- Mt. Gox has begun repaying creditors who suffered losses when it collapsed in 2014

- Ethereum fell to an intraday low of $2,825 and seemed to be on course for 4 consecutive daily red candles, at press time

As a researcher with extensive experience in the cryptocurrency market, I find the recent turn of events quite concerning. The news of Mt. Gox repaying creditors while Bitcoin and Ethereum plunge to new lows is a stark reminder of the volatility and risk inherent in this space.

The largest cryptocurrency, Bitcoin, experienced a significant drop in value today, reaching its lowest point since February. This decline followed news of transactions involving a wallet linked to the defunct Mt Gox exchange. As a result, Bitcoin’s price dipped below $55,000 and saw a weekly decrease of over 9%.

Despite not standing alone, Ethereum mirrored Bitcoin’s downturn. Its value plunged as well, dropping beneath the $3,000 mark to reach a low of $2,820 during the trading session.

Whale activity also contributed to the losses

The decline of Ethereum seems to have been intensified by large investors, or “whales,” offloading substantial quantities of Ethereum (ETH) to cover debts from failed investments.

According to the data from LookOnChain, the decrease in Ethereum’s price brought about potential liquidation threats for Ethereum magnates who had bought Ethereum through platforms like Aave and Compound. For illustration, LookOnChain identified an address disposing of 26,600 ETH to cover a debt on Aave as documented in post X.

