- The January lows which launched the rally to $4k were retested in the early hours on the 5th of July.

- It’s too early to call for an Ethereum bottom, but investors can wait for more clarity over the next week.

As a seasoned researcher with over a decade of experience in the volatile world of cryptocurrencies, I must admit that watching Ethereum [ETH] plunge to its January lows yet again has been an unexpected rollercoaster ride. The market’s unpredictability is indeed the spice of life for us crypto enthusiasts!

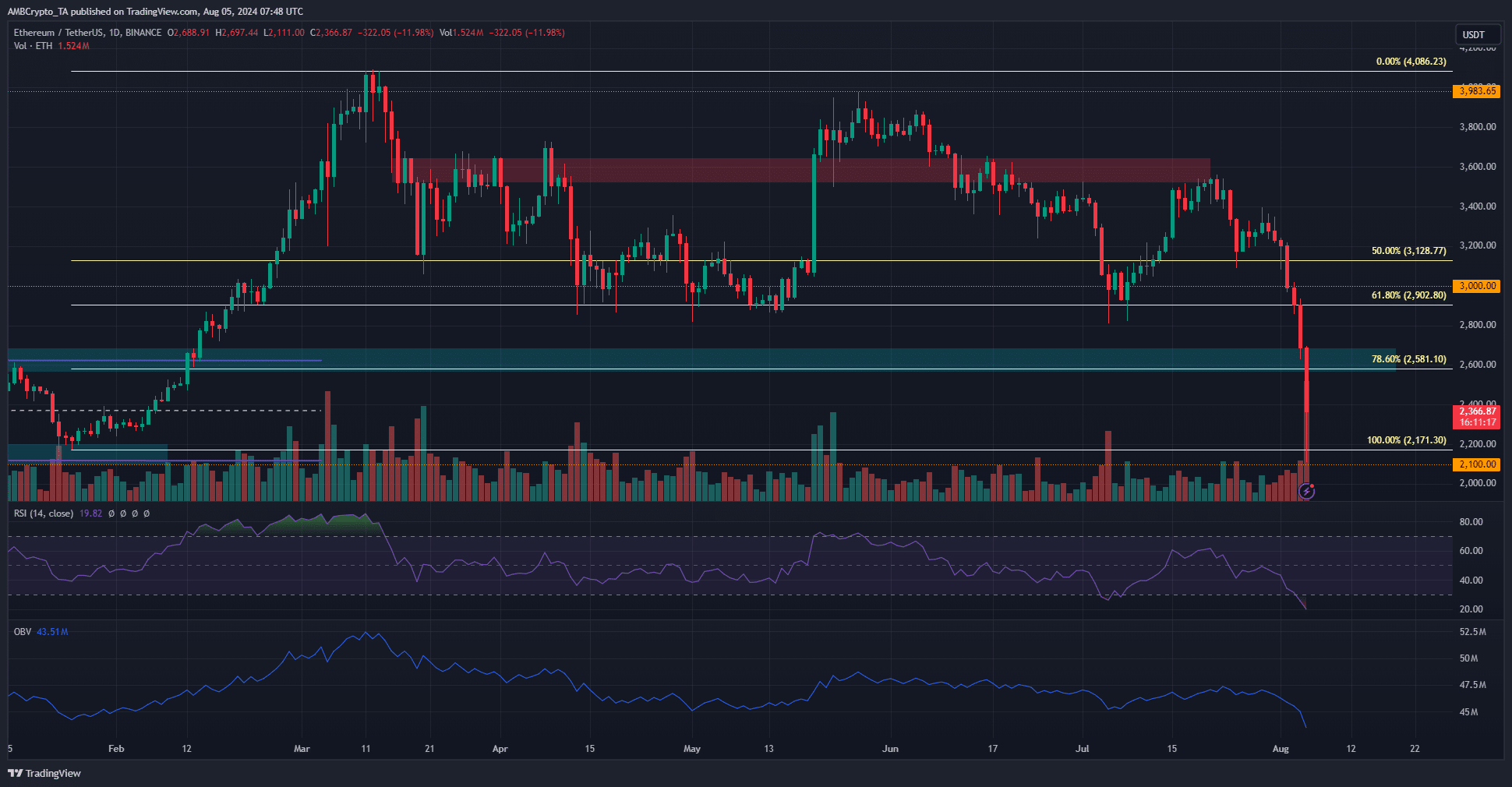

Over the last few hours, the price of Ethereum (ETH) has dipped down to levels last seen in January. This decline beneath $2,900 led to a 27.5% drop within the subsequent 12 hours.

At press time, ETH has bounced to $2366 from the $2.1k lows, a 12.17% bounce.

The smart money that bought close to $20 million when prices were at $2.9k and $3.1k has not been correct this time, smudging a previously perfect track record.

