-

BTC dropped near the $60K psychological support after FOMC Minutes.

Will U.S. CPI data trigger a rebound or escalate the decline?

As a seasoned analyst with over a decade of experience in the financial markets, I have seen numerous market cycles and learned to read between the lines. The recent drop in Bitcoin (BTC) to the $60K psychological support is reminiscent of similar patterns we’ve witnessed before.

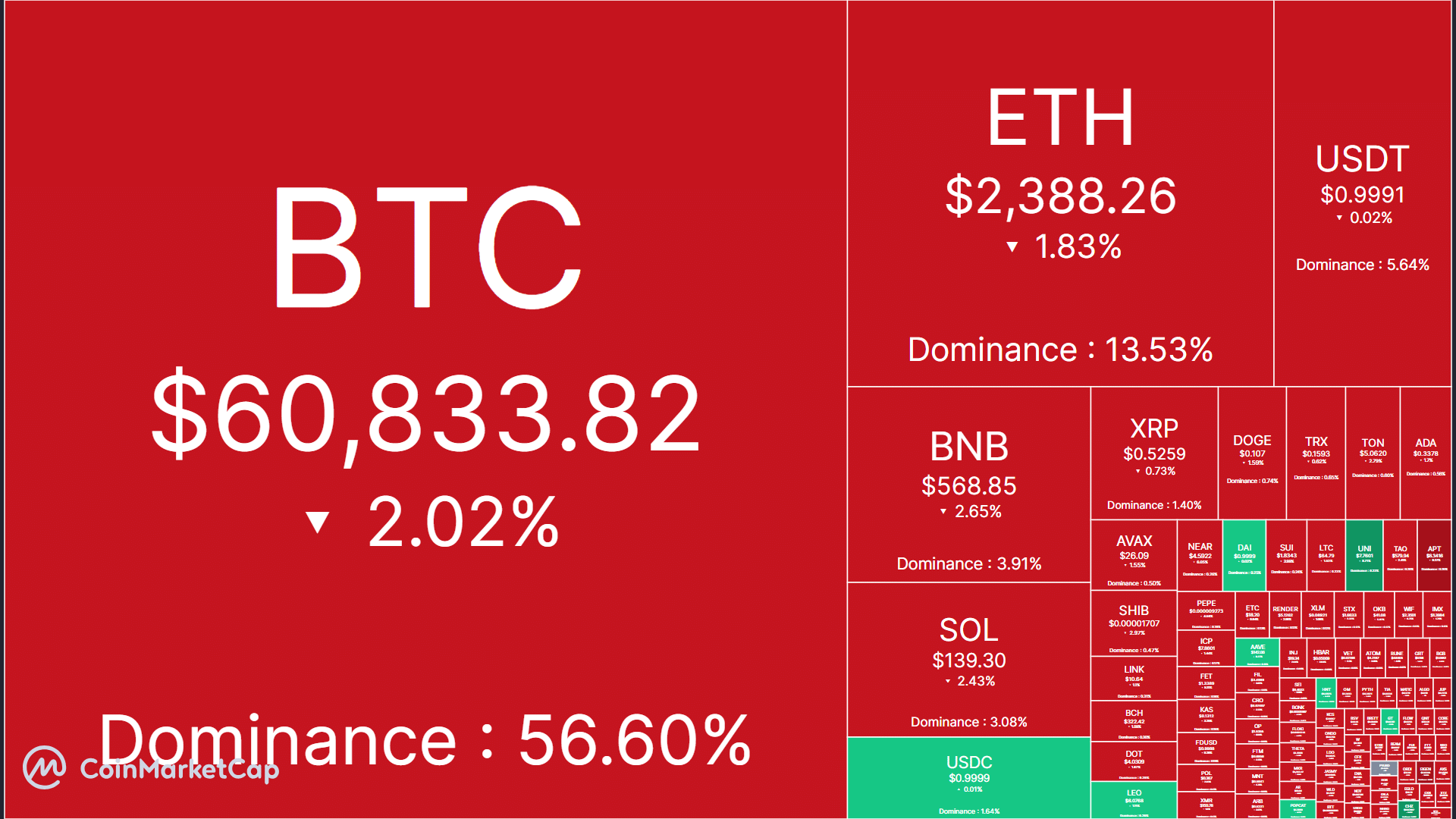

On October 9th, I witnessed Bitcoin (BTC) spearheading the downward trend in the cryptocurrency market, dipping by 2.45%. This dip took it to a critical level of support.

After the publication of minutes from the September Federal Open Market Committee (FOMC) meeting, the value of the world’s biggest digital asset decreased by approximately $1,500, falling from $62,500 to a low of $60,300.

FOMC minutes sink BTC, crypto

Among the majors, Binance [BNB] saw the highest retracement at 2.65% at press time.

