- Bitcoin has a bearish structure on the weekly chart.

- The recent losses might be reversed next week, but it is unclear if the bulls can drive prices beyond $69k.

As a seasoned researcher with extensive experience in analyzing cryptocurrency markets, I have closely observed Bitcoin’s recent price behavior and trends. Based on my analysis of various charts and market indicators, I believe that Bitcoin has a bearish structure on the weekly chart.

Bitcoin’s price dipped by 2.2% on Thursday, July 25th, with the day’s trading still ongoing. Since the beginning of the week on Monday, BTC has experienced a decline of 5.84%. The significant breakthrough above $60,000 was celebrated as essential, but it seems the price may be aiming for that level once more.

Without requiring a specific catalyst or news item, Bitcoin’s price movements can fluctuate. However, the current price decline has a probable explanation.

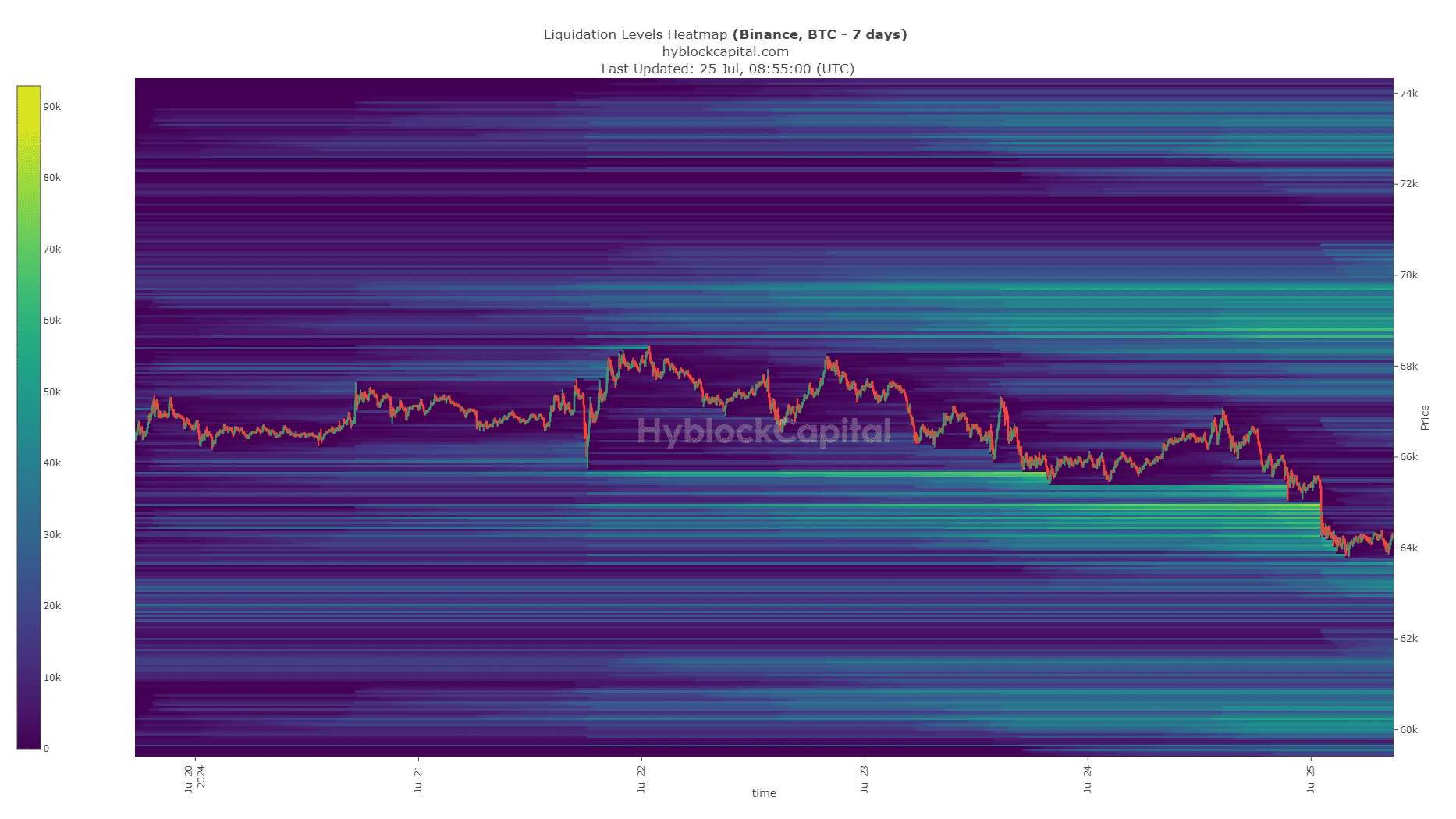

Liquidation levels indicate BTC might move toward $69k next week

As a crypto analyst, I’ve identified a potential trend for Bitcoin’s price based on my analysis of the market. Specifically, I’ve noticed a significant liquidity pool around the $64,500 level on lower timeframes. This observation leads me to predict that Bitcoin’s price may trend downwards and approach this price point.

