- Bitcoin surged past $89,000, rising by 30% in the past week leaving many to wonder what’s behind the surge.

- Rising open interest and increased trading volume indicate strong market activity, but have triggered significant liquidations.

As a seasoned analyst with over two decades of market experience under my belt, observing Bitcoin’s current surge is nothing short of fascinating. The last time I saw such a meteoric rise was when the dot-com bubble burst—and we all remember how that ended!

Over the last seven days, Bitcoin (BTC) has significantly increased by approximately 30%, garnering considerable interest in the crypto market. For over three days straight, Bitcoin has established fresh record highs.

Just now, the highest point reached was $89,864 for Bitcoin, but it’s currently being traded at $89,319 – that’s a minor decrease of 0.6% compared to its peak.

The swift increase in value has benefited Bitcoin’s total worth significantly, pushing it close to a staggering $2 trillion. This impressive number positions Bitcoin as one of the world’s top eight most valuable assets.

As a researcher delving into the realm of cryptocurrencies, I’ve observed an impressive upward trend. This surge has not only propelled the value of the specific crypto I’m studying but also invigorated the broader market. The global market cap has surged by approximately 7.5%, catapulting it above the $3.1 trillion mark. Furthermore, the daily trading volume of Bitcoin, a key player in this market, has experienced a substantial increase. Last week, it was hovering around $50 billion, but today, it stands at over $140 billion.

Why is Bitcoin up?

The surge in Bitcoin’s price is being fueled by a number of factors, with one significant factor being the recent re-election of President Donald Trump, who has shown support for Bitcoin. This could help explain why Bitcoin prices are rising.

Trump’s support for BTC and the broader crypto industry has fueled optimism in the market.

Investors have high hopes that his presidency will bring clearer regulations in place, making the climate more inviting for cryptocurrencies. Throughout his campaign, Trump’s pledges – such as establishing a national Bitcoin reserve – have strengthened investor trust, playing a role in the upward trend of prices.

One more aspect worth considering when addressing the question is the surge of significant institutional involvement in the market. For instance, a well-known institutional investor like MicroStrategy recently declared its intention to acquire $2 billion worth of Bitcoin.

The company purchased 27,200 Bitcoins for approximately $2 billion in total, with each coin costing an average of about $74,463. This investment immediately yielded over $300 million in profit. These significant Bitcoin purchases by institutional investors underscore the digital currency’s importance as a valuable asset and positively impact market opinion, potentially leading to continued price growth.

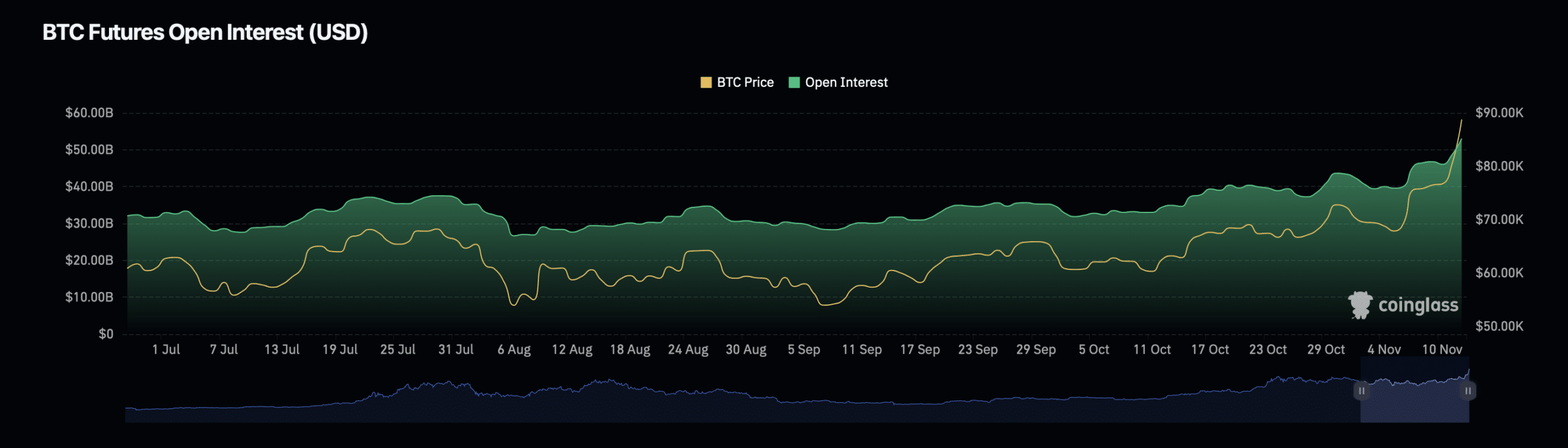

Beyond the influences of macroeconomics and institutions, there’s also a notable increase in Bitcoin’s open investment positions.