In contrast, Ripple (XRP) experienced minimal decrease, whereas Solana (SOL) and Ethereum (ETH) dipped by 2.4% and 1.8% individually. However, it was Uniswap (UNI) that stood out as the day’s significant riser.

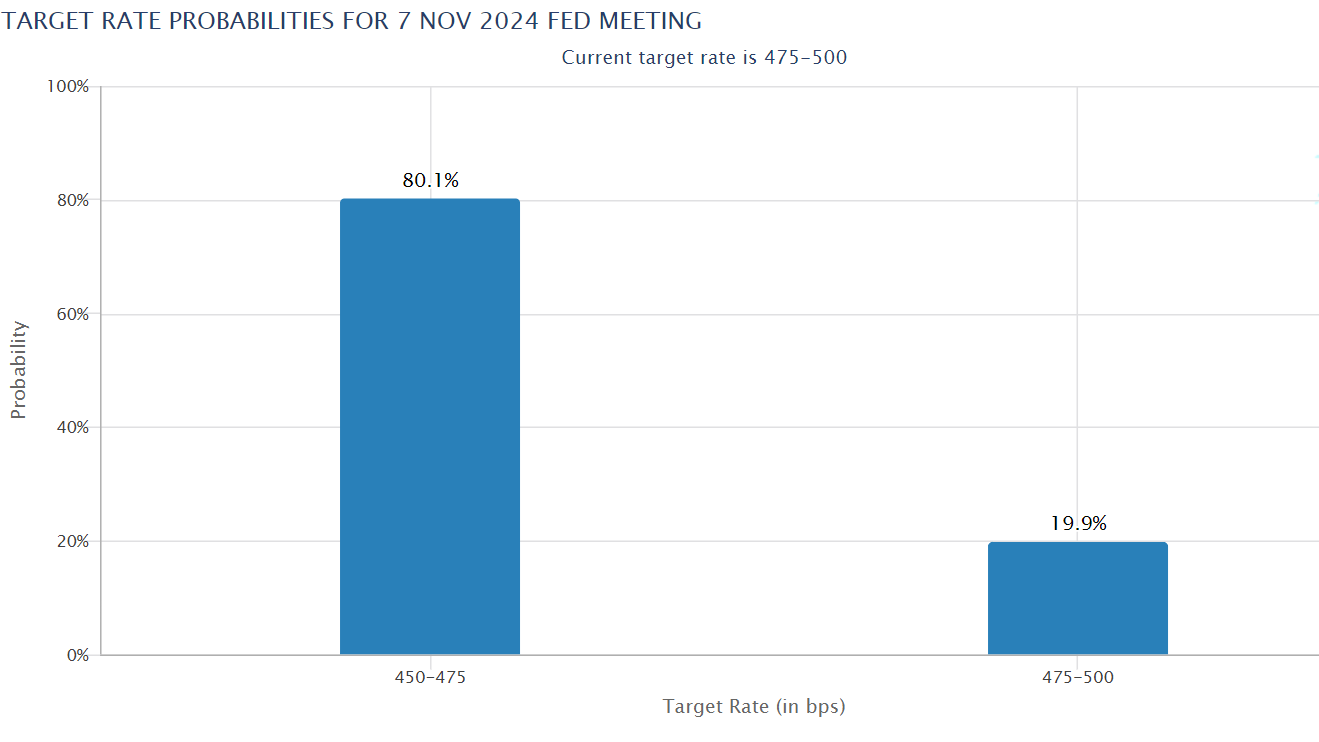

As a researcher, I found that the market’s downturn could be attributed, at least in part, to the publication of the FOMC Minutes, which seemed to lower the anticipation for another 50 basis points reduction in the Federal Reserve’s interest rate in November.

It’s worth noting that the meeting minutes indicated a majority of members favored a significant 5.0% reduction in interest rates by the Fed in September. They cited the then-current weak state of the U.S. job market as their rationale.

Nevertheless, the American job market has significantly expanded over time. As per the statistics disclosed on October 4th, an estimated 250,000 jobs were created in September, surpassing the predictions made by experts.

In simpler terms, this implied that a significant issue affecting the job market, which is crucial for predicting a drastic reduction in interest rates, had been resolved or was not a concern anymore.

Consequently, analysts foresee that the Federal Reserve could opt for a 0.25 percentage point reduction in interest rates or decide to keep them as they are.

As of the latest updates, traders estimate that there’s an 80% likelihood of a 0.25 percentage point reduction in interest rates and a 20% possibility that the existing rates will remain the same.

The response to the upcoming September inflation data (CPI) may alter the current situation. Bitcoin (BTC), like other ‘risk-on’ assets, tends to react in a way that is common when there are expectations for Fed rate cuts and U.S. equities. This sensitivity could shift based on the inflation data.

