-

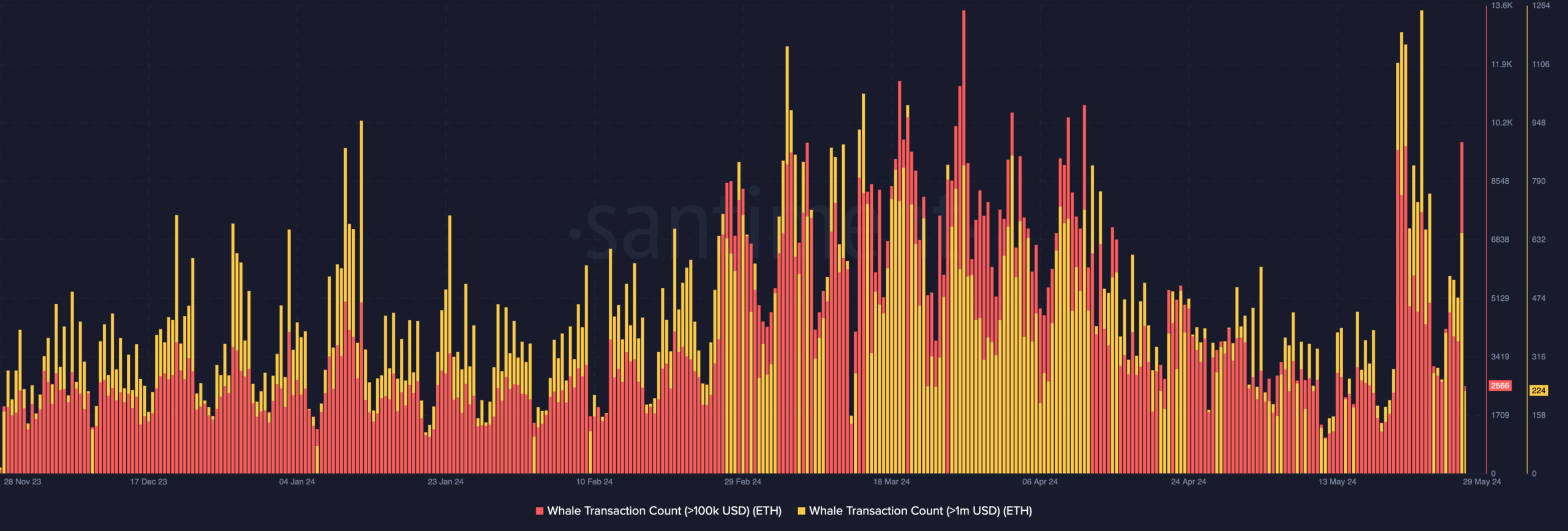

The past few months have been marked by an uptick in ETH whale activity.

Since the SEC approved ETH spot ETF, there has been a rally in daily whale transfers.

As an experienced financial analyst, I’ve been closely monitoring the Ethereum (ETH) market over the past few months, and I must say that the recent surge in whale activity has been noteworthy. According to Santiment’s latest report, we’ve seen a significant increase in daily whale transactions exceeding $100,000 and $1 million since the U.S. Securities and Exchange Commission (SEC) approved ETH spot ETFs.

In recent months, there has been a significant increase in large-scale transactions involving Ethereum [ETH]. According to Santiment’s latest analysis.

As an analyst examining the latest on-chain data, I’ve observed a noticeable surge in whale transactions. This increase can be attributed to whispers and speculation circulating around potential approvals of spot Ethereum exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC).

On May 23rd, the regulatory body granted approval for 19b-4 forms related to the ETF applications submitted by BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton.

This approval came unexpectedly after an extended refusal to communicate with issuers.

ETH whales take charge

According to Santiment’s findings, the collective ownership of Ethereum by whale wallets containing over 10,000 ETH coins has grown by approximately 27% in the past 14 months.

During that timeframe, this group of Ethereum owners purchased a total of 21.39 million ETH, which equates to approximately $83 billion based on current market values.

