-

BTC has dipped below $60K once again, sparking renewed discussions in the crypto world.

A reversal could be possible if several key conditions are met.

As an experienced analyst with a background in both traditional finance and the crypto world, I’ve seen my fair share of market fluctuations. The recent dip in Bitcoin below $60K is reminiscent of similar situations we’ve witnessed before – a pattern that seems to repeat itself like a broken record.

Over the weekend, the price of Bitcoin (BTC) climbed beyond $60,000 following a fortnight of steady holding. But this growth spurt didn’t last long, with Bitcoin falling back to $58,580 by the time of publishing.

As the pace slows down, AMBCrypto examined the reasons for the drop – Could this be just a brief setback, or is a prolonged downtrend on the horizon?

Why is Bitcoin down today? STHs explain

Examining the daily price graph, it’s not unreasonable to expect that numerous investors might opt to secure their gains following a streak of six successive upward candles.

As someone who has been closely following the cryptocurrency market for quite some time now, I can confidently say that the recent bearish pullback in late August was particularly noteworthy. Having witnessed numerous ups and downs in the market, I’ve learned to keep a close eye on such events as they often provide valuable insights into broader trends. In this case, the drop below $55K in BTC served as a stark reminder of the volatile nature of the crypto market and the importance of staying informed and adaptable. While it may be tempting to panic-sell during such periods, I believe that a long-term perspective is crucial for success in the world of cryptocurrencies. With patience and a solid strategy, I remain optimistic about the future of BTC and the broader crypto market.

Consequently, after a challenging battle, stakeholders squeezed in before the momentum stalled.

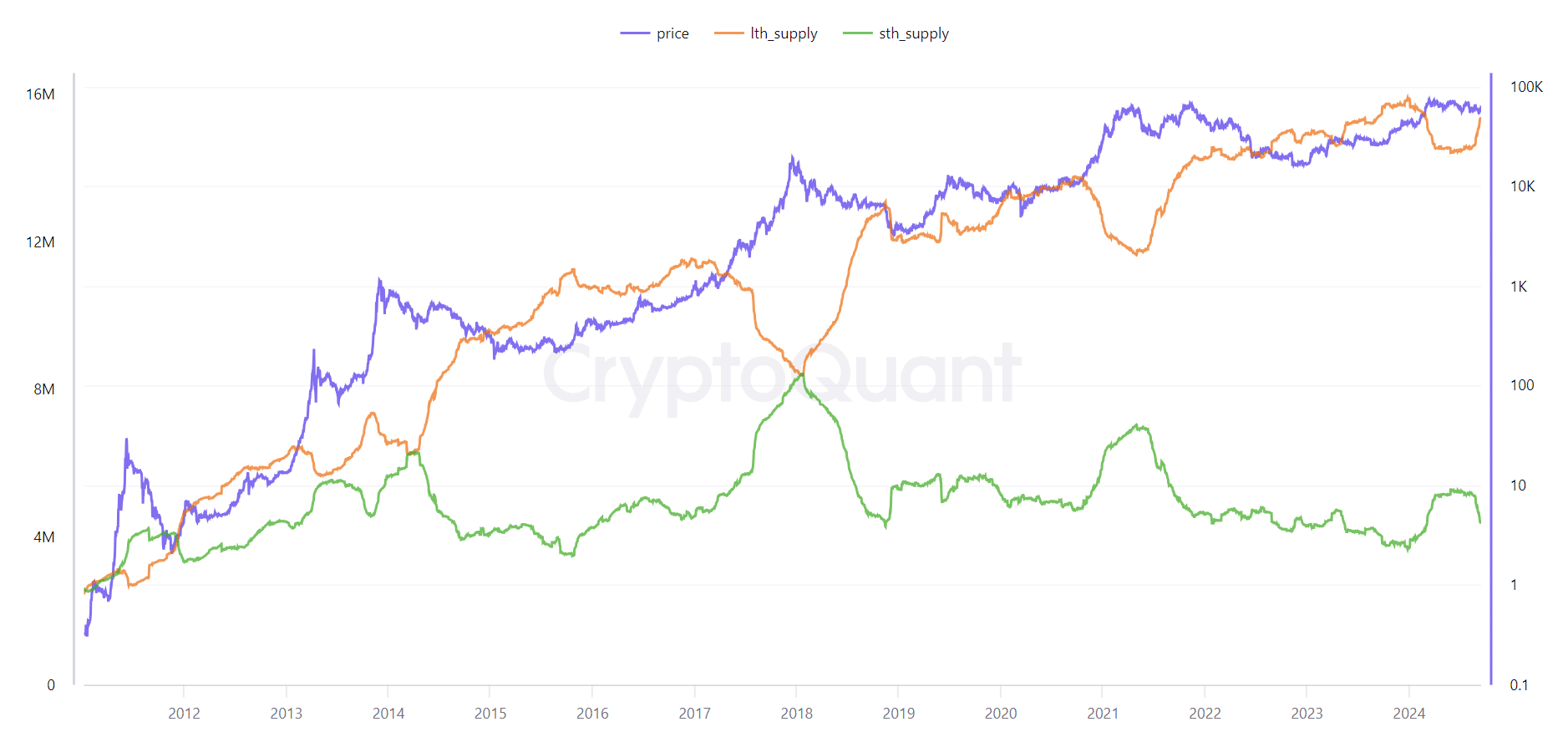

Source : CryptoQuant

Looking at the graph above, it’s evident that Long-Term Holders (LTHs) and Short-Term Holders (STHs) adopt distinct strategies during market fluctuations. LTHs tend to buy Bitcoin when prices decrease, while STHs usually make their moves as the price approaches a market peak.

