-

Bitcoin hit a new monthly high ahead of Fed’s decision.

BTC whales doubled down on BTC despite short-term term market uncertainty.

As a seasoned crypto investor with a knack for navigating through market turbulence, I find myself intrigued by the recent Bitcoin [BTC] dynamics. The fact that BTC hit a new monthly high just hours before the Fed’s decision speaks volumes about its resilience and potential for growth.

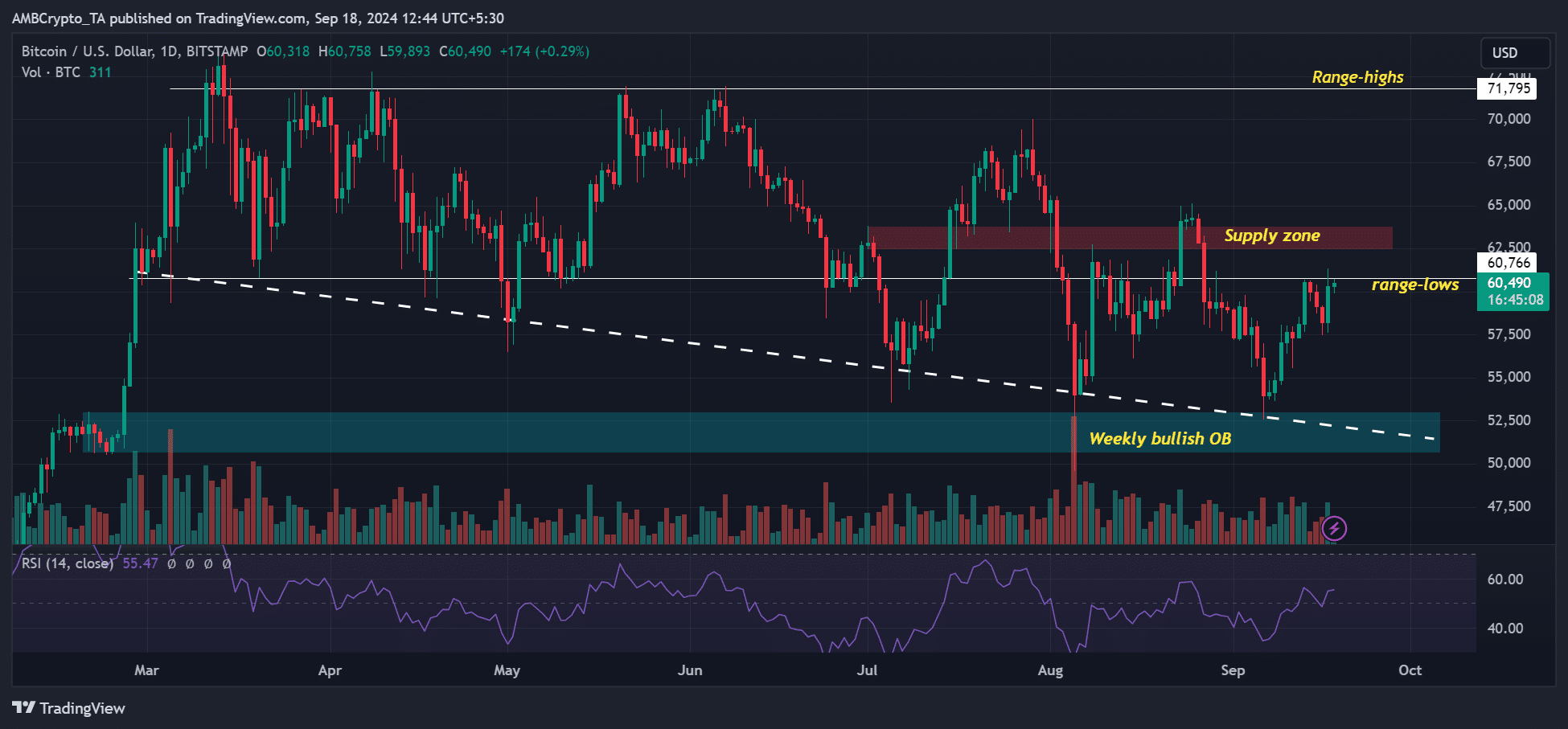

As a researcher, I recently observed that the value of Bitcoin (BTC) reached an unprecedented monthly peak of $61.3K on the 17th of September. This significant milestone came merely hours prior to the Fed’s decision, which was announced on the 18th of September.

