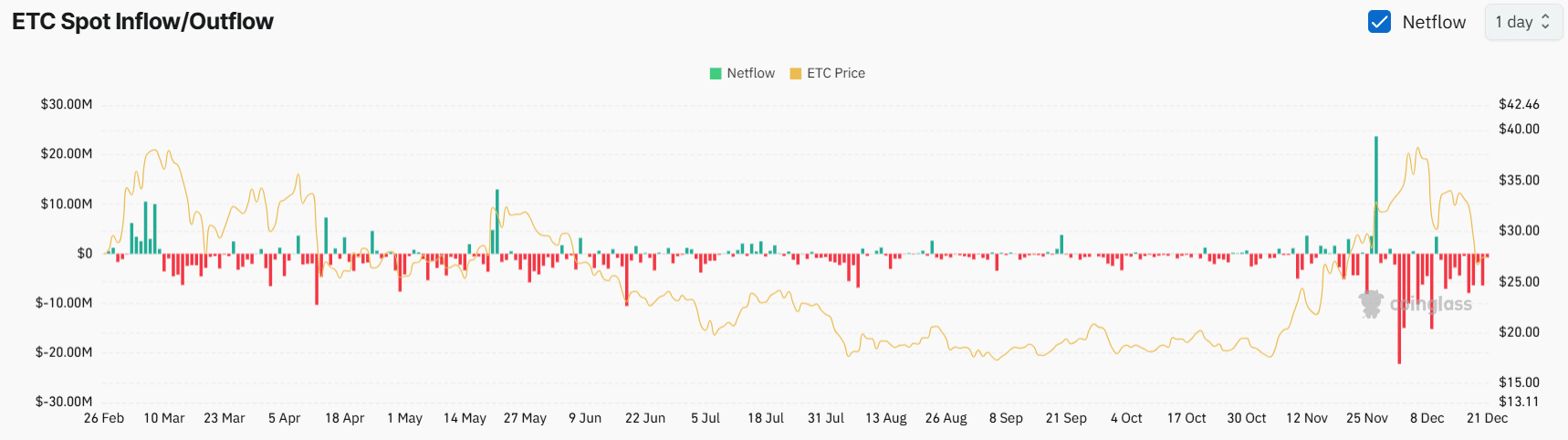

- On-chain metrics revealed that exchanges have experienced a substantial $22.85 million worth of ETC outflow.

- ETC long/short ratio indicating strong bullish sentiment among traders.

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the current bullish trend unfolding for Ethereum Classic (ETC). The significant outflow of ETC from exchanges and the rising long/short ratio are telling signs that both whales and retail traders have their eyes on this altcoin.

The Ethereum Classic’s native token, ETC, is generating attention due to its strong surge after experiencing a substantial drop in value in the past few days. There appears to be a growing optimism across the market that prices will rebound following a steep fall, with significant assets such as Bitcoin [BTC] and Ethereum [ETH] also showing signs of recovery.

Ethereum Classic’s bullish on-chain metrics

During this persistent market uptrend, Ethereum Classic (ETC) has climbed over 22%, drawing in investors who plan to hold for the long term. As the price rise places ETC within an area that could potentially generate further growth, it seems poised for positive momentum in the near future.

Based on data from Coinglass’s ETC inflow/outflow analysis, there has been a significant withdrawal of approximately $22.85 million in ETC from various cryptocurrency exchanges.

This significant movement suggests a possible surge in prices and a great chance for those holding ETC to buy, as it shows that assets are being moved from exchanges into long-term investors’ wallets, possibly signaling accumulation.

Besides long-term investors, traders are now expressing an interest in the token too, according to the insights provided by Coinglass, a firm specializing in on-chain analysis. At this moment, the ETC ratio of long positions to short positions is 1.019, suggesting that traders have a predominantly bullish outlook.

