-

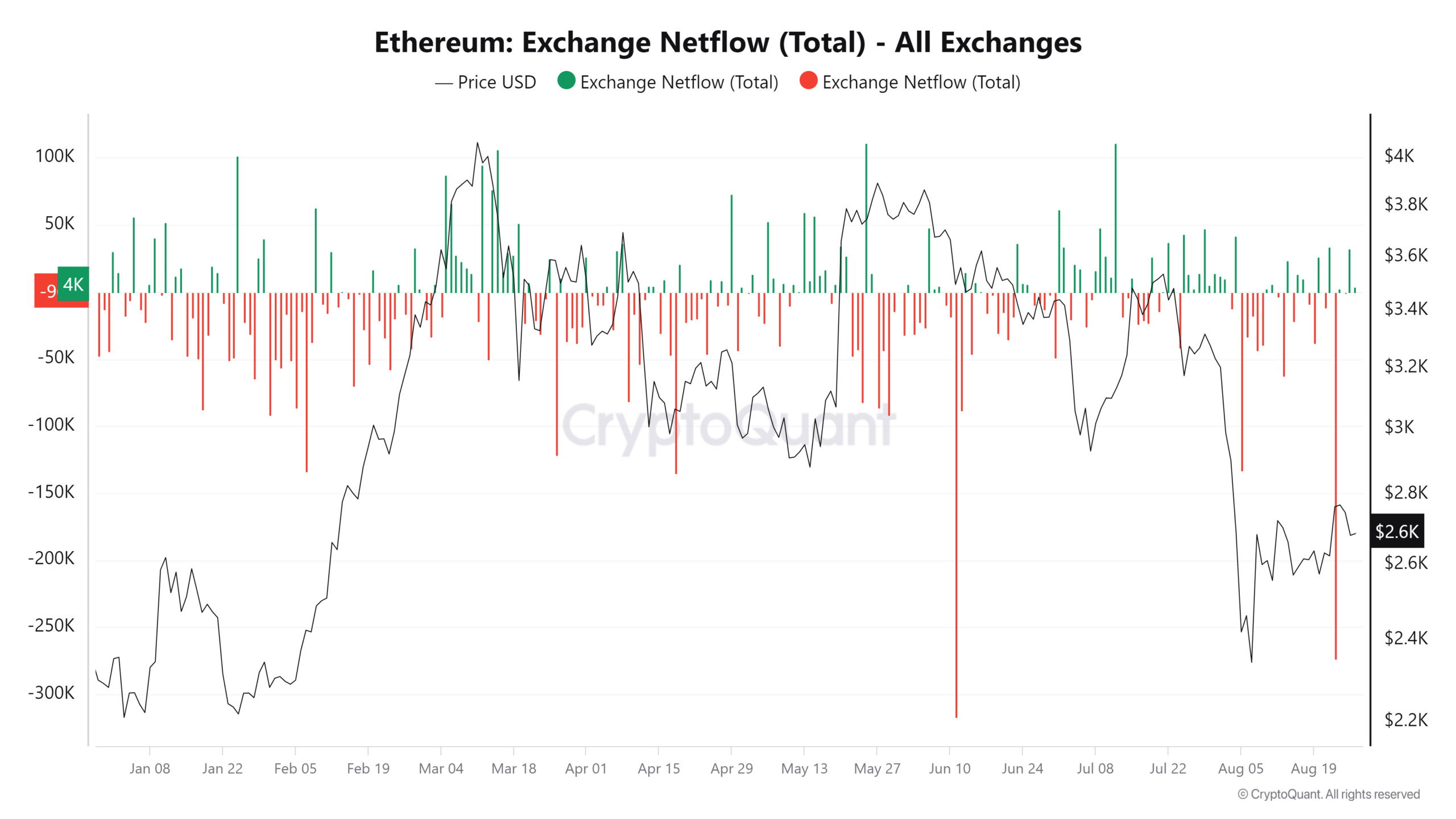

ETH saw more inflow into exchanges in the last trading session.