According to Coinglass, there’s been a notable rise of approximately 10.26%, placing the current worth at an impressive $54.38 billion. Remarkably, the open interest volume has shown even steeper growth, skyrocketing by as much as 111% to stand at a staggering $221.58 billion.

Increased open interest indicates a surge in market involvement related to Bitcoin derivatives, suggesting more people are getting involved. This usually means there’s a rise in trading actions and overall market interaction.

BTC liquidation trends

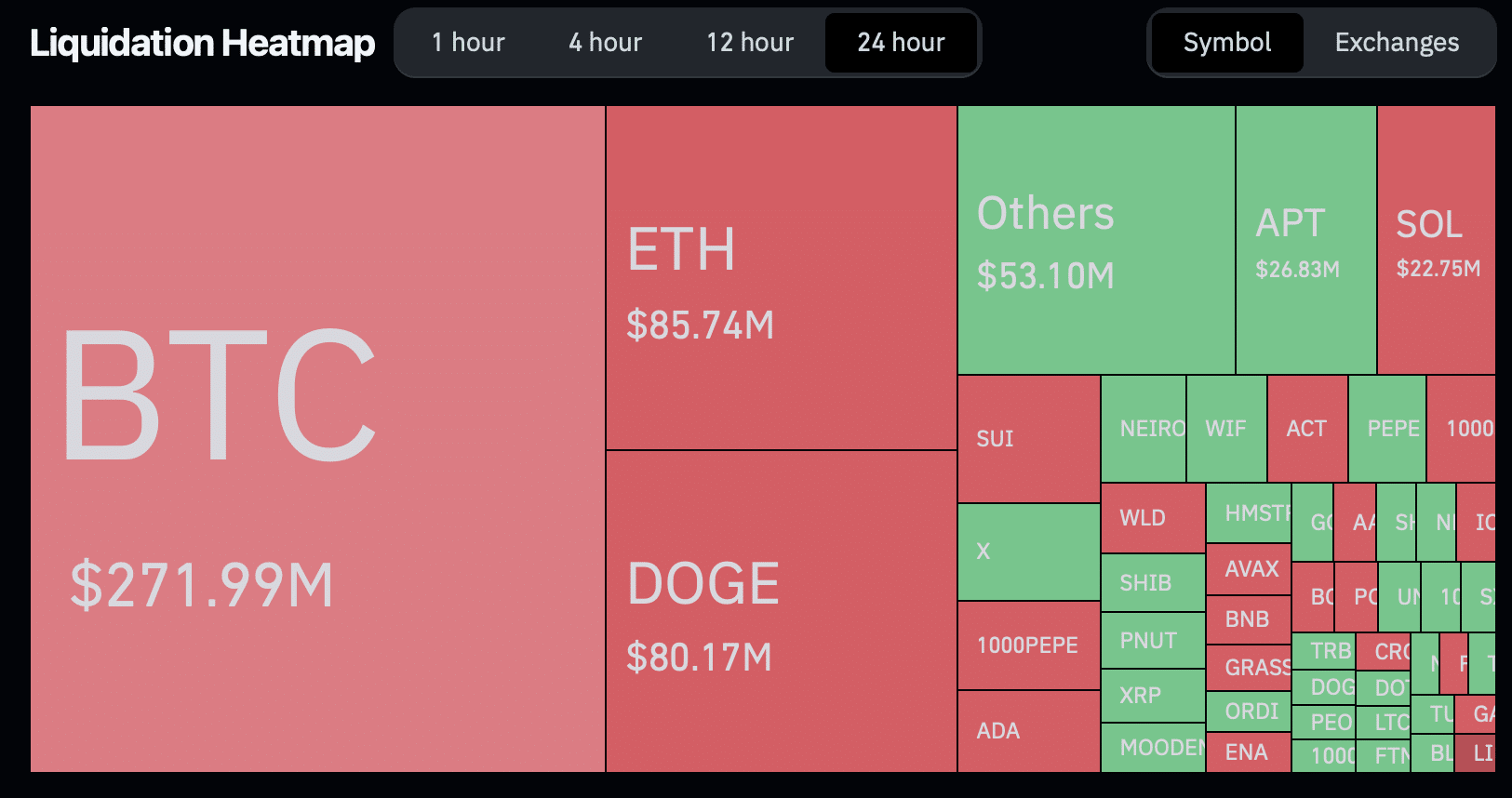

The significant increase in Bitcoin’s value has sparked enthusiasm, but at the same time, it’s brought about increased market fluctuations and potential hazards for some investors.

According to information from Coinglass, over 175 thousand traders faced liquidation within the last day, amounting to a massive $693.87 million in total liquidated funds.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Most of these instances were about the liquidation of Bitcoin and Ethereum, accounting for approximately $271.99 million and $85.74 million in liquidated amounts for each respectively.

Significantly, it’s been challenging for short traders as they’ve sustained losses worth approximately $218 million in Bitcoin shorts and $48.78 million in Ethereum shorts during this market shift.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-11-13 00:08