Liquidations

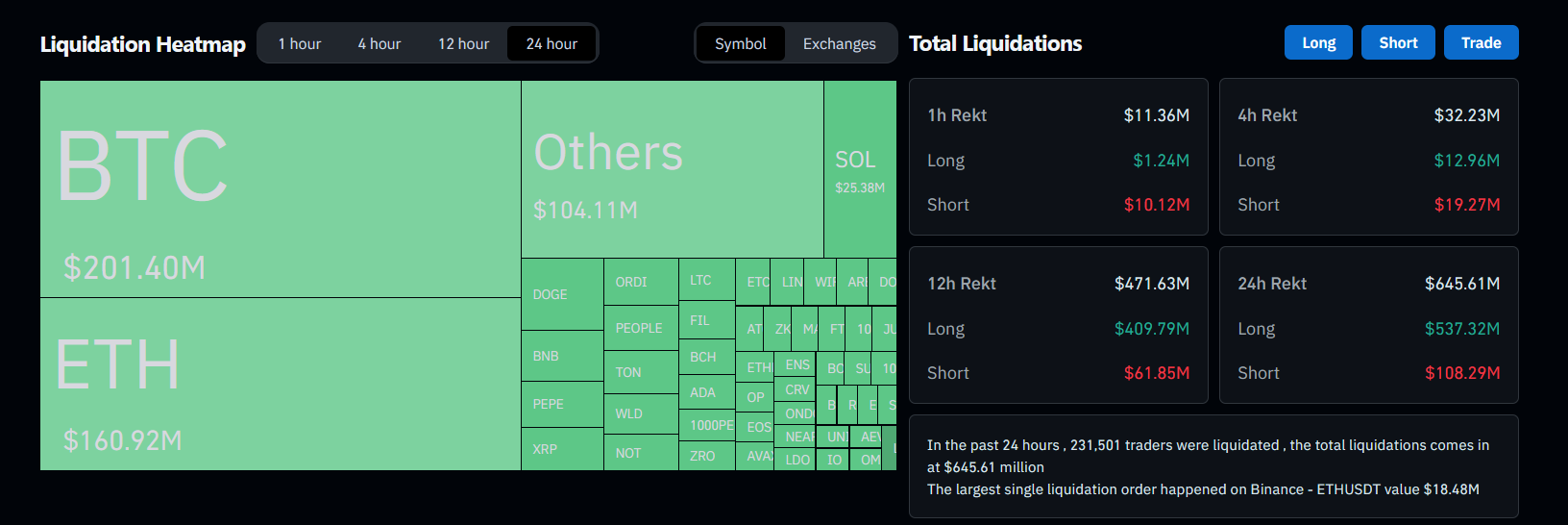

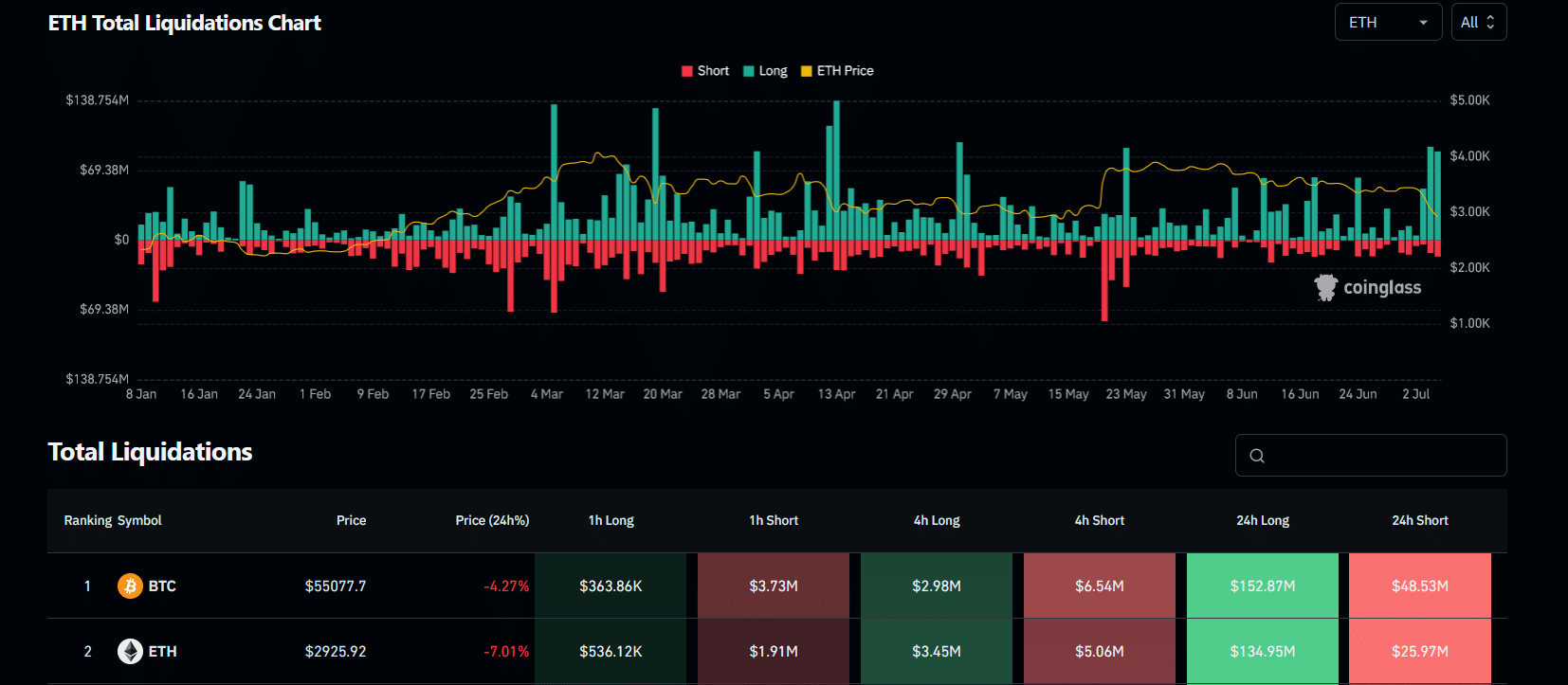

I was bracing myself for market volatility when, true to form, Friday’s sell-off saw an astonishing $650 million in crypto assets get wiped out over the course of a single day. Among those hit hardest were bullish bettors, who suffered losses totaling approximately $537 million.

As a crypto investor, I can tell you that over $130 million in Ethereum long positions were liquidated within the past 24 hours before this message was sent. This means that traders holding long positions on Ethereum were forced to sell their assets due to market movements resulting in significant losses.