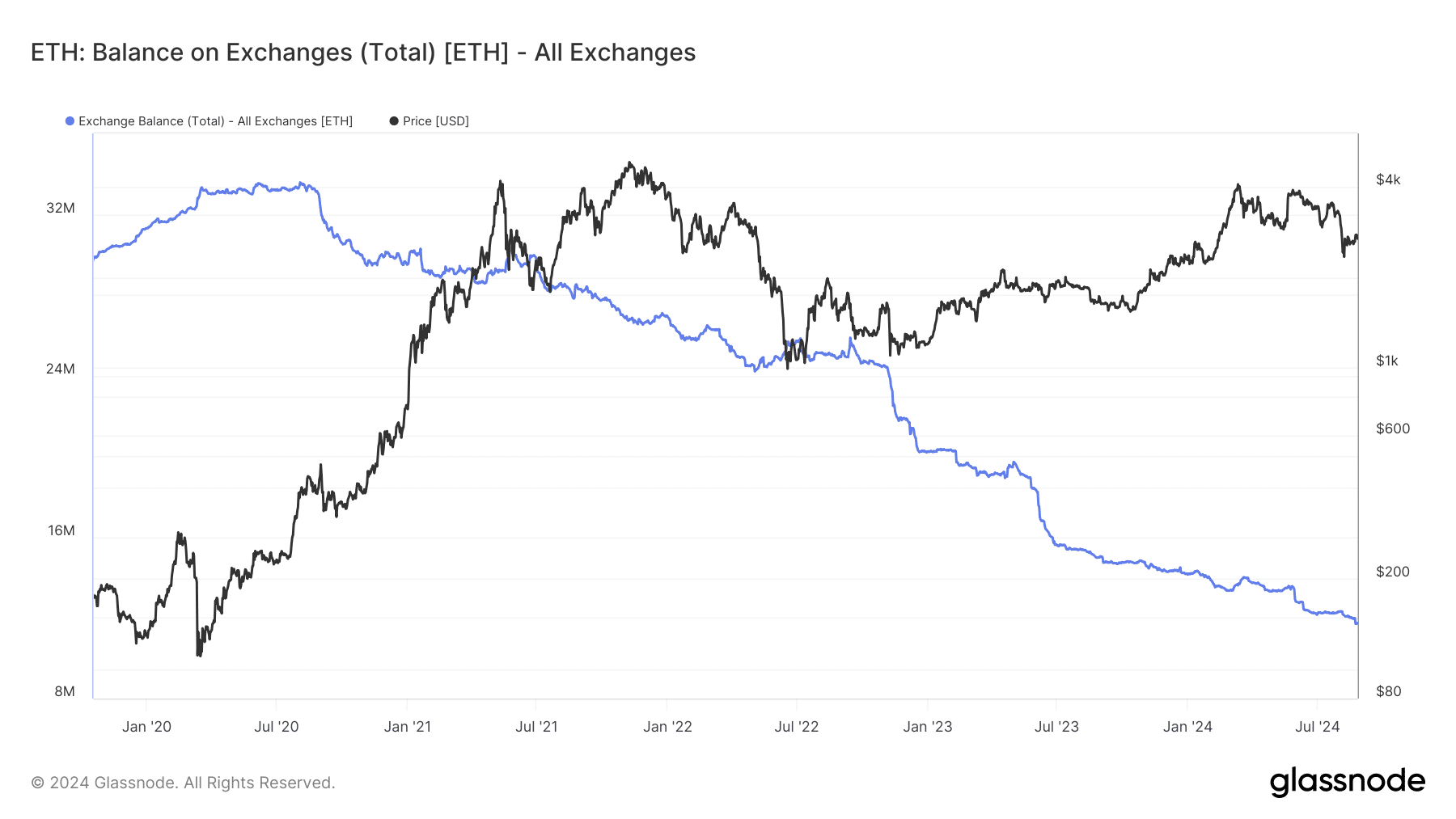

The ETH balance on exchange has continued to decline.

As a seasoned crypto investor who has weathered numerous market cycles, I find myself observing Ethereum [ETH] with a blend of cautious optimism and intrigue. The recent accumulation by whales, accompanied by the decline in ETH balance on exchanges, presents a complex picture that could be interpreted as bullish or bearish, depending on one’s perspective.

💥 EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

Market chaos looms — top analysts release an urgent forecast you must see!

