- Ethereum’s latest bullish divergence hinted at the end of a bearish trend and the start of a bullish trend

- CVD revealed many DEX traders are taking profits or closing their positions

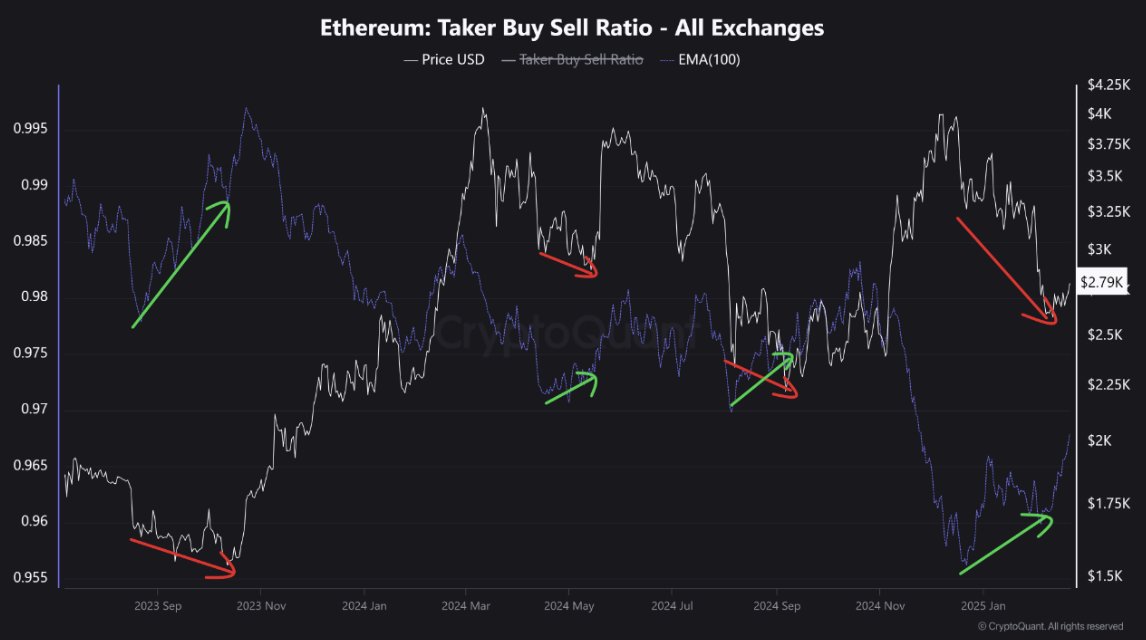

In a universe not so far away, Ethereum’s (ETH) market, at the time of this writing, was projecting a major bullish divergence. This was identified by the taker buy-sell ratio against the price trend, which, if you squint hard enough, often precedes a market recovery on the charts. Or at least, that’s what the optimistic folks say while sipping their overpriced lattes.

For instance, back in the ancient times of September 2023, despite the price plummeting to a mere $1,500 (which is about as fun as stepping on a Lego), the taker buy-sell ratio began to climb. A sign of buildup in buying pressure, or perhaps just a sign that someone had finally found their wallet. This soon resulted in ETH recovering towards the $2,000-level, which is like finding a twenty-dollar bill in your old coat pocket.

Also, from November 2024 to January 2025, Ethereum’s price took a nosedive to around $2,700. However, the taker buy-sell ratio again flashed an uptrend, highlighting potential buying interest despite the fall in the altcoin’s price. It’s like watching a soap opera where the characters keep making the same mistakes over and over again.

Historically, such patterns signal the end of bearish phases and initiate new bullish trends. Or at least, that’s what the history books would have you believe.

Its latest interplay suggested that despite the press time price of $2,800, an uptrend could be imminent. This could mirror past patterns where rising taker buy activity correlated with price recoveries. Or it could just be a cosmic joke played by the universe.

Whales vs Smart DEX Traders

Furthermore, recent activities across the Ethereum ecosystem presented a striking contrast between large-scale buyers (the whales) and active traders on decentralized exchanges. This was in the midst of rising prices, before the sharp drop due to the Bybit hack where $1.4 billion ETH were lost. Yes, you read that right. Billion with a ‘B’.

Notably, whale accounts have ramped up their holdings by accumulating an additional 140,000 ETH – signaling a bullish position or a long-term hold. This mass acquisition seemed to be in line with an uptrend in ETH’s price, hinting at strong confidence among large holders. Or perhaps they just really like the number 140,000.

However, the Cumulative Volume Delta (CVD) indicated a trend where smart DEX traders have been increasingly taking profits or closing their positions. This alluded to a possible sentiment shift or risk aversion at press time price levels. It’s like watching a game of musical chairs, but with more existential dread.

This selling activity could create short-term price volatility or pressure as profits are secured, contrasting with the whales’ accumulating behavior. The complex interplay could lead to divergent short-term versus long-term impact on Ethereum’s trajectory. Or it could just lead to a lot of confused investors scratching their heads.

Ethereum’s Log Curves

Ethereum, at the time of writing, was trading in the oversold zone. This historically means a potential reversal on the charts. ETH’s price seemed to be trading below this critical threshold within the log curve zones – increasing the likelihood of a price bounce. Or at least, that’s what the optimistic analysts are betting their lunch money on.

Historically, such positioning has preluded major rebounds, like in mid-2017 and late 2020. During this period, ETH navigated from the oversold region to higher zones, reflecting strong buying interest at perceived value levels. It’s like watching a rubber band stretch, only to snap back and hit you in the face.

Conversely, while oversold conditions often herald

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2025-02-22 14:18