- BTC crossed $70K and hit a 4-month high, partly driven by a liquidity grab.

- BTC was only 3.5% away from its ATH, but there was a roadblock to clear.

As a seasoned crypto investor with a decade of experience under my belt, I can confidently say that the recent surge of Bitcoin (BTC) above $70K is a testament to the resilience and potential of this digital asset. Having witnessed numerous bull and bear cycles, I’ve learned to appreciate the unpredictable yet captivating nature of the crypto market.

Bitcoin [BTC] crossed the $70K psychological level and surged to a four-month high of $71.5K. The upswing brought its ‘Upbtober’ gains to 11%, marking an effective breakout from its multi-month consolidation range since March.

Why is Bitcoin up?

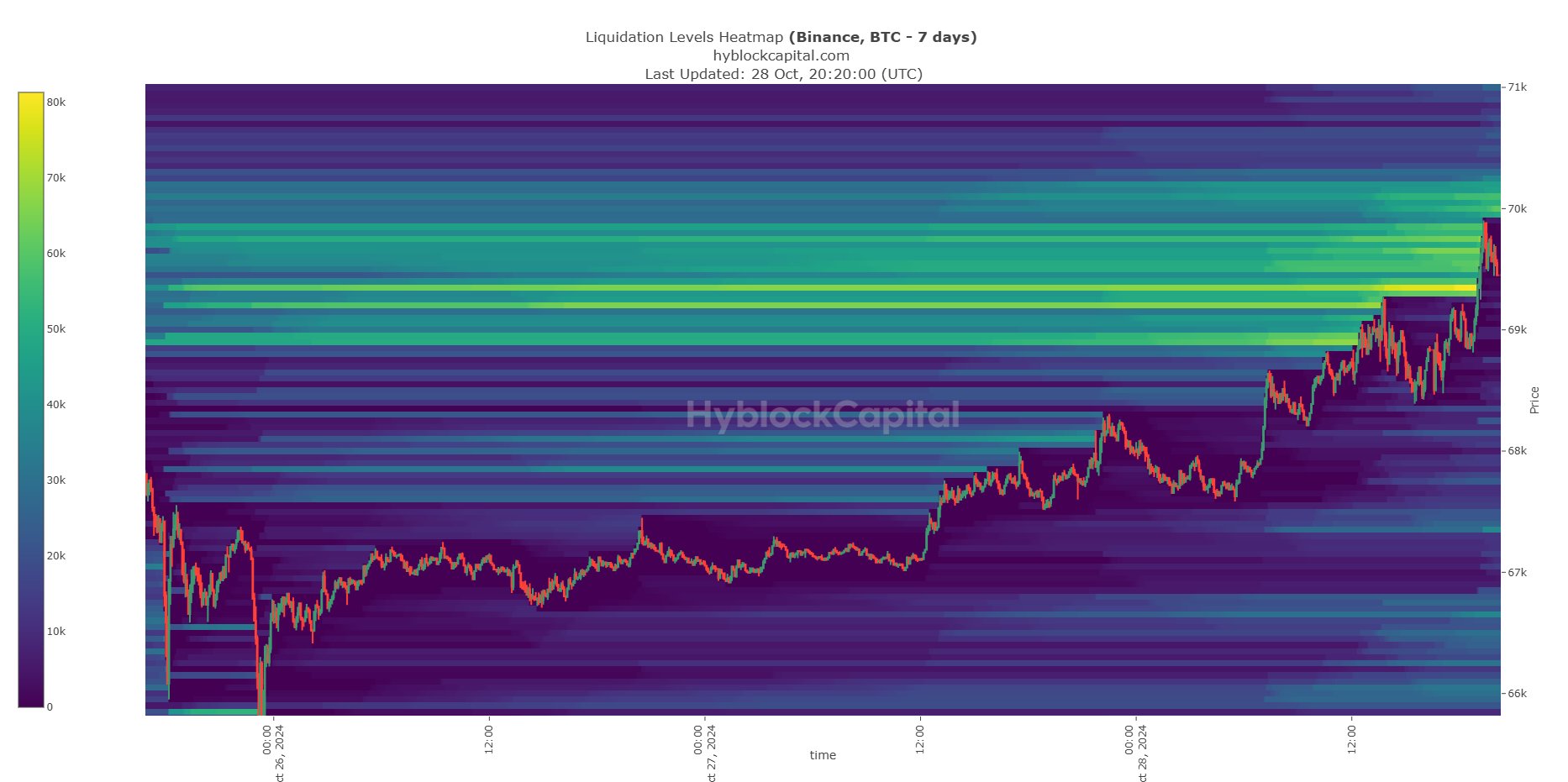

The surge in price beyond $70K was fueled by a liquidity grab, where significant liquidity pools or short positions were found between the ranges of $69.4K and $70K according to Bitcoin analyst and trader CrypNeuvo.

The behavior of prices usually aligns with these significant liquidation points (highlighted in bright yellow), primarily due to the impact of market maker activities. As a result, the grouping around $70K functioned like a magnetic force during the recent surge, triggering the liquidation of substantial short positions at that level.

