- Bitcoin’s price dropped by over 7% in the last seven days.

- Selling pressure on Bitcoin was high.

As an experienced analyst, I believe that the recent decline in Bitcoin’s price, which dropped by over 7% in just seven days, can be attributed to several factors. One of the most significant reasons could be the selling pressure on Bitcoin, as evidenced by the high net deposits of Bitcoin into exchanges compared to the average of the last seven days. This trend was further supported by the red Coinbase Premium and aSORP indicators, which suggested that U.S. investors were selling at a profit, indicating a bearish sentiment.

The price of Bitcoin [BTC] has been experiencing difficulties for some time now, dropping below the $63,000 mark. One potential explanation for this lackluster performance could be decreased demand from exchange-traded fund (ETF) investors amongst the market’s leading players.

Based on current data, it appears that the Bitcoin trend could shift shortly. It would be beneficial to examine the reasons behind its recent decline and explore potential possibilities for a turnaround.

Why is Bitcoin down?

According to CoinMarketCap’s latest update, Bitcoin’s price experienced a significant decrease, dropping by more than 7% within the last 24 hours. To add to that, this downward trend also caused Bitcoin’s price to decline by over 4% in just the past hour.

In my current composition, Bitcoin was priced at $61,360.70 for each unit in exchange markets, while its total market worth exceeded one trillion dollars.

One possible explanation for this decrease is the significant drop in Bitcoin ETFs. While it’s likely that multiple influences were involved, the weakening trend of Bitcoin ETFs may have been a major contributing factor.

According to a previous article by AMBCrypto published on the 21st of June, Fidelity Wise Origin Bitcoin Fund experienced the largest withdrawals, amounting to $44.8 million.

The Grayscale Bitcoin Trust (GBTC) experienced significant outflows to the tune of $34.2 million in just one day, while not every Bitcoin ETF underwent substantial withdrawals.

IBTC at BlackRock stayed steady, with no days of withdrawals both during and before this time.

A trend reversal for BTC?

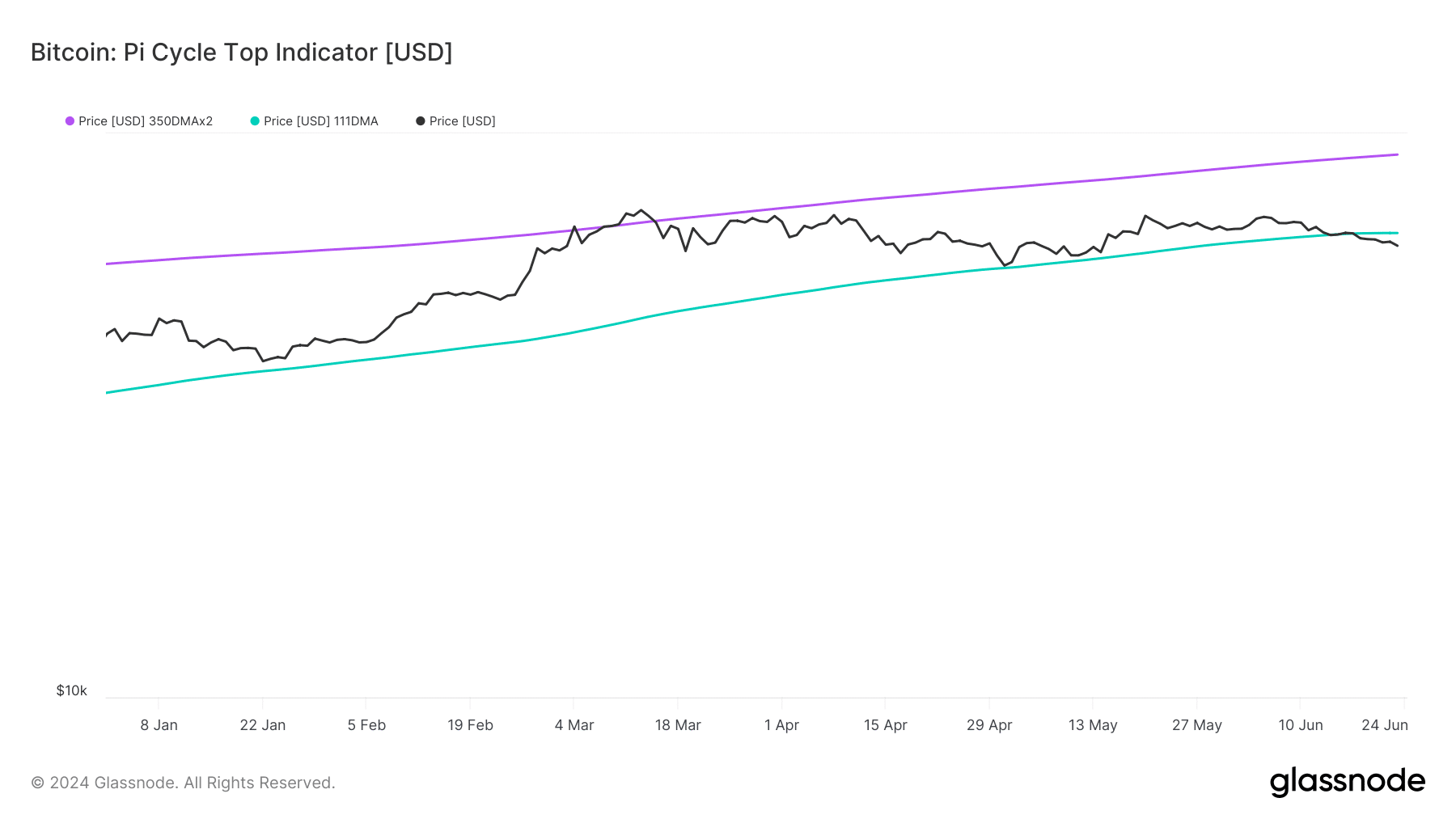

While delving into the latest cryptocurrency trends, my research uncovered intriguing insights using AMBCrypto’s interpretation of Glassnode’s data. Notably, Bitcoin’s price dipped below its market bottom for the initial time in the year 2024, as indicated by its Pi Cycle Top indicator.

