- Ethereum flipped its 1-day market structure bearishly.

- The former range highs were the next support region of interest.

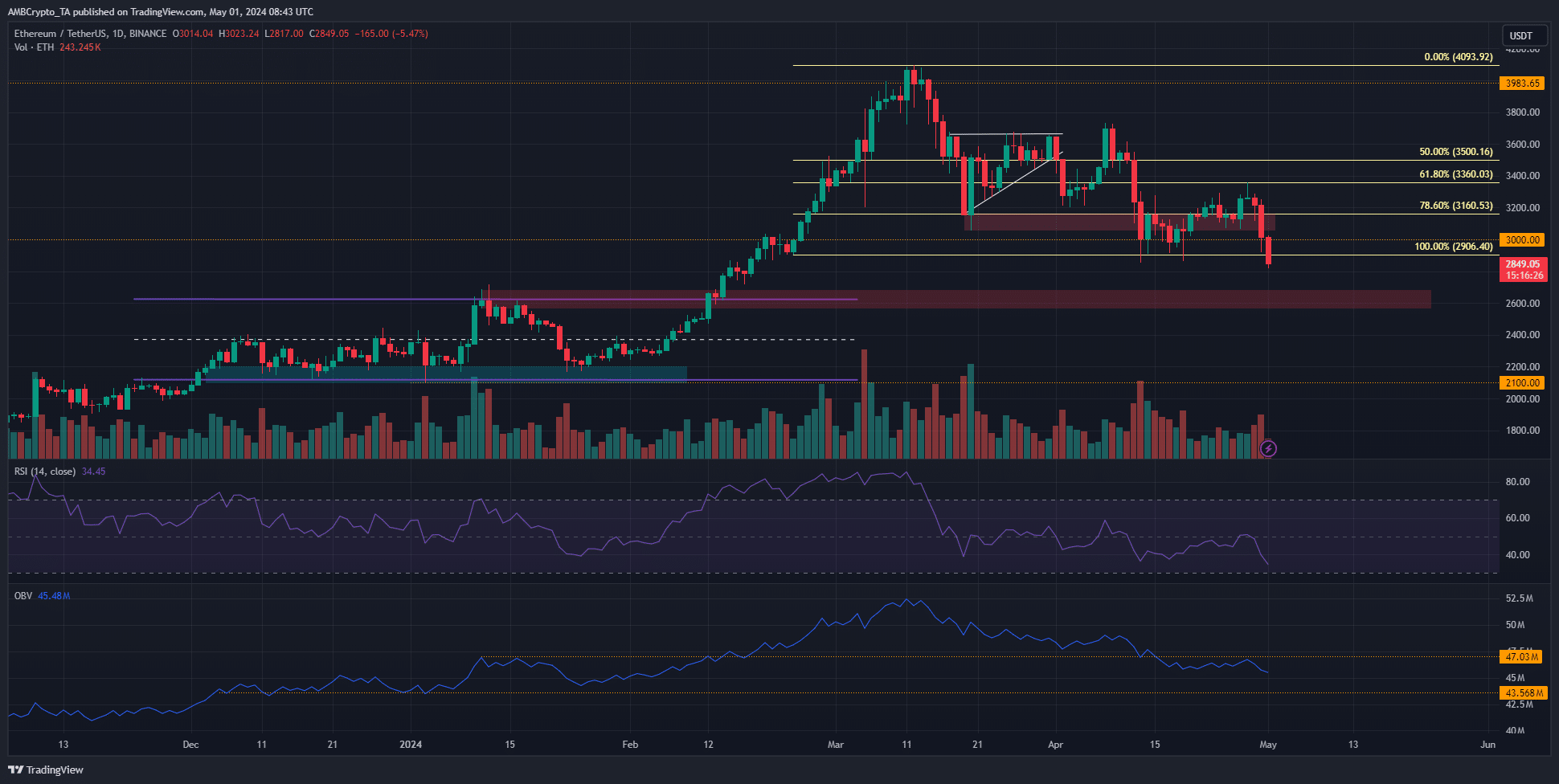

As a researcher with extensive experience in analyzing cryptocurrency markets, I have closely monitored Ethereum’s [ETH] recent price action. Based on my observations and technical analysis, it appears that Ethereum has flipped its 1-day market structure bearishly. The former range highs now serve as the support region of interest.

In April, there was a surge in selling on Ethereum [ETH], prompted by profits being taken and heightened anxiety. The downward trend for Ethereum became more pronounced, with an increasing number of transactions being sell orders.

The indicators were bearish on the one-day timeframe.

The low trading volume of Hong Kong ETFs for Ethereum and cryptocurrencies on their debut day signaled a cautious investor attitude towards Ethereum and the crypto market. Moreover, a decrease in Open Interest suggested that speculators adopted a more prudent stance.

The bullish order block above $2500 next

As a researcher studying Ethereum’s price trends, I have observed that the higher timeframe outlook took a bearish turn after the cryptocurrency dipped below its previous swing low of $2906. If the daily session ends up closing below this level, it is highly probable that the price will move towards the next potential support area around $2600.

