- Ethereum symmetrical triangle pattern could indicate a bottom formation, with potential for further declines before a rally.

- Increased leverage ratio and fluctuating open interest volumes suggest significant market movement.

As a seasoned crypto investor with battle-tested nerves and a knack for deciphering complex market patterns, I can’t help but see the current Ethereum [ETH] situation as a classic case of the bull and bear dance. The symmetrical triangle pattern hints at a bottom formation, which could potentially signal a reversal, but I’ve learned to never underestimate the unpredictability of this rollercoaster ride we call the crypto market.

Over the last seven days, Ethereum [ETH] has shown considerable price fluctuations, dropping by approximately 10.8%. Following a powerful surge that propelled the digital currency beyond $2,700 in an effort to regain the $3,000 threshold, the market underwent a correction, causing Ethereum’s value to decrease.

Currently, there are indications of a rebound, with an increase of about 2.4% over the last 24 hours. This has placed the asset around $2,389 in market value. These price fluctuations have sparked much discussion among investors regarding where the asset might head next.

Further decline before a surge

Significantly, the well-respected cryptocurrency expert, Trader Tardigrade, provided predictions about the possible price fluctuations of Ethereum on platform X.

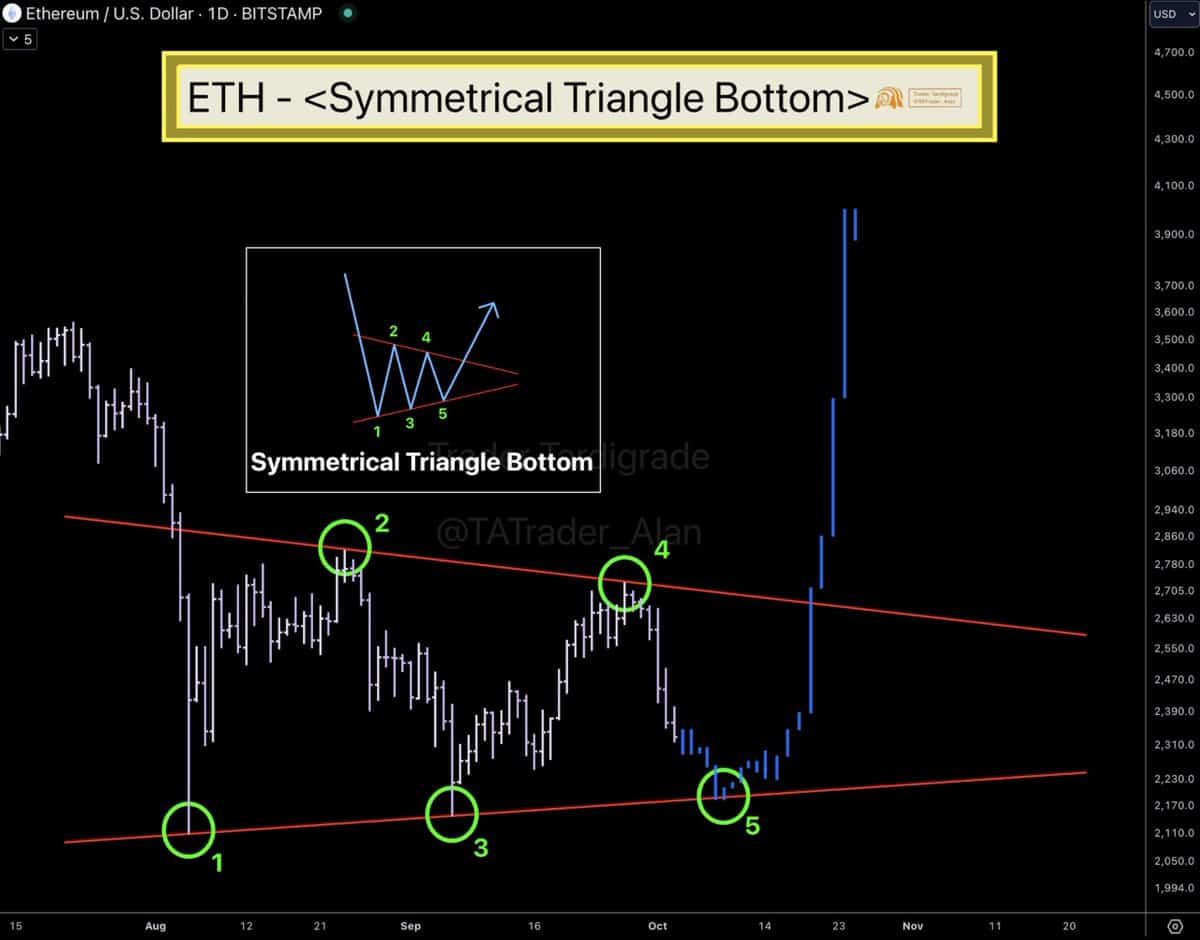

Based on an analyst’s assessment, Ethereum appears to be shaping a “Symmetrical Triangle Base,” a technical configuration often indicating a potential shift in direction.

