Bitcoin surpassed a new record high above $70,000 in March, but its bullish trend has since faltered. Bearish investors appear to be gaining the upper hand as markets grapple with uncertainty due to geopolitical tensions, the Bitcoin halving event, and potential US financial regulations. Traders are hesitant to make purchases, while some are even selling off their holdings.

Bitcoin’s newfound price peak gave way on April 15th, with the cryptocurrency falling below $63,000. Some observers view this as a typical market fluctuation preceding the upcoming halving event, while others express concern over an imminent Bitcoin price downturn. In this article, we delve into the recent market influences and shed light on the reasons behind Bitcoin’s decline.

Why Did Bitcoin Crash?

The crypto market as a whole is experiencing a downturn once again, with significant losses for major currencies like Bitcoin and Ethereum, which hit all-time highs of $73,000 and $4,000 respectively during the second half of March 2024. Previously, Ethereum had not surpassed $4,000 since the year 2022, and Bitcoin’s new record price was a notable milestone for the crypto world. Other digital currencies also followed this trend.

Starting on April 12th, there was a market drop that affected most cryptocurrencies, including Bitcoin, which currently faces resistance around $64,000 after bouncing back from below $60,000.

Bears are becoming increasingly active in the market with heightened selling, causing a collective fear that could push Bitcoin’s price down. If bulls can’t manage to drive the price above $64,000, the coin may dip towards the $58,000 to $59,000 range instead. However, it’s important to understand what triggered this recent Bitcoin price drop.

Geopolitical Factors

On April 13th, tensions between Iran and Israel in the Middle East reached a boiling point, leading to heightened conflict and intensifying the existing disagreements in the area. In periods of armed conflict, the cost of oil and the US dollar tends to rise due to increased demand.

Consequently, traders shift their investments towards these two securities due to price surges, yet this comes at the cost of allocating resources away from alternative investments like cryptocurrencies.

Some investors chose to sell their stocks and cryptocurrencies to purchase USD-denominated assets and oil commodities instead, leading to a surge in selling and potentially causing Bitcoin’s price to drop.

Bitcoin Halving 2024 Prediction

Currently, just three days remain until the predicted Bitcoin halving takes place. During this process, mining rewards, coin prices, and the supply of Bitcoins are all reduced by half. Some analysts view the current market turbulence as a normal occurrence prior to this event. Historically, the price of Bitcoin has bounced back following similar network adjustments.

However, the ongoing circumstances increase the division between bulls and bears.

Liquidation Pressures

Some investors amplified their holdings during the extraordinary market expansion. Yet, unexpected events led to a wave of forced selling, leaving numerous traders unable to maintain their positions.

Within just a few days, this factor significantly contributed to the stock market decline, reducing its total value from $1.4 trillion to $1.24 trillion.