In this area, there is a meeting point with past peaks in the Ethereum price chart from several months ago. The Relative Strength Index (RSI) on the daily scale has remained under the 50-neutral mark throughout most of April, indicating persistent price declines.

The OBV, or On-Balance Volume, dipped beneath a previous support threshold and subsequently bounced back as resistance. It’s anticipated that Ethereum may experience significant declines before touching the subsequent significant mark on this technical indicator.

The hunt for liquidity could see ETH go south

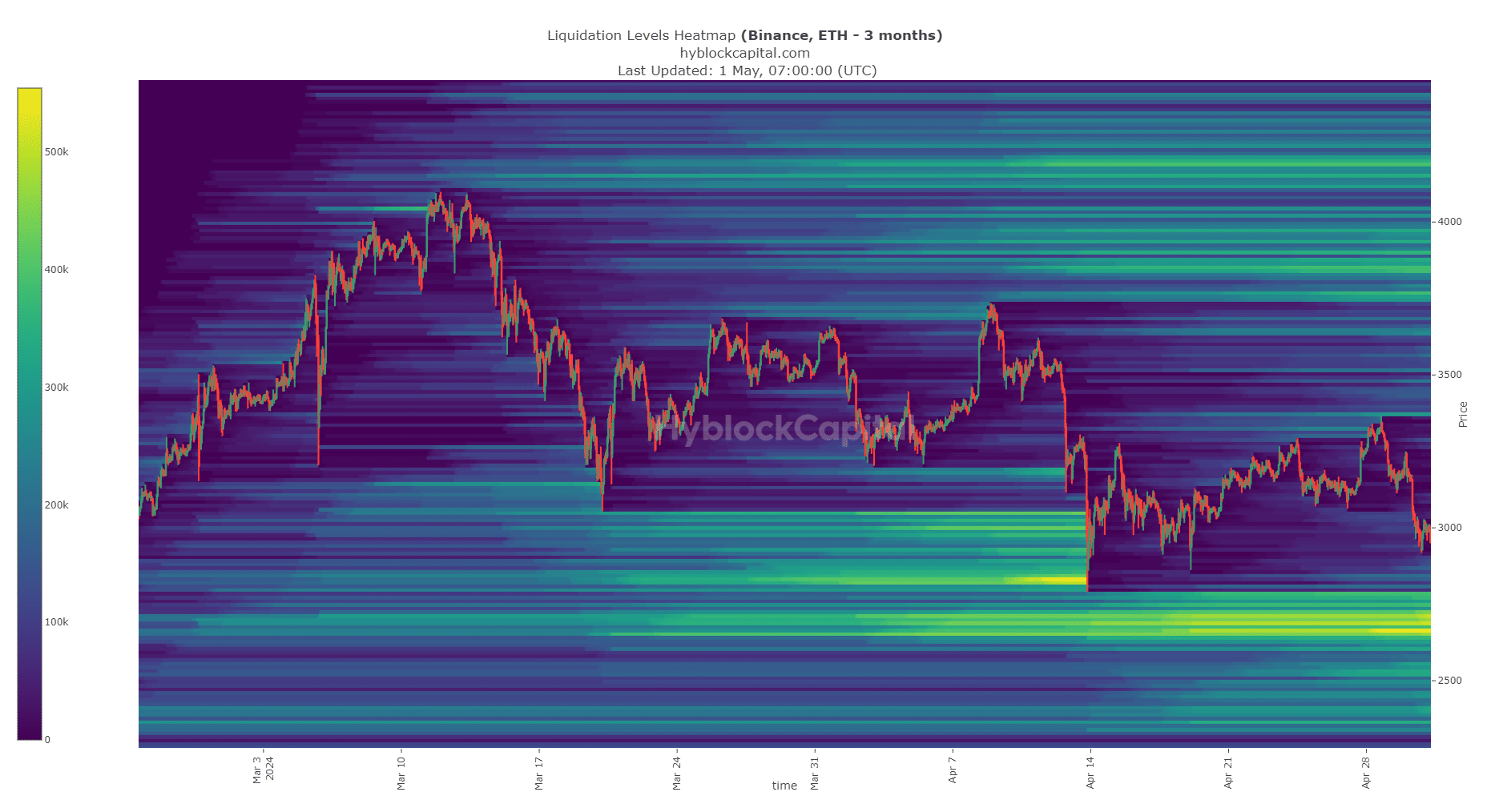

In simpler terms, the grouping of prices at which ETH could be sold off in large quantities was located lower down. The range between $2640 and $2750 offered a significant pool of availability for buyers.

It also has confluence with the bullish order block highlighted at the range highs.

As a researcher studying the trends of Ethereum (ETH) prices, I anticipate that ETH may dip into this area of low liquidity before experiencing a potential reversal. The likelihood of a reversal occurring prior to this point was minimal, given that these specific liquidation levels exert a strong magnetic pull on price movements.

Read More

2024-05-01 16:07