For those unfamiliar, the Pi Cycle indicator is formed by combining Bitcoin’s 111-day moving average and a twofold version of its 350-day moving average. This configuration implies a strong possibility that Bitcoin may resume its bullish trend.

If that turns out to be the case, then BTC might touch $91k in the coming weeks.

To determine if Bitcoin (BTC) was due for a trend change, AMBCrypto examined the statistics from CryptoQuant. Notably, we discovered that the amount of BTC being sold was significant, as indicated by a higher than normal net deposit into exchanges over the previous week.

As an analyst, I’ve observed that both Coinbase Premium and Bitcoin’s adjusted Sharp Ratio (aSORP) displayed a red hue. This indicates that the selling sentiment among U.S. investors was more prevalent than buying sentiment in the case of Coinbase Premium. Regarding Bitcoin’s aSORP, this metric suggests that investors were more likely to sell their holdings at a profit rather than holding onto them.

In the middle of a bull market, it can indicate a market top.

Read Bitcoin’s [BTC] Price Prediction 2024-25

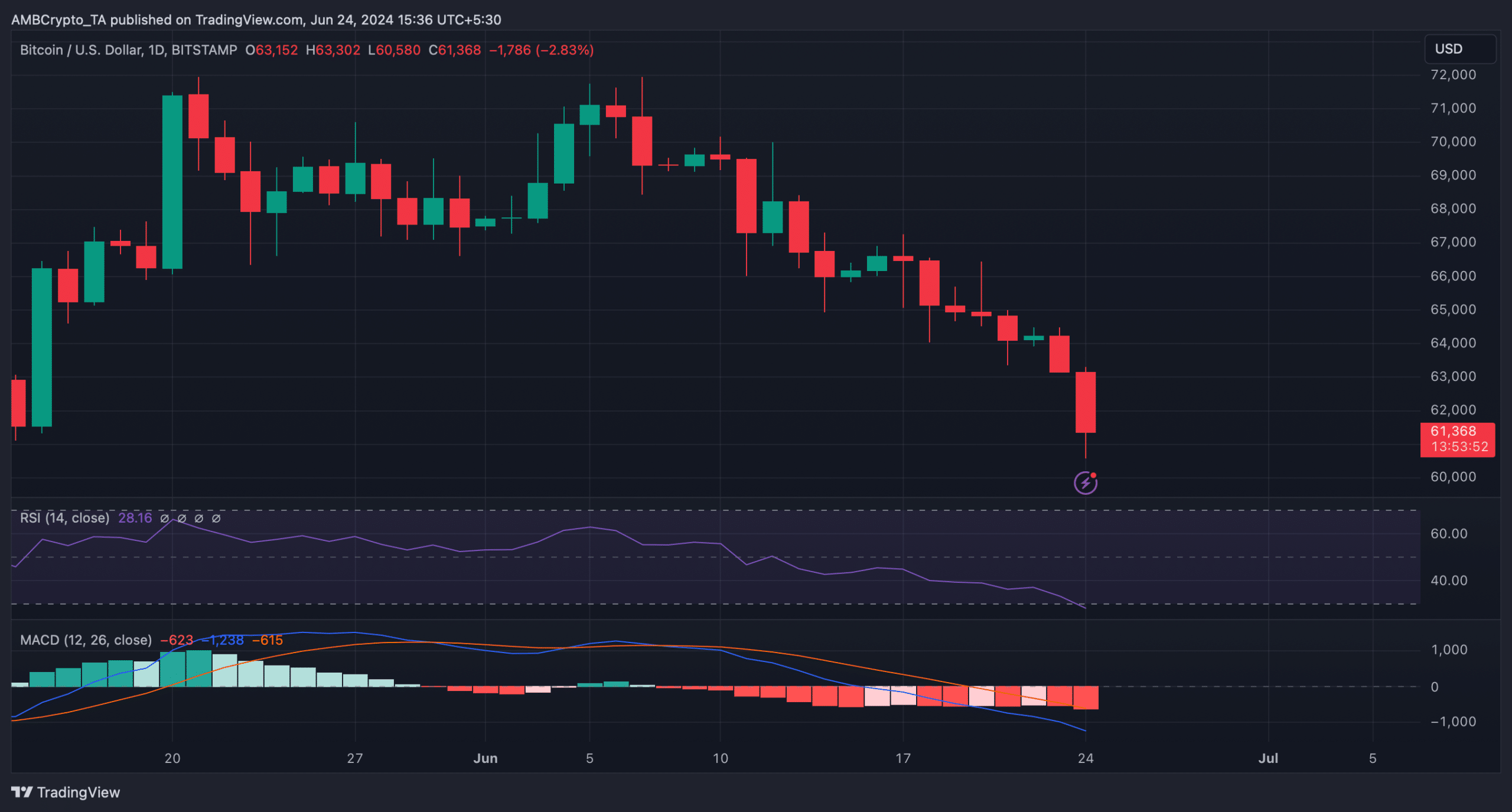

In simpler terms, the MACD technical indicator showed a strong negative edge during the stock’s handling, implying a possible continuation of the downward trend. On the other hand, Bitcoin’s RSI was approaching the oversold threshold.

This might increase buying pressure and, in turn, put an end to its bearish price action.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-24 20:07