Bitcoin Price Prediction

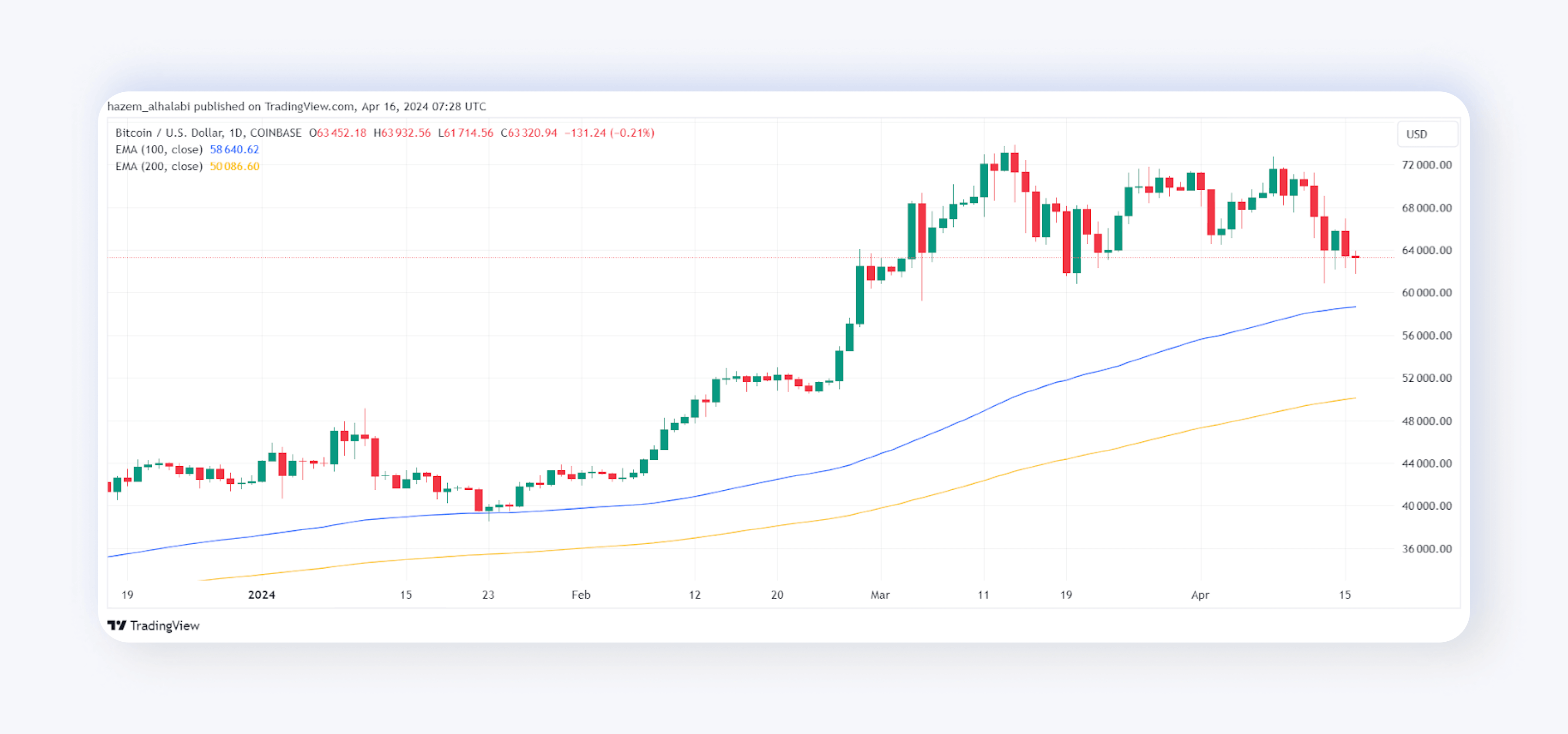

We should examine the Bitcoin price closely and consider recent developments in relation to the exponential moving average chart. This analysis can help us understand present and possible future trends.

Long-Term

Initially, we examine the price in relation to the 200-day and 100-day Exponential Moving Averages (EMAs). Notably, there is a significant discrepancy between these two lines.

Despite the current market price being significantly higher than both the simple moving average (SMA) and the exponential moving average (EMA) of 200 days, it suggests that the previous price surge is continuing to outpace these averages and may persist in the elevated pricing range.

As the price decrease occurred, the 100-day moving average grew more stable towards the end, forming a new resistance level around the $64,000 mark.