View Urgent ForecastOver the past few days, I’ve noticed a recurring trend in Ethereum‘s [ETH] market dynamics. Specifically, various addresses have been engaging in both accumulation and sell-offs, which suggests a strategic movement of Ether supply. This pattern is intriguing as it could potentially indicate shifts in market sentiment or institutional activity within the Ethereum ecosystem.

Regardless of the varying tendencies, there’s been a general decline in the amount of Ethereum held on exchanges, a trend that’s frequently interpreted as positive or bullish.

Ethereum sees mixed signals

Lately, the behavior in the Ethereum market has sent conflicting messages through major indicators. While on one side, significant stockpiling by prominent investors, often referred to as “whales,” suggests a positive outlook (bullish), on the other hand, there are also signals that might hint at a less optimistic scenario.

An examination of the data from these ‘whale’ wallets indicates a rise in their Ethereum holdings, amounting to roughly 200,000 ETH or about $540 million.

Conversely, some significant market actors are unloading their holdings, possibly suggesting a more conservative or pessimistic stance by these investors.

According to information from Lookonchain, major entities such as Amber Group and Cumberland offloaded approximately 13,000 Ether within the past day, with a total value exceeding $35 million.

As a crypto investor, I’ve noticed a fascinating dynamic playing out in the market lately. Institutions seem to be offloading their digital assets, creating a wave of selling pressure. On the other hand, the whales are buying up large quantities, indicating accumulation. This combination results in a market sentiment that’s somewhat ambiguous, with optimism and caution coexisting side by side.

While the whale accumulation points to a strong belief in Ethereum’s future, the institutional sell-offs could reflect concerns about short-term price movements or broader market uncertainties.

Ethereum flow shows the dominance of sellers

On the 26th of August, an examination by AMBCrypto of Ethereum’s exchange inflow and outflow data provided by CryptoQuant indicated a higher amount of Ethereum was moving out of exchanges compared to entering, signifying a positive netflow.

On that particular day, a larger amount of Ether (ETH) was sent to exchanges than taken out, as indicated by the net flow exceeding 32,000 ETH. This implies that selling activity was greater than buying or accumulation during that time frame.

A positive netflow often indicates that investors may be transferring ETH to trading platforms, potentially for the purpose of selling or trading, leading to temporary increases in supply and potential downward price pressure.

As a crypto investor, I’ve noticed that entities like Amber Group and Cumberland are offloading substantial quantities of ETH, according to the latest data. This trend makes me ponder if it could be a sign of a potential shift in their investment strategy or market sentiment. It’s essential for me to keep a close eye on these developments and adjust my own portfolio accordingly.

While I’ve observed a recent surge in Ethereum inflows into exchanges, my analysis indicates that the general pattern over the past few weeks leans towards a net outflow of Ethereum.

On a larger time frame, it’s usually seen that more Ethereum (ETH) is being taken out of exchanges than put in, which is generally viewed as a positive or bullish sign.

ETH’s exchange flight

The continuous decrease in Ethereum stored on trading platforms is a notable pattern, suggesting that a growing number of investors are transferring their assets out of these platforms.

It seems like this decrease in the exchange balance implies that investors could be transferring their Ethereum to offline wallets for safekeeping, staking it, or holding onto it for a longer term instead of having it readily accessible for transactions.

Reducing the flow of ETH into exchanges might cause a shortage, and this situation often indicates a positive trend for the currency’s worth.

As a crypto investor, I’ve noticed that when the number of coins available for trading decreases while demand continues to be robust or even grow, the scarcity of those coins can lead to an increase in their price. This phenomenon is based on the fundamental economic principle of supply and demand, where a decrease in supply coupled with a consistent or growing demand often results in higher prices.

Despite some conflicting signs recently, the decrease in the exchange balance contributes positively to the growing optimism surrounding Ethereum.