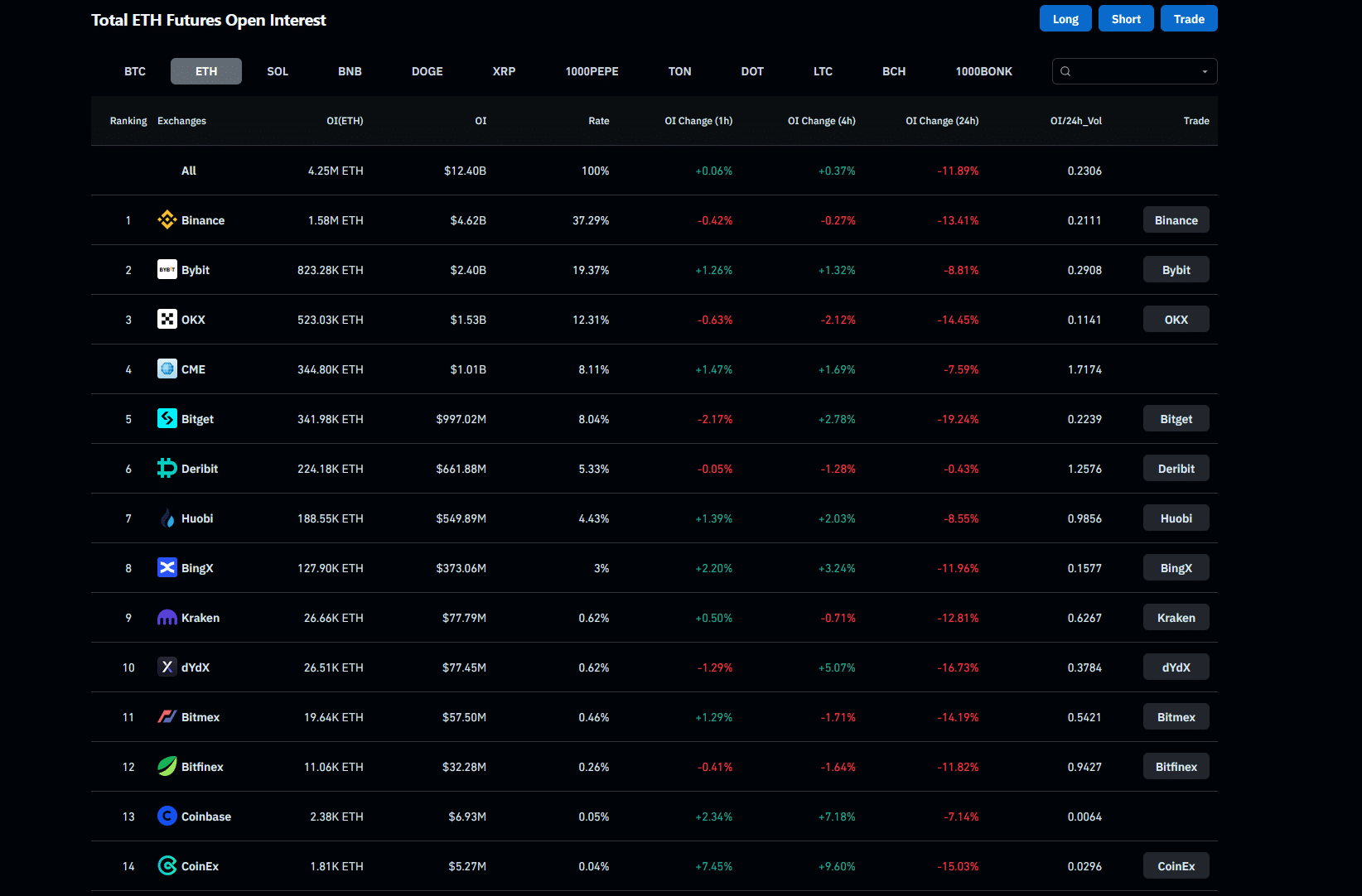

Over the specified time frame, I observed a nearly 12% decrease in the total Ethereum Futures open interest (OI) across leading platforms. This reduction may indicate investors pulling out of the market.

Lastly, the Open Interest on Ethereum’s CME contract decreased by 7.59%, signaling a bearish attitude among investors towards this cryptocurrency.

