-

Ethereum was trading in the $3,800 price zone at the time of this writing.

ETH was creating a string support for itself around this level.

As a seasoned crypto investor, I’ve seen my fair share of market fluctuations, and Ethereum’s recent price action has been intriguing. With Bitcoin surpassing $71,000, the focus naturally shifts to Ethereum, which was trading in the $3,800 price zone at the time of writing.

Recently, Bitcoin (BTC) reached a new milestone by breaking through the $71,000 price barrier. This development often steers market attention towards Ethereum (ETH). An examination revealed that Ethereum did indeed rally but this upward trend proved to be fleeting.

Ethereum fails to sustain momentum

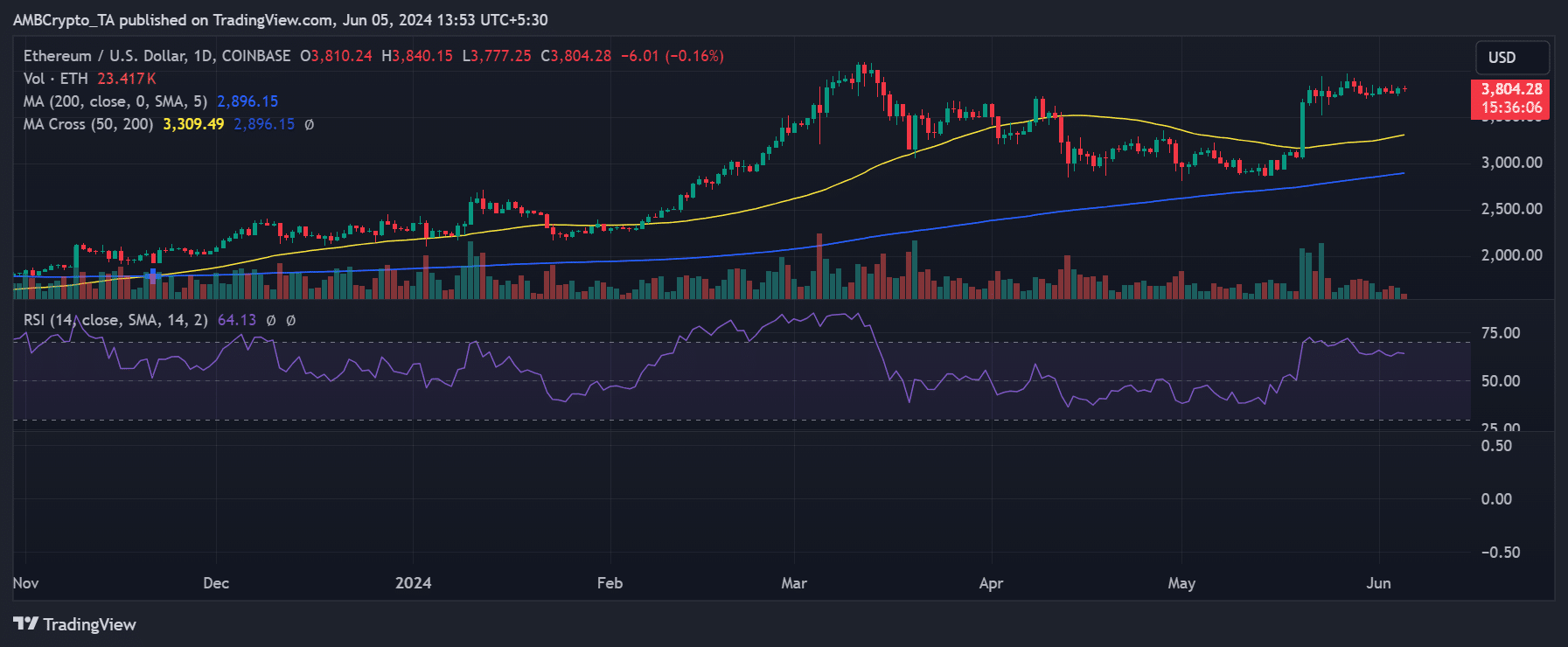

On June 4th’s daily chart, Ethereum exhibited a modest uptrend toward the close of trading hours, pushing its value up by approximately 1%. Consequently, ETH settled at roughly $3,810.

Modest advances propelled Ethereum to reach the $3,800 mark for the first time in several days, signaling a positive shift after three consecutive days of decline. Yet, at present, Ethereum’s price trend has turned bearish once again.

Despite keeping its price within the $3,800 bracket, Ethereum experienced a slight decrease of under 1% in value during the analysis.

An analysis of the Relative Strength Index (RSI) revealed that it continued to exhibit bullish tendencies, even amidst recent subpar price action, as the RSI approached the 65 threshold at the time of this report.

As a researcher, I’ve observed that the price of the asset has been consistently rebounding each time it touches the $3,700 mark. This level seems to be serving as a significant support for the price in the immediate term.