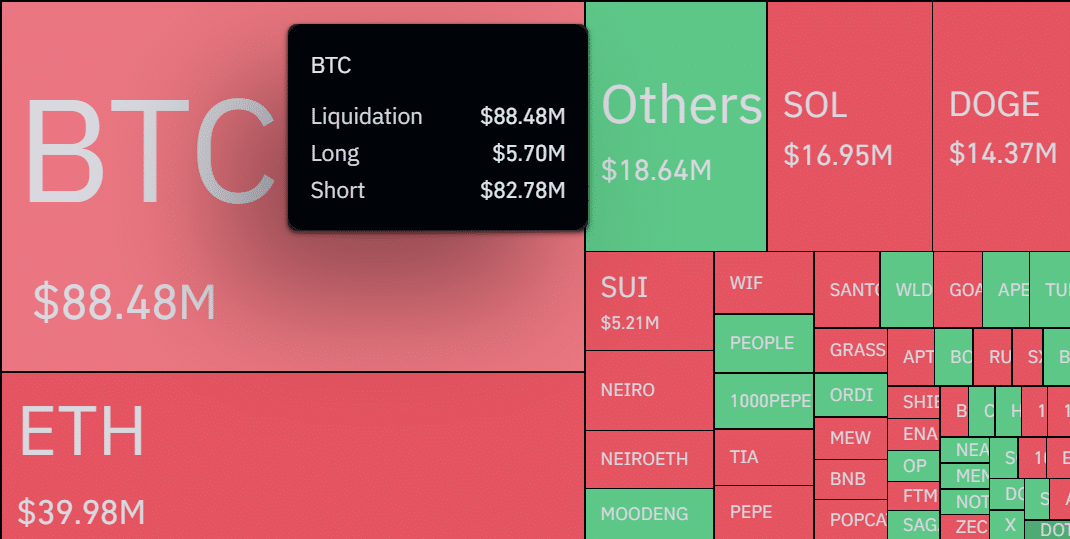

Over $80 million shorts rekt

Based on information from Coinglass, approximately $88 million worth of positions were closed out following Bitcoin’s rise above the psychologically significant level of $70,000.

In the last day, those who wagered against a potential price increase above $70K (those who took short positions) endured significant losses totaling approximately $83 million.

In other words, this implication points towards a positive outlook on the market, since everyone is eagerly waiting for the results of the U.S. elections, which are scheduled to take place next week.

As predictions suggest a higher likelihood of Donald Trump’s victory in the U.S. elections, Bitfinex analysts posit that the elections might serve as a ‘tumultuous event’ for Bitcoin. They expressed this viewpoint, stating…

In simple terms, the combination of unpredictability surrounding elections, the popular “Trump trade” idea, and beneficial trends during the last quarter of the year could make Bitcoin particularly interesting in the coming weeks, even with volatile price fluctuations prior to the election.

According to analyst Peter Brandt, he expressed a comparable prediction, suggesting that surpassing $70K could initiate the long-anticipated surge – often referred to as a ‘parabolic rally’ – following Bitcoin’s halving event.