BTC has recovered about 14% from its early August lows and was back at its previous range lows.

The recent surge in Bitcoin’s value may have been partially fueled by anticipation of a possible Federal Reserve interest rate reduction. Last week, evidence emerged suggesting a decrease in inflation and a plateauing U.S. job market.

Some policymakers and U.S. politicians are advocating for a reduction of 0.75% in the Federal Reserve’s interest rate as a means of protecting the job market.

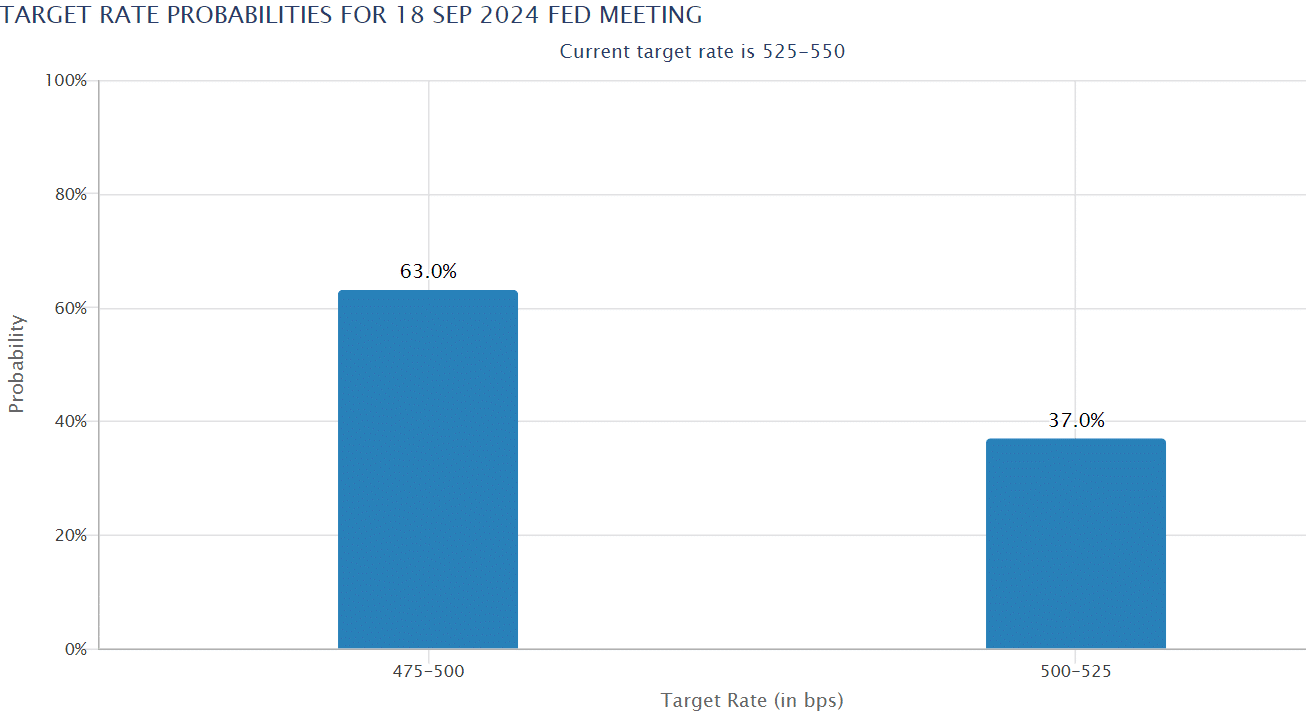

Currently, traders specializing in interest rates were estimating approximately a 63% likelihood for the Federal Reserve to reduce its interest rate by 0.50%. This is a significant shift compared to just a week ago, where the estimated probability was only 14% for a similar 50 basis point cut.

Impact of interest rate cuts

Experts generally concur that lower Federal Reserve interest rates create a favorable environment for high-risk investments, as the cost of credit becomes more affordable.

As a crypto investor, I’ve noticed that some analysts believe a 50 basis point reduction in interest rates could indicate the Federal Reserve’s growing worry about the economy. Such a move might create uncertainty in the market, potentially impacting riskier assets like cryptocurrencies negatively in the immediate future.

