-

ETH plunged by 8% despite the remarkable US spot ETH ETF debut.

Analysts offer mixed views on the ETH’s downward pressure.

As a seasoned crypto investor with several years of experience under my belt, I’ve witnessed numerous market fluctuations and learned to read between the lines when it comes to market news and analysis. The recent plunge in Ethereum [ETH], despite the US spot ETH ETF debut, left me feeling a mix of disappointment and caution.

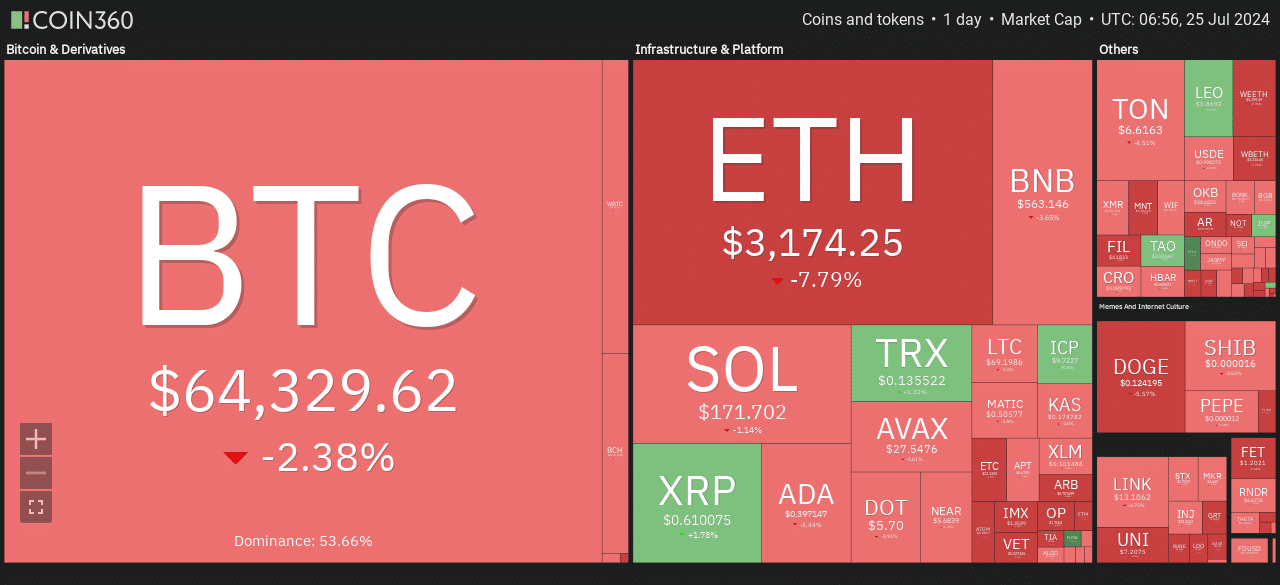

As an analyst, I observed a significant decline of more than 7% in Ethereum‘s [ETH] value during the intraday trading on July 24th. This drop came in the wake of a broader market downturn in US equities that reportedly erased over $1 trillion from their collective market capitalization.

During the market downturn, the biggest altcoin, previously holding steady just under $3.5k prior and post the US launch of the ETF for Ethereum spot, moved nearer to the $3000 threshold.

It’s intriguing that the impressive gains of the Ethereum ETF over the past few days haven’t prevented a significant drop in Ethereum itself. Let me explain: despite the strong performance of the Ethereum ETF, Ethereum as a cryptocurrency has experienced a substantial decline recently. So, what could be causing this discrepancy?

Some market watchers held contrasting opinions regarding the sharp decline. Hsaka, a well-known altcoin trader and market analyst, proposed that the tumble in the US stock market might have influenced the price drop of Ethereum.

Ethereum has officially been incorporated into Traditional Finance (TradFi). In the past day, Nasdaq experienced its most dismal closing in over two years, resulting in a staggering loss of approximately $1.1 trillion from the US stock market.

According to Charles Edwards, founder of Capriole Investments, the rejection of the ETH ETF proposal wasn’t entirely surprising. He believed that this decision would negatively impact both Bitcoin and Ethereum.

The introduction of an ETF based on Ethereum (ETH) has had detrimental effects on both Bitcoin (BTC) and Ethereum. Throughout this market cycle, Ethereum has underperformed, and its recent ETF debut has further complicated matters for institutional investors by introducing more complexity to the Ethereum narrative.

