- Ethereum’s price falls by 10% post-ETF launch, contrary to bullish predictions.

- Factors like market corrections and external economic pressures contribute to the downturn

As a seasoned crypto investor with several years of experience navigating the volatile and dynamic digital asset market, I find the recent Ethereum price drop post-ETF launch particularly intriguing. Having witnessed similar trends in the past, I’m well aware that the excitement surrounding new developments can sometimes lead to a sell-the-news scenario.

Lately, Ethereum’s [ETH] value has experienced a significant decrease, dropping approximately 10% in just the last 24 hours, now trading at around $3,164.

The fact that this decrease occurs immediately following the introduction of much-hyped Ethereum ETFs is noteworthy, as many believed these financial products would spark an uptrend for ETH.

Despite the early stages of live trading for Ethereum-based financial products, 10x Research, a renowned digital asset research firm for traders and institutions, has highlighted several potential reasons explaining Ethereum’s recent downturn.

Why the sudden drop?

Although there was great anticipation for the performance of these ETFs when they were first introduced to the market, the reality has fallen short of the hopes and expectations.

Based on findings from 10x Research, the swift decline in enthusiasm following the announcement of Ethereum ETFs has resulted in a common “selling the news” situation.

The occurrence of this trend is not unique to the cryptocurrency sector; comparable patterns have been noted in major digital asset happenings in the past, such as during significant events in 2017, 2021, and the early part of 2024.

10x Research points out that the timing of the ETF launch may have exacerbated the situation.

The timing of this event was significant as it occurred not just during the dispensation of Bitcoin from the protracted Mt. Gox scandal, but also amidst a more extensive market slump instigated by disappointing results in the US tech industry.

Recent significant stock sales at corporations such as Alphabet and Tesla have sparked concern and caution among investors, as decreased consumer spending projections have cast a shadow over various markets.

Furthermore, the impact of these factors appears to be more pronounced for Ethereum.

Prior to the debut of the Ethereum ETF, 10x Research identified Ethereum as overbought, implying that a price correction was imminent given the market conditions. This prediction appears to have held true with recent fluctuations in Ethereum’s value, which saw it underperforming despite substantial investments into newly launched Ethereum ETFs.

Ethereum ETF inflows and price drop impact

In spite of a decrease in Ethereum’s market prices, Ethereum-based ETFs have drawn significant interest from investors. On their debut trading day, these funds amassed approximately $106 million in total net investments.

BlackRock’s iShares Ethereum Trust ETF spearheaded the way with an impressive inflow of $266.5 million. The Bitwise Ethereum ETF followed closely behind, attracting $204 million, and the Fidelity Ethereum Fund managed to draw in $71 million.

Although not every fund reported positive inflows, the Grayscale Ethereum Trust undergoing its transformation into an ETF faced substantial outflows amounting to $484 million. This figure surpassed the initial outflows recorded by its Bitcoin equivalent earlier in the year.