It’s worth noting that unlike cryptocurrency markets, U.S. equities didn’t decline following the release of the FOMC Minutes. Instead, U.S. stocks ended the day with gains, while Bitcoin experienced heightened selling activity.

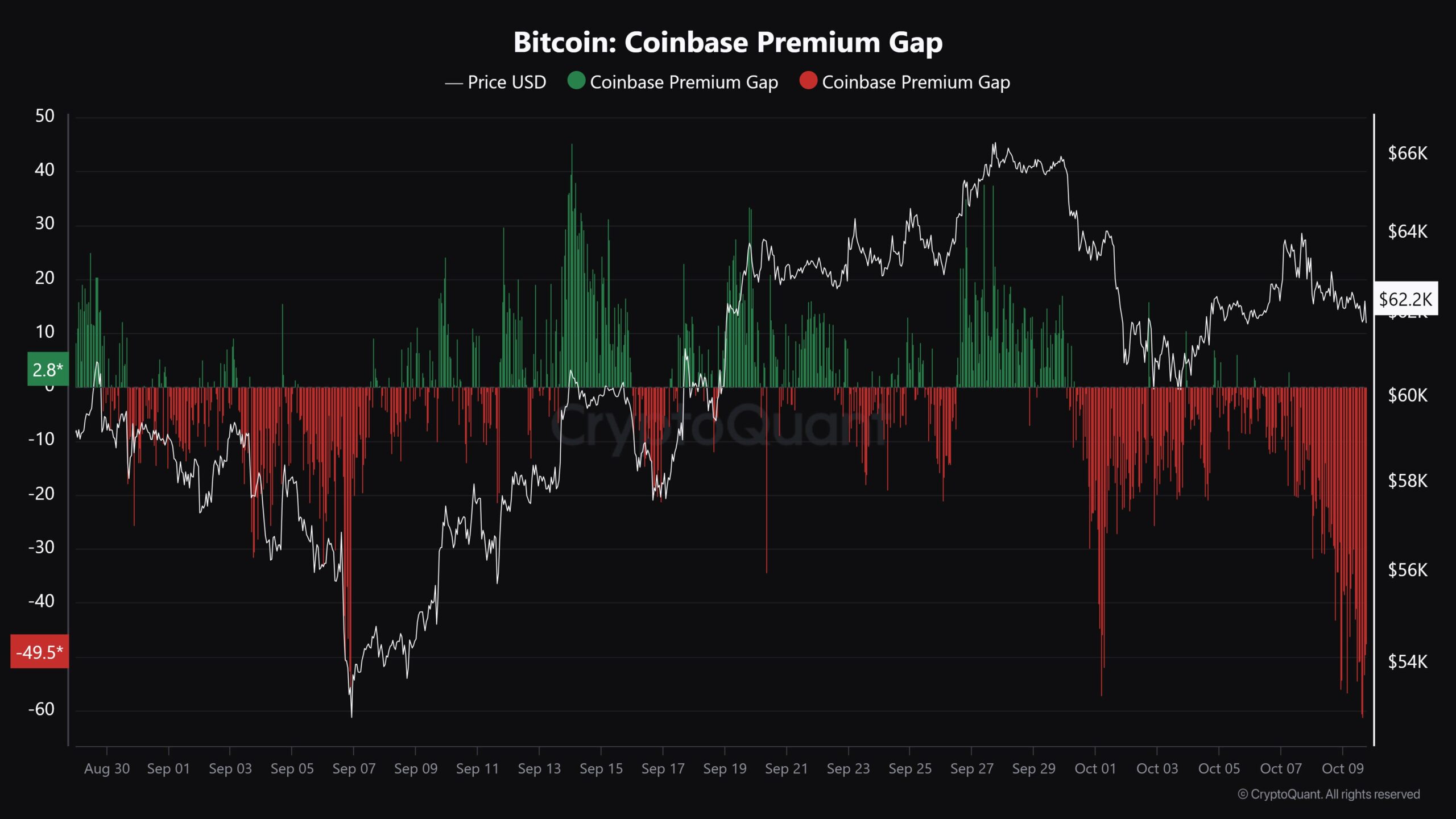

As per JA Maartun’s analysis from CryptoQuant, a potential reversal of the Bitcoin (BTC) drop might occur if American investors lessen their selling pressure.

“Prediction: Bitcoin is poised for a sharp rise once the Coinbase seller is finished.”

On Bitcoin’s price graphs, the cryptocurrency found a crucial support level around $60,000. This support prevented a significant drop in early October. However, whether this support would continue to hold following the release of the U.S. Consumer Price Index (CPI) data was yet to be determined.

If the current support at $60,000 remains strong, it’s possible that the price could bounce back towards the 200-day Moving Average, which is approximately $63,500.

However, a crack below the support post-CPI could drag BTC to the next support at $58K.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-10-10 17:12