- ETH stalled on the charts as memecoins gained momentum throughout the week

- A strong catalyst may be needed to spark a short squeeze

As a seasoned crypto researcher with years of market analysis under my belt, I can’t help but feel a sense of intrigue and cautious optimism regarding the current state of Ethereum [ETH]. The market dynamics are shifting, and it seems memecoins have seized the limelight for now.

In my role as a researcher, I’ve noticed an impressive surge in the crypto market lately, driven primarily by Bitcoin [BTC] approaching its previous All-Time High (ATH). Remarkably, Ethereum [ETH] has been a significant beneficiary of this rally, recording weekly growth almost touching 10%. At the moment I’m writing, Ethereum is trading at approximately $2.6k.

This mirrored a widely-used investment approach, in which high-value alternative cryptocurrencies tend to flourish as Bitcoin reaches a significant resistance level, leading individual investors to reallocate their funds to reduce potential risks.

Instead of increasing like earlier periods, Ethereum (ETH) has been holding steady for the past three days, whereas Bitcoin (BTC) experienced daily growth surpassing 2% during that same duration.

Simply put, there has been an underlying shift in the market dynamics.

Memecoins have reaped the most benefits

Over the past week, meme coins have experienced a significant price surge, and interestingly, three out of the top five performers are meme-based tokens.

It’s worth mentioning that DOGE was at the forefront with remarkable 30% weekly growth, indicating growing investor trust in high-risk assets promising rapid, substantial returns. Meanwhile, as traders started focusing more on memecoins, ETH saw a decrease in interest, resulting in its stabilization on charts according to AMBCrypto.

Yet, according to another report from AMBCrypto, the rise in Dogecoin (DOGE) might indicate a heated market that could potentially experience a correction soon.

Therefore, the question arises – Might this possible decrease in ETH’s value entice more capital towards it, potentially triggering a short squeeze situation?

