- The cryptocurrency market witnessed a bloodbath that wiped out $500M in both long and short positions.

- The bloodbath was fueled by escalating geopolitical tensions in the Middle East.

As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen my fair share of market volatility and bloodbaths. The recent events of October 2nd were no exception, as the cryptocurrency market took a nosedive, wiping out $500M in both long and short positions.

On October 2nd, the value of cryptocurrencies dropped overall, with the combined market cap decreasing by over 5% to approximately $2.25 trillion when last checked.

Bitcoin (BTC) has given in to the bearish trend and dipped to a seven-day low of around $61,000. Similarly, many other cryptocurrencies have lost their recent advancements, with Ethereum (ETH) falling by 6.5% to currently trade at approximately $2,473.

In simpler terms, the prices of Binance Coin (BNB), Solana (SOL), and Ripple (XRP) all decreased. BNB dropped by about 4.9%, SOL by 5.7%, and XRP fell below $0.60 after a decline of 3.6%.

Among the leading ten digital currencies based on market value, Dogecoin (DOGE) experienced the steepest declines, falling approximately 9% and trading for around $0.108 as of the latest update.

As a researcher, I observed similar trends in conventional financial markets, notably a 2.5% decrease in the Nikkei 225 index as per Google Finance’s data.

Crypto market reacts to geopolitical tensions

Increased political conflicts in the Middle East, triggered by Iran’s launching of numerous missiles towards Israel, have led to significant financial losses across the board. This incident caused traders to become uneasy about the potential volatility of high-risk investments.

In periods of doubt or instability, investors often move away from high-risk investments like cryptocurrencies and instead opt for safer options known as “safe-havens”.

For instance, as crypto prices plunged, gold saw minimal losses of less than 1%.

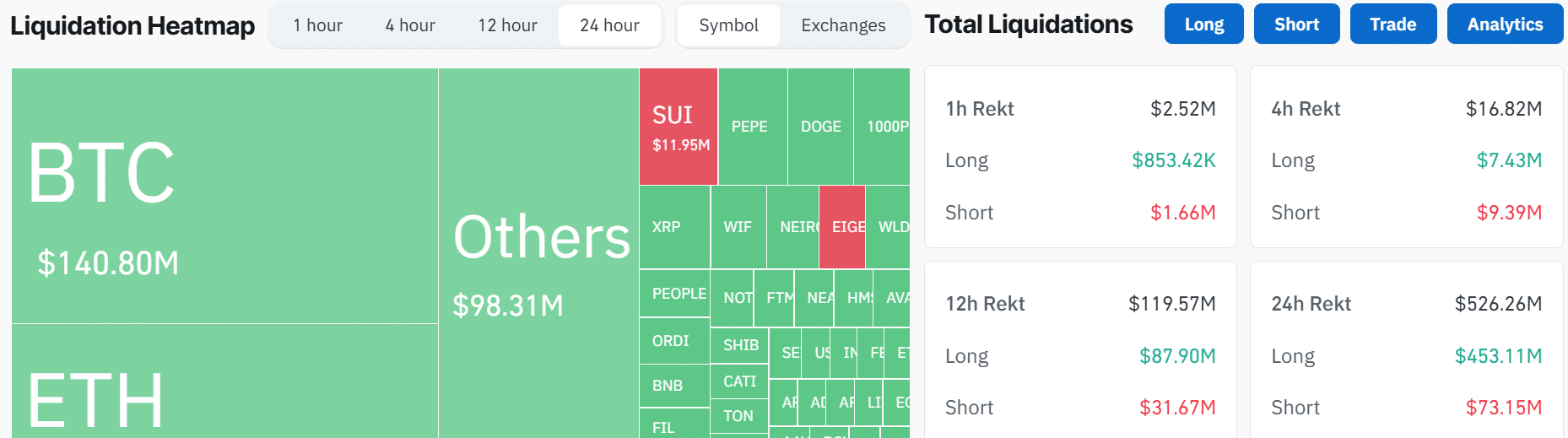

According to Coinglass data, over half a billion dollars in assets were forcedly sold off within the past day, with approximately 450 million coming from traders who had taken long positions. This wave of sell-offs affected around 155,000 different investors.

In a recent report by Coinglass, it’s been noted that Bitcoin and Ethereum had the biggest market exits worth approximately $140 million and $110 million respectively. The largest single exit, exceeding $12 million, happened on Binance, as one trader experienced this significant liquidation.

Crypto ETFs post outflows

According to data from SoSoValue, there were record-high outflows of approximately $242 million from U.S. spot Bitcoin ETFs on October 2nd, marking the largest withdrawal since early September.

In a notable development, Fidelity’s Bitcoin Exchange-Traded Funds (ETFs) experienced an outflow of approximately $144 million. Contrastingly, all other Bitcoin ETF products registered zero or negative inflows, except for the iShares Bitcoin Trust ETF, which recorded a positive flow of $40 million, maintaining its upward trend.

Ethereum ETFs also came in negative with $48M in outflows, the highest level in more than a week.

In simpler terms, when the Bitcoin Fear and Greed Index dropped to 42 – its lowest point in over two weeks – it indicates that a sense of fear has taken hold within the market, suggesting a decrease in positive sentiment about Bitcoin.

Read More

2024-10-02 17:11