The February rally’s launchpad was retested

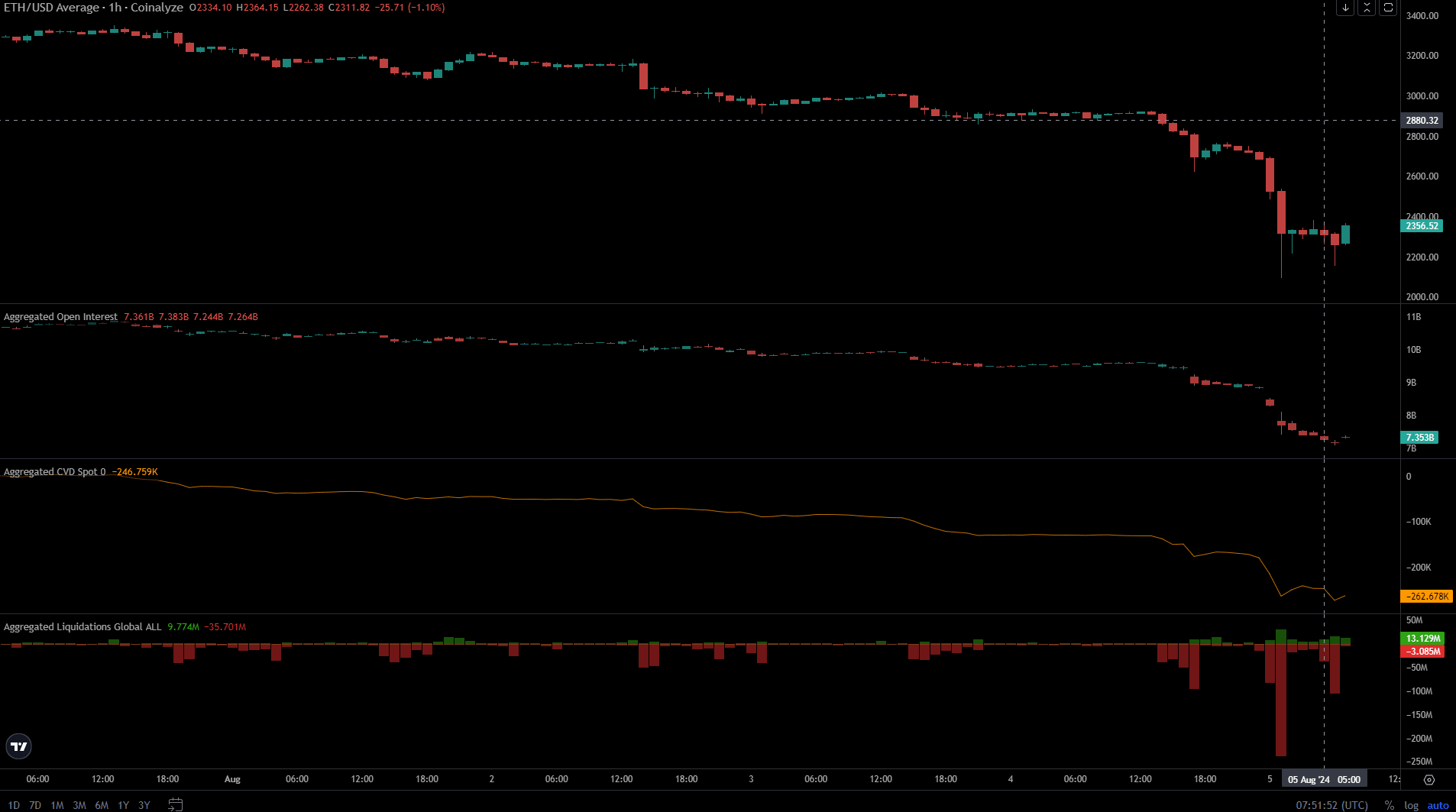

Over the past few days, we’ve witnessed a harsh drop in prices. In fact, within the last day alone, Ethereum markets experienced nearly $346.5 million in liquidations. Moreover, the Relative Strength Index (RSI) plummeted to 19, reaching its lowest point since August 18, 2023.

So far, today’s trading session remains open, but it’s worth noting that all the gains made during the early part of the year have now been completely erased. It’s anticipated that the $2.5k-$2.6k range could act as a barrier to further price increase in the near future.

On this particular day, the OBV reached a fresh minimum, signifying an unusually high level of sell-offs. So far in 2024, the daily trading volume of Ethereum has peaked at 1.55 million ETH, marking the highest transaction activity recorded thus far.

Less aggressive traders and investors may prefer waiting until the price recovers important support levels and maintains that position for several days, before feeling comfortable enough to make their purchase.

The Futures market wiped out swathes of ETH traders

It’s unwise to engage in highly leveraged trades during periods like these when market crashes occur, as evidenced by more than 270,000 crypto traders over the weekend. The Open Interest has significantly decreased from approximately $9.9 billion on August 3rd to around $7.35 billion at the current press time.

1. The decline in the stock market for CVD became more pronounced, indicating heavy selling. As anticipated, most of the sell-offs over the past few days were from long positions.

It’s plausible for a rise towards $2.5k, but the New York trading period might experience increased selling forces.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- SOL PREDICTION. SOL cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-05 18:15