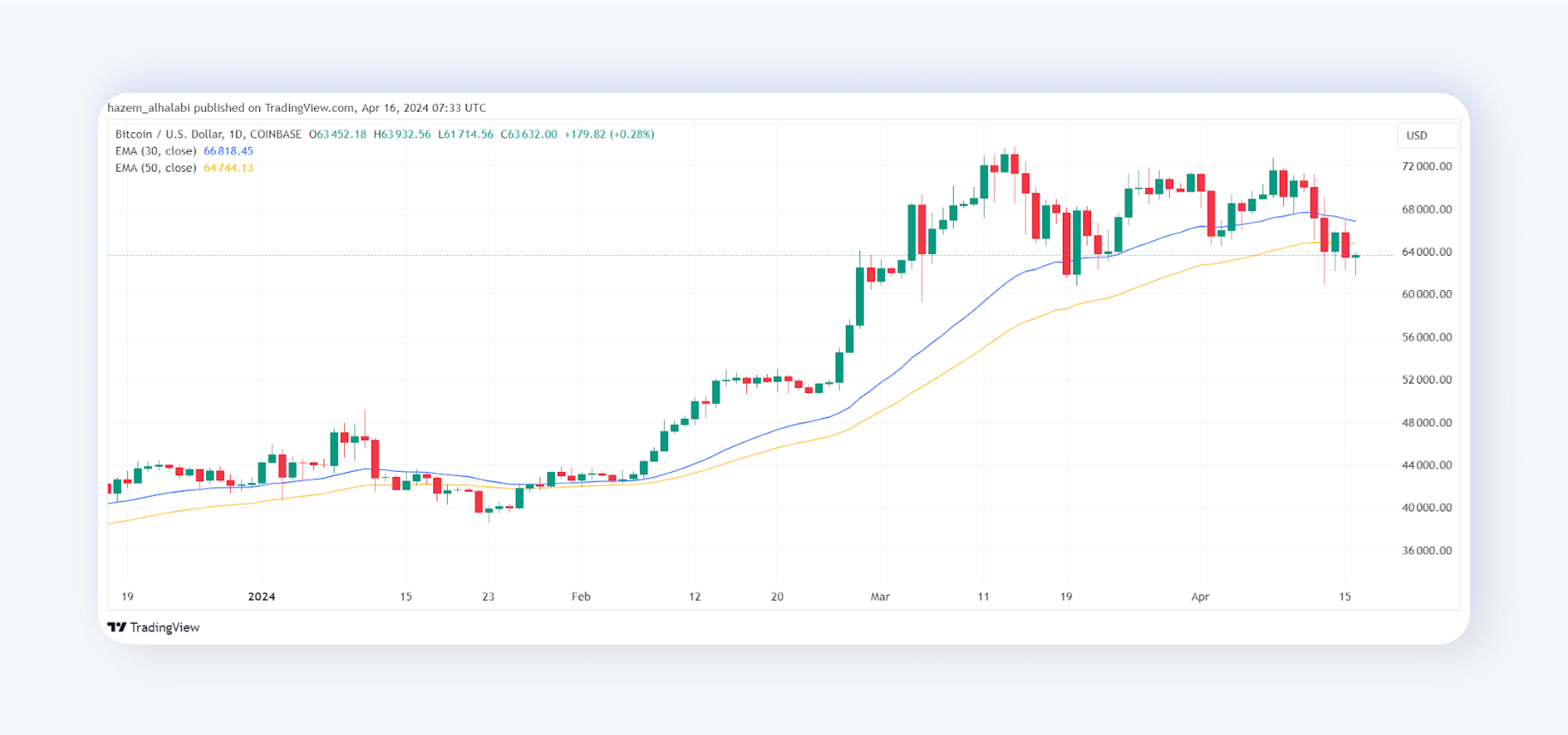

Short-Term

If we examine the difference between the 30-day and 50-day moving averages, we observe that they have both declined in response to the recent price decrease. Notably, the market value currently sits noticeably below the 30-day average.

Even though the cost decreases slightly below the 50-day mark, the falling 30-day trend prompts selling actions among investors, leading them to dump their stock holdings.

Conclusion: Should I Sell Bitcoin?

In the third quarter of 2024, the crypto market kicked off with unexpected fluctuations. Cryptocurrencies hit all-time highs only to be followed by Bitcoin’s dip and severe price drops due to geopolitical tensions, leaving investors uncertain about the market’s direction.

The current Bitcoin price might signal that it’s a good time to sell. But, with the upcoming halving and more accommodating US regulatory stance towards cryptocurrencies, there’s a strong possibility for another price surge.

The majority of the expected price rise for Bitcoin can be attributed to the fact that reducing its supply in half will cause the coin’s price to go up due to a significant decrease in available coins.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in cryptocurrencies, including meme coins, carries ingrained risks, and individuals should conduct their own research before making any investment decisions.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-16 19:55