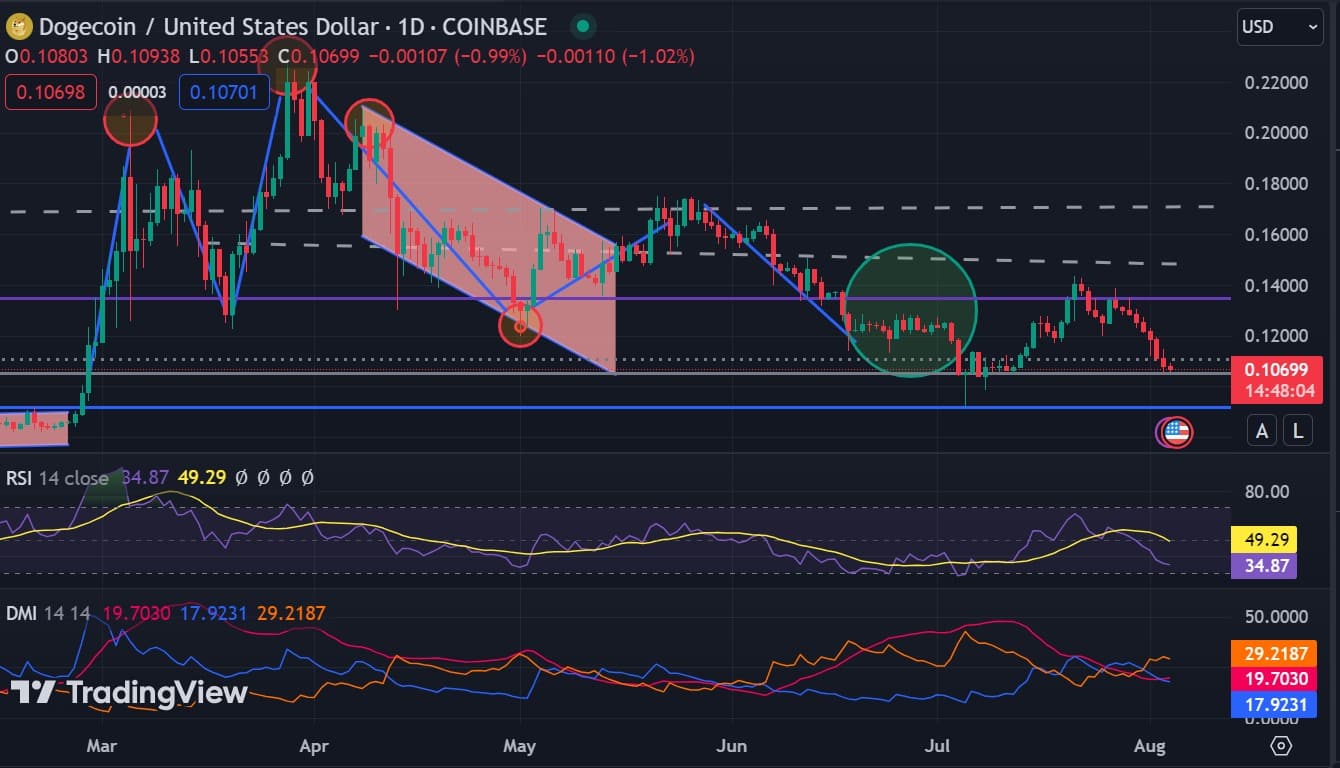

As of this writing, Doge was trading at $0.107 following a 4.97% decline on daily charts.

Additionally, the meme cryptocurrency dropped by 17.86% in weekly graphs, following a month-long negative streak. Similarly, its trading activity decreased by 20.48%, amounting to $713.6 million within the past day.

Consequently, AMBCrypto’s examination indicated a significant decrease in Dogecoin (DOGE), suggesting a bearish trend. At that point, the Relative Strength Index stood at 34, whereas the moving average based on RSI was at 49.

As a crypto investor, I’m observing a trend where it appears that sellers are holding more sway in the market, suggesting increased selling pressure.

As a crypto investor, I find it advantageous when the Relative Strength Index (RSI) indicates an oversold condition. This situation often signals a potential buying opportunity where increased demand could spark a trend reversal due to heightened buying pressure.

Furthermore, the Directional Movement Index indicates a weakening bullish trend. While the current reading of -19.7 is higher than +17.9, it’s important to note that the negative value has been decreasing.

Similarly, the neutral index being positioned higher than the negative index indicates a possible change, perhaps a reversal, since the prices are dropping towards an oversold area.