Ethereum volume shows positive signs

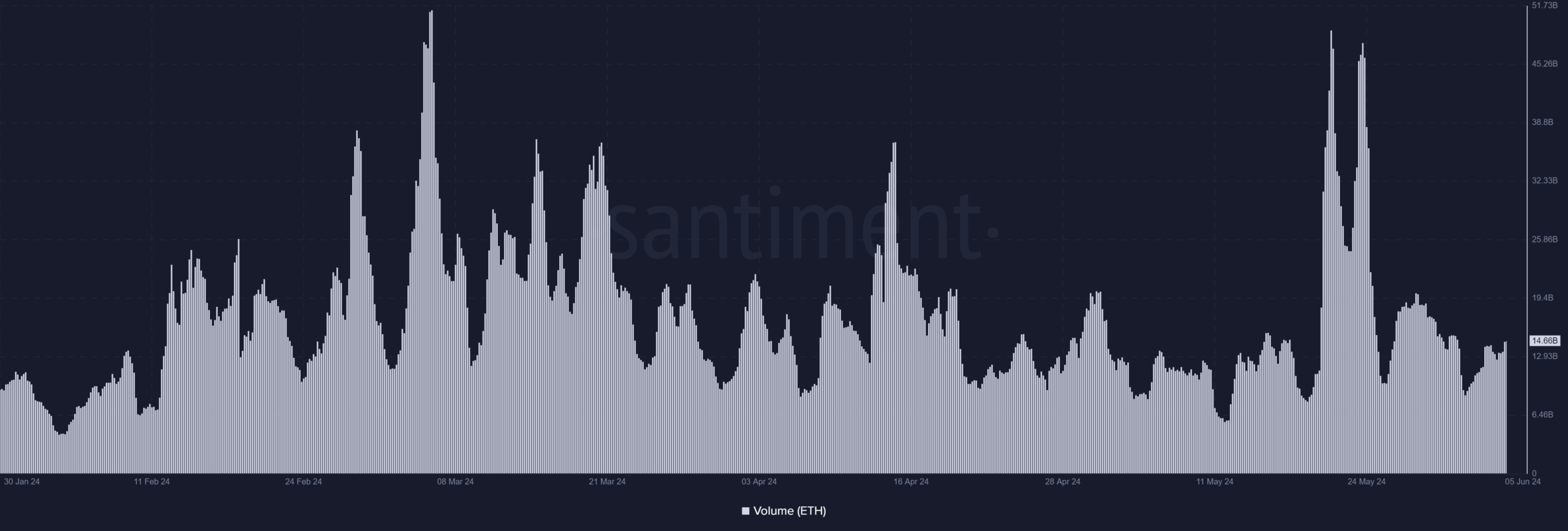

The volume of Ethereum underwent an examination, revealing a bounce-back following the beginning of this month. At the onset, the trading activity dipped to approximately $9 billion. However, there has been a steady climb since then, with the peak hitting its highest mark in terms of volume for this month.

By the close of trading on June 4th, the trading volume reached approximately $13.5 billion. At present, this figure has surpassed $14.6 billion. The escalating trading volume is a significant indicator to consider when attempting to forecast Ethereum’s price trend.

The cost hasn’t jumped noticeably just yet, but the surge in trading volume suggests a pickup in market action that might impact price trends.

ETH in profit sees a slight increase

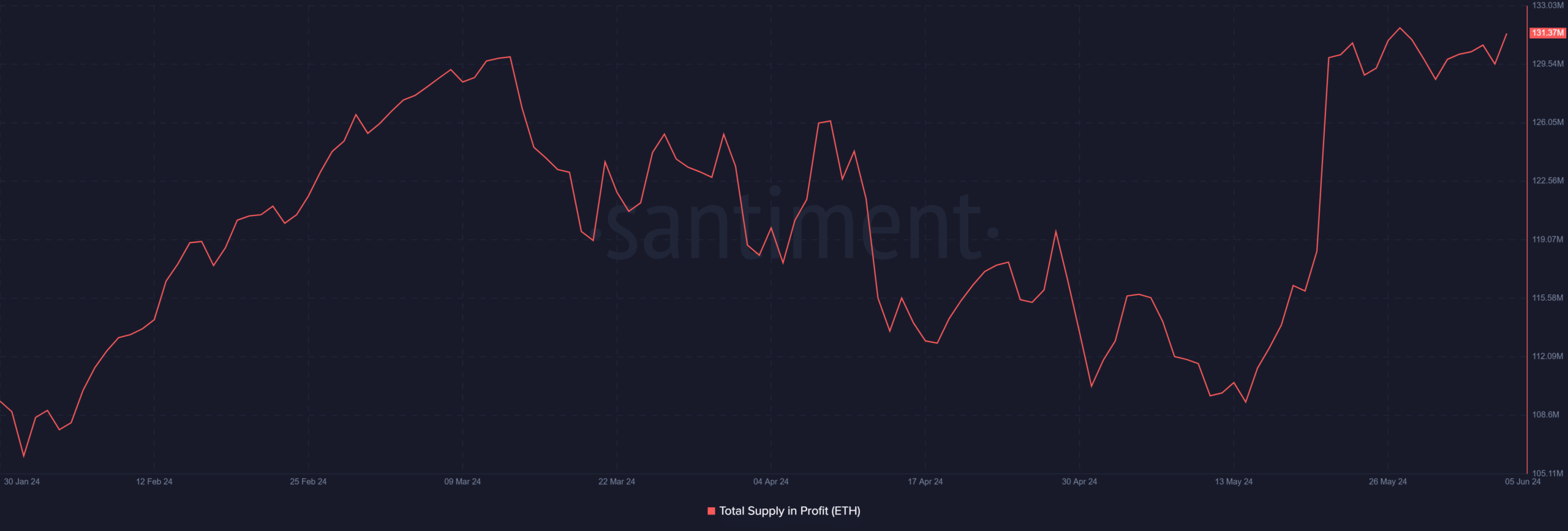

As a crypto investor, I’ve noticed that Ethereum’s profit volume saw a significant surge of around 2 million Ether in the past 24 hours based on my analysis.

Read Ethereum (ETH) Price Prediction 2024-25

Based on Santiment’s data, approximately 129.5 million Ethereum units were in profit as of the close of trading on the 4th of July.

At present, the figure exceeds 131 million; this expansion has resulted in a rise in the proportion of profitable supply from approximately 93.4% to more than 94%.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-06-06 01:11