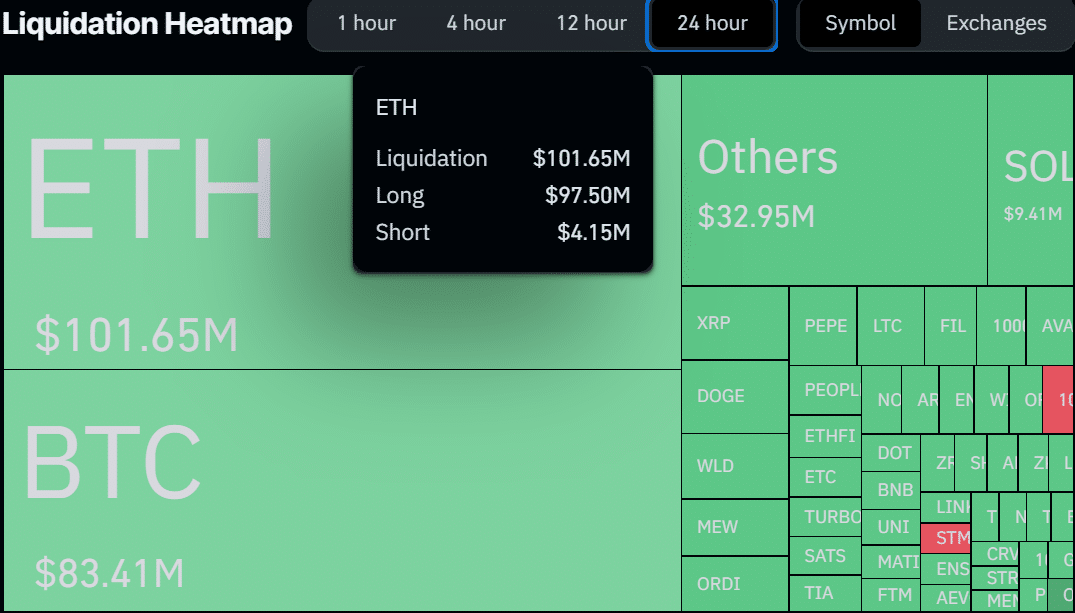

Ethereum dump trigger $100 million in liquidations

In the previous 24 hours, a 7% drop caused approximately $100 million in losses through forced selling, impacting heavily on investors who had employed leverage to boost their bullish positions.

According to Coinglass data, long positions with a value of approximately $97.5 million suffered significant losses, whereas bear positions incurred minor losses amounting to around $4.15 million.

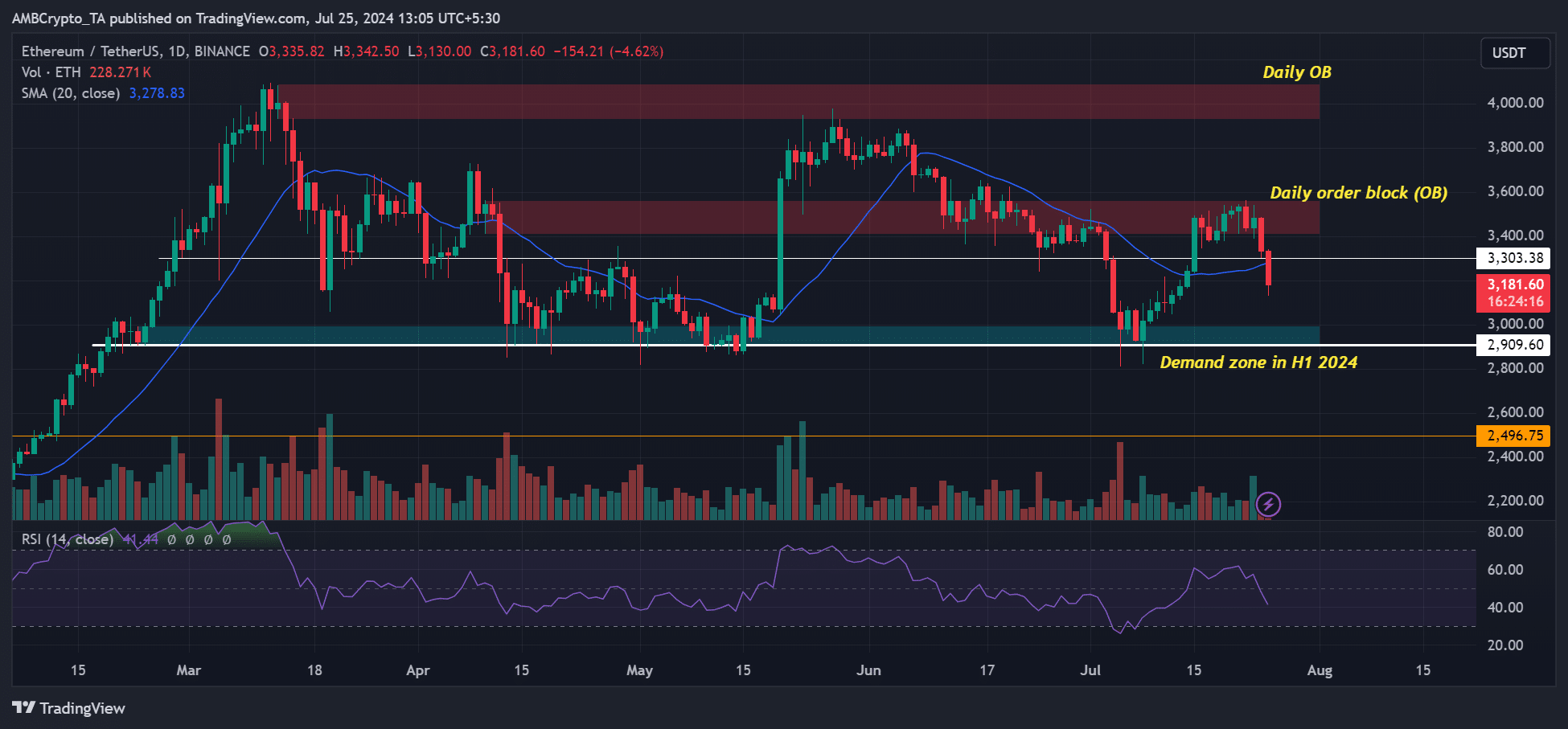

At present, indicators related to derivative contracts, such as volume and open interest, have turned negative, signaling pessimism among traders in the futures market.

If the pessimistic market feeling continues, the ETH price may be held down through the weekend.

If the downward trend continues, there’s a chance that Bitcoin may revisit the $3000 mark. This level holds significant psychological importance, having acted as a strong support area in the past when the market experienced sell-offs in 2024.

If the daily closing price of a candlestick is beneath the 20-day Simple Moving Average, it may quicken the descent towards the $3k support zone.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-07-25 20:07