Yet, it’s important to note that the expert suggests a potential drop in ETH‘s value could occur initially, prior to any substantial uptrend.

He suggested, “Perhaps ETH could reach its lower support during wave 5 before finalizing its Bottom pattern, indicating a potential pause or pullback before completion.

In technical analysis, a symmetrical triangle pattern refers to a graph configuration where the price movement narrows down over time, resulting in a shape that looks like an equilateral triangle. This is due to the price oscillating within increasingly tighter boundaries.

Frequently, this shape signals a time when the market is uncertain because traders are battling for dominance as buyers and sellers alike. This geometric figure, referred to as a symmetrical triangle, presents a progression of lower peaks and higher valleys, which ultimately converge at a specific point called the peak.

Once this pattern wraps up, it frequently triggers a surge in either direction – be it upward or downward – indicating the onset of a fresh market movement.

Regarding Ethereum, the current symmetric triangle shape indicates that it may be going through a phase of stability or consolidation before making a significant price shift. If this predicted triangle pattern unfolds as expected, Ethereum might experience a possible price increase following contact with its underlying support level.

Ethereum key metrics signal major market move

Looking past just the technical aspects, it’s also important to analyze the underlying factors influencing Ethereum’s market performance. These fundamental elements offer a more comprehensive perspective on its price movements.

