- Total crypto market cap falls below $2T for the first time since 4th August global markets crash.

- Historical data suggests September is an ideal month for accumulation in anticipation of gains in October.

As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies, I find myself both intrigued and cautious as the total crypto market cap dips below $2 trillion for the first time since the global markets crash on 4th August. The eerie similarity between this week’s decline and the one in August is hard to ignore, especially given the BoJ’s hints at more interest rate hikes that have fueled fears about the health of the global economy.

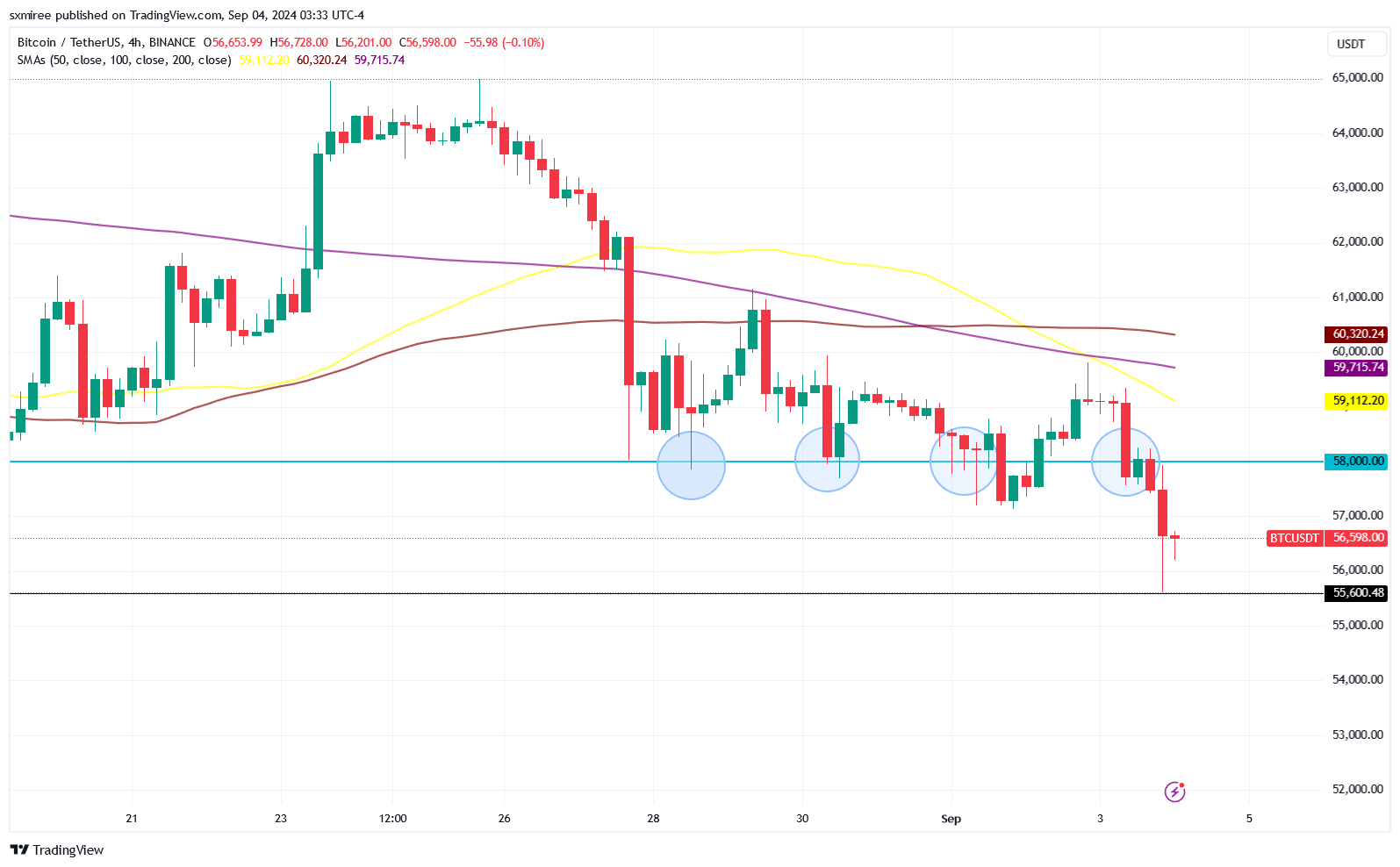

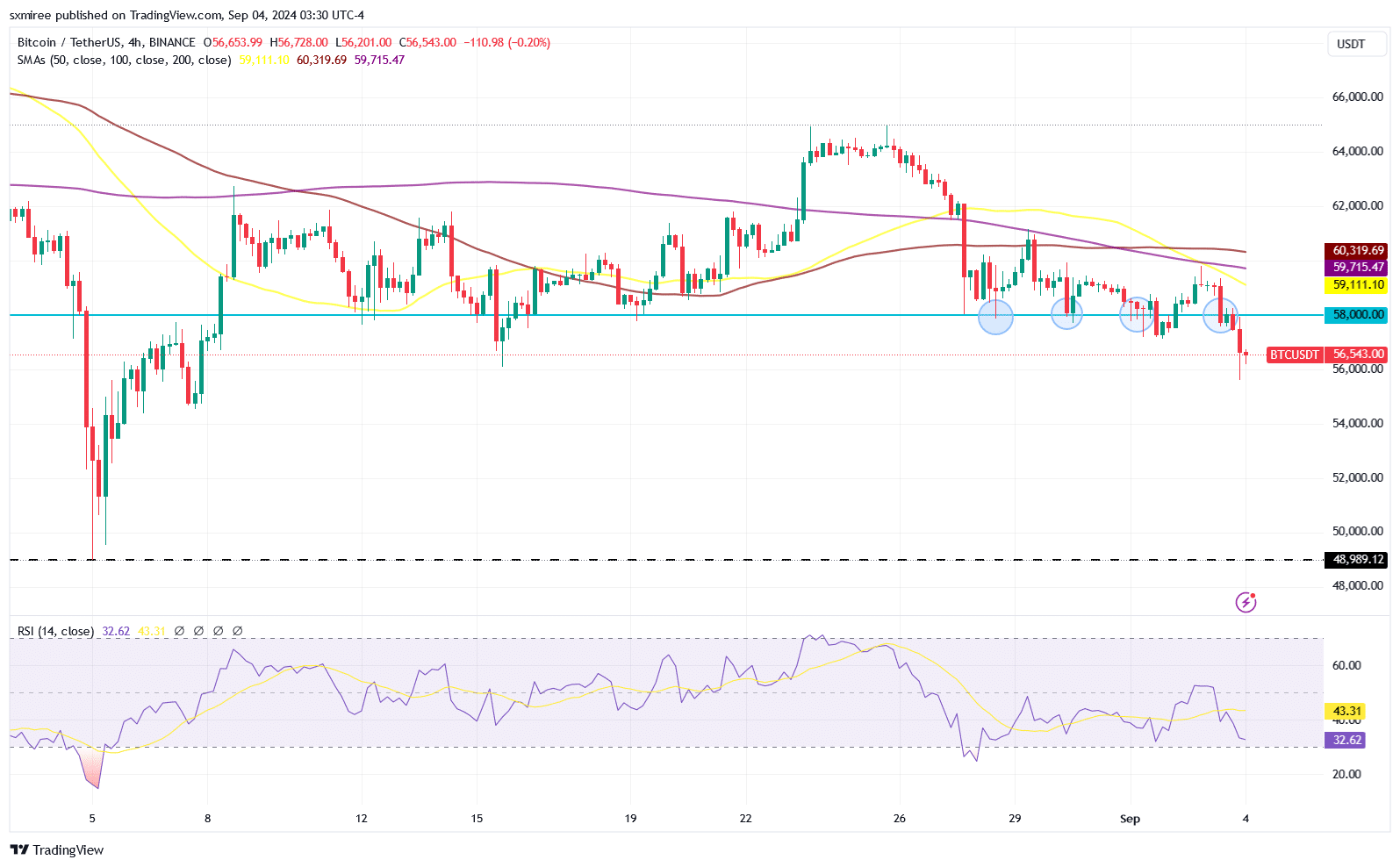

As an analyst, I observed a notable dip in the value of Bitcoin, which fell beneath the $58,000 threshold on the 3rd of September, making it the fourth such occurrence in the past seven days when examining the BTC/USDT 4-hour chart

In August, Bitcoin’s performance was disappointing, causing a decline of 8.6% as reported by Coinglass. This negative trend, leaning towards falling prices, followed the modest gains achieved in July

On the morning of September 4th, the leading digital currency saw a continuation of its drop, reaching a low of $55,673 on Binance. This downtrend seems to have been influenced by a ripple effect stemming from significant losses in U.S. and Asian stock markets

“Seven impressive stocks have collectively lost approximately $550 billion in market value today. Specifically, Nvidia ($NVDA) is heading towards its most significant one-day decline since the year 2024, as reported by Kobeissi Letter.”

At its lowest point during the downturn, the overall cryptocurrency market dipped below $2 trillion for the first time since August 4th

The widespread market downturn is linked to remarks made by the Governor of the Bank of Japan (BoJ), suggesting potential increases in interest rates, sparking concerns about the stability of the world’s economic condition once again

Hauntingly identical crypto market decline

This week’s decline in both cryptocurrency and stock markets resembles the worldwide market drop in early August, which was caused by a similar fear following the Bank of Japan increasing their key lending rate at the end of July

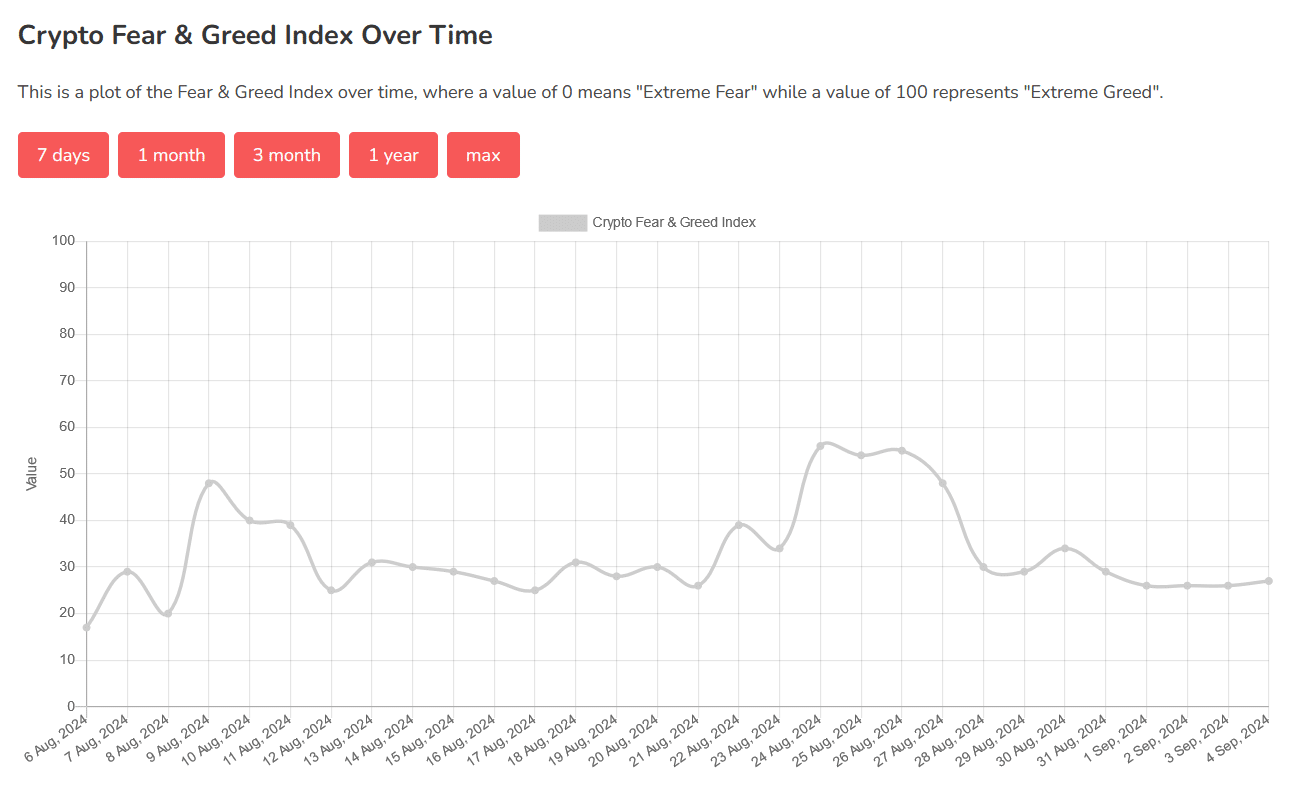

It’s worth noting that although the market is experiencing a downturn, the Crypto Fear & Greed Index has climbed to 27 today from its initial 26 points over the first three days of this month, suggesting a slight increase in optimism among crypto investors

Despite the fact that September has traditionally been Bitcoin’s weakest month, with an average decline of 4.5%, investors remain optimistic and are placing their bets on a resurgence of bullish market movements characterized by increased volatility

Macro volatility: BoJ, Federal Reserve interest rate decisions

This month, a new batch of American economic reports will surface, beginning with the August nonfarm payrolls report scheduled for release on September 6th. These figures could either bolster or challenge the current perspective that the U.S. economy is decelerating

In early August, the Non-Farm Payroll (NFP) report for July indicated an increase in the United States’ unemployment rate, moving from 4.1% to 4.3%. This upward trend placed a negative influence on international financial markets

Keeping an eye on the Bank of Japan’s policy decisions is another significant factor outside the U.S. Their decision to raise interest rates in late July, coupled with a weak jobs report from the U.S. in July, sparked worries that the Federal Reserve might be slow to reduce interest rates, which could negatively impact risky investments in early August

As a result, during his speech on the U.S. economic forecast on August 23rd, the Federal Reserve Chair emphasized that it was now appropriate to make changes in our policies

Anticipation is high for a reduction of 0.25% (or 25 basis points) in interest rates during the Federal Open Market Committee (FOMC) meeting on September 18th. If this prediction comes true, it could create a potentially advantageous monetary climate for riskier investments such as cryptocurrencies

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In other words, if the job market in the U.S. during August shows signs of weakness, it could prompt a substantial rate reduction of half a percentage point. This move might amplify fears of a recession and potentially trigger a market adjustment

Alternatively, a robust report might significantly impact the Federal Reserve’s choice regarding initiating interest rate reductions. However, both scenarios provide opportunities for market turbulence

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-04 20:14