ETH/USDT technical analysis

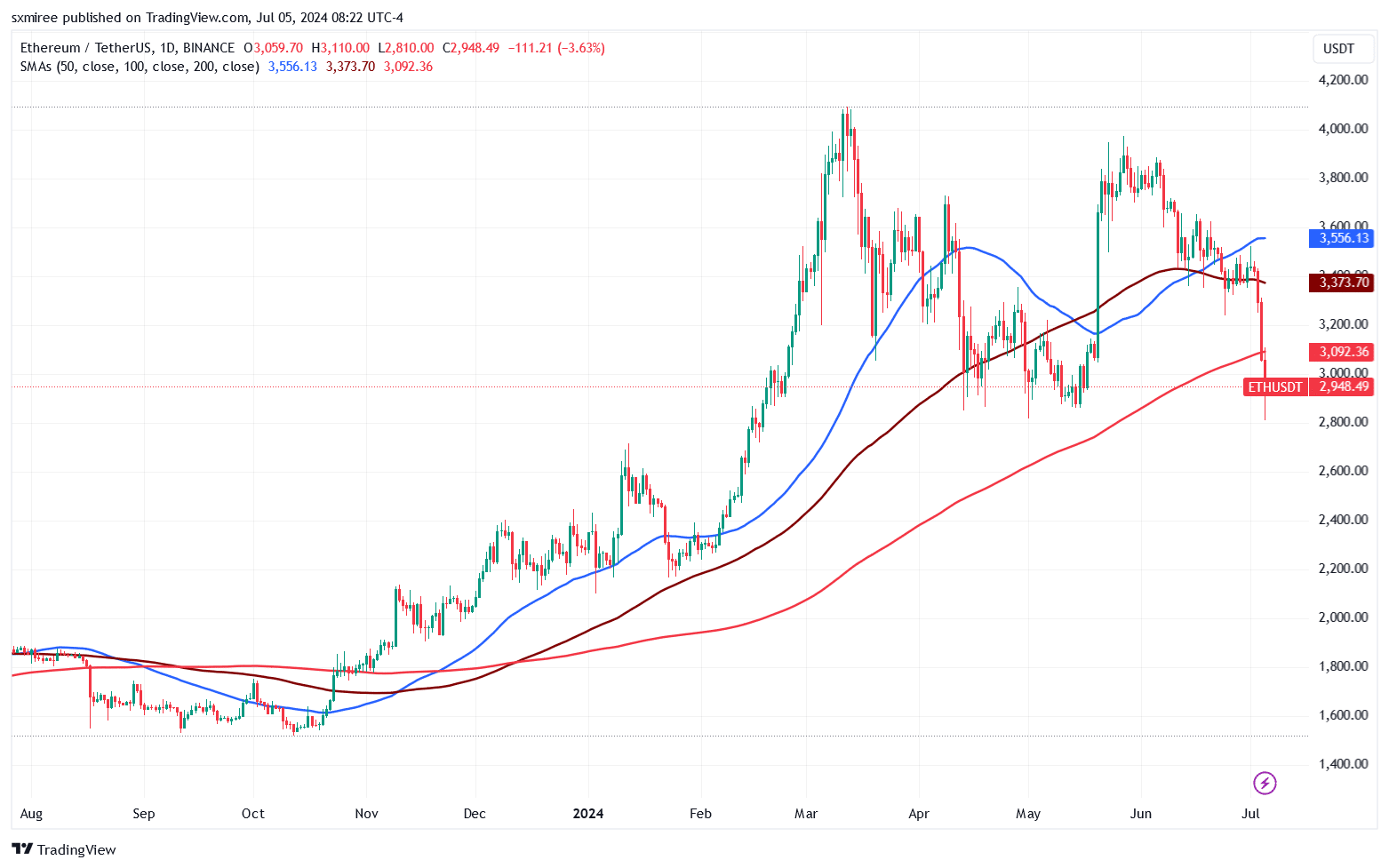

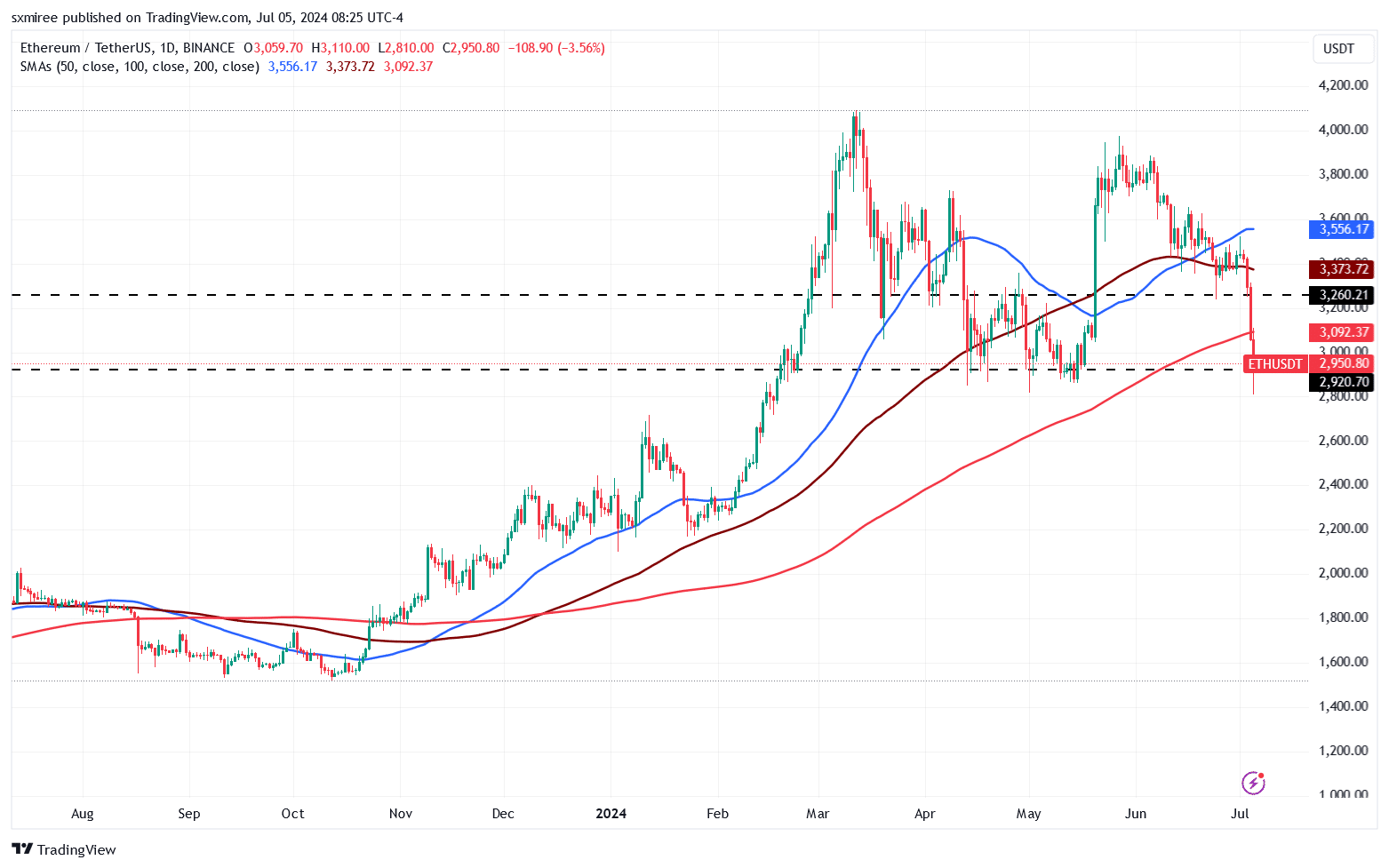

The losses for ETH against USDT have continued for a fourth consecutive day, putting significant strain on the pair. Due to these persistent losses, the pair has broken through crucial support thresholds during the market downturn. The price of ETH has fallen below its 50-day, 100-day, and 200-day simple moving averages in the daily chart.

In August 2023, ETH/USDT dipped below all three trendlines on the daily chart for the first time. This event coincided with negative news about Elon Musk’s SpaceX allegedly selling off their Bitcoin holdings, causing marketwide crypto losses.

According to CoinMarketCap, the last recorded price of Ethereum was $2,920, representing a 40% decrease from its peak. This week’s modest Ethereum performance has added weight to the bearish perspective in the near future.

The resistance level for the ETH/USDT pair is currently at approximately $3,200. This was a level that the pair had previously encountered and traded between during the middle of April and June.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-07-05 22:15