ETH continues to trend weakly

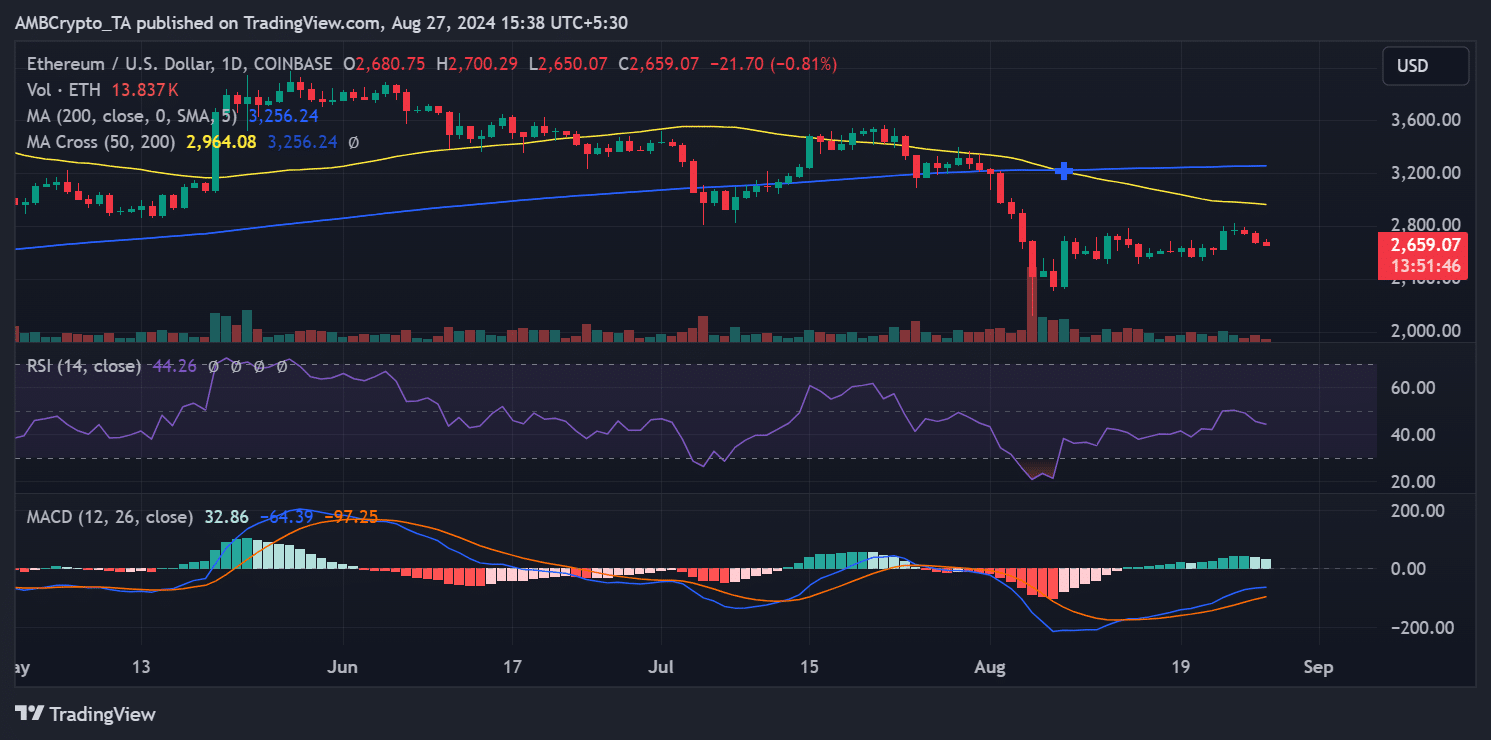

According to AMBCrypto’s analysis, Ethereum has recently struggled to maintain positive momentum.

Over the past three days, I’ve observed a consistent downtrend in Ethereum’s daily price movement. Currently, Ethereum is trading around $2,656, marking a nearly 1% drop from its previous levels.

The quickly shifting average (represented by the yellow line) consistently served as a substantial barrier for price movement near $2,900.

Read Ethereum’s [ETH] Price Prediction 2024-25

On multiple occasions, this resistance has acted as a barrier, stopping Ethereum from advancing further, thereby adding to the current bearish trend affecting its price.

The persistent drop in price suggests a confusing picture of Ethereum’s market behavior over the past few weeks, where temporary bearish tendencies clash with more optimistic long-term signs, like decreasing exchange holdings for instance.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-27 22:16