His forecast had proven accurate so far, as Bitcoin tended to pull prices towards it, and its value was currently at $64,200 at the time of reporting. He had also anticipated a rebound to around $68,900.

In their analysis, AMBCrypto noted that the 7-day liquidation map showed a concentration of liquidation points in the range between $64,000 and $64,800.

On July 21, a Sunday, as the analyst had noted, it was possible for the markets to experience a pullback to these specific levels in order to acquire more liquidity.

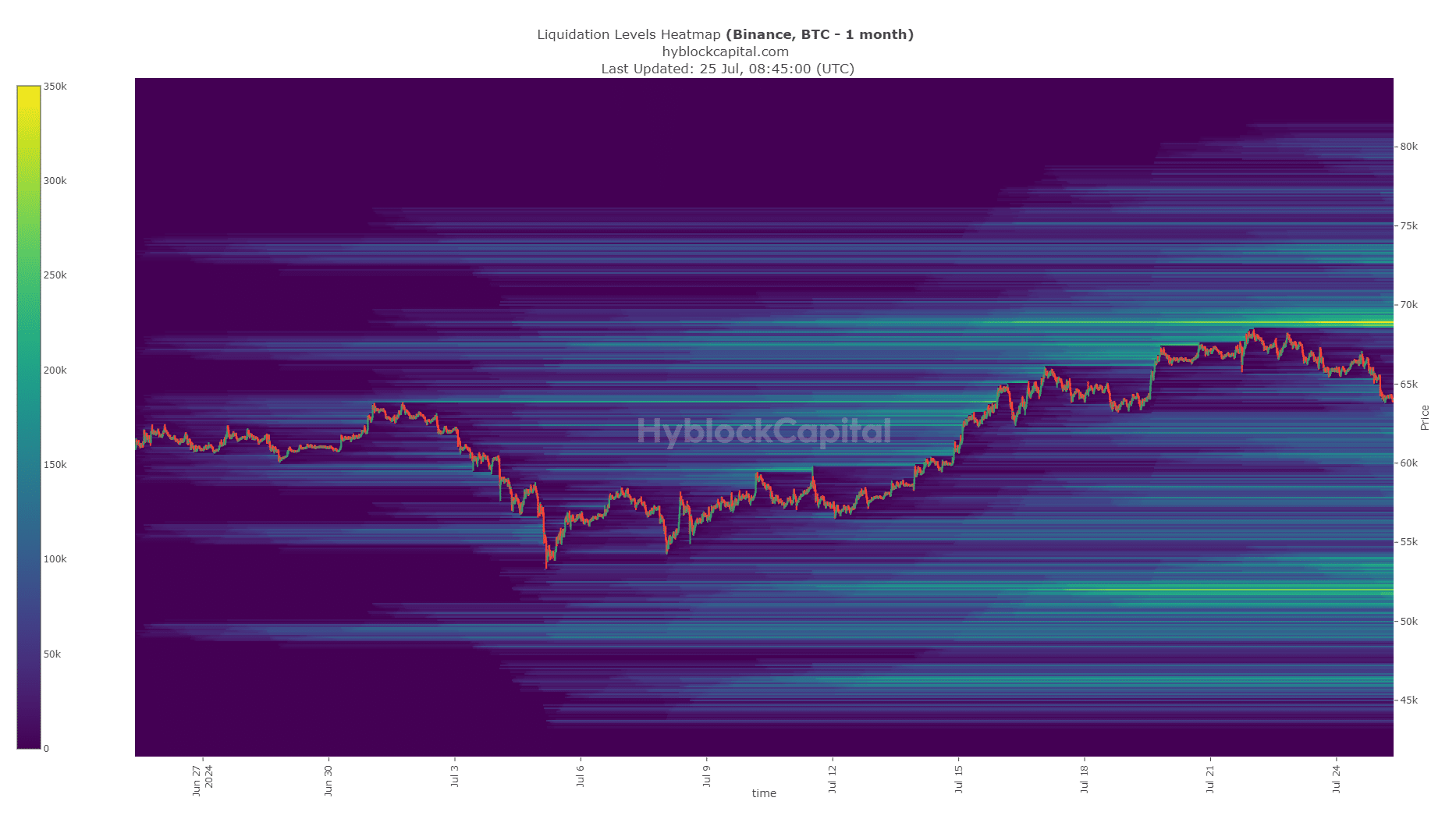

AMBCrypto analyzed the 1-month Bitcoin chart to predict future price trends. The chart indicated that the $69k mark, marked by significant liquidation levels, could draw prices upward.