According to Santiment,

Over the past month, Ethereum has outpaced Bitcoin in terms of percentage growth following the rumors and subsequent approval of the first Spot Ethereum Exchange-Traded Funds (ETFs) by the Securities and Exchange Commission (SEC). Consequently, it’s not surprising that the trend of large investors, or “whales,” continuing to amass Ethereum has persisted.

As an analyst examining daily Ethereum (ETH) transactions involving whales, I’ve observed some noteworthy trends in on-chain data. Following the recent approval of spot Bitcoin ETFs, there has been a significant increase in the number of whale-sized ETH transactions exceeding $100,000 and $1 million, hitting year-to-date highs.

That day, there were 7,649 Ethereum transactions worth over $100,000, and a grand total of 1,252 transactions surpassing the value of one million dollars.

Large-scale coin proprietors increased their profits by selling off their holdings, leading to this rise in value as observed by Santiment.

“Whales seized this chance to make a gain, but Ethereum’s price might surpass Bitcoin’s if these wallets holding over 10,000 ETH keep moving upward in the market instability.”

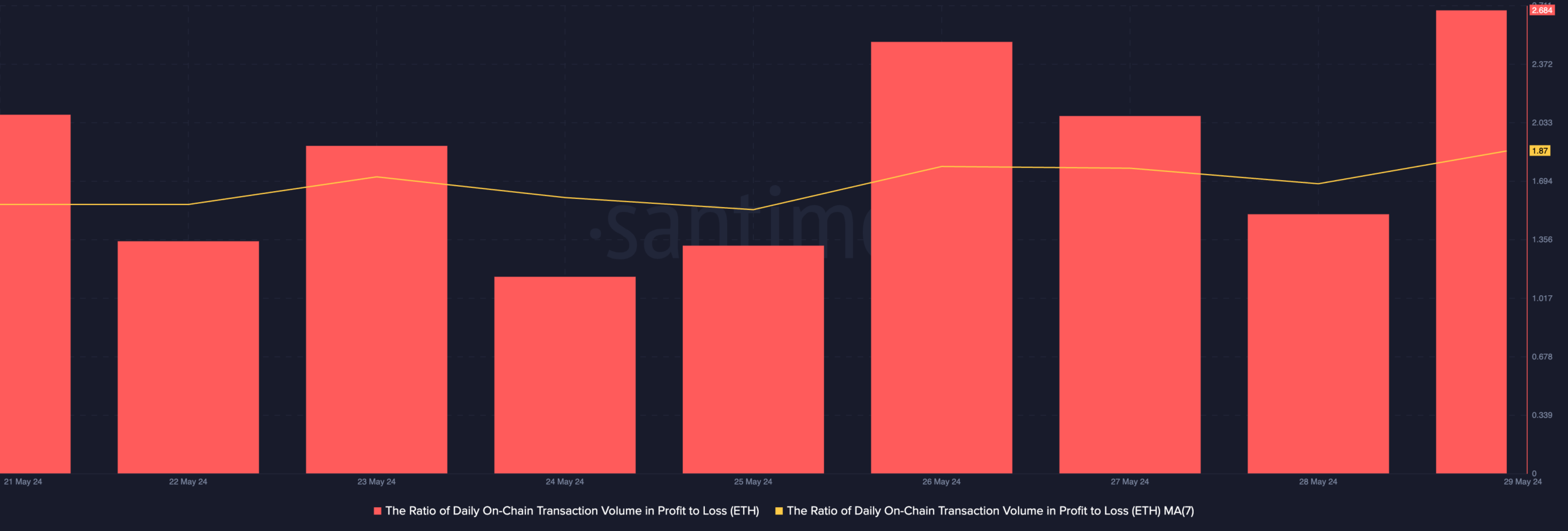

ETH holders book gains

As a data analyst, I’ve observed an uptick in whale activity over the past week, leading to profitable daily transactions using Ethereum (ETH).

Based on an analysis by AMBCrypto using a seven-day moving average, the altcoin’s daily transaction volume in profits outpaced losses by a factor of 1.87.

For each ETH transaction resulting in a loss within the past week, there were approximately 1.87 profitable transactions.

At press time, the altcoin exchanged hands at $3,865, according to CoinMarketCap’s data.

Read More

2024-05-29 19:24