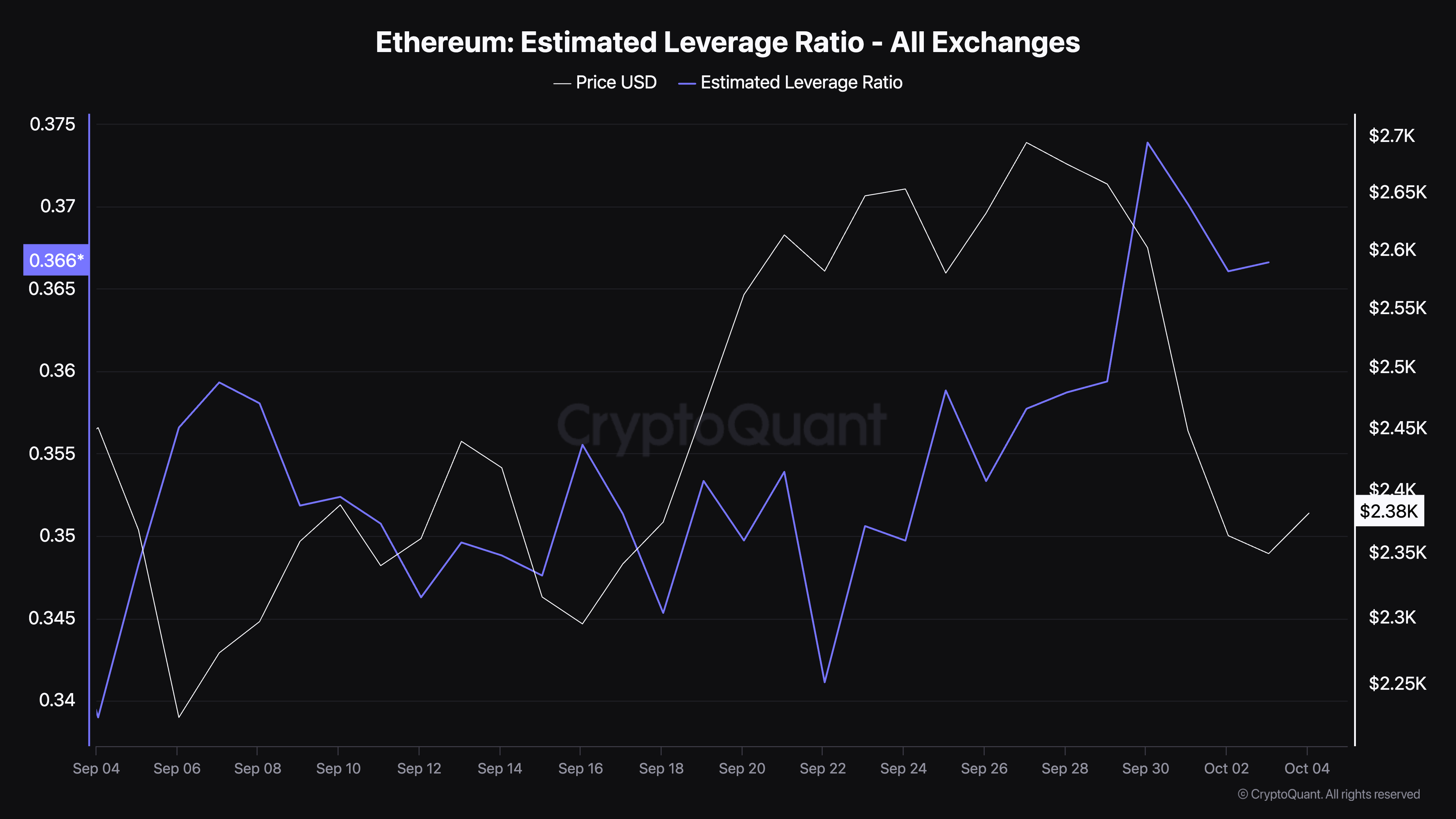

One key metric to observe is the “Estimated Leverage Ratio,” a measure that reflects the amount of leverage being used in the Ethereum market.

This figure is determined by splitting the sum of all active derivative contracts, known as open interest, by the exchange-held reserve of an asset. A large leverage ratio may signal heightened speculative behavior, implying that traders are employing leverage to boost their investments’ impact, suggesting they’re taking on greater risks.

At present, based on information from CryptoQuant, it appears that Ethereum’s approximate borrowing ratio has climbed from 0.341 at the end of last month to 0.366 currently. This increase could indicate that traders are progressively employing more leverage, which might be a sign of escalating risk and volatility within the market.

As an analyst, I’ve noticed that a higher leverage ratio can amplify price fluctuations significantly. When holding leveraged positions, I’ve found that they become more vulnerable to liquidation events when the market unexpectedly shifts in the opposite direction of our predictions.

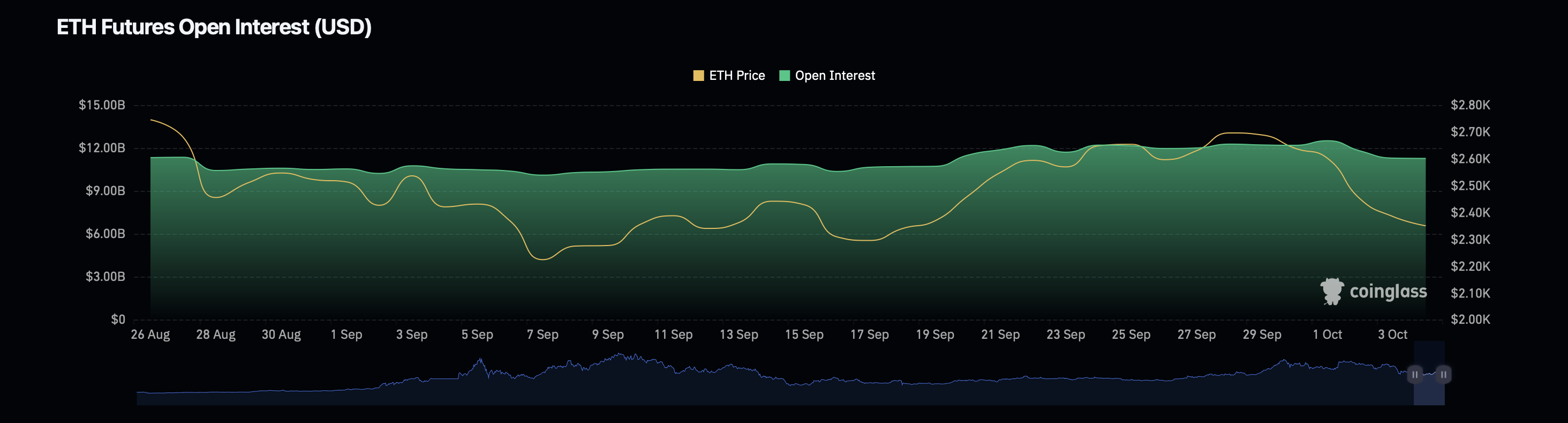

Moreover, data from Coinglass indicates a 0.81% rise in Ethereum’s open interest figure, which now stands at approximately $11.44 billion. This open interest metric quantifies the total amount of unfilled derivative contracts available in the market.

Read Ethereum’s [ETH] Price Prediction 2024–2025

A higher value for this measure might suggest a surge in speculative trading and market involvement. On the other hand, Ethereum’s open interest volume has dropped by 24.17% to reach a current level of $24.33 billion.

The divergence between open interest and volume could suggest a cautious market. Traders might be holding back from taking larger positions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-10-04 22:48