-

Fantom could potentially see a 234% price increase due to a hidden bullish divergence.

Javon Marks suggests FTM’s price could reach a high of $3, triggering a substantial rally.

As an analyst with over two decades of experience in financial markets, I must say that I find the outlook for Fantom (FTM) quite intriguing. The hidden bullish divergence pattern, as pointed out by Javon Marks, is not something to be dismissed lightly. While it’s essential to approach such predictions with a grain of salt, the potential 234% price increase to $3 does seem plausible given the right market conditions.

As an analyst, I’ve observed that Fantom [FTM] has registered more subdued growth compared to other significant altcoins this year. In contrast, digital currencies such as Solana and Toncoin have witnessed a staggering surge of over 100%. Meanwhile, FTM has managed a modest increase of approximately 40% year-to-date.

As an analyst, I’ve observed that my recent investment, FTM, has experienced a dip of approximately 5.7% within the past day, now trading at $0.3393. However, it’s crucial to note that this short-term decline follows a robust performance last week where the asset surged by over 15%, even reaching beyond $0.36 on Sunday, 11th August. This temporary downturn doesn’t overshadow the asset’s strong showing in the past few days.

234% rally on the horizon

Javon Marks, an analyst within the crypto community, has highlighted a promising scenario for FTM.

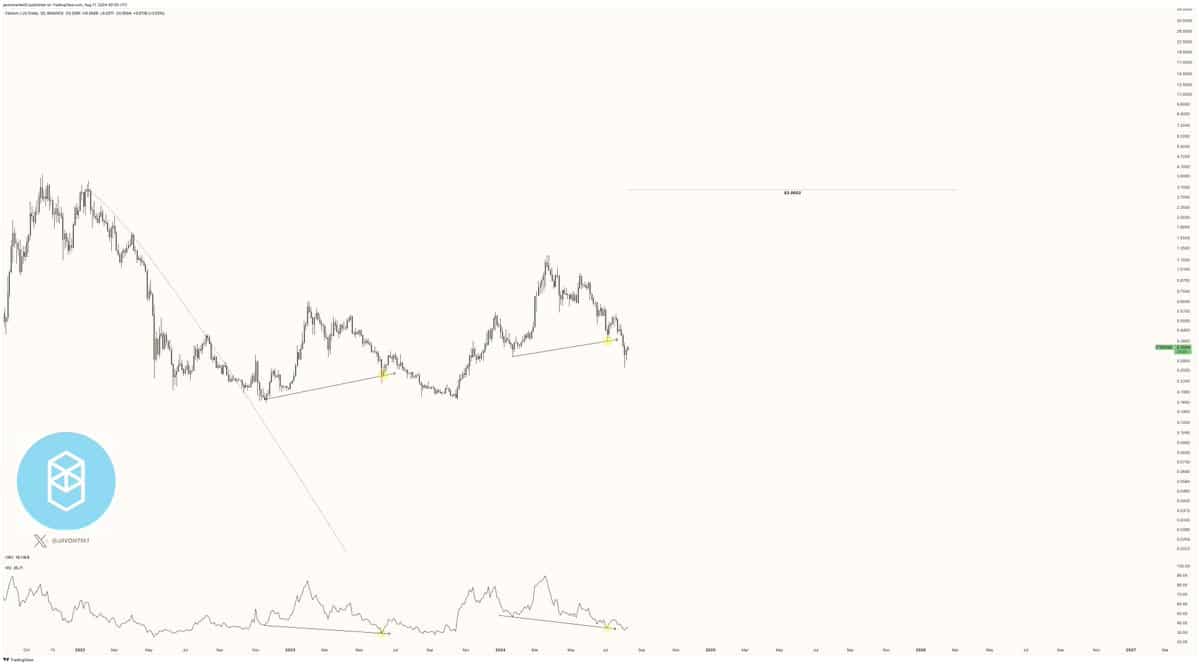

Based on Marks’ analysis, Fantom seems to be displaying symptoms of a concealed Bullish Divergence on its graphs, a technical indicator that typically foreshadows possible price increases.

The trend indicates that even with the recent decrease in prices, there might be a significant surge coming in the upward direction due to the building strength beneath.

