- Ah, Bitcoin! Its price action and market structure dance in a familiar waltz reminiscent of past bull cycles.

- While the echoes of history whisper sweet nothings of bullish prospects, one must tread carefully amidst the lurking shadows of external risks.

Behold! Bitcoin’s [BTC] current price action is a mirror reflecting its March 2017 cycle, where our dear BTC was still a mere nine months away from its glorious peak. How quaint! 🪙

If the universe has a sense of humor and history decides to repeat itself, BTC might just waltz into its next “extreme greed” phase by Q4 2025, heralding the final act of its bull run. 🎭

So, what lofty heights might BTC aspire to if this cycle follows the well-trodden path of its predecessors? One can only speculate! 🤔

Bitcoin’s RSI: A Nostalgic Echo of the 2017 Cycle

A recent post on X (formerly known as Twitter, because why not?) has illuminated the fact that Bitcoin has returned to those critically low RSI Bollinger Band % levels. Ah, the sweet scent of nostalgia! 🌸

When BTC’s RSI Bollinger Band % dips to such depths, it suggests the asset is deeply oversold within its volatility range, often hinting at a potential rebound. A classic tale, indeed!

This pattern is akin to the thrilling escapades of 2013, 2016, and 2020, just before Bitcoin soared to new heights. What a rollercoaster! 🎢

Notably, the RSI Bollinger Bands now mirror 2017, when Bitcoin languished below $1,000 before erupting like a volcano, surging 1,500% to $19,086 by Q4. Talk about a comeback! 💥

However, at $83,078, BTC’s price action remains as uncertain as a cat in a room full of rocking chairs. 🐱

Analysts, those ever-watchful sentinels, warn that a local bottom hasn’t yet formed, with institutional outflows accelerating and long-term holder supply dwindling to pre-election lows – signs of short-term weakness. Oh, the drama!

Despite this volatility, Bitcoin’s historical cycle patterns remain as steadfast as a loyal dog. If history is any guide, could HODLing still be the best long-term strategy? One can only hope! 🙏

Identifying the Next Market Top: A Quest for the Holy Grail

While a definitive bottom hasn’t graced us with its presence, there are no strong signals of a market top either. The suspense is palpable! 🎬

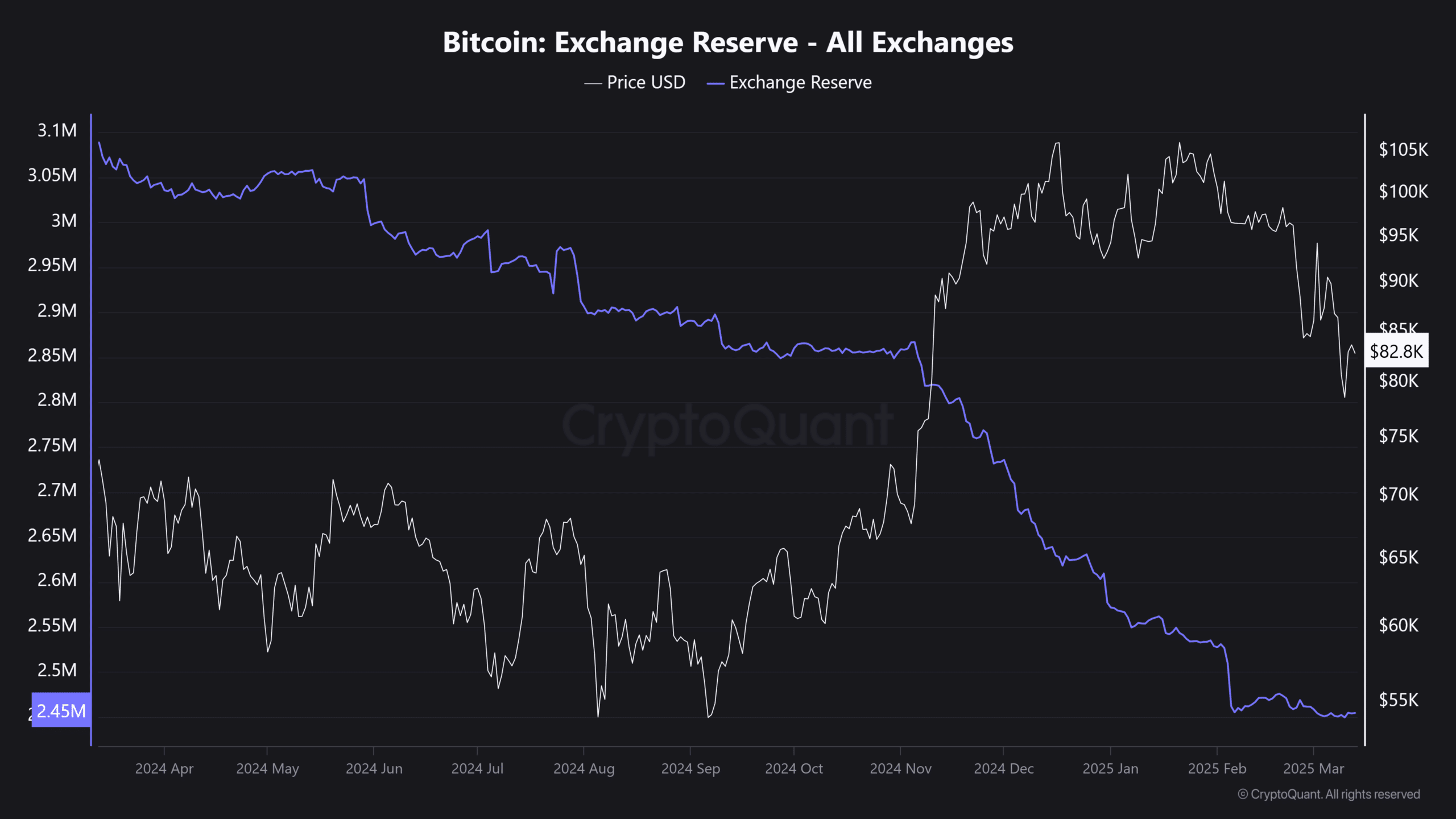

FOMO is steadily rising, with exchange reserves plunging to a one-year low, reflecting persistent long-term accumulation rather than profit-taking. A curious phenomenon, indeed!

In fact, despite Bitcoin’s 22% pullback from its $109K peak, BTC supply on exchanges continues to shrink – a sign that investors are holding on tighter than a toddler to their favorite toy. 🧸

For Bitcoin to replicate its 2017 bull cycle, this accumulation trend must persist. If sustained, historical data suggests the market’s true cycle top could still be nine months away. Patience, dear investors!

Even amid macro uncertainty and stock market liquidations, BTC has maintained its $77K–$80K range, reflecting unwavering investor confidence. A true testament to the human spirit! 💪

In the near term, breaking past $90K remains the key challenge. But in the long run, sustained accumulation and growing confidence could catapult Bitcoin into the realm of six-digit territory. A lofty ambition, indeed!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-03-14 03:08