Whenever Bitcoin (BTC) nears a significant price level, there’s usually an increase in the number of people selling their holdings (STH), which can lead to a sudden drop in price.

This pattern shows Short-Term Holders (STHs) taking advantage of Long-Term Holders’ (LTHs) stockpiling to boost prices, after which they withdraw their holdings when the peak has been attained.

To further confirm whether STHs selling contributed to Bitcoin’s decline, AMBCrypto examined the index below.

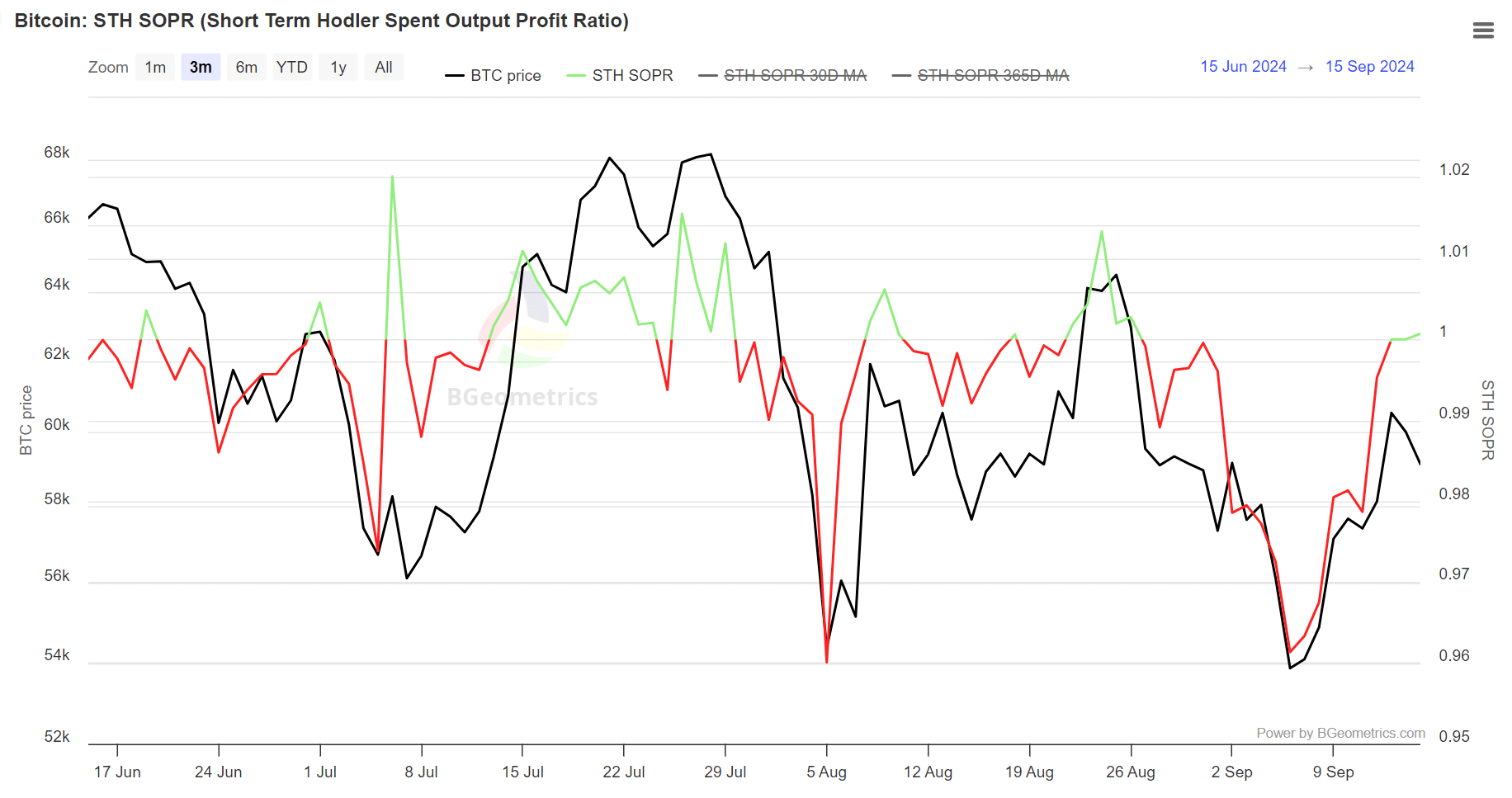

Source : BGeometrics

It’s not surprising that after Bitcoin closed at around $60,500, the Short-Term Holder SOPR (SOPR) went beyond 1, suggesting that a larger number of short-term holders were selling to realize their profits.