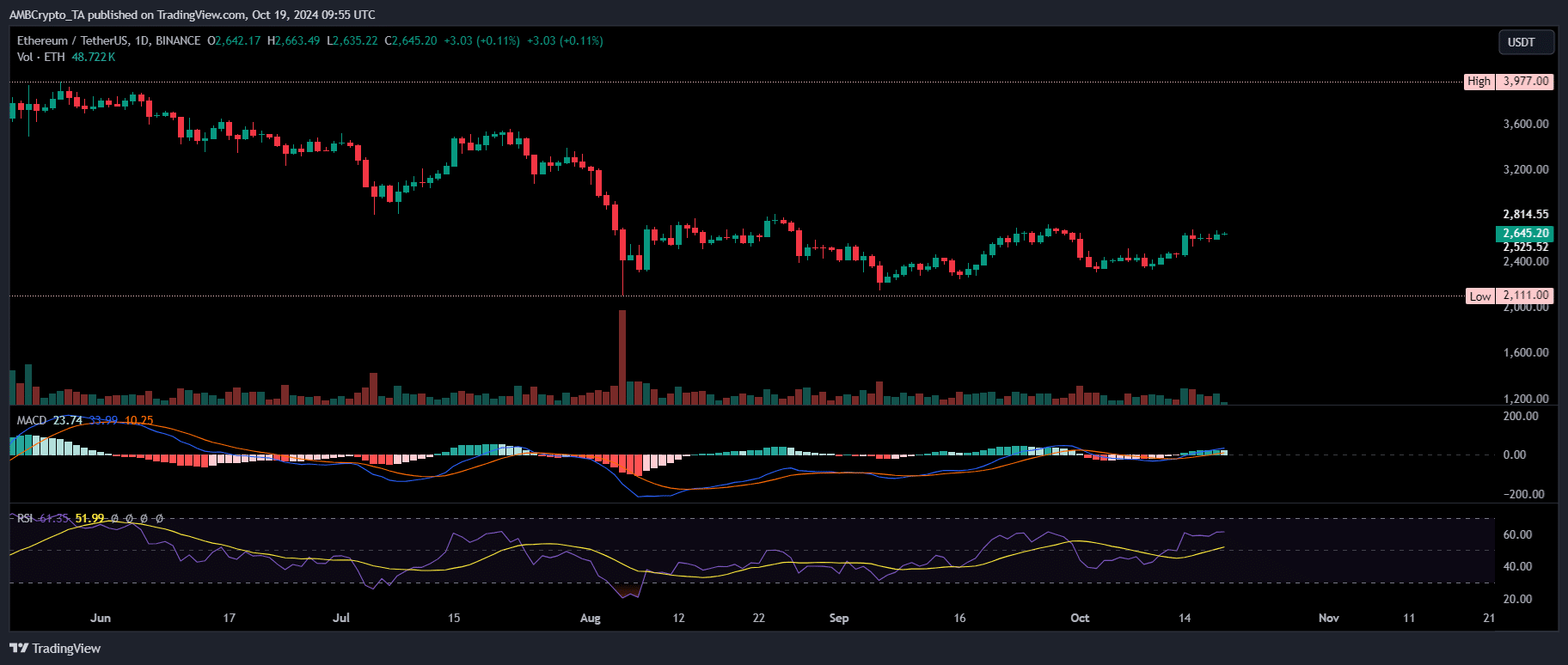

Currently, when I’m typing this, the MACD lines are almost set for convergence, which, if it happens as anticipated, might serve to reinforce the projected Ethereum shift during the upcoming weekend.

Contrarily to what the RSI suggests, I’ve noticed that about 74% of the recent price movements over the past two weeks have been on an upward trend. This could potentially signal a shift in trend direction, hinting at a possible reversal coming up.

Combining various factors, it could be argued that Ethereum (ETH) appears to be declining in several crucial aspects. This downturn seems to be driven by a growing number of sellers, as they capitalize on the trend surrounding meme coins.

Should this trend continue unabated without a change in direction, it may lead to a wave of forced selling from long-term investors who must offload their positions.

In such circumstances, ETH’s potential for growth could be restrained as Bitcoin reaches its peak. Often, this pattern signals the beginning of altcoin market dominance.

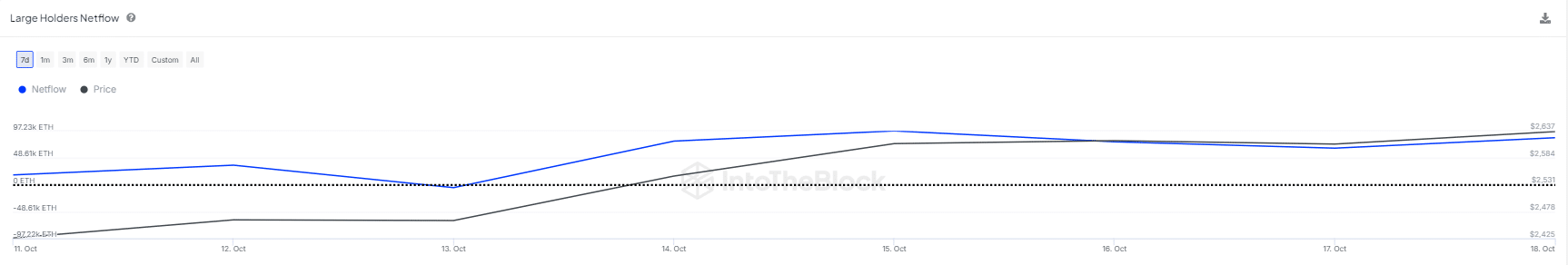

ETH holders are targeting the dip

Generally speaking, when individual investors sell their assets, it often indicates that the market has peaked, as they are taking advantage of their profits.

Instead, when big investors start amassing assets at a price point considered low in a specific region, they could be signaling a market bottom. This is because they view this decrease as a chance to purchase more.

Over the last three days, major ETH holders took advantage of price drops by purchasing ETH at discounted rates. They believed that Bitcoin’s upward trend would persist, causing more investors to seek out altcoins as a safe haven.

As a result, there was a large withdrawal of Ethereum (ETH) tokens from exchanges, which triggered a 10% increase over the past week, even in the face of widespread market anxiety.

Read Ethereum [ETH] Price Prediction 2024-2025

Essentially, Ethereum (ETH) finds itself at a pivotal moment, with multiple elements impacting its potential path forward.

If memecoins continue to draw liquidity away from BTC traders, the potential for a short squeeze may hinge on large holder activity. This might make ETH more vulnerable to uneven concentration and sudden price swings.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-19 22:16