In simpler terms, Hidden Bullish Divergence happens when the price decreases less than it previously did (forms a higher low), but the indicator showing the overall trend (the oscillator) shows a more pronounced decrease (a lower low). This mismatch in trends might suggest that the positive market sentiment is persisting, potentially leading to substantial price rises.

Marks speculates that this setup could propel FTM to increase by as much as 234%. Such a rally would not only reverse the recent losses but could push the cryptocurrency to new heights, potentially reaching the $3 mark.

Based on my personal experience and observations in the cryptocurrency market, I find myself feeling optimistic about Fantom’s current standing. My past encounters with similar situations have taught me that volatility in price activity can often be a sign of potential recovery, especially when it follows a retracement phase. In fact, I remember instances where such retractions preceded significant rallies. So, while I understand the risks involved, I am cautiously optimistic about Fantom’s future prospects.

Marks explained in a post,

“The latest evidence from Fantom showing a ‘Hidden Bullish Divergence’ has been followed by a pullback, but this trend mirrors past occurrences that were typically followed by significant price upturns.”

Based on my years of trading experience and analysis of the FTM chart, I believe there could be an upward trend that may potentially reach a significant level of $3.0053. This price point appears to be a critical breakout level for FTM, and if history repeats itself, it could signify a long-term target worth considering. However, as always, I urge caution when making investment decisions, as past performance is not guaranteed to repeat in the future, and market conditions can change rapidly.

Fantom (FTM) fundamental outlook

Even though the technical analysis suggests a bright outlook for FTM, it’s crucial not to overlook its underlying financial strengths as well.

