- BlackRock’s BUIDL Fund allows institutional investors to gain exposure to U.S. dollar yields.

- Both retail and institutional investors can trade the perpetual index market that tracks the BUIDL Fund’s supply changes.

As a seasoned researcher with a penchant for exploring the intricacies of the blockchain world, I find the introduction of Injective Labs’ BUIDL Index for BlackRock’s USD Institutional Digital Liquidity Fund to be an exciting development that could reshape the landscape of decentralized finance.

Research and innovation firm Injective Labs, responsible for INJ‘s creation, unveils an innovative tokenized index for the institutional digital liquidity fund of BlackRock USD – a groundbreaking financial product.

The BUIDL Index tracks the supply changes of the BUIDL tokens constituting the BUIDL fund.

The amount of BUIDL tokens supplied has a direct impact on the price of the perpetual index. In other words, if the supply of these tokens goes up or down, you can expect the index price to increase or decrease accordingly.

Injective Labs CEO Eric Chen said in the announcement blog,

The BUIDL Index highlights the immense capability of Injective’s structure, demonstrating its true ability to transport traditional finance seamlessly onto entirely decentralized tracks.

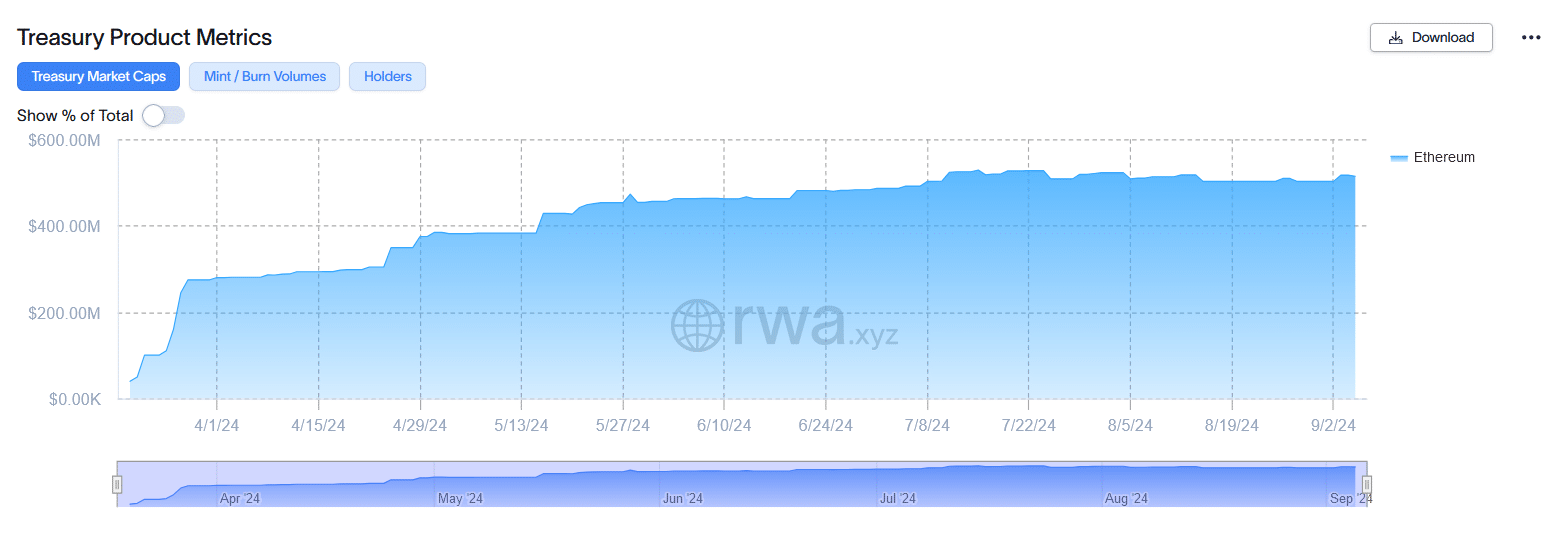

On the Ethereum network, the BUIDL fund quickly gained attention as it exceeded a comparable fund handled by Franklin Templeton in terms of growth during its initial six weeks following its launch in March.

First tokenized index for BlackRock’s BUIDL fund

The BUIDL Fund represents the biggest investment fund stored on a blockchain, boasting a managed value of approximately $514 million, as indicated by information obtained from rwa.xyz.

Historically, this particular fund has a minimum investment threshold set at $5 million, making it exclusive to wealthier investors, with just around 20 owners reported so far.

As an analyst, I’d articulate it this way: “I analyze how Injective’s BUIDL Index breaks down barriers for investment by offering a pathway for both small and large investors to secure U.S. dollar returns within the digital asset ecosystem.

Investors have the opportunity to place either long or short positions on the fund’s fluctuations in supply, depending on their predictions about the market trend. Notably, this index can exclusively be accessed through native Injective Decentralized Exchanges (DEXs), offering speculators the option to utilize leverage.

Injective’s growing presence in asset tokenization

In terms of web-based financial systems, Injective stands out as an innovative, interconnected blockchain that specializes in the first layer (L1). It has been instrumental in facilitating the development and operation of Decentralized Finance (DeFi) applications.

Introducing the BUIDL Index, fueled by the open data marketplace Stork, signifies a significant milestone in the development of decentralized finance.

Last month, Injective rolled out Altaris – the first major ecosystem upgrade after Volan which was unveiled in January.

The launch of Altaris’ mainnet showcased various enhancements, among them was the debut of the initial RWA oracle module, opening up Injective’s ability to provide innovative tokenized asset options.

This week, Chainlink teamed up with Injective’s data streams, providing blockchain enthusiasts and developers with the ability to influence the development of global markets using on-chain solutions.

Injective [INJ] price action

Building on the idea that the BUIDL Index might appeal to both large-scale investors (institutions) and individual investors (retail), this attraction could potentially boost interest in Injective’s native token, INJ, by increasing its demand.

Using Injective’s decentralized applications (dApps) and financial tools more frequently may lead to increased liquidity and user interaction, potentially boosting the value of INJ tokens.

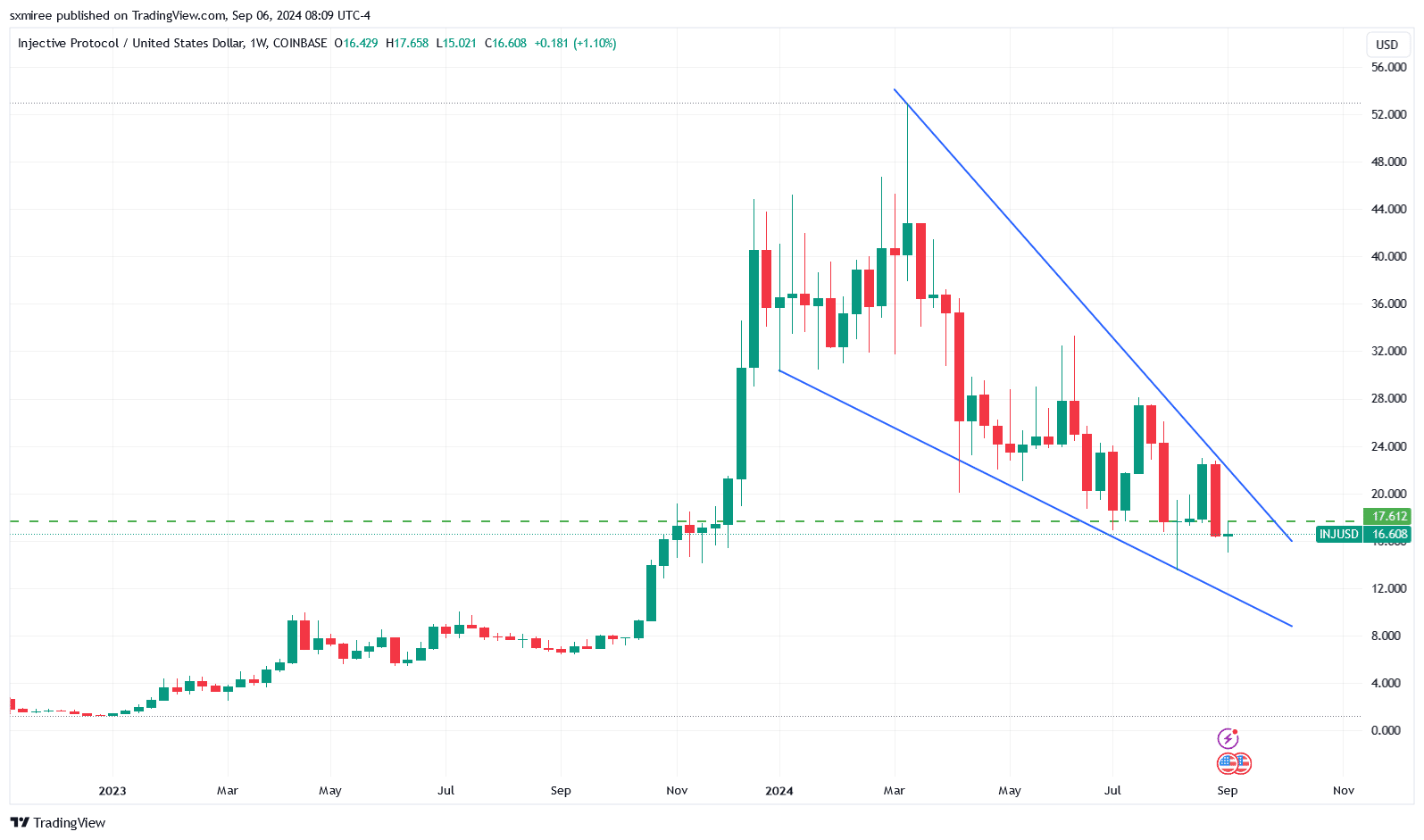

On September 4, the price of the INJ token momentarily increased due to the unveiling of the BUIDL index, approaching its monthly closing point around $17.60. However, it was turned away at that level.

Read Injective’s [INJ] Price Prediction 2024–2025

According to data from TradingView, the INJ/USDT pair appears to be moving within a descending triangle pattern on its weekly chart, suggesting a potential reversal or continuation of the downward trend.

At the moment of reporting, INJ was valued at $16.68, marking a decrease of 6.12% over the last week. So far this year, INJ has dropped by 53%, putting it behind Bitcoin [BTC] and other significant alternatives, which have seen growth during this timeframe.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-07 12:08