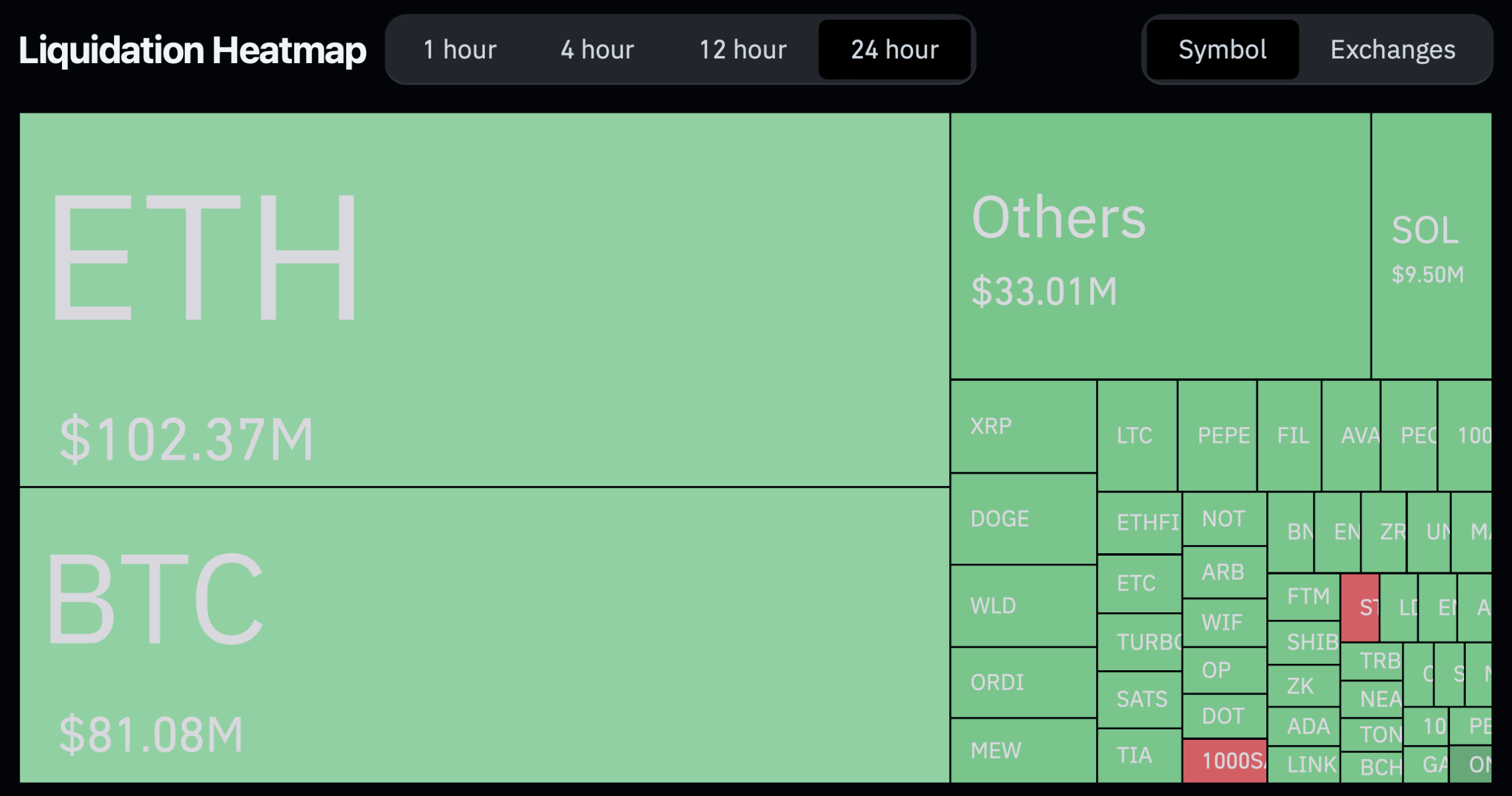

While the market is processing recent changes and accommodating an increased supply of ETF-related Ethereum, the cryptocurrency’s price instability has resulted in significant losses for numerous traders.

In the last 24 hours, an astonishing number of 73,119 traders encountered forced settlements on their positions, and Ethereum transactions accounted for a substantial sum of $102.37 million in these liquidations.

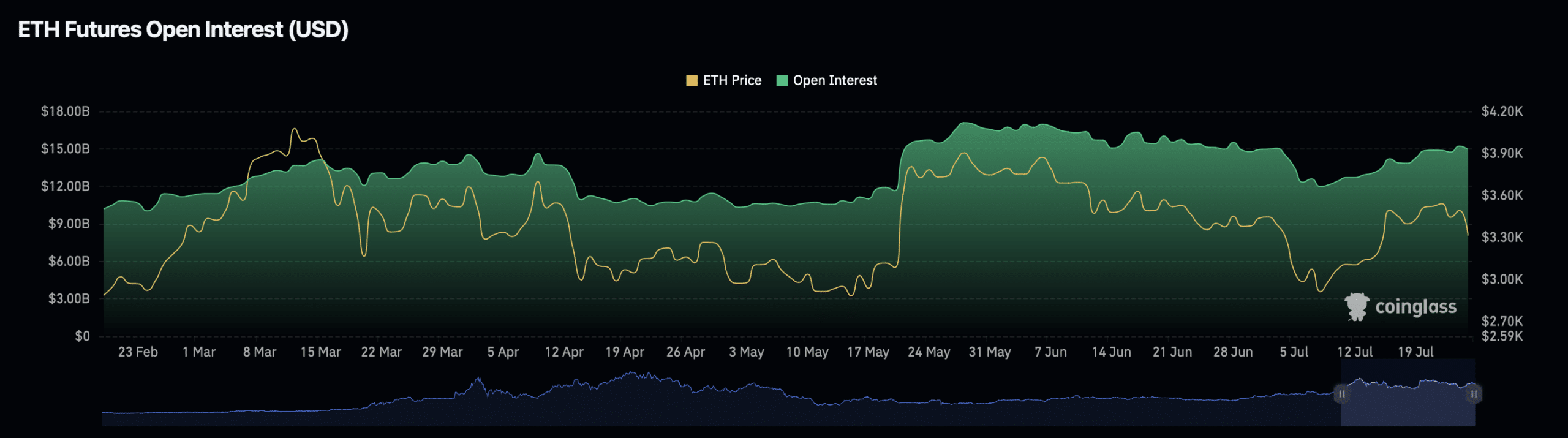

As a crypto investor, I’ve noticed that recent market developments have led to a significant decrease in Ethereum’s open interest. Specifically, it has dropped by almost 5%, bringing the total to around $14.32 billion. Additionally, the trading volume has declined by approximately 3.92%.

Read More

2024-07-25 16:08