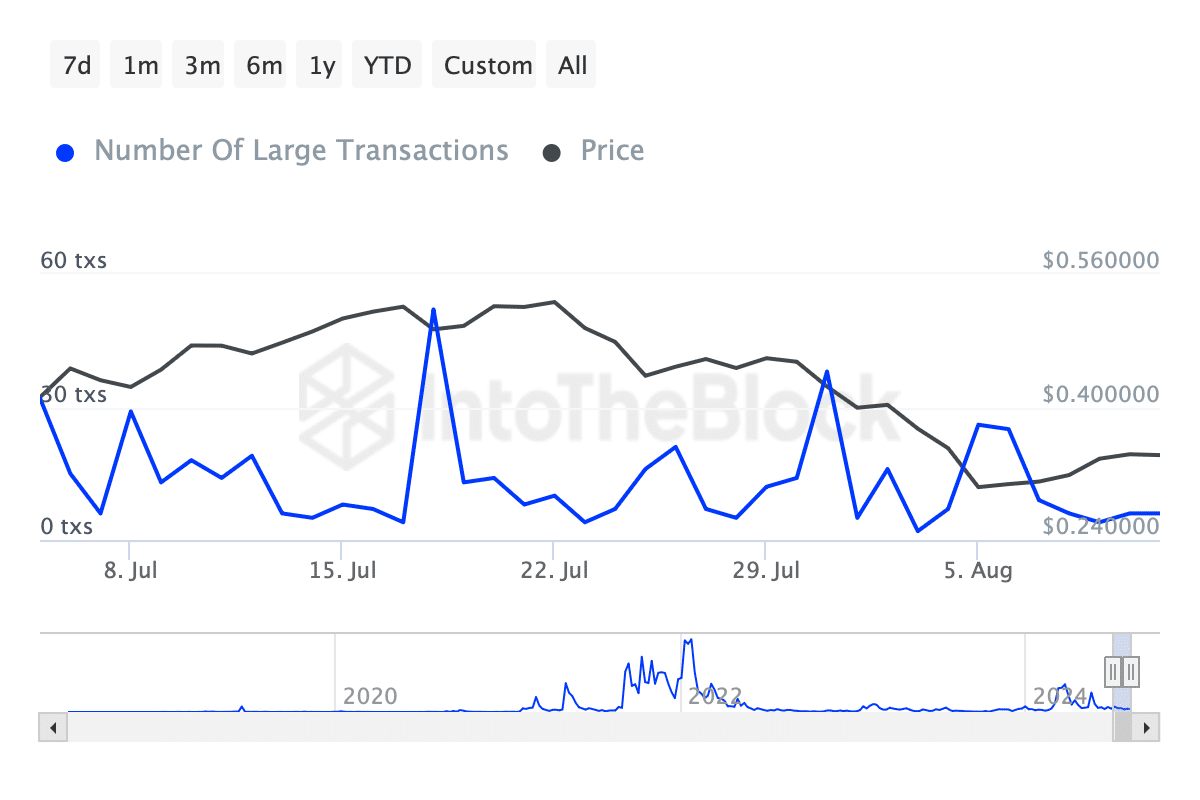

As a seasoned crypto investor with years of experience under my belt, I’ve noticed that the decrease in large transactions (whale transactions) from over 20 significant transactions last week to just 6 this week could signal a shift in smart money movements within the market. This trend may be an indicator of cautiousness or even uncertainty among big players, which I find quite intriguing. It’s essential to keep a close eye on such patterns, as they can provide valuable insights into the broader market sentiment and potential future trends.

A decrease in whale activity might indicate a brief dip in investor assurance, or it could be a period of consolidation preceding a possible surge in activity.

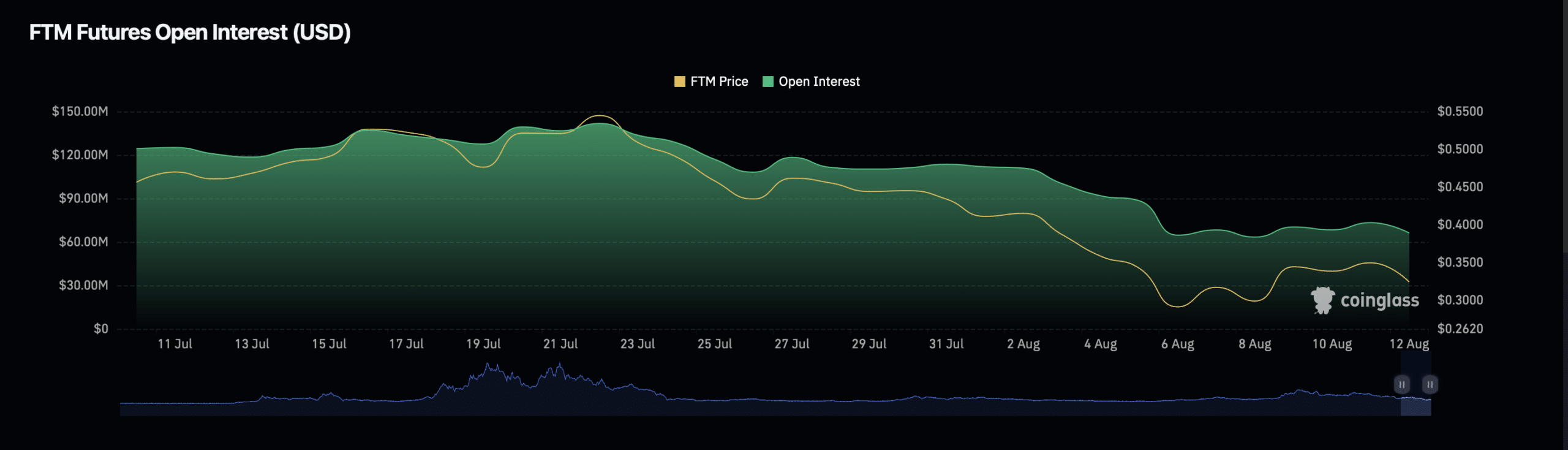

Moreover, the open positions for FTM (Futures Term Margin), representing the count of unsettled derivative agreements like futures, have exhibited a variety of patterns.

Realistic or not, here’s FTM’s market cap in SOL terms

Although the number of active leverage positions has dropped by 9.2%, indicating a slowdown, the total volume of these open interests has significantly increased by 47.59%.

Based on my experience as a long-time investor, observing market trends and patterns, this increase could suggest that fresh funds are flowing into the market, potentially due to the expectation of future price hikes. I have seen similar situations in the past where such influxes preceded significant market movements, so it’s essential to keep a close eye on these developments.

Read More

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Elevation – PRIME VIDEO

2024-08-12 17:44