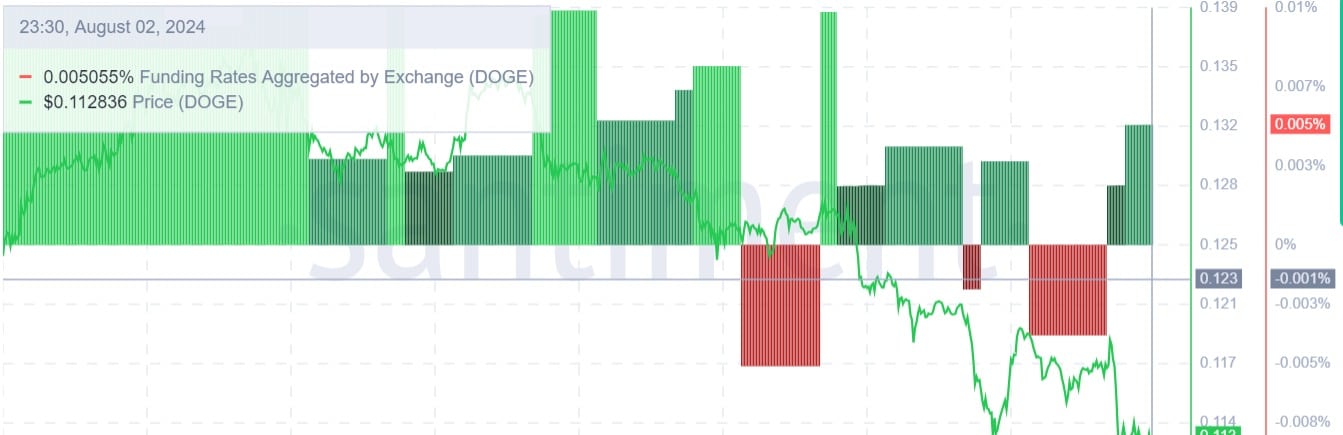

By examining more closely, it appears that the total funding rates pooled together by cryptocurrency exchanges have a favorable rate of 0.005%.

Based on my years of trading experience, I have noticed that when long position holders start paying short positions to maintain their positions, it often indicates a strong bullish sentiment among traders. This means they believe the price is set to rise in the near future. As someone who has seen markets fluctuate wildly over the years, I can attest to the fact that such behavior can be a powerful indicator of upcoming trends.

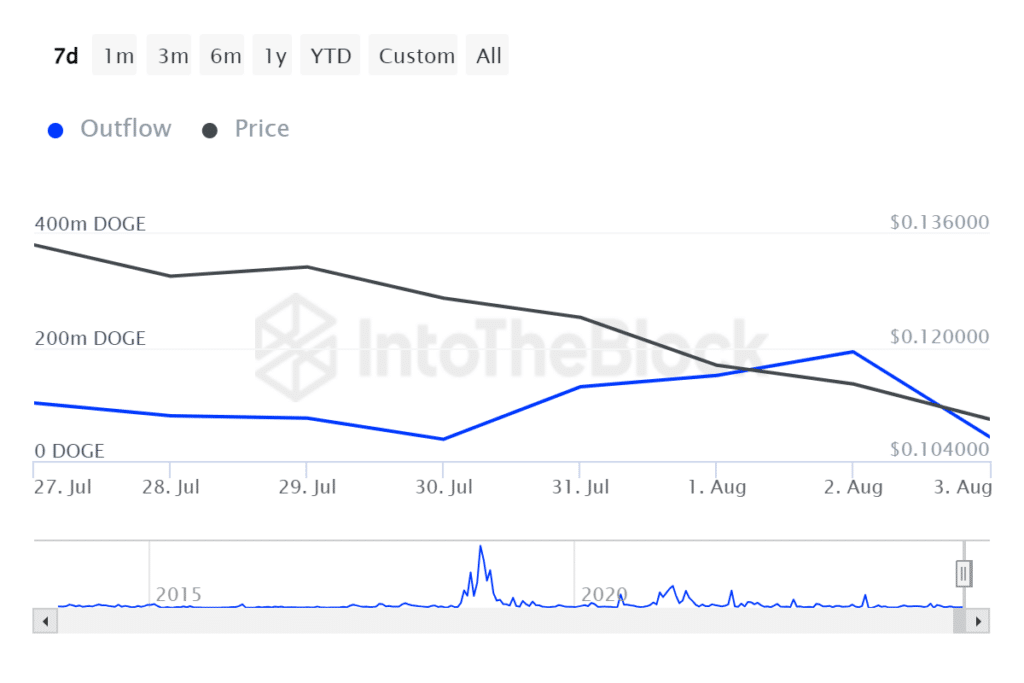

Large holdings of Dogecoin have consistently decreased, falling from a peak of 192 million down to 42 million. This decrease indicates that big investors are not offloading their Dogecoin, which could imply they believe in a possible shift in the trend towards an uptick.

If Dogecoin ends its daily trading above the crucial support of $0.105, it’s likely that the coin will try to change its current direction and aim to surpass the substantial resistance at $0.13.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-05 04:08