It’s concerning that both the $52,000 and $46,000 price points have accumulated significant sell orders. These levels may see an increase in congestion in the near future, increasing the probability that Bitcoin will encounter resistance at these prices.

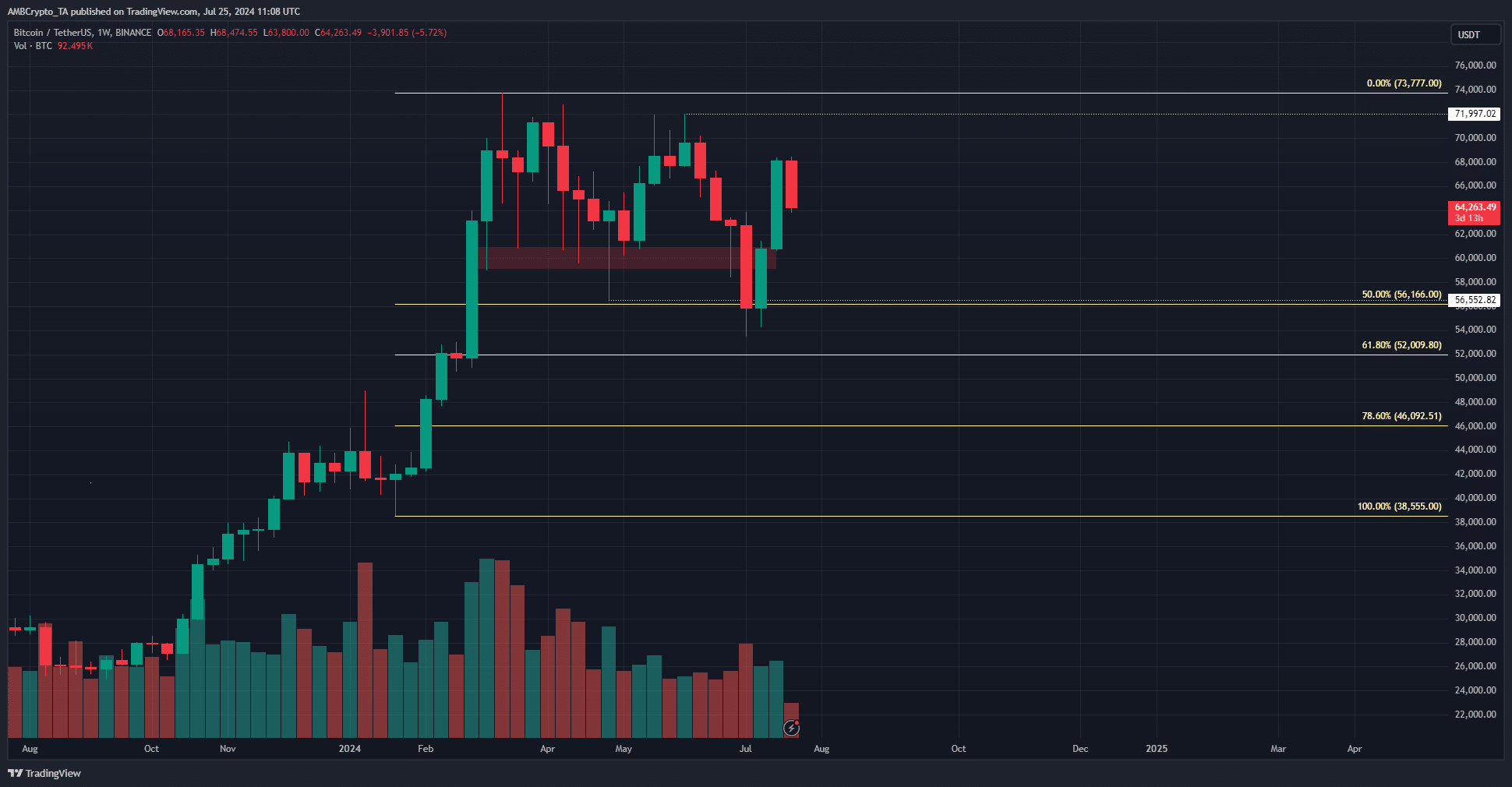

The weekly chart hints at a continuation

In a recent post on X, well-known cryptocurrency trader Trader Mayne noted that the weekly trend remained negative. This shift to bearish occurred following the break below the higher low of $56,500 from April, which happened around early July.

Read Bitcoin’s [BTC] Price Prediction 2024-25

During the past week, the record high of $72k in our area hadn’t been surpassed or challenged. This could signal a potential bearish trend, which may not bode well for those holding positions for the long term.

The Fibonacci retracement levels identified the $52k and $46k marks as the 61.8% and 78.6% pullback levels, both of which were significant points for liquidity.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-07-25 21:11