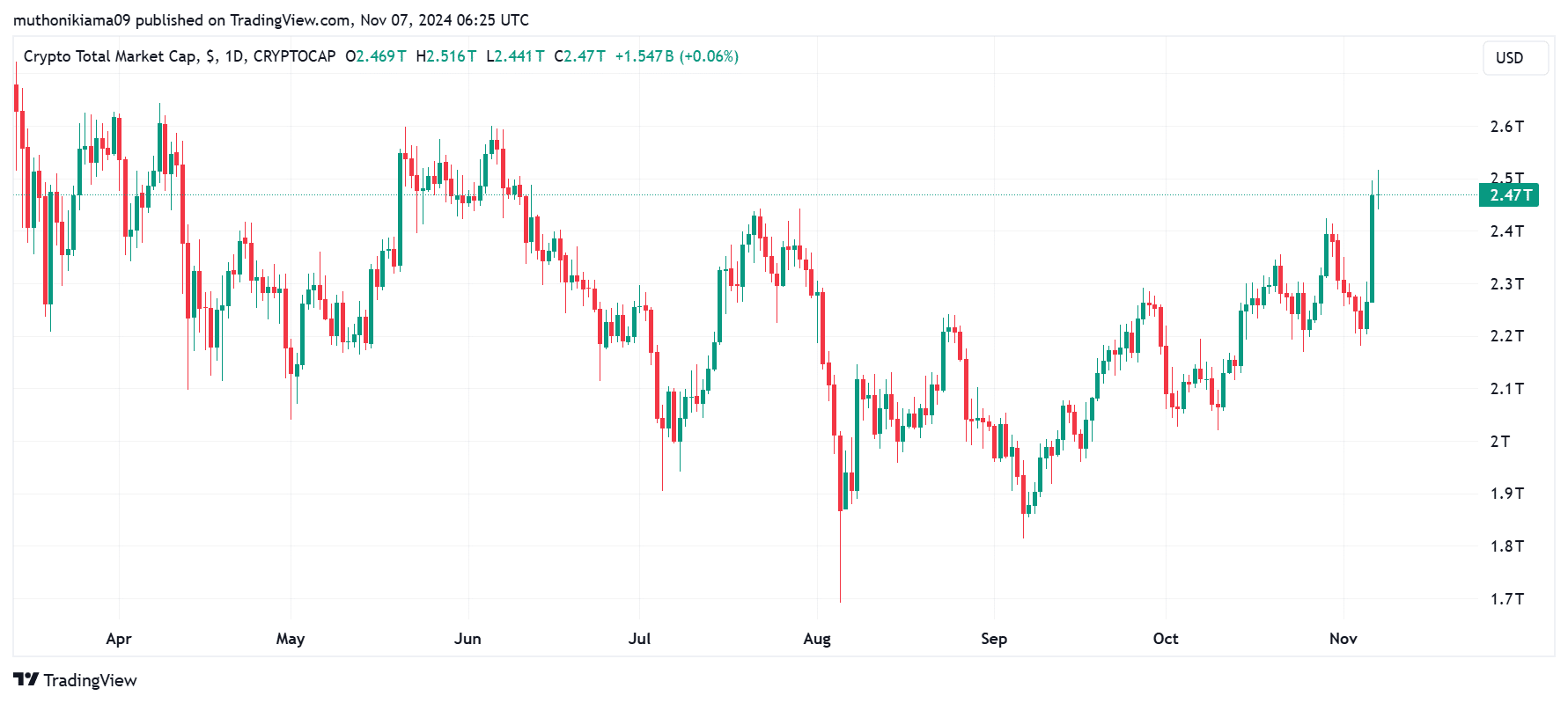

- The total cryptocurrency market capitalization has surged to a five-month high above $2.47 trillion.

- The recent gains came as traders bought into Trump’s election win.