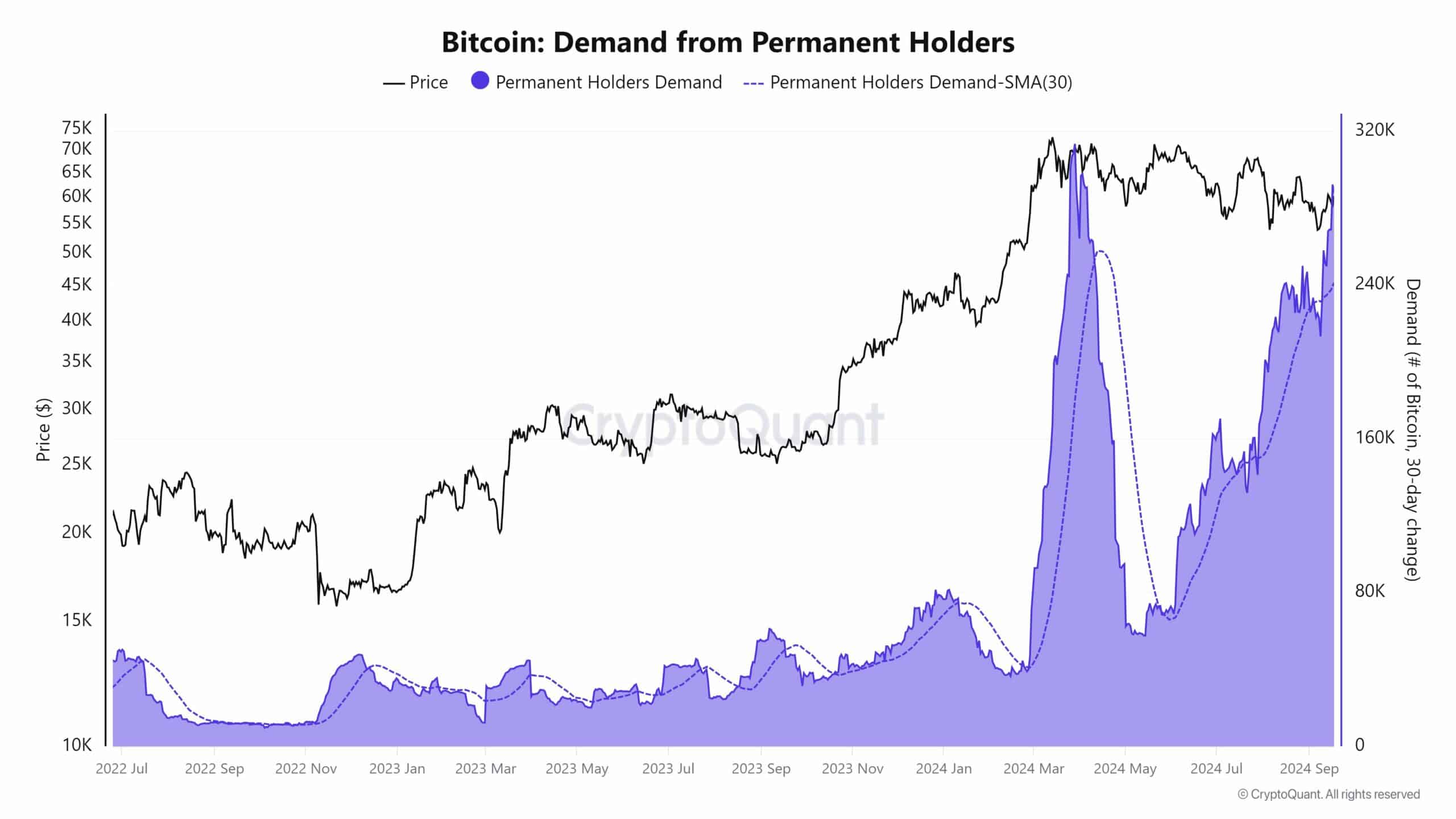

During this period, it appears that whales are advantageously placed regarding the upcoming Fed interest rate decision. As reported by CryptoQuant founder Ki Young Ju, Bitcoin whales have been actively purchasing large amounts of BTC over the past six days, coinciding with a growing scarcity in the supply.

Furthermore, there was an uptick in interest for Bitcoin ETFs based in the U.S., resulting in a $186.76 million net influx on Tuesday. This trend suggests that investors are adopting a more aggressive stance as they await the Federal Reserve’s decision.