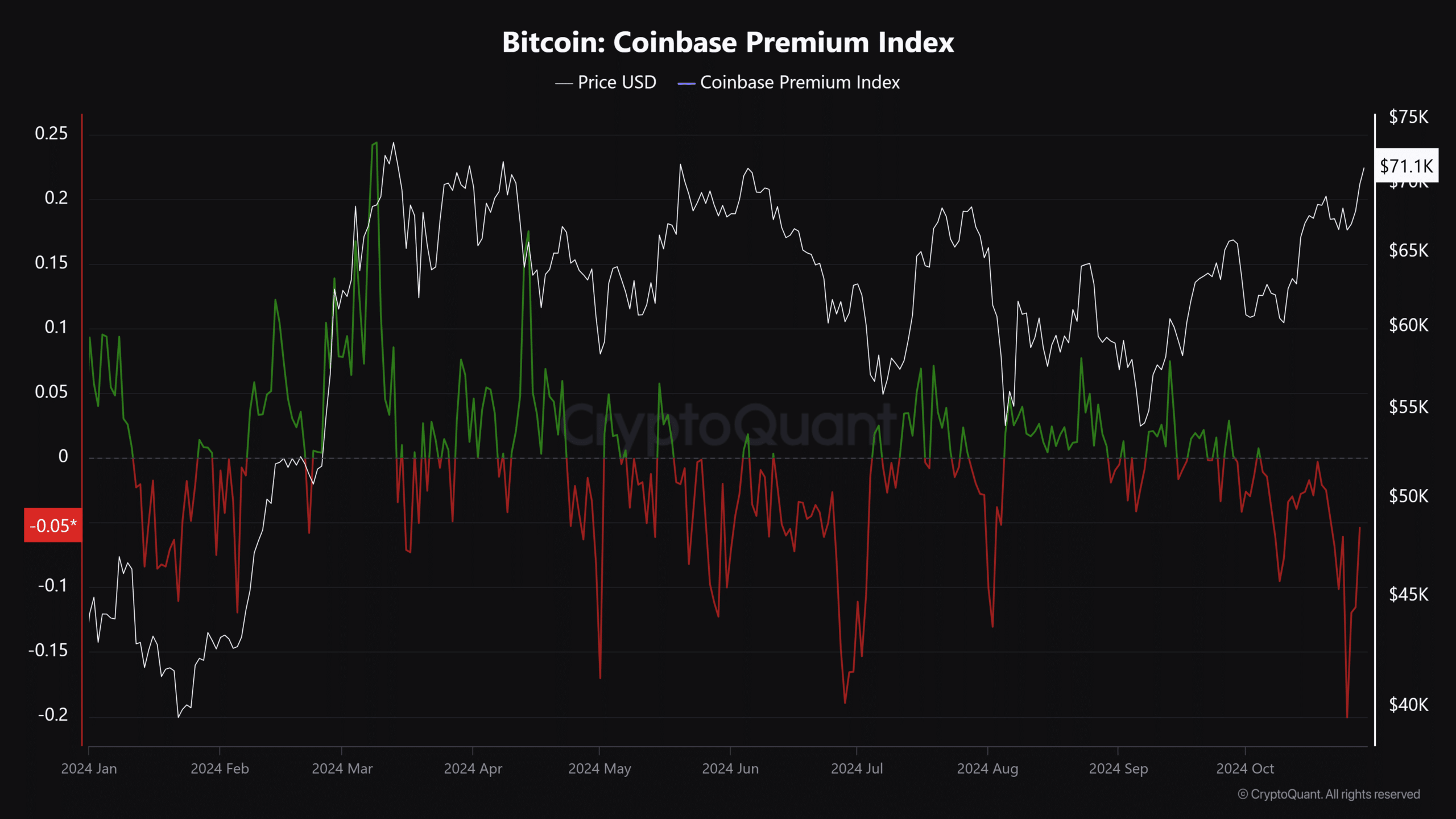

It’s worth noting that as Bitcoin surged, U.S. investors showed increased interest, evidenced by the flip in the Coinbase Premium Index.

In most cases, a strong US demand (green) always coincides with a sustainable recovery for BTC.