As a seasoned researcher with over two decades of experience in the financial markets, I must admit that I’ve never seen such a rollercoaster ride as the one we’re witnessing with cryptocurrencies right now. The market capitalization soaring to its highest level since June, Trump’s election win sending ripples across the crypto landscape, and sudden surges in ETF trading volumes – it’s like watching a real-life version of the Trading Places script!

This week, the value of the cryptocurrency market has seen substantial growth, as its overall worth surged over $231 billion within a single day.

As I analyze the current market situation, I can report that at this moment, the total market capitalization stands at an impressive $2.47 trillion – a peak not seen since June. This surge is largely driven by Bitcoin [BTC] and the majority of altcoins, which are inching upward.

Over the past day, significant profits were made across various sectors, but these gains came hand-in-hand with increased market turbulence that led to substantial sell-offs in the derivatives industry as reported by Coinglass. In fact, over $380 million worth of cryptocurrencies were sold off, and it was the short sellers who suffered the most losses.

Among these events, $234 million worth were associated with short positions, and $169 million were connected to long positions. Liquidation for Bitcoin amounted to a staggering $150 million, with Ethereum [ETH] trailing closely behind at $64 million in liquidated positions.

Recently, the Crypto Fear & Greed Index reached a high of 77, indicating “intense greed” among investors. What factors are fueling this increased confidence in crypto investments, and can we expect this trend to persist?

US election pump

The significant increases we’re seeing are largely driven by the outcome of the U.S. Presidential election. A pro-cryptocurrency candidate, Donald Trump, secured a clear victory and has since been elected as the next President.

Trump pledged various commitments to the American cryptocurrency sector, such as creating a strategic Bitcoin reserve and replacing Gary Gensler, the current head of the U.S. Securities and Exchange Commission (SEC).

The community has high hopes that these promises will be kept. According to Ripple CEO Brad Garlinghouse, during his initial 100 days in office, Trump could replace the SEC leadership, advocate for a pro-cryptocurrency law, and offer clarification on whether Ethereum is considered a non-security.

According to a co-founder of Gemini, Cameron Winklevoss, it is his belief that during the next four years, the cryptocurrency sector may experience further expansion due to supportive regulations.

Think about all the progress we can make over the next four years, as the cryptocurrency sector no longer faces massive legal expenses battling the SEC (Securities and Exchange Commission),” the Winklevoss twin suggested.

Gemini co-founders had donated $2 million to the Trump campaign.

The optimism around a crypto-friendly SEC, Senate, and White House is driving the bullish sentiment in the crypto industry.

Inflows to crypto ETFs soar

On the day of the elections, there was an unexpected increase in activity concerning U.S.-based Bitcoin Exchange-Traded Funds (ETFs). According to SoSoValue, the amount of Bitcoin ETFs traded reached a peak of $6.07 billion, which was the highest level since March.

The total inflows to Bitcoin ETFs during the day also reached $621 million, marking the highest level in one week.

On their finest day since September, Ethereum ETFs experienced an inflow of approximately $52 million. This optimistic trend propelled Ether to reach a two-month peak exceeding $2,800.

As a researcher studying market dynamics, I’ve observed that an upward trend in Exchange-Traded Fund (ETF) investments serves as a catalyst for demand in the underlying assets. If these robust inflows persist, it’s plausible to anticipate a potential increase in value for Bitcoin and Ethereum.

Crypto stocks are also rising

The surge in the cryptocurrency market has been advantageous not only for digital currencies but also for shares of cryptocurrency companies. For instance, on Wednesday, the stock price of Coinbase (COIN) surged by 31% to reach $254, marking its highest point since July.

By the end of trading, MicroStrategy’s stock (MSTR) had risen by 13% and closed at $257. This year, it has been one of the top-performing cryptocurrency stocks, recording a remarkable increase of 276% up to now.

Jack Dorsey’s Block Corporation witnessed a significant boost in its stock price, reaching a six-month peak following a 7% increase. Meanwhile, the Bitcoin mining firm MARA Holdings experienced a notable surge of 18% in its own stock value.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-07 19:54