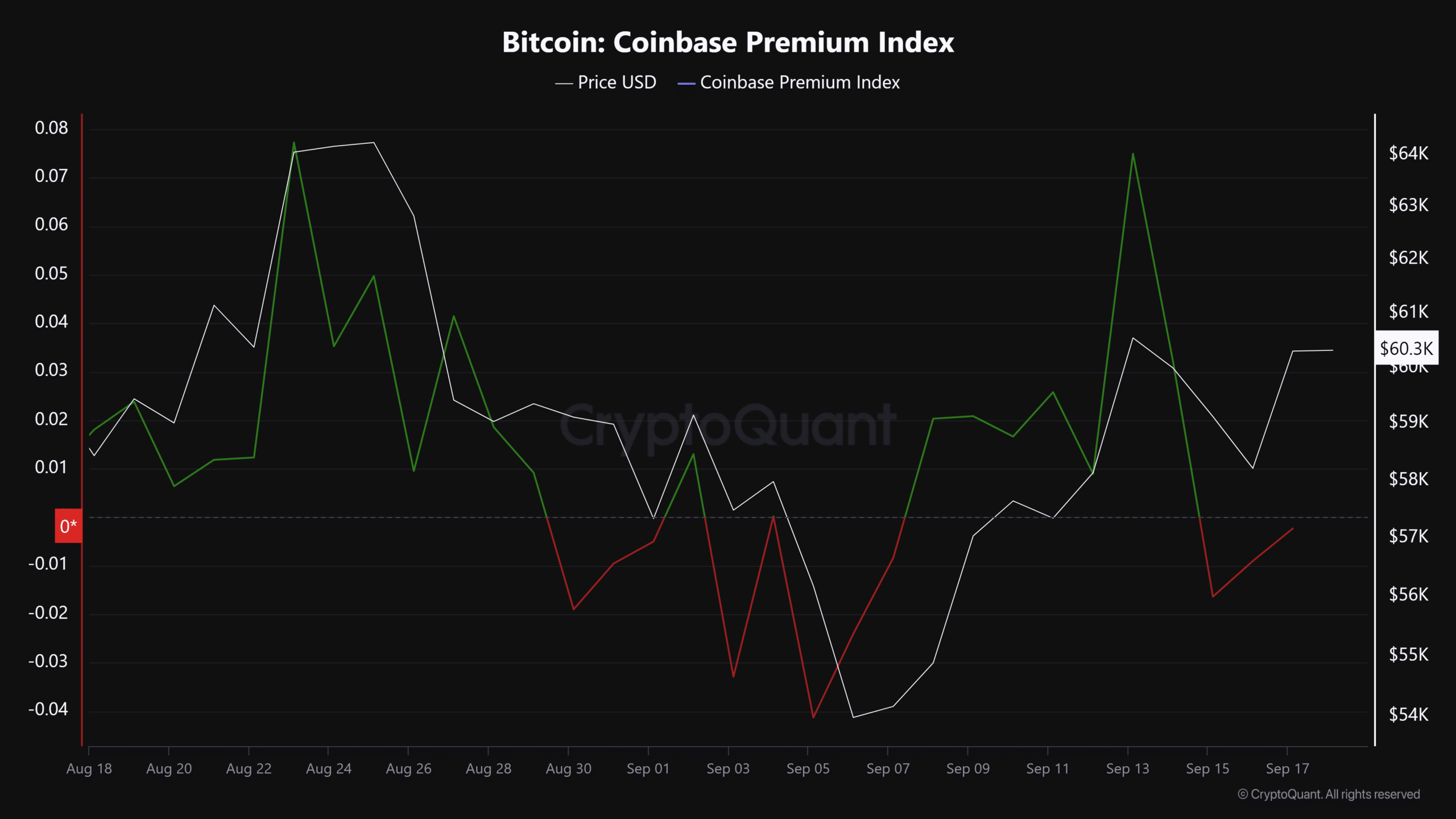

Currently, the demand for investment from U.S. investors is relatively weak, as indicated by a negative value in the Coinbase Premium Index.

This temporarily increased market volatility as the possibility of the Federal Reserve reducing interest rates for the first time since 2020 emerged. It’s unclear whether the risk-taking attitude displayed by U.S. Bitcoin ETF investors will continue following the Fed’s decision.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-18 22:15