Although the latest enhancement in BTC’s performance was noteworthy, it had a modest impact on reader engagement, suggesting that investor enthusiasm remained comparatively lower than during March, when Bitcoin reached an unprecedented peak.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

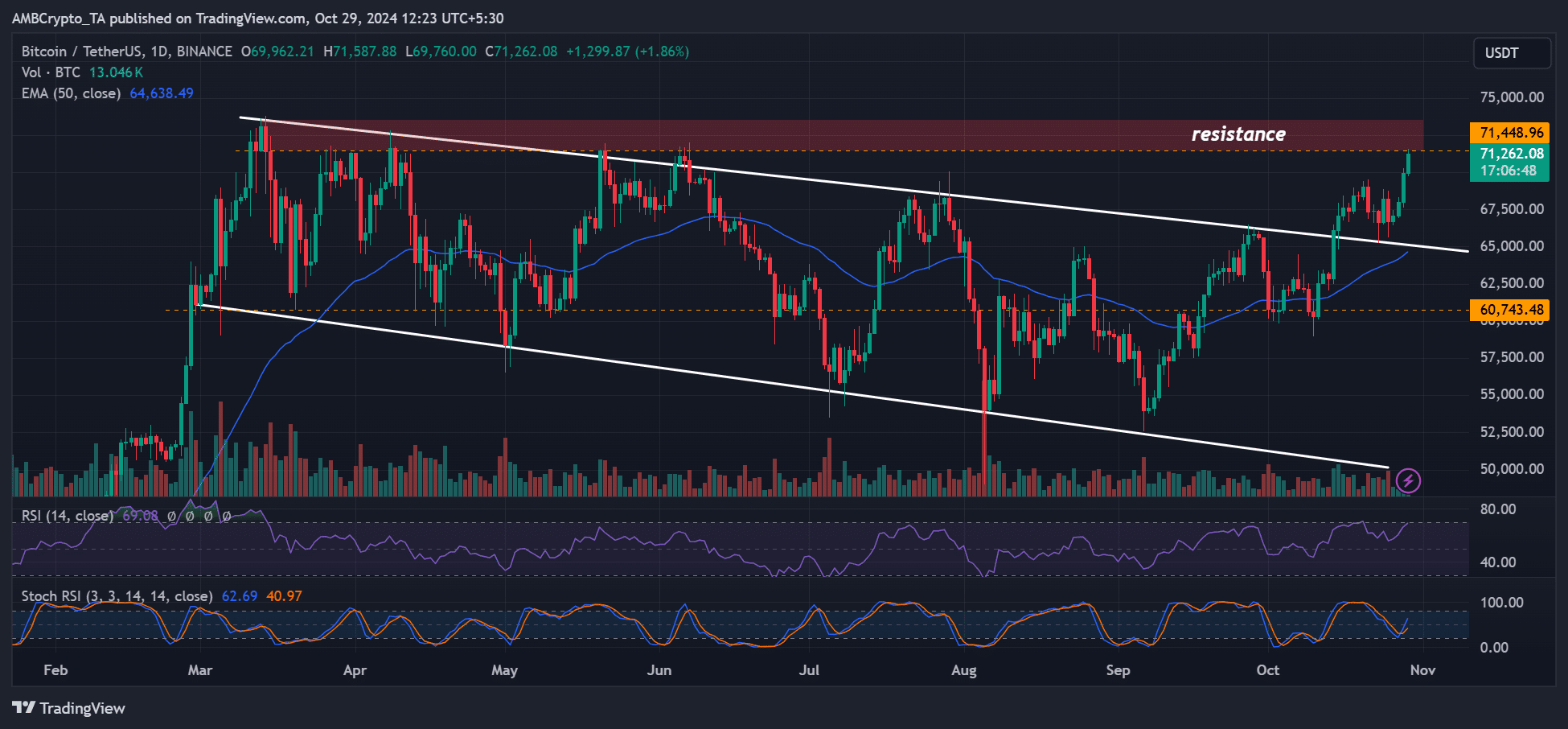

According to the day-to-day price graph, Bitcoin was exhibiting a bullish trend pattern. It was merely 3.5% short of its All-Time High (ATH) and looked poised to reach new pricing levels.

Yet, it encountered opposition, resulting in a bearish order barrier (red) being established near the all-time high of March. To keep the upward trend in the immediate future, Bitcoin needed to surpass the hurdle at around $71,000 – $73,000.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-10-29 11:20