Ethereum Classic (ETC) price action and upcoming level

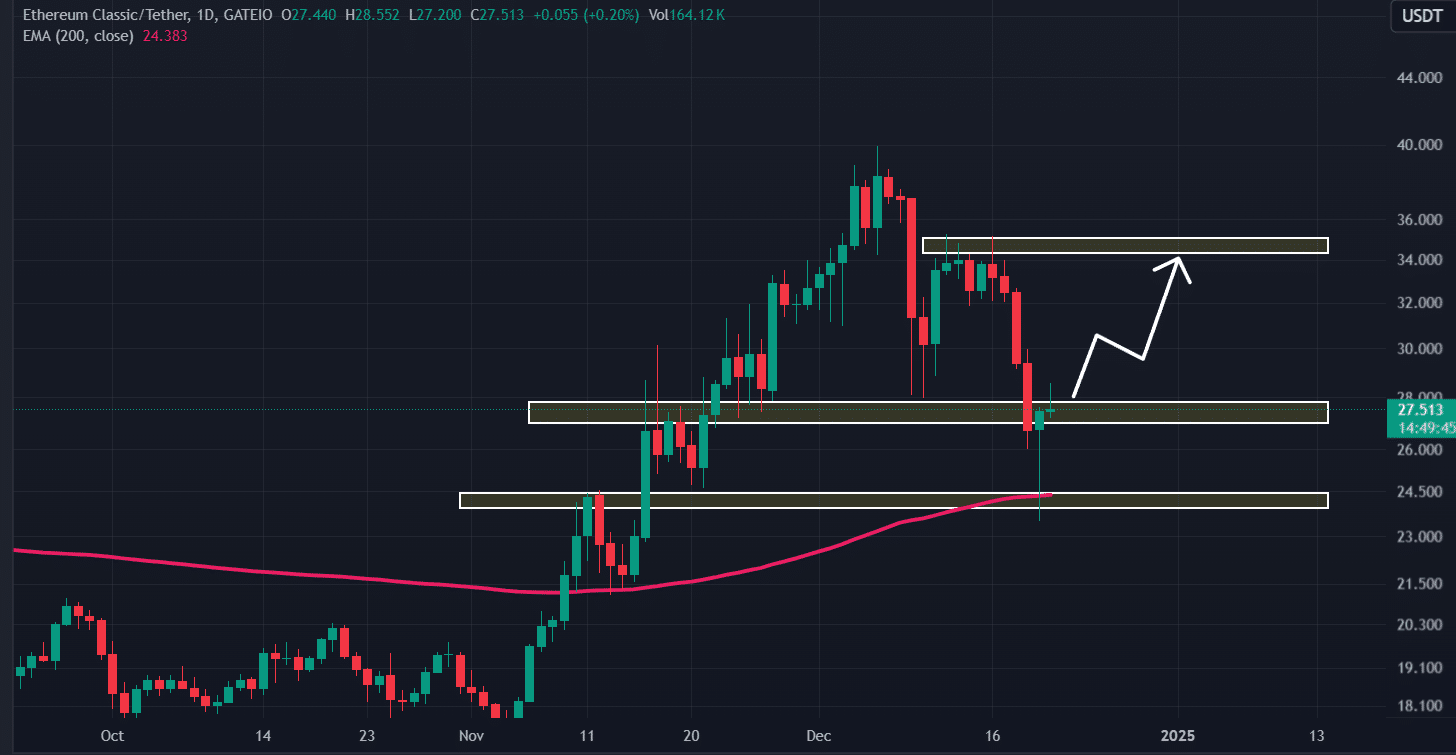

The growing attention towards Ethereum Classic (ETC) is noteworthy, considering it has recently tested its breakout point and the 200-day Exponential Moving Average (EMA), suggesting a potentially positive trend.

Based on specialist technical assessment, Ethereum Classic (ETC) appears to have created a bullish candlestick pattern at the significant support point of $26.70. Additionally, it seems to be receiving support from the 200 Exponential Moving Average (EMA).

Given the latest market trends, if Ethereum Classic (ETC) ends its daily trading session above $28.50, it’s likely that it might surge by approximately 20%, potentially reaching the upcoming resistance at $34.25 in the near future.

From a favorable perspective, ETC’s Relative Strength Index (RSI) is close to the oversold region, hinting at potential increase in momentum.

Read Ethereum Classic’s [ETC] Price Prediction 2024–2025

It seems that by blending these blockchain indicators with traditional chart analysis, we can see that at present, the bullish sentiment is strong and may shortly drive the price of the asset up towards the $34 level.

At the moment, ETC is hovering around $27.54, and it’s seen a significant increase of more than 13.5% in its price over the last 24 hours. However, during this timeframe, the number of trades (or participation) has decreased by about 30%. This suggests less activity from traders and investors.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-12-22 12:39