Additionally, the situation became more challenging as whales reduced their investments, which further increased the downward momentum in the market. This prolonged bearish phase could have diminished the potential for a short-squeeze event, which had initially driven the price rise.

Now, the next dip could be more appealing, allowing LTHs to step in and counter the pullback.

Finding the next dip

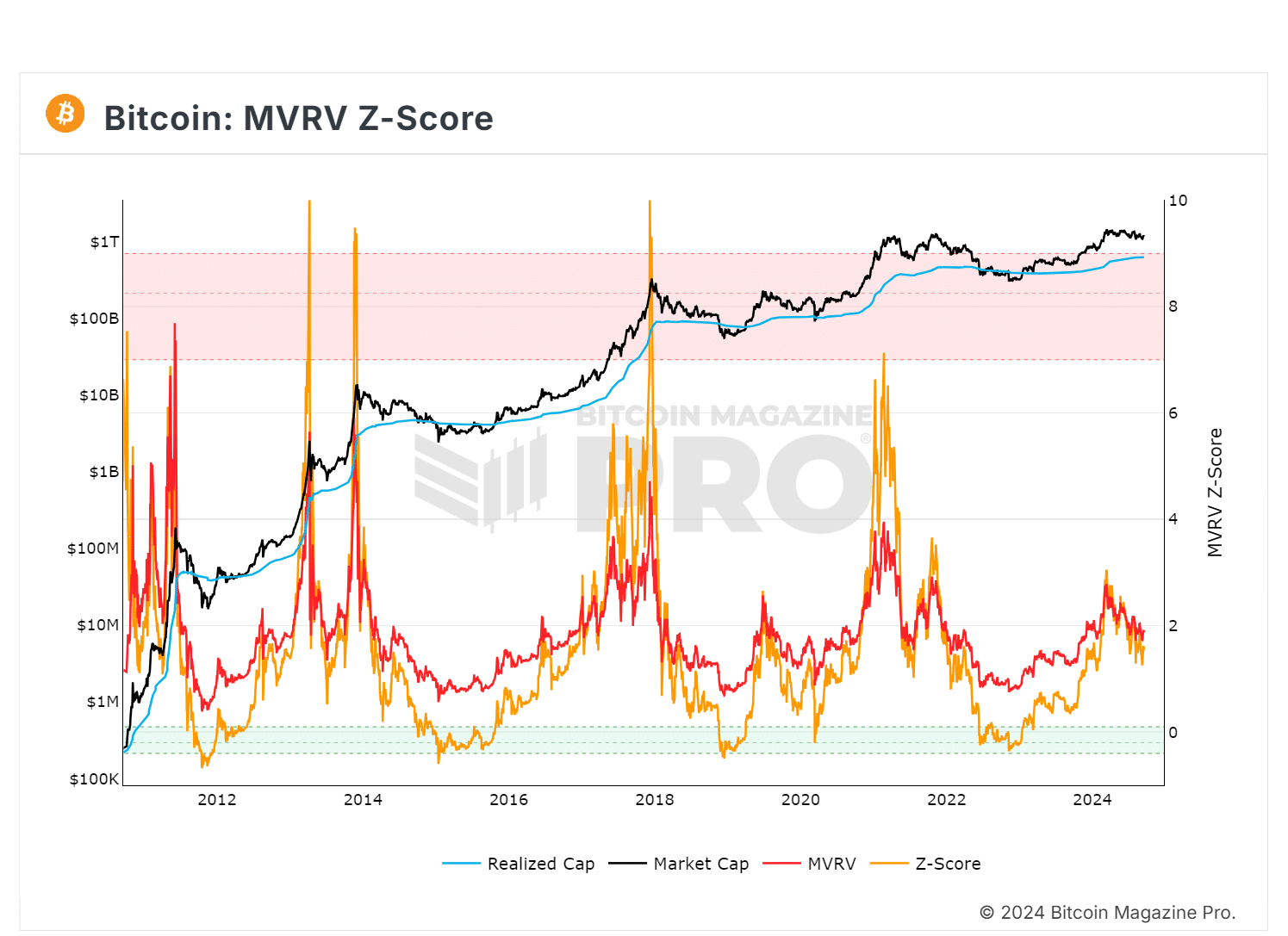

The graph indicates that Bitcoin’s MVRV momentum has been decreasing since it dipped below $66,750 in June. Although there have been ups and downs, this negative trend persists without any signs of reversal yet.

Source : Bitcoin Magazine Pro

If bulls don’t act swiftly to regain momentum, there’s a possibility that the price could fall below the $58,100 level, potentially causing it to slide down towards $55,000.

Historically, when the z-score falls within the green range, investing in Bitcoin has typically resulted in significant profits for long-term holders, causing them to stockpile more Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In addition, changes in broader economic conditions could lead to a decrease in prices, which might cause the z-score to hit its peak value before we enter the accumulation stage.

Essentially, a reversal won’t necessarily occur unless specific criteria are fulfilled. Instead of profit-taking, we might witness a robust uptrend, which could be triggered by a fall to $55K or an anticipated interest rate reduction by the Federal Reserve.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-17 05:12