- An unknown wallet transferred BTC worth hundreds of millions to Coinbase

- At press time, BTC seemed to be approaching a crucial support, and a re-test could change the prevailing market trend

As a seasoned crypto investor with over a decade of experience in this dynamic market, I find myself both intrigued and cautiously optimistic about the recent developments with Bitcoin [BTC]. The sudden drop below $70k has left some investors scratching their heads, but let’s try to make sense of it all.

In recent times, Bitcoin [BTC] enthusiasts have been in high spirits due to its success in surpassing $72,000 on price charts. Yet, the bullish trend didn’t last long as Bitcoin began to decline shortly after.

Hence, it’s worth taking a closer look at why Bitcoin is down today.

Why did Bitcoin drop below $70k again?

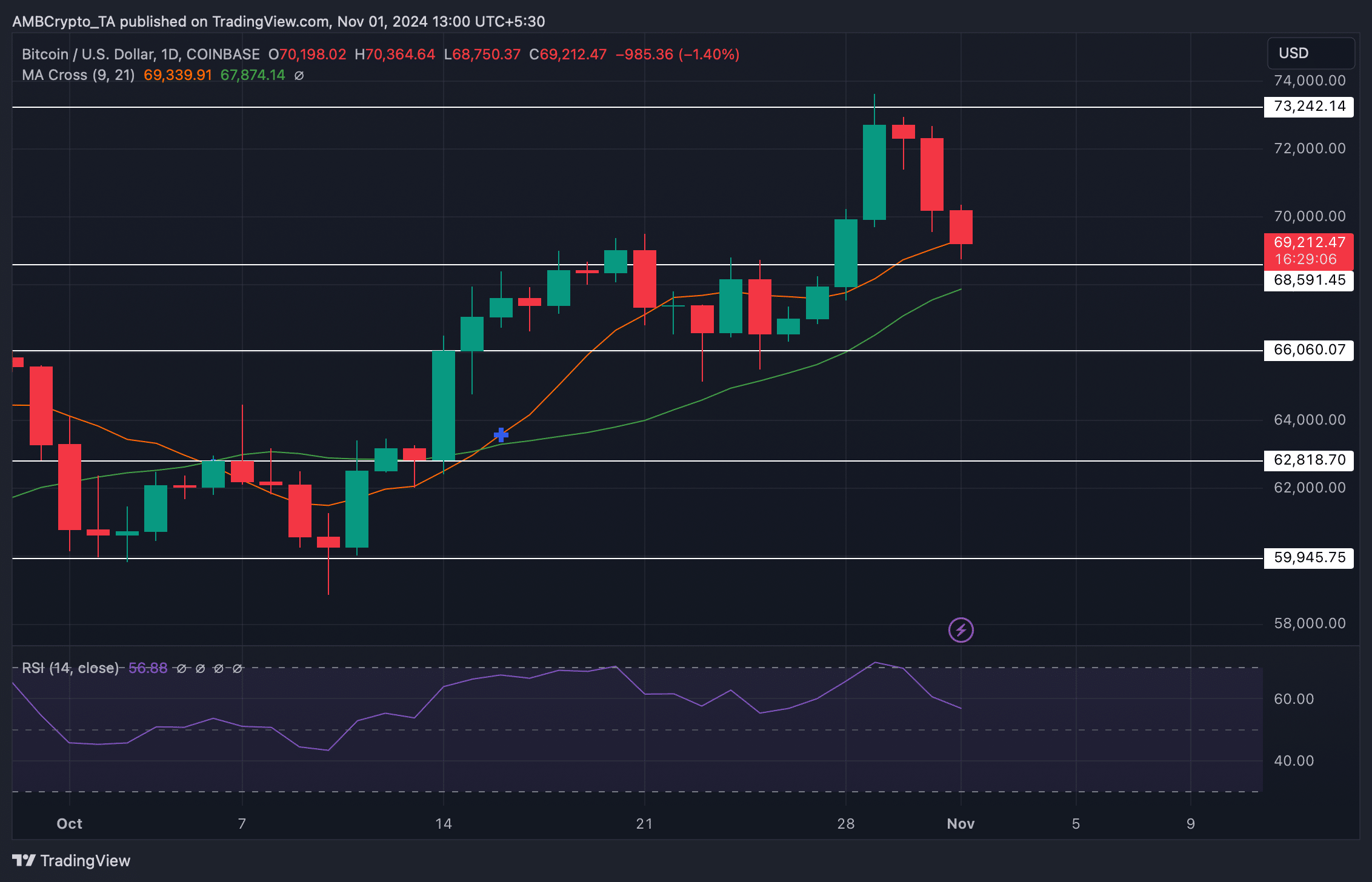

Starting from October 27th, Bitcoin enthusiasts have been in charge of the market. Since then, BTC has shown excellent performance, reaching a peak value of $73,400 on October 30th. Subsequently, the cryptocurrency stabilized and hovered around the $72,000 mark.

Over the past day, things have significantly changed for the worse. The bearish trend in Bitcoin resurfaced, causing its price to drop by over 4%. As I’m writing this, it is currently being traded at approximately $69,063.85 according to market charts.

One potential explanation for the recent drop in price might be a significant transaction. Whale Alerts, a platform that provides updates on whale activity, has reported that over 8000 Bitcoin, valued at approximately $567 million, were moved from an unidentified wallet to Coinbase.

Typically, large transactions lead to price drops. But in this specific instance, it seems unusual because the transfer may have originated from a cold exchange wallet, which typically doesn’t cause significant price changes.

In fact, Lookonchain’s recent tweet suggested that a whale actually bought the dip.

Based on the information provided, when Bitcoin’s price dropped, a large investor (referred to as a ‘whale’) purchased approximately 550 Bitcoins, valued at around $38.68 million. Subsequently, AMBCrypto decided to examine other datasets to determine if there was an increase in buying interest over the past 24 hours.

What next for BTC?

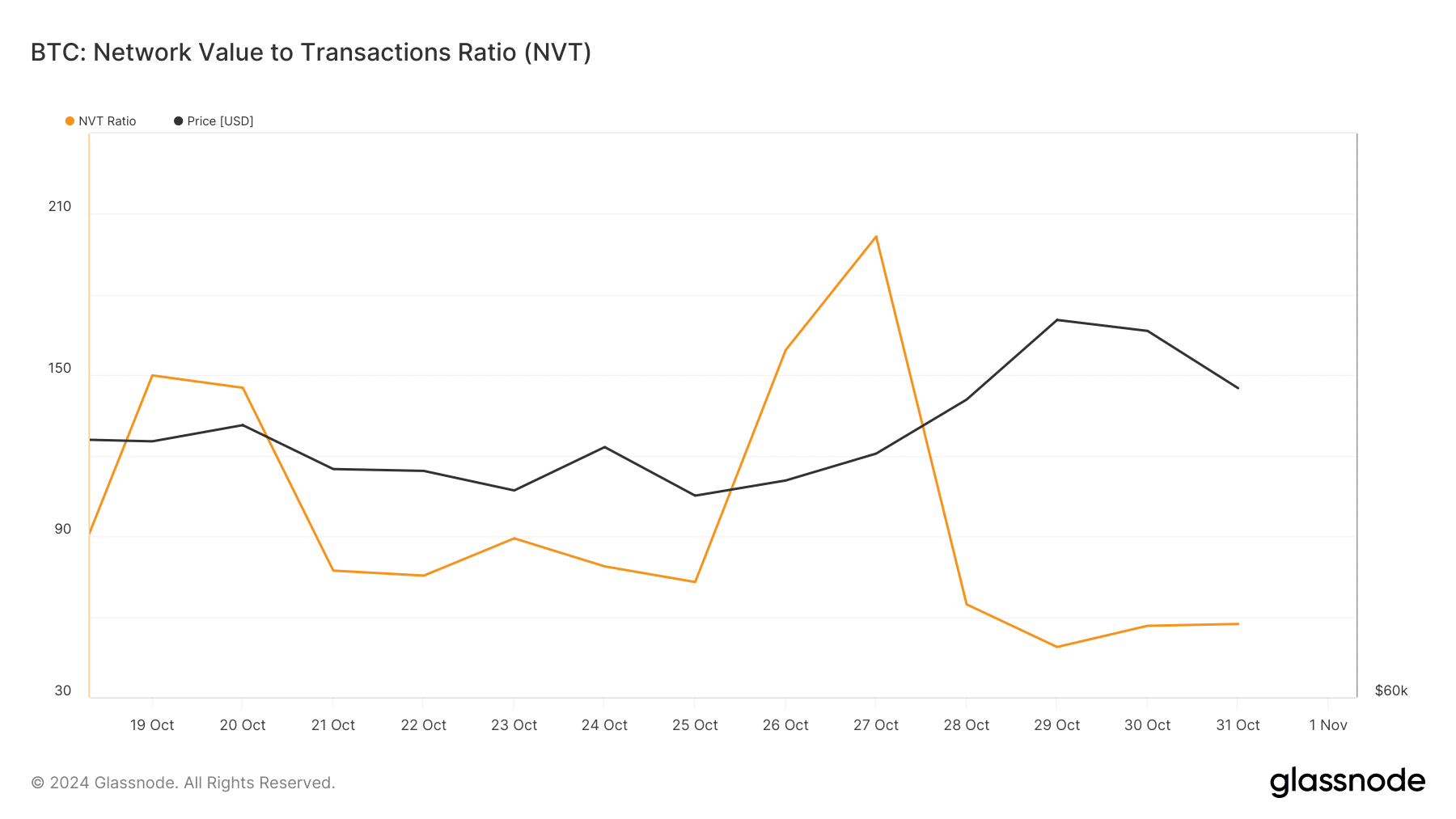

Based on Glassnode’s data assessment, the Accumulation Trend Score for Bitcoin was 0.88. A value near 1 suggests increased buying activity. Moreover, the Network Value to Transactions (NVT) ratio has dropped significantly in recent days.

A drop in the metric means that an asset is undervalued. This could have also motivated investors to increase their accumulation while BTC’s price dropped.

To get a clearer picture of why Bitcoin has dropped today, we examined its day-by-day graph. Our investigation revealed that the Bitcoin’s Relative Strength Index (RSI) dropped significantly during the past few days.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Nonetheless, the MA cross indicator revealed that the 9-day MA was well above the 21-day MA, which looked bullish. At press time, BTC was approaching its support at $68.59k. A successful